Updated July 29, 2023

Difference Between NASDAQ vs Dow Jones

Often, people use words such as ‘the Dow’ and ‘NASDAQ’ with similar connotations, failing to understand that both are different. Dow Jones Industrial Average (DJIA) refers to a stock market index, whereas NASDAQ is an electronic exchange system for the National Association of Securities Dealers Automated Quotients Exchange. NASDAQ also refers to an index. Hence it is used in two ways, i.e. an exchange and an index that presents a certain portion of the market. Here we discuss the NASDAQ vs Dow Jones.

NASDAQ

NASDAQ is the largest electronic stock exchange in the world by Market capitalization after the New York Stock Exchange (NYSE) in the USA. The NASDAQ was founded in 1971 as a replacement for over-the-counter (OTC) trading. It has the highest trading volume compared to any other global exchange. Because of this highest trading volume, it suffers from volatility compared to other exchanges.

NASDAQ Inc. is the owner of an exchange platform. It also owns and operates some stock exchanges in the European markets. The Securities and Exchange Commission (SEC) recognized NASDAQ Inc. as a stock exchange in 2006.

Dow Jones

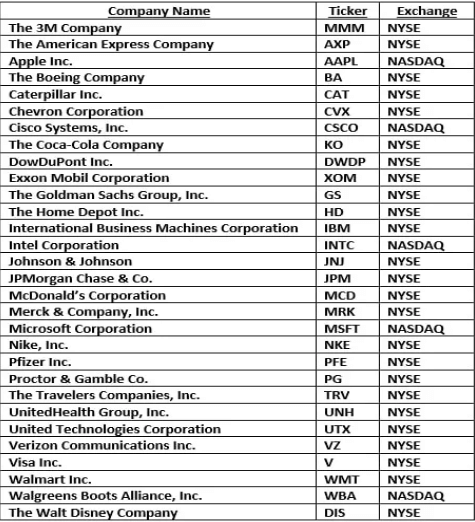

Dow Jones is a financial and business news company. Although the Dow Jones Industrial Average tracks publicly listed companies, Dow Jones is not publicly traded. It was founded in 1896 by Charles Dow, Edward T. Jones, and Charles Berkstresser. The DJIA is the stock index that tracks 30 large publicly owned companies in the USA traded on NYSE and NASDAQ.

The above screenshot lists 30 companies on the Dow Jones Industrial Average.

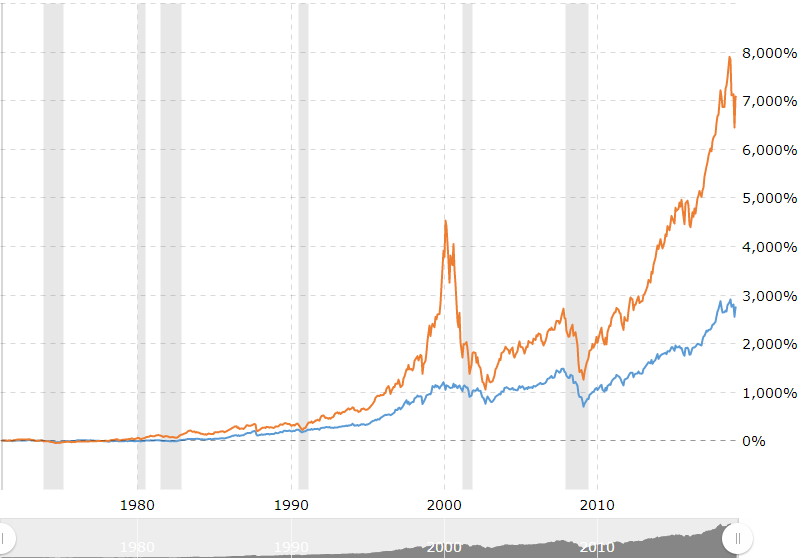

NASDAQ to Dow Jones Ratio

The ratio between NASDAQ vs Dow Jones gives us an interactive chart. A high ratio is an indicator of the fact that the market has gone frenzy, and a high bullish sentiment is prevalent. It is also an indicator of the fact that the economy is faring well. Below is the chart from 1977 to the present presenting both indices’ ratios.

These ways of trading on NASDAQ vs Dow Jones are via ETFs and Index Funds. Index Funds are constructed to track a particular index, such as NASDAQ 100. Investing in an index fund is a passive style of investing. The returns maximize by reducing the buying and selling of stocks frequently. It is an efficient method to reduce operating expenses. Since the fund replicates an index, it eliminates the need for research analysts and other related expenses. Even Warren Buffett recommends investing via Index funds and classifies these funds as a safe haven for retirement. He also says that the performance of an average index fund will fare well compared to the performance of the most active managers.

