Updated June 16, 2023

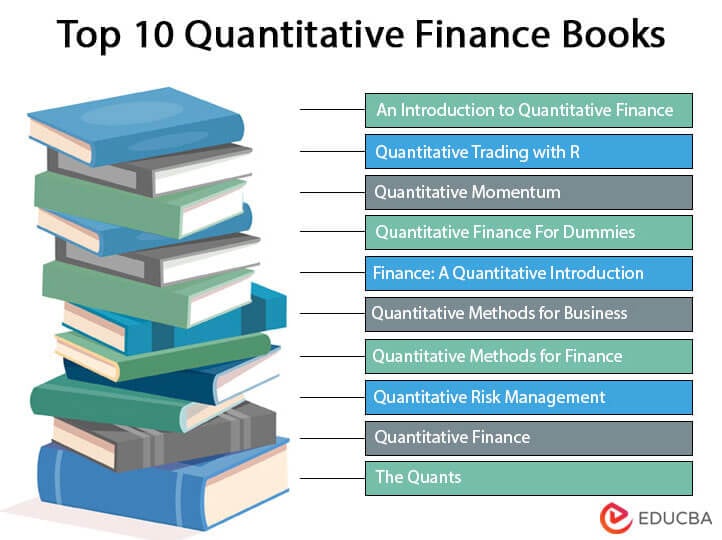

Best Books for Reading about Quantitative Finance

Quantitative Finance Books help develop the insight to understand the workings of financial markets and analyze financial securities. Quantitative Analysts, also known as Quants and mathematicians, use mathematical models and enormous datasets for analysis. Since it is difficult to decipher raw data, Quants organize it visually to better understand their patterns.

We have provided a book list below that clarifies the meaning and workings of Quantitative Finance. They help basic and intermediate readers to attain better insight and knowledge on the subject matter or help professionals to make strides in their careers.

Below is the list of books through which professionals and beginners can enhance their understanding of quantitative Finance.

|

# |

Quantitative Finance Books | Author | Published Year |

Rating |

| 1 | An Introduction to Quantitative Finance | Stephen Blyth | 2013 | Amazon: 4.5

Goodreads: 4.39 |

| 2 | Quantitative Trading with R | Harry Georgakopoulos | 2015 | Amazon: 4.2

Goodreads: 3.54 |

| 3 | Quantitative Momentum | Wesley R. Gray, Jack R. Vogel | 2016 | Amazon: 4.3

Goodreads: 4.23 |

| 4 | Quantitative Finance For Dummies | Steve Bell DPhil | 2016 | Amazon: 3.7

Goodreads: 3.61 |

| 5 | Finance: A Quantitative Introduction | Nico van der Wijst | 2012 | Amazon: 4.2

Goodreads: 3.75 |

| 6 | Quantitative Methods for Business | R. Kipp Martin, Jeffrey D Camm, Thomas A. Williams, David R. Anderson, Dennis J. Sweeney | 2013 | Amazon: 4.3

Goodreads: 3.5 |

| 7 | Quantitative Methods for Finance | Keith Parramore, Terry Watsham | 2013 | Amazon: 4.3

Goodreads: 4.36 |

| 8 | Quantitative Risk Management | Alexander J. McNeil, Paul Embrechts, Rudiger Frey | 2015 | Amazon: 4.7

Goodreads: 4.39 |

| 9 | Quantitative Finance | Matt Davison | 2014 | Amazon: 5

Goodreads: 4.36 |

| 10 | The Quants: The maths geniuses who brought down Wall Street | Scott Patterson | 2011 | Amazon: 4.5

Goodreads: 3.88 |

Let us review each book and critical points in detail to understand its approach to revealing the workings of Quantitative Finance.

