Updated September 27, 2023

Difference Between NASDAQ and NYSE

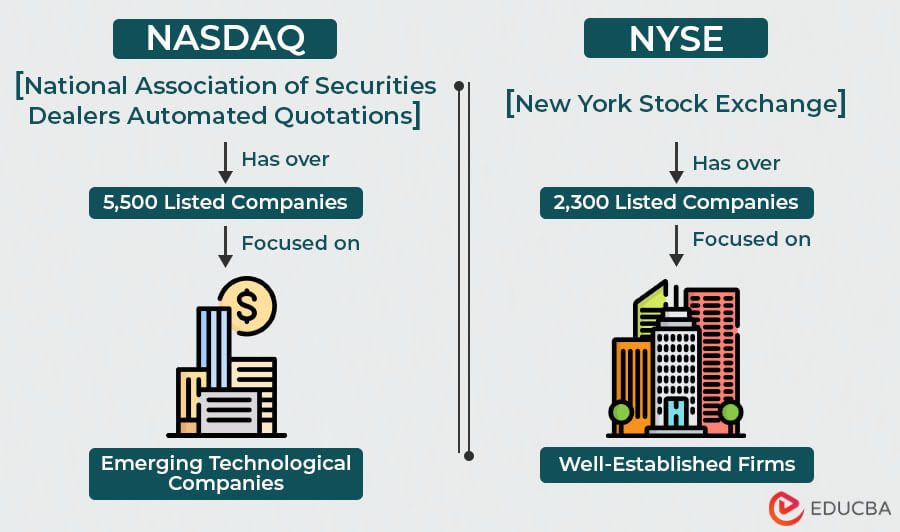

In the United States, both NASDAQ vs NYSE are dominating stock exchanges. The fundamental difference between NASDAQ and NYSE is the way in which they operate. NYSE is an auction-based market, and NASDAQ is a dealer’s market.

Let us see the key differences between both stock exchanges in detail.

What is NYSE?

NYSE stands for New York Stock Exchange, one of the world’s oldest and largest stock exchanges. Founded in 1792 by 24 brokers who signed the Buttonwood agreement, it is located on Wall Street in New York City.

Unlike NASDAQ, NYSE has a physical trading floor where trading specialists oversee transactions. NYSE is known for its traditional and prestigious image and has a diverse range of listed companies, including many well-established blue-chip companies. It is often associated with industries beyond technology, such as finance, energy, and manufacturing. They can also trade electronically across various markets and asset types to offer clients a comprehensive trading experience.