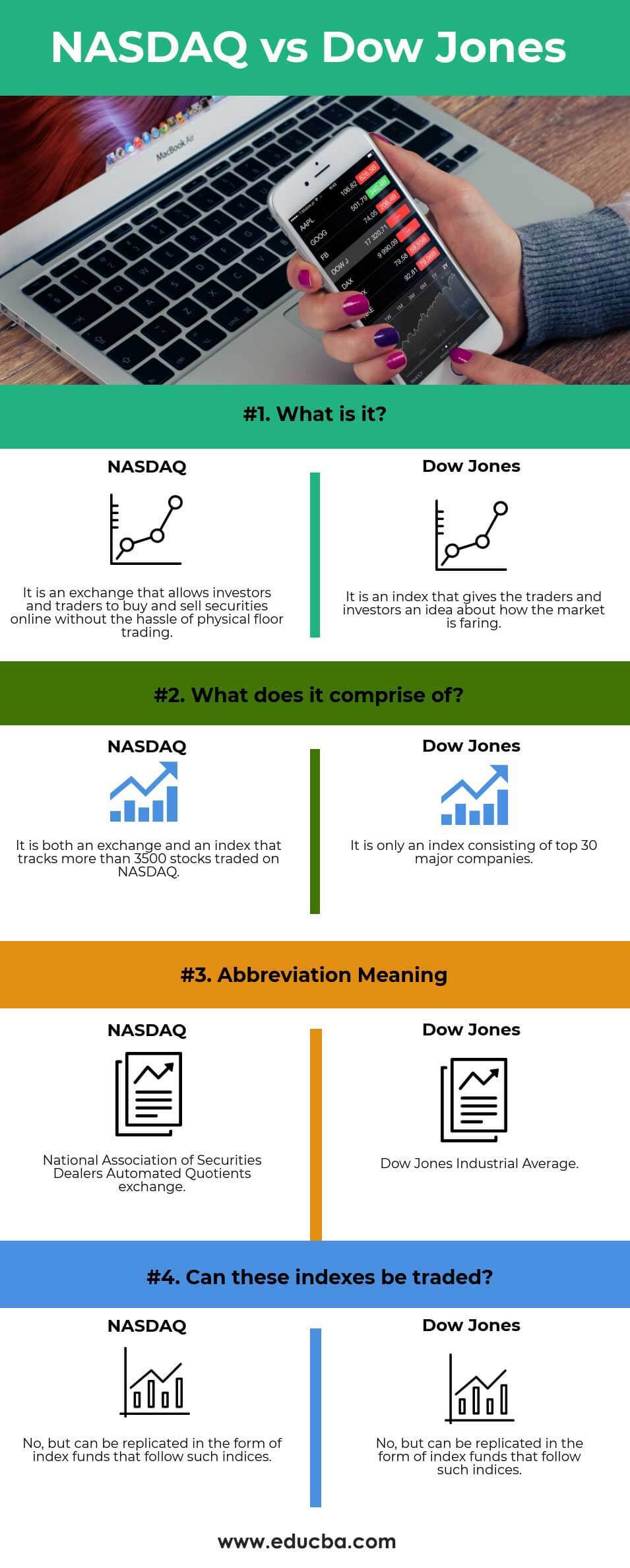

Head To Head Comparison Between NASDAQ vs Dow Jones(Infographics)

Below is the top 4 difference between NASDAQ vs Dow Jones:

Key Differences Between NASDAQ vs Dow Jones

Let us discuss some of the major differences between NASDAQ vs Dow Jones:

- NASDAQ is a stock index consisting of more than 3000 companies, whereas DJIA (Dow Jones Industrial Average) consists of only 30 major companies traded on the NYSE and NASDAQ

- NASDAQ mainly comprises companies in the technology sector or companies in the growth stages, while Dow Jones is more about the stock price and is hence dependent on earnings. If the stock price drops, the index will assign it less weight and may no longer remain a part of it.

- Volatility in the case of Dow Jones is low because it consists of the top 30 companies by sector, and hence these blue-chip companies contribute low volatility whereas, for instance, NASDAQ 100 is more volatile as compared to Dow Jones because of the high risk and growth-oriented companies (the tech giants)

- How technology stocks are faring primarily determines the performance of NASDAQ. Still, in the case of Dow Jones, it is about the 30 companies together and not any company individually.

- Dow Jones calculates the indices in a way that gives greater weight to companies with higher stock prices since it is a price-weighted index. The effect of mergers and stock splits considers by addition or subtraction to the index. In the case of NASDAQ, it is based on the average of the companies’ Market capitalization (Price * Outstanding shares) on the index.

- NASDAQ comprises three market tiers, namely:

- Global Select Market –The NASDAQ Global Select Market has the highest initial global listing standards of any exchange.

- Global Market – The NASDAQ Global Market lists companies with overall global leadership and international reach with their products and services.

- Capital Market – NASDAQ Capital Markets focuses on its core purpose for listed companies, i.e. capital raising.

- DJIA is accessible through :

- ETFs (Exchange-traded funds)

- Futures

- Options

NASDAQ vs Dow Jones Comparison Table

Let’s look at the topmost 4 Comparisons between NASDAQ vs Dow Jones.

| Basis of Comparison |

NASDAQ |

Dow Jones |

| What is it? | It is an exchange that allows investors and traders to buy and sell securities online without the hassle of physical floor trading. | It is an index that gives traders and investors an idea about how the market is faring. |

| What does it comprise of? | It is both an exchange and an index that tracks more than 3500 stocks traded on NASDAQ. | It is only an index consisting of the top 30 major companies. |

| Abbreviation meaning | National Association of Securities Dealers Automated Quotients exchange | Dow Jones Industrial Average |

| Can these indexes be traded? | Index funds can replicate it as they follow such indices. | Index funds can replicate it by following such indices. |

Conclusion

NASDAQ vs Dow Jones refers to market indices, but it should be noted that an investor can only buy and sell stocks on NASDAQ since it is an exchange also where the stocks can be bought and sold electronically. Moreover, traders cannot trade these indices directly as they only represent a certain set of stocks based on certain criteria, as we looked at in this article (price-weighted and Market capitalization based). The ways of trading are through Exchange-traded funds or index funds.

Recommended Articles

This has guided the top difference between NASDAQ and Dow Jones. Here we also discuss the NASDAQ vs Dow Jones key differences with infographics and a comparison table. You may also have a look at the following articles to learn more.