Updated July 31, 2023

Difference Between Equity vs Fixed Income

Any business which needs to survive and stay healthy in the long term and in the interest of time needs to raise financing and funds to meet its financial goals and fulfill its long-term plans. Any company needs cash inflow in the form of equity or cash from revenue to pay off its short-term and long-term obligations. This Equity vs Fixed Income article will try to understand the key differences between the two major fundraising mediums: fixed income and equity, which businesses generally take to run their day-to-day operations and manage long-term capital expenditures.

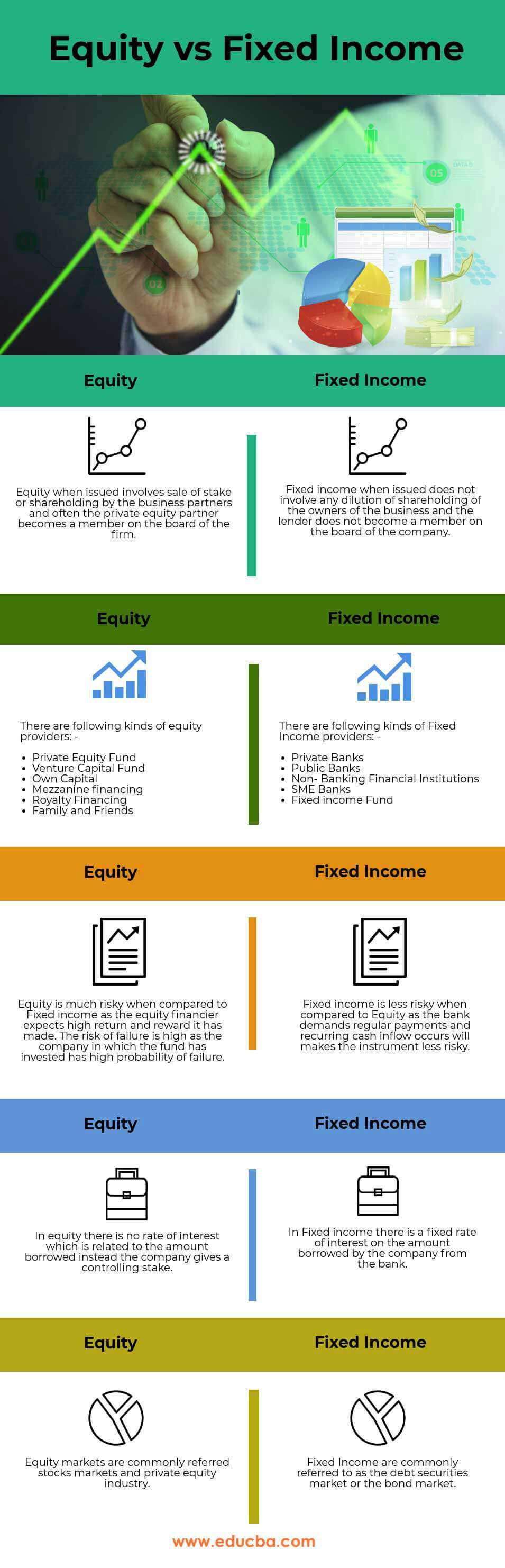

Head To Head Comparison Between Equity vs Fixed Income (Infographics)

Below is the top 5 difference between Equity vs Fixed Income.

Key Differences Between Equity vs Fixed Income

Let us discuss some of the major differences.

- The major and the most important difference between Equity vs Fixed Income is that under fixed income, there is a necessary payment obligation to repay the interest and the principal on the fixed income availed by the company from any sources. In contrast, in the case of equity, there is no such obligation for repayment; the term is much longer than fixed-income financing.

- Another major difference between Equity vs Fixed Income is that in equity investment, the investor willing to invest in the company runs on a lot of risks as the returns on the investment are not steady, whereas, in fixed income, the return on the investment is steady. The cash flow looks recurring and consistent.

- A company can raise equity for the business from various sources, for example – venture capitalist funds or private equity funds which are focused on a certain sector; also, if a company is in the bootstrapping stage, the founders should pool in their capital, which is also in the form of equity to kickstart the operations of the business. On the contrary, the company’s sources of long-term or short-term fixed income are major Banks and Non-banking Financial Institutions, also government banks from which fixed income can be availed.

Equity is generally the shareholder’s capital invested by the business partners. The stake in the company is generally decided in the proportion of their invested amount. On the other hand, Fixed income, when offered, does not involve any sale of a stake or anything by the owners of the business; it is simply a liability that needs to be repaid on a timely basis by the business.

Equity vs Fixed Income Comparison Table

Let’s look at the top 5 Comparisons between Equity vs Fixed Income.

| Equity | Fixed income |

| When issued, Equity involves a sale of stake or shareholding by the business partners, and often the private equity partner becomes a member of the board of the firm. | When issued, fixed income does not dilute the business owners’ shareholding, and the lender does not become a member of the company’s board. |

There are the following kinds of equity providers: –

|

There are the following kinds of Fixed Income providers: –

|

| Equity is much risky when compared to Fixed income as the equity financier expects a high return and reward it has made. The risk of failure is high as the company in which the fund has invested has a high probability of failure. | Fixed income is less risky than Equity as the bank demands regular payments, and recurring cash inflow will make the instrument less risky. |

| Inequity, there is no interest rate related to the amount borrowed; instead, the company gives a controlling stake. | There is a fixed interest rate on the amount borrowed by the company from the bank in Fixed income. |

| Equity markets are commonly referred to as stocks and private equity industries. | Fixed Income commonly refers to the debt securities market or the bond market. |

Conclusion

Also, equity comes with voting rights as compared with fixed income. Hence both are major sources of financing and cash flow for any business. The company should find an adequate fixed income and equity mix to form a balanced capital structure to enjoy the fixed income. Striking a balance between both is not always possible. However, Businesses should optimize leverage to maximize benefits and minimize capital costs.

Recommended Articles

This has guided the top difference between Equity vs Fixed Income. Here; we also discuss the key differences between infographics and comparison table. You may also have a look at the following articles to learn more –