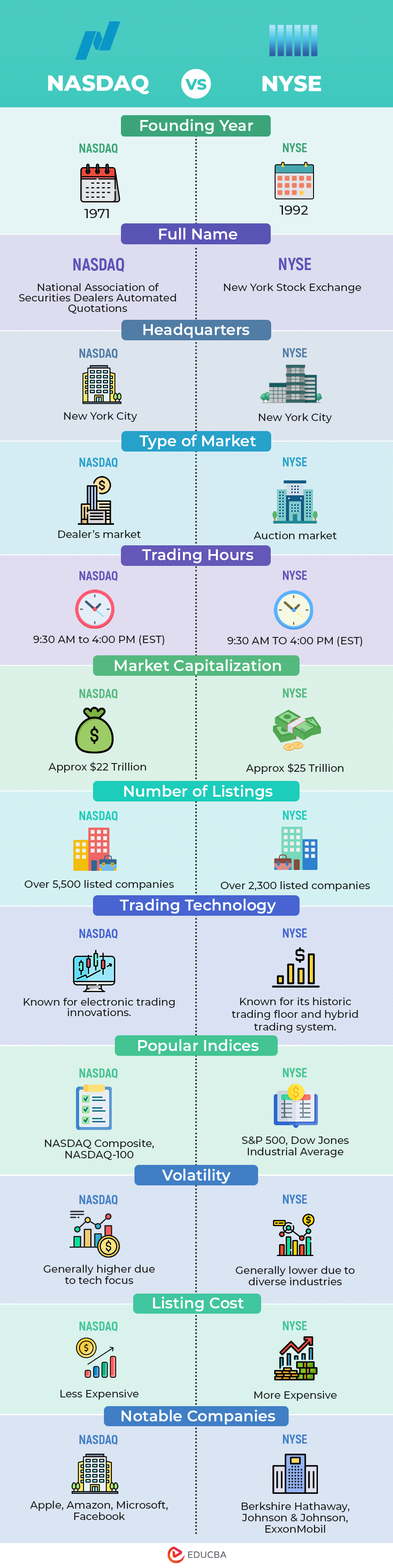

NASDAQ Vs NYSE Infographics

Below is an infographic listing the top 10 differences between NASDAQ vs. NYSE.

Volatility:

- NYSE: It contains companies that are established and old, such as IBM, Walmart, Coca-Cola, and CitiBank. Thus, the stocks are generally more stable.

- NASDAQ: NASDAQ hosts fast-growing volatile companies, primarily tech businesses, with the potential for significant price movements. It includes Google, Apple, Facebook, and Amazon. Thus, the stocks can be more volatile.

Comparison Between NASDAQ Vs NYSE

Here are the other aspects in which NASDAQ vs. NYSE differ.

| Aspect | NASDAQ | NYSE |

| Popular Indices | NASDAQ Composite, NASDAQ-100 | S&P 500, Dow Jones Industrial Average |

| Type of Market | Dealer’s market | Auction market |

| Number of Listings | Over 5,500 listed companies. | Over 2,300 listed companies. |

| Notable Companies | Apple, Amazon, Microsoft, Facebook | Berkshire Hathaway, Johnson & Johnson, ExxonMobil |

| Trading Hours | 9:30 AM to 4:00 PM (EST) | 9:30 AM TO 4:00 PM (EST) |

| Listing Requirements | Generally technology-focused companies. | Diverse range of companies across industries. |

| Market Capitalization | Approx $22 trillion | Approx $25 trillion |

| Volatility | Generally higher due to tech focus. | Generally lower due to diverse industries. |

| Listing Cost | Least Expensive Option: $50,000 initial fee plus $47,000 to $84,000 annually | $295,000 + initial fee plus $74,000 + annually or $0.00117 per share.

Proposed Increase: Minimum $80,000 annually or $0.001215 per share. |

| Corporate Governance | Emphasis on shareholder rights and transparency. | Strong focus on corporate governance and regulation. |

| Trading Technology | Known for electronic trading innovations. | Known for its historic trading floor and hybrid trading system. |

| Exchange Ranking by Size | Ranked 2nd in the list of largest stock exchanges. | Ranked 1st in the list of largest stock exchanges. |

Frequently Asked Questions (FAQs)

Q1. How can I track the performance of stocks on NASDAQ and NYSE?

Answer: You can track the performance of stocks listed on NASDAQ and NYSE through financial news websites, stock market apps, or by viewing stock quotes on your brokerage platform. Additionally, major financial news networks often provide real-time updates on stock prices.

Q2. Are there any specific advantages or disadvantages to listing on NASDAQ vs. NYSE for companies?

Answer: When a company decides where to list its stocks, the decision usually depends on the company’s goals and industry. NASDAQ is a good option if they want tech-savvy investors and easier requirements. On the other hand, NYSE is better if they prefer a prestigious and traditional image.

Q3. How do trading halts work on NASDAQ and NYSE?

Answer: Trading halts can occur on both exchanges due to unusual market activity or significant news events. During a halt, trading is temporarily paused to allow investors to digest new information. The exchange or regulatory authorities typically determine when trading resumes.

Recommended Articles

We hope this EDUCBA guide on NASDAQ vs. NYSE was helpful to you. You can learn more about related topics from the following articles: