Updated July 24, 2023

Prime Cost Formula (Table of Contents)

What is the Prime Cost Formula?

The term “prime cost” refers to the direct cost of production incurred during a given period of time. In other words, the aggregate of all variable costs directly attributes to the manufacturing process, primarily raw material costs and direct labor costs. Prime cost is also known as ‘direct cost’, ‘flat cost’ or ‘first cost’.

The prime cost formula simply expresses a summation of raw material cost and direct labor cost incurred during the given period of time. Mathematically, it represents as,

Examples of Prime Cost Formula (With Excel Template)

Let’s take an example to understand the calculation of Prime Cost in a better manner.

Prime Cost Formula – Example #1

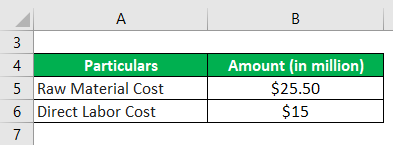

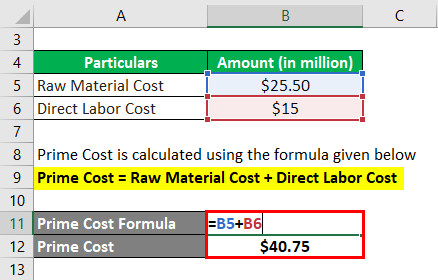

Let us take the simple example of a company that incurred $25.50 million in raw material costs and $15.25 million in direct labor costs in 2018. Calculate the prime cost incurred by the company in 2018.

Solution:

Prime Cost is calculated using the formula given below

Prime Cost = Raw Material Cost + Direct Labor Cost

- Prime Cost = $25.50 million + $15.25 million

- Prime Cost = $40.75 million

Therefore, the company incurred a prime cost of $40.75 million in 2018.

Prime Cost Formula – Example #2

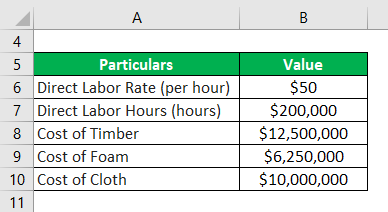

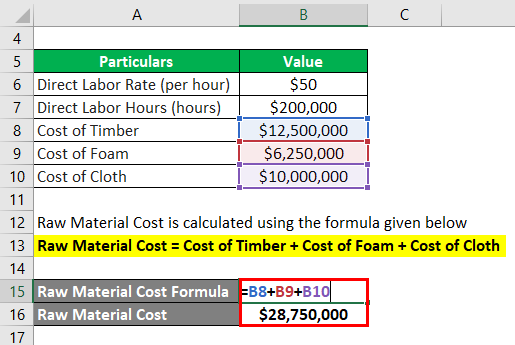

Let us take the example of a company engaged in manufacturing a sofa in the city of Chicago, US. According to the accounts department of the company, the following information is available:

Compute the company’s prime cost during the given period based on the given information.

Solution:

Raw Material Cost is calculated using the formula given below

Raw Material Cost = Cost of Timber + Cost of Foam + Cost of Cloth

- Raw Material Cost = $12500,000 + $6,250,000 + $10,000,000

- Raw Material Cost = $28,750,000

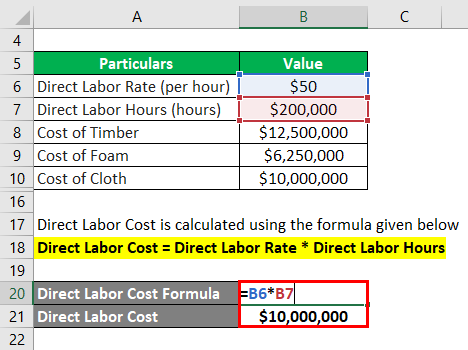

Direct Labor Cost is calculated using the formula given below

Direct Labor Cost = Direct Labor Rate * Direct Labor Hours

- Direct Labor Cost = $50 per hour * 200,000 hours

- Direct Labor Cost = $10,000,000

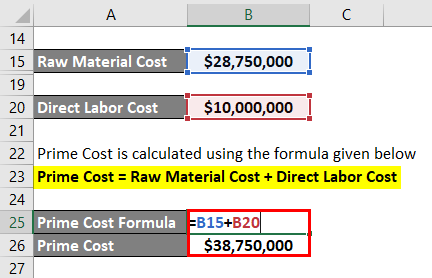

Prime Cost calculates by using the formula given below

Prime Cost = Raw Material Cost + Direct Labor Cost

- Prime Cost = $28,750,000 + $10,000,000

- Prime Cost = $38,750,000

Therefore, the prime cost incurred by the company during the given period was $38.75 million.

