Updated February 6, 2023

Reserve Ratio Formula (Table of Contents)

What is the Reserve Ratio Formula?

The term “Reserve Ratio” of a commercial bank refers to the financial ratio that shows how much of the total liabilities have been maintained as cash reserve (or simply reserve) by the bank with the Central bank of the country. The quantum of the reserve to be maintained by the banks is decided by the Central bank of the respective country. Examples of Central banks are Federal Reserve in the US and Reserve Bank of India in India. The reserve ratio is also known as the cash reserve ratio.

The formula for reserve ratio is expressed as the dollar amount of reserve maintained with Central bank divided by the dollar amount of deposit liabilities owed by the bank to the customers. Mathematically, it is represented as,

Example of Reserve Ratio Formula (With Excel Template)

Let’s take an example to understand the calculation of the Reserve Ratio in a better manner.

Reserve Ratio Formula – Example #1

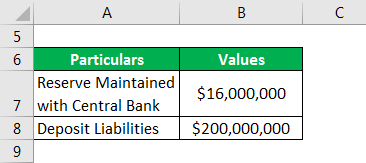

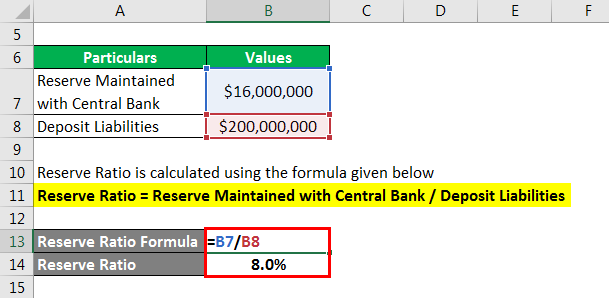

Let us take the example of the ASD Bank to illustrate the calculation of the Reserve Ratio. According to the recent regulation of the Central bank of the country, ASD Bank maintained a cash reserve of $16 million with the Central bank given its deposit liabilities to the tune of $200 million for the given period. Calculate whether the bank is conforming to the central bank’s reserve requirement which is currently pegged at 7.5%.

Solution:

Reserve Ratio is calculated using the formula given below

Reserve Ratio = Reserve Maintained with Central Bank / Deposit Liabilities

- Reserve Ratio = $16 million / $200 million

- Reserve Ratio = 8.0%

Therefore, the ASD Bank with Reserve Ratio of 8.0% is compliant with the Central bank’s reserve requirement (7.5%).

Reserve Ratio Formula – Example #2

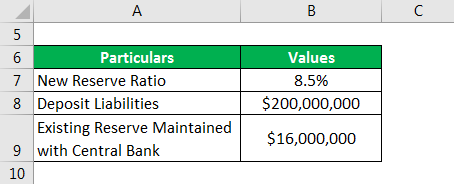

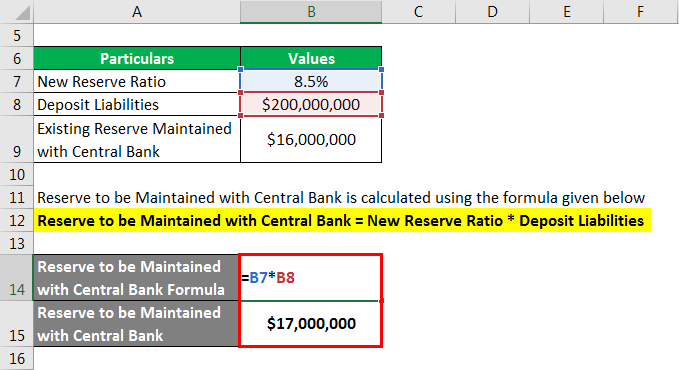

Let us now assume that the Central bank in the above example has decided to increase the required reserve ratio from the current 7.5% to 8.5% in order to curb the money supply in the economy. Calculate the incremental dollar amount that ASD Bank needs to add to its existing reserve to be compliant with the new reserve regime.

Solution:

Reserve to be Maintained with Central Bank is calculated using the formula given below

Reserve to be Maintained with Central Bank = New Reserve Ratio * Deposit Liabilities

