Updated July 27, 2023

Difference Between Profit vs Income

Profit vs Income are generally used as synonyms, but it is important to understand the difference between these two terms for accounting purposes. In short, we can say, Profit is Income minus Expenses. There are two important terms in accountancy to understand the financial strength of any firm. In this article, we will understand the meaning and major difference between these two terms,

Profit

Profit is the amount left (Positive) post deduction of all kinds of costs, expenses, taxes, etc., from the income or revenue. Profit represents the actual reward for the risk undertaken by the businessman. In short, profit is the revenue that remains after deducting the expenses.

Income

Income is the total amount earned post-sale of products or any services. It’s the actual earning of any company at the first stage. It also differs from the term Revenue. Income is the business’s total earnings from direct or indirect business activities. Income is also referred to as Gross Revenue.

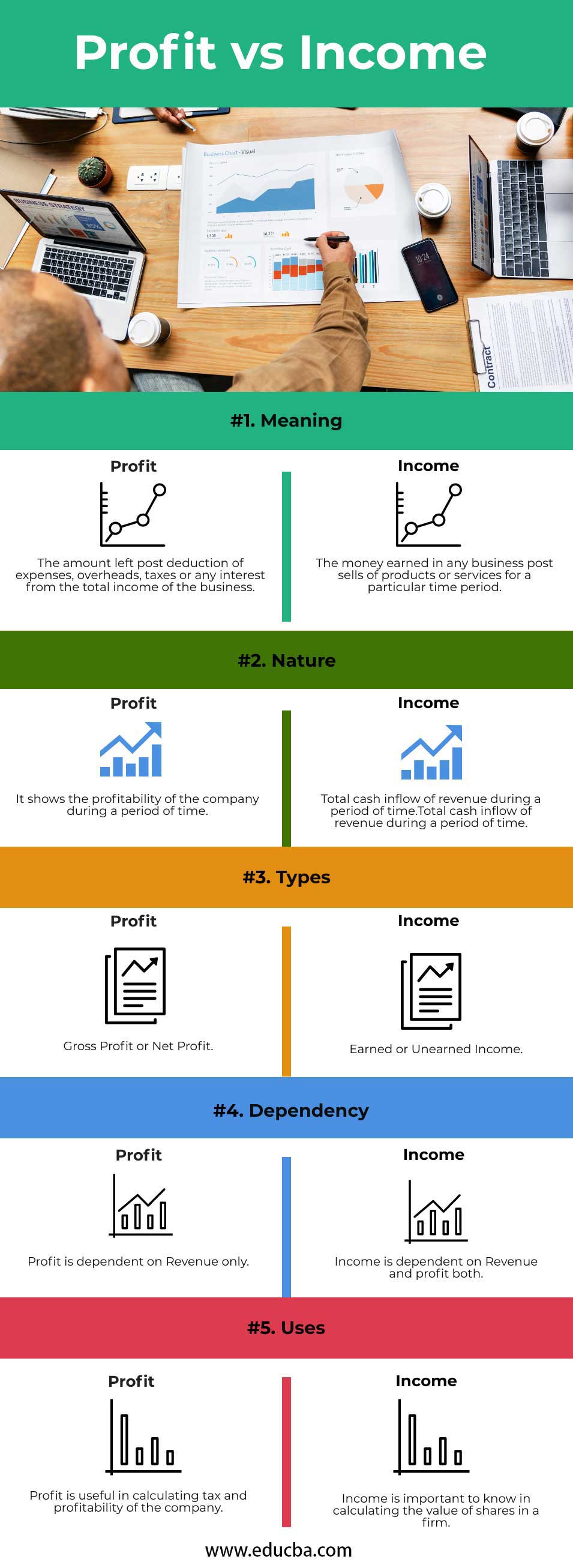

Head to Head Comparison Between Profit vs Income (Infographics)

Below is the Top 5 Comparison between Profit vs Income:

Key Differences Between Profit vs Income

To understand the differences between profit vs income, let’s take one example,

- Suppose one company, Modern Fashion Pvt. Ltd. manufactures gents’ shirts, and each shirt costs $10. In the financial year 2018-19, they sold a total of 5,000 shirts, and they received $50,000 as income.

- As per the accounts, they spent $35,000 as expenses on raw materials, salaries, and other overheads. In this case, the total profit would be $15,000, which would be useful in calculating the tax for the firm and would be transferred to the reserve account in the balance sheet after deducting dividends to the shareholders.

So, by this example, we can understand the difference between profit vs income. Below are the main differences between Profit vs Income,

- Profit is the amount left over after paying for expenses such as raw materials, salaries, tax, interest, or other overheads from the income in the firm. Still, income is the amount received from business activities, whether from direct or indirect sources.

- There are two types of Profit which are Gross Profit and Net Profit. In the same way, income could be two types, Earned or Unearned income.

- Both are dependent on Revenue. Income is dependent on both Profit and revenue.

- Profit shows the company’s actual strength in terms of profitability; it is also helpful in calculating the total tax payable by the firm. On the other side, income shows how much money the firm can distribute among shareholders and keep reserves or reinvest in the firm.

Profit vs Income Comparison table

Below is the topmost comparison between Profit vs Income

| Basis of Comparison | Income | Profit |

| Meaning | The money earned in any business post sells products or services for a particular time period. | The amount left post deduction of expenses, overheads, taxes, or any interest from the business’s total income. |

| Nature | Total cash inflow of revenue during a period of time. | It shows the profitability of the company during a period of time. |

| Types | Earned or Unearned Income | Gross Profit or Net Profit. |

| Dependency | Income is dependent on Revenue and profit both. | Profit is dependent on Revenue only. |

| Uses | Income is important to know when calculating a firm’s share value. | Profit is useful in calculating the tax and profitability of the company. |

Conclusion

So, from the above discussion, we have understood the meaning and differences between Profit vs income. It is clear now that these two terms differ in meaning and uses in accounting. The conclusion of the above discussion is as follows,

- Income and profit are two important terms to understand the financial strength of any company during any particular period of time.

- Income shows the amount earned in any financial year. Still, profit is the positive amount left from the income post deduction of all expenses, overheads, taxes, or interest. In accounting, the terms profit and income can be used interchangeably. Income is termed net earning also.

- Both income and profit deal with positive cash flow.

- There are two types of profit: gross profit and net profit. Gross Profit means the revenue post deduction of trading expenses such as raw material, direct costs, etc. Trading expenses refer to the expenses related to the business’s main activities. On the other hand, net profit also considers income from main and other activities.

- In the same way, there are two kinds of income: earned and unearned. Earned income refers to the amount received from main business activities, such as selling products or services. Still, unearned income means the amount received from other sources, such as investment or the sale of any assets in the business.

- The amount of income is not controllable as it depends on various kinds of internal or external factors. Still, we can control profit as the expenses are internal kind of nature and manageable by effective management.

- The profit during any particular period is directly proportionate to income if the management can control expenses. More income means more profit for the business.

- Profit and income are the two main parts of financial statements to know the profitability and strength of any firm.

- In the initial stage of any business, profit vs income considers the same terms due to fewer transactions. But the management should understand the difference between these two terms to make proper decisions in the business. These help in cash flow and financial decisions.

Recommended Articles

This is a guide to the top difference between Profit vs Income. Here we also discuss the Profit vs Income and key differences with infographics. You may also have a look at the following articles to learn more-