Prime Cost Formula – Example #3

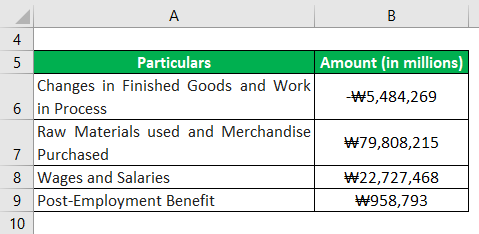

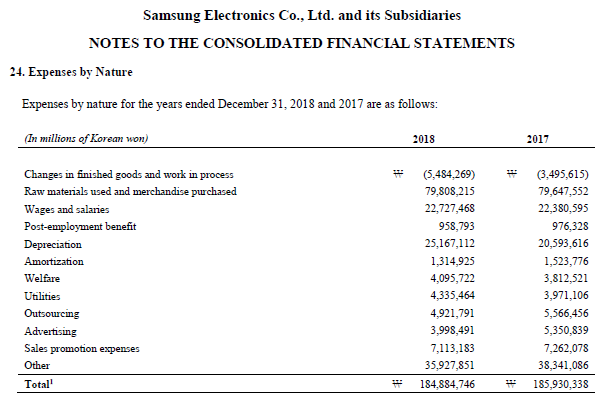

Let us take the example of Samsung Electronics Co. Ltd.’s consolidated financials for 2018. From the annual report, the following information is available:

Compute the prime cost incurred by Samsung Electronics Co. Ltd. during the year 2018 based on the above information.

Solution:

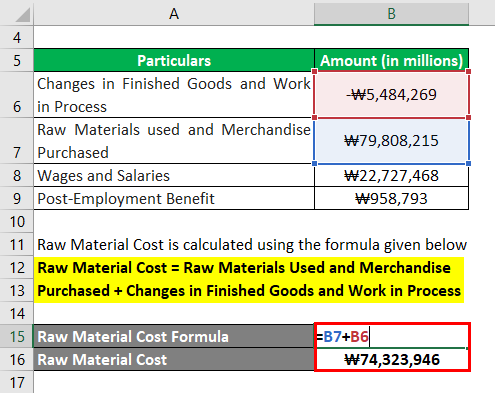

Raw Material Cost calculates by using the formula given below

Raw Material Cost = Raw Materials Used and Merchandise Purchased + Changes in Finished Goods and Work in Process

- Raw Material Cost = ₩79,808,215 million – ₩5,484,269 million

- Raw Material Cost = ₩74,323,946 million

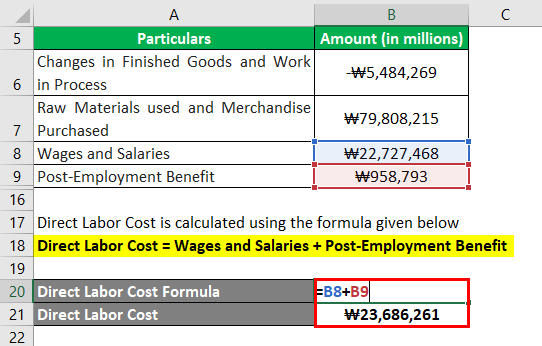

Direct Labor Cost calculates by using the formula given below

Direct Labor Cost = Wages and Salaries + Post-Employment Benefit

- Direct Labor Cost = ₩22,727,468 million + ₩958,793 million

- Direct Labor Cost= ₩23,686,261 million

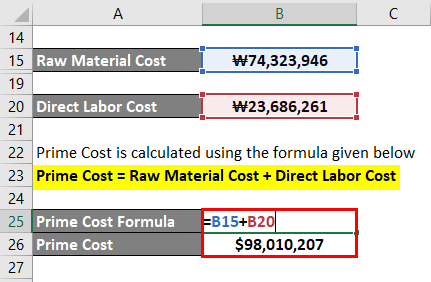

Prime Cost calculates by using the formula given below

Prime Cost = Raw Material Cost + Direct Labor Cost

Prime Cost = ₩74,323,946 million + ₩23,686,261 million

Prime Cost = ₩98,010,207 million

Therefore, Samsung Electronics Co. Ltd. prime cost of ₩98,010,207 million during the year 2018.

Explanation

The formula for prime cost derives by using the following steps:

Step 1: Firstly, determine the cost of raw material incurred in the finished good production during a specific period of time. In most cases, companies report the raw material cost as a separate line item under of cost of goods sold.

Step 2: Next, determine the cost of direct labor, which is the total wages paid to the manpower directly involved in the production process. It usually reports as a separate line item under the cost of goods sold.

Step 3: Finally, the formula for the prime cost incurred during the given period can be derived by adding the raw material cost (step 1) and the direct labor cost (step 2), as shown below.

Prime cost = Raw material cost + Direct labor cost

Screenshot of income statement used for calculation

Source Link: Samsung Inc. Balance Sheet

Relevance and Use of Prime Cost Formula

Understanding the concept of prime cost is crucial because it directly impacts a company’s gross profit and plays a significant role in determining the cost of goods sold. Companies utilize prime cost in computing the contribution margin, which subsequently informs their pricing decisions for finished products. Moreover, the prime cost percentage of sales is a useful metric for comparing peers within the same industry, enabling valuable insights. Theoretically, the lower prime cost is always desirable for better profitability.

Prime Cost Formula Calculator

You can use the following Prime Cost Calculator

| Raw Material Cost | |

| Direct Labor Cost | |

| Prime Cost | |

| Prime Cost = | Raw Material Cost + Direct Labor Cost | |

| 0 + 0 = | 0 |

Recommended Articles

This is a guide to Prime Cost Formula. Here we discuss how to calculate Prime Cost along with practical examples. We also provide a Prime Cost calculator with a downloadable excel template. You may also look at the following articles to learn more –