Updated July 21, 2023

Introduction to Publicly Traded Companies

A Publicly Traded Companies is a business or company that has been listed on at least one stock exchange for the purpose of traders to buy or sell the stock of such a company with ownership and claim to the company’s assets (liabilities) and profits (loss).

Explanation of Publicly Traded Companies

A public company is constituted by the coming together of shareholders that essentially become the owners of the companies while setting up management that controls the business and works to maximize shareholder wealth.

A public company has many legal obligations to fulfill to enjoy the benefits of becoming public. Some of them are enforced by the regulatory bodies in the country, while others are self-imposed for stringent control and shareholder-management coordination.

Characteristics of Publicly Traded Companies

- A public company is characterized by its size in terms of market capitalization, which is simply the market value of its share times the number of shares outstanding. A corporation with $1 million shares outstanding and a $20.00 share price has a market capitalization of $20 million.

- A public company is characterized by its limited liability as opposed to the unlimited liability of private companies, partnerships, or sole proprietorships. This broadly means that in case of a lawsuit against the company, no individual shareholder will be held, i.e., no individual responsibility.

- A public company is a going concern and has perpetual succession. This means that the company’s board members will succeed every time in case of dissolution or retirement, and the company shall live forever.

How Does it Work?

A business is always a private company before it becomes a public company. Take, for example, a young entrepreneur who started his business selling computers back in 2010 from California. He ran the business quite well until 2014 before bringing in investors who were confident about this business.

Over the next four years, the team, including the investors involved in decision-making due to their stakeholding, did sell lots of products to expand the business in many other states. The corporation had $20 million in annual revenues and handsome profits. But in 2019, the team decided to float an initial public offering in the market to gain funding for further expansion. In this pursuit, the couple hires a banking team that helps the young entrepreneur in the process.

This virtual company has been public for a year now, making regular shareholder interactions and releasing documents related to financial disclosure.

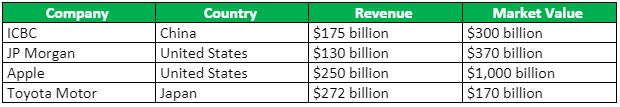

Example of Publicly Traded Companies

Some of the most significant public companies (at some point in time, revenues and market values have changed now) were:

Publicly Traded Companies vs Private Traded Companies

The significant points of difference between a public company and a private company are the claim of ownership and listing on markets. A company becomes public when it allows investors or traders from among the public to buy or sell its stocks. On the other hand, a private company does not list its stock on any public stock exchange and hence cannot be offered for public trading.

To understand the difference between these two entities, it should be made clear that a private company is similar to a public company on the grounds of financing, funding, and investing opportunities. A private company can attract individual or institutional investors in return for ownership in the company. However, the transaction or the deal is not carried out in the public market.

A private company is not answerable to shareholders of any kind whatsoever. Even if the company has investments of individuals or institutions, there is no such agreement as it is between a public company and its shareholders.

Benefits of Publicly Traded Companies

Following are some of the benefits that publicly traded companies have:

- Public companies have greater recognition in terms of outreach and brand reputation. If a public company performs well enough, it gets noticed quicker and better.

- Public companies, with easier access to equity markets, have the option of a cheaper form of financing in equity. Private companies have to rely mostly on bank loans or venture capitalists.

- As a company listed on the stock exchange becomes public, there is a natural distribution of risk among owners and investors as more people become shareholders in the company.

- Public companies can deploy models linking growth/profits with employees’ performances using stock options. Such models tie performances with share ownership and incentivize employees immensely.

Limitations of Publicly Traded Companies

Following are some of the Limitations that publicly traded companies have:

- Public companies must follow regulatory standards that are mandatory for companies before getting listed on stock exchanges.

- Public companies must publish and release documents periodically as mandated by various standards. Annual and quarterly reports are some such examples.

- These companies are also required to undergo regular audits, following which public disclosures are made to engage shareholders actively.

- One of the biggest challenges to publicly traded companies is the agency problem. This occurs when the objectives of management (that runs a public company) are not aligned with that of the shareholder.

Conclusion

Public companies are answerable to stockholders because the stockholders directly vote on significant decisions of the company/business. Every shareholder has proportional representation in voting rights. A public company follows and is mandated by regulations to do so, standards, and prescribed formats of reporting to the shareholder.

Public companies work to maximize shareholder wealth, growing their business and public trust. Such companies should refrain from principal-agent problems (agency problems). If a company incentivizes its senior management, it may run the risk of managers producing false reports of growth and profits.

Recommended Articles

This is a guide to Publicly Traded Companies. Here we also discuss the introduction to Publicly Traded Companies, how it works, and their characteristics. You may also have a look at the following articles to learn more –