Updated July 5, 2023

What is the Manufacturing Overhead Formula?

Manufacturing overhead is the cost of everything a company needs to make a product that is not linked directly to any specific product. For example, the rent a company pays for its factory is an overhead cost because it applies to the whole factory, not just one product.

Therefore, to find how much manufacturing overhead a company has, it uses a manufacturing overhead formula that adds up all costs that do not link to a specific product.

When a company produces something, it incurs different kinds of costs. Some costs are directly related to making the product (eg: cost of raw materials and labor). These are called direct costs. Other costs aren’t directly tied to any product and include rent, utilities, and equipment maintenance. We call these indirect costs.

Now, sometimes indirect costs are necessary for production but can’t be traced to a specific product. These are known as manufacturing overhead costs.

The manufacturing overhead formula helps the company understand the true cost of making its products and allows them to decide how to price its products and how many to produce. We can derive the formula for manufacturing overhead by deducting the cost of raw materials and direct labor cost (a.k.a. wages) from the cost of goods sold. This formula allows companies to make better decisions about running their business and making more money.

Manufacturing Overhead Formula

There are a few different versions of the manufacturing overhead formula that you can use to calculate the manufacturing overhead costs. Those formulas are:

Or

Or

Types of Overheads Costs

1. Fixed: These overhead costs remain constant regardless of production or sales volume changes. Examples include rent, property taxes, and insurance premiums.

2. Variable: These are overhead costs that change proportionately to production or sales volume changes. Examples include direct materials and direct labor costs.

3. Semi-variable: These overhead costs have fixed and variable components. Examples include utility costs, which may have a fixed component (such as an essential service charge) and a variable component (such as usage-based charges).

Types of Manufacturing Costs

1. Facility Costs: These include rent, property taxes, insurance, and maintenance necessary to run the manufacturing facility.

2. Utilities: These include electricity, water, and gas used in manufacturing.

3. Supervision and Management: These include salaries, benefits, and other costs associated with supervisory and management personnel responsible for overseeing the manufacturing process.

4. Equipment Costs: These include depreciation, maintenance, and repair costs for machinery and equipment used in manufacturing.

5. Quality Control: These include costs associated with ensuring the quality of the manufactured products, such as inspection, testing, and auditing costs.

6. Materials Handling and Storage: These include costs for moving and storing materials used in the manufacturing process, such as forklift operation, pallets, and warehouse space.

7. Quality Control: These costs include the cost of inspection, testing, and quality assurance of the finished product before its shipment to the customer.

8. Research and Development: These include costs associated with researching and developing new products or improving existing ones.

9. Taxes and Licenses: These include taxes and licenses required to operate a manufacturing facility, such as property taxes, business licenses, and environmental permits.

How to Calculate Manufacturing Overhead Formula?

Step #1

Determine the total cost of indirect materials used in the production process, such as a month or a year, during a given period. It includes lubricants, cleaning supplies, and other materials used in the manufacturing process.

Step #2

Determine the total indirect labor cost for the same period. It may include salaries, wages, and benefits paid to employees not directly involved in the production process, such as Supervisors and Maintenance Personnel.

Step #3

Determine the total cost of other overhead expenses for the same period, such as rent, utilities, insurance, and taxes.

Step #4

Add the three numbers obtained in steps 1, 2, and 3 to calculate the total manufacturing overhead for the period.

Examples of Manufacturing Overhead Formula (With Excel Template)

Example #1

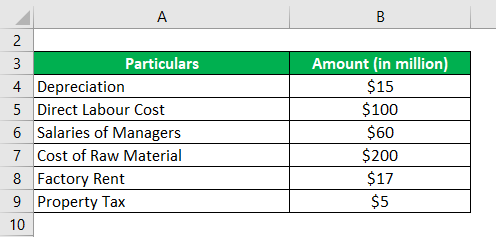

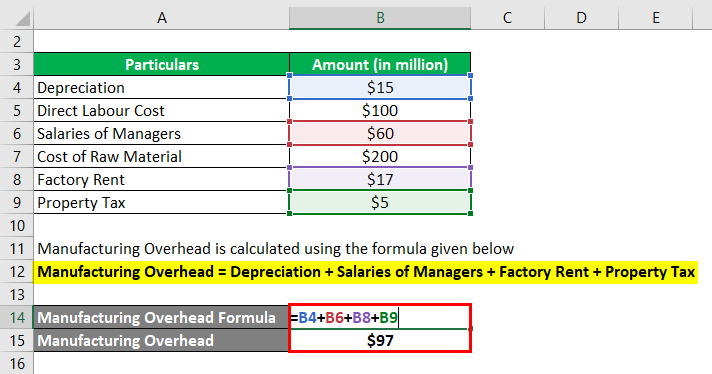

Given are the various cost fields of company ABC. Calculate the Manufacturing Overhead from the given data.

Solution:

From the above list, depreciation, salaries of managers, factory rent, and property tax fall in the category of manufacturing overhead. However, we will not consider direct labor costs and the cost of raw materials for calculation as they are direct production costs.

Thus, the formula to calculate Manufacturing Overhead is as follows:

Manufacturing Overhead = Depreciation + Salaries of Managers + Factory Rent + Property Tax

= $15 million + $60 million + $17 million + $5 million = $97 million

Hence, the company’s manufacturing overhead for the year stood at $97 million.

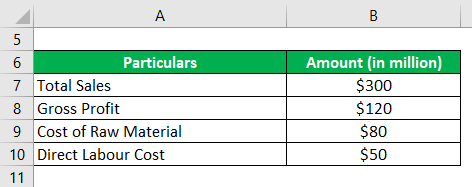

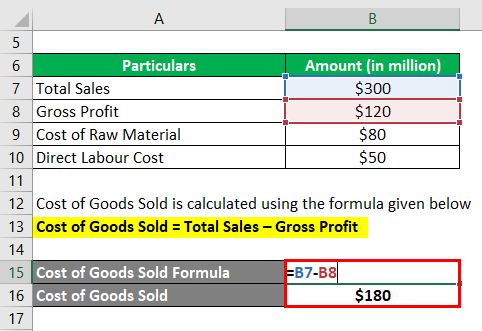