Book #1: An Introduction to Quantitative Finance

Author: Stephen Blyth

Buy the book here

Review:

Written by Stephen Blyth, An Introduction to Quantitative Finance from the fundamental principles combined with a practical understanding of Financial markets. This book helps provide simple and practical approaches to risk management in a post-pandemic world dealing with a global recession. The author explains how fundamental financial assets and probabilities determine the value of the contract between two entities, as per his trading experience involving derivatives on Wall Street.

Key Points:

- This book covers the salient components of Quantitative Finance as applicable in the financial markets.

- An Introduction to Quantitative Finance is a good mix of computational exercises for practical use in determining values while trading.

- The book covers basic financial instruments like option pricing and fundamental bond valuations.

Book #2: Quantitative Trading with R

Author: Harry Georgakopoulos

Buy the book here

Review:

Quantitative Trading with R by the Wall Street trader and professor Georgakopoulos summarizes the fundamental trading concepts. It explains to the reader the essential mathematics, finance, data analysis, and programming ideas that help to implement a strategy successfully. The author has explained complicated finance problems and step-by-step methods to build working computer code.

Key Points:

- The author has added computer codes that the working financial models use.

- The book enables beginners to craft usable trading models using the open-source programming language R.

- The book enables professionals, students, and teachers to apply mathematical concepts, statistical programming, and financial concepts to create and analyze trading strategies.

- The author has explained from scratch, and the user doesn’t need any prior coding.

Book #3: Quantitative Momentum

Author: Wesley R. Gray, Jack R. Vogel

Buy the book here

Review:

The author brings Wall Street trading momentum investing techniques to individuals. It elaborates on the value strategy for momentum investing from hedge funds to the masses. He elaborates on the systematic approach that has enriched the treasury of Wall Street deft investors. The author differentiates momentum investing from the commonly believed myth that it is ‘growth’ investing. The book outlines momentum trading principles, biases it exploits, similarities to value investing, differences with growth investing, behavioral sciences’ influence on momentum trading, etc.

Key Points:

- Learn the roots of behavioral psychology and the key strategies that pull individual and institutional investors to the momentum fold.

- Learn momentum strategy from the Wall Street expert, and beat the market with the know-how.

- The author unveils how momentum strategy aids asset allocation and stock selection strategy.

- The book teaches how to construct your momentum strategy with DIY implementation.

Book #4: Quantitative Finance For Dummies

Author: Steve Bell

Buy the book here

Review:

Quantitative Finance For Dummies has simplified the application of mathematics to complicated investing decisions. The reader gets a deep insight into the financial workings of futures, risks, and options. Quantitative finance is also known as mathematical finance, as the field of financial markets uses mathematics at every step. Therefore, the author helps the user speed up the most popular methods, formulas, equations, and models used in quantitative finance.

Key Points:

- This book enables learners to learn the tools for investment success and models like the Black-Scholes model.

- Steve Bell focuses on risk/portfolio management and market trading/strategy, which interests private investors.

- Quantitative Finance For Dummies is a go-to guide for aspirants learning about QF/risk management.

Book #5: Finance: A Quantitative Introduction

Author: Nico van der Wijst

Buy the book here

Review:

Professor Van Der Wijst provides a brilliant roadmap to modern finance. The author explores and simplifies the complicated theories regarding asset pricing, asset pricing options, and corporate finance. It explores the quantitative methods that aid analyses and decision-making in the finance field in today’s globalized markets.

Key Points:

- The author provides a clear and in-depth understanding of the main areas of modern finance and their application in the financial markets.

- The book studies asset pricing and corporate finance and provides their pros and cons.

- It touches on the main concepts of finance from the market and firm perspectives and provides numerous relevant examples.

Book #6: Quantitative Methods for Business

Author: R. Kipp Martin, Jeffrey D Camm, Thomas A. Williams, David R. Anderson, Dennis J. Sweeney

Buy the book here

Review:

The renowned authors Anderson/Martin / Williams/ Sweeney / Camm have written the book “Quantitative Methods For Business” for nonmathematicians and professors. It reflects how quantitative methods and techniques are critical in business decision-making. It enables the reader to develop essential skills to interpret and apply data with the book’s Problem-Scenario strategies. The managerial approach of Quantitative Methods in decision-making interests students.