- Reserve to be Maintained with Central Bank = 8.5% * $200 million

- Reserve to be Maintained with Central Bank = $17 million

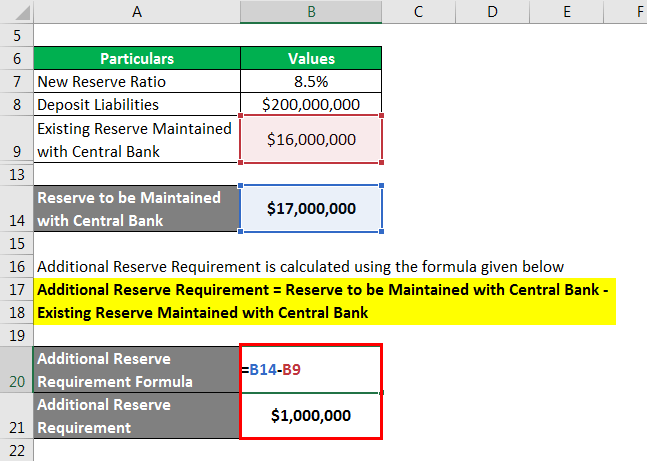

Additional Reserve Requirement is calculated using the formula given below

Additional Reserve Requirement = Reserve to be Maintained with Central Bank – Existing Reserve Maintained with Central Bank

- Additional Reserve Requirement = $17 million – $16 million

- Additional Reserve Requirement = $1 million

Therefore, ASD Bank is required to add another $1.0 million to the existing reserve amount in order to be compliant with the new reserve requirement.

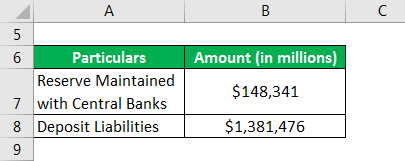

Reserve Ratio Formula – Example #3

Let us now take the example of Bank of America to illustrate the calculation of the imputed reserve ratio based on its annual report for 2018. As on December 31, 2018, the bank’s total deposits stood at $1,381,476 million, while the dollar amount of reserve maintained with the Central banks globally stood at $148,341 million. Calculate Bank of America’s reserve ratio for the year 2018 based on the given information.

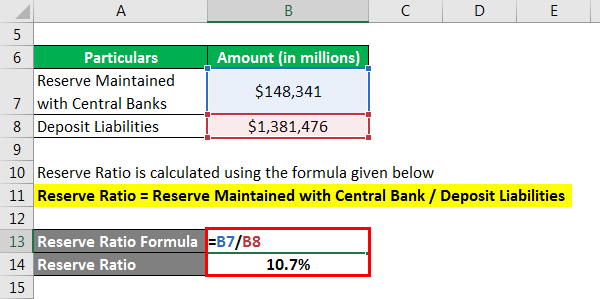

Solution:

Reserve Ratio is calculated using the formula given below

Reserve Ratio = Reserve Maintained with Central Bank / Deposit Liabilities

- Reserve Ratio = $148,341 million / $1,381,476 million

- Reserve Ratio = 10.7%

Therefore, it can be seen that Bank of America maintained a reserve ratio of more than 10% which is the requirement in the US because of its presence in other nations where the requirement may be much higher than 10%.

Explanation

The formula for Reserve Ratio Formula can be calculated by using the following steps:

Step 1: Firstly, determine the dollar value of the amount held by the subject commercial bank with its Central bank. Banks usually capture this information in their financial reporting.

Step 2: Next, determine the dollar amount of the deposit liabilities against which the bank is obligated to maintain reserves. It is also known as net transaction accounts (NTA) or net demand and time liabilities (NDTL).

Step 3: Finally, the formula for reserve ratio can be derived by dividing the dollar amount of the reserve maintained by the bank (step 1) by the dollar amount of its deposit liabilities (step 2) as shown below.

Reserve Ratio = Reserve Maintained with Central Bank / Deposit Liabilities

Relevance and Use of Reserve Ratio Formula

In the banking economics parlance, the concept of reserve ratio plays a very important role as it is predominantly used by the Central banks across the world to maintain the supply of money in the financial system. One of the main ideas behind the reserve requirement is to protect the banks against a probable shortage of funds in case bank runs. Also, the reserve ratio indicates the portion of deposits that the commercial banks can’t use for lending, which in essence influences the available liquidity in the market. For instance, the Central banks tend to increase the required reserve ratio in order to curb money supply and control inflation. On the other hand, the Central banks tend to cut down the required reserve ratio to increase market liquidity when the economy is in expansion mode.

Please note that the regulations surrounding reserve requirements vary significantly across nations. For instance, the reserve requirement is not applicable to savings accounts and time deposit accounts in the US. On the other hand, some countries like the United Kingdom, Canada, Australia, New Zealand, Sweden, and Hong Kong have abolished the statutory reserve requirement entirely.

Reserve Ratio Formula Calculator

You can use the following Reserve Ratio Formula Calculator

| Reserve Maintained with Central Bank | |

| Deposit Liabilities | |

| Reserve Ratio | |

| Reserve Ratio = | Reserve Maintained with Central Bank / Deposit Liabilities |

| = | 0 / 0 = 0 |

Recommended Articles

This is a guide to Reserve Ratio Formula. Here we discuss how to calculate the Reserve Ratio Formula along with practical examples. We also provide a Reserve Ratio calculator with a downloadable excel template. You may also look at the following articles to learn more –