Key Points:

- Quantitative Methods for Business use the “Problem-Scenario Approach” to engage and help students learn efficiently.

- The author has written the book while keeping Professors, students, and non mathematicians to understand and apply mathematical concepts and techniques.

Book #7: Quantitative Methods for Finance

Author: Keith Parramore, Terry Watsham

Buy the book here

Review:

Quantitative Methods for Finance explains the mathematical and quantifiable applications relevant to modern financial instruments and risk management techniques. In this book, Terry talks about various topics ranging from the basic statistics of finance to stochastic calculus and multivariate techniques.

Key Points:

- The author has made it easy for novices to understand modern financial instruments’ workings and correlate mathematics’s role.

- It describes the statistical and mathematical applications’ roles in risk management techniques.

- The book fills the gap in understanding complex financial engineering that uses applied and theoretical math.

- The book simplifies the most difficult topics in mathematics for easy comprehensions, like- Probability, Time Series Analysis – Arch, Garch and Cointegration, Numerical Methods, Optimization, Stochastic Calculus, and Multivariate Techniques.

Book #8: Quantitative Risk Management

Author: Alexander J. McNeil, Paul Embrechts, Rudiger Frey

Buy the book here

Review:

The author has painstakingly detailed the statistical approach of quantitative Risk Management- which is of great value to Financial Regulators and professionals. The book offers a comprehensive system of theoretical modeling concepts and Quantitative techniques. The author tackles the three core types of risk in financial markets: market risk, operational risk, and credit risk. It provides a toolkit of various risk management problem-analysis and real-life techniques to address market movements.

Key Points:

- The book kicks-starts with a brief history of financial risk management and the development of financial regulation and covers brief details of risk and risk management.

- In his book Quantitative Risk Management, Alexander J. McNeil, Rüdiger Frey, and Paul Embrechts deal with 3 types of risks: Aggregate, Market, and Credit Risk.

- This book focuses on the statistical behavior of portfolios of risky instruments instead of pricing individual instruments.

Book #9: Quantitative Finance

Author: Matt Davison

Buy the book here

Review:

The Quantitative book Finance by Matt Davison gives a reasonable introduction to quantitative finance. Most books on quantitative finance focus on the mathematics of finance instead of describing important financial concepts. The main emphasis of this book that targets a larger audience is financial institutions. The author has highlighted the concepts in a step-by-step approach and explained the topics in detail.

Key Points:

- This book is an ideal introduction to the essential mathematical models of utility in modern finance for readers more interested in understanding these models and how to use them in practice.

- In his book, Davison has combined theoretical discussion of the most relevant topics with a guide to hands-on implementation.

- This book, Quantitative Finance, handles all the direct and practical approaches by working through limiting cases and conducting Excel simulations.

Book #10: The Quants: The maths geniuses who brought down Wall Street

Author: Scott Patterson

Buy the book here

Review:

Scott Patterson is an experienced financial reporter who served for several years at the Wall Street Journal. The Quants is a Wall Street Journal and New York Times best seller. It unfolds the history of Wall Street quantitative trading. It reveals the saga of brilliant Wall Street practitioners who had immeasurable faith in their unbeatable computer programs. They started from dust to boom and finally to bust as the series of crises that led to the failure of quant funds in 2007.

Key Points:

- The author has brilliantly unfolded the saga of the 2007 crisis and the Quants, who were confident of their impermeable computer programs.

- The book also discloses how computer models devised hedge funds with hedging and arbitrage techniques- including the Midas model that lowered the risk of making losing bets.

Recommended Books

Our top 10 quantitative finance books article aims to help you. For more such books, EDUCBA recommends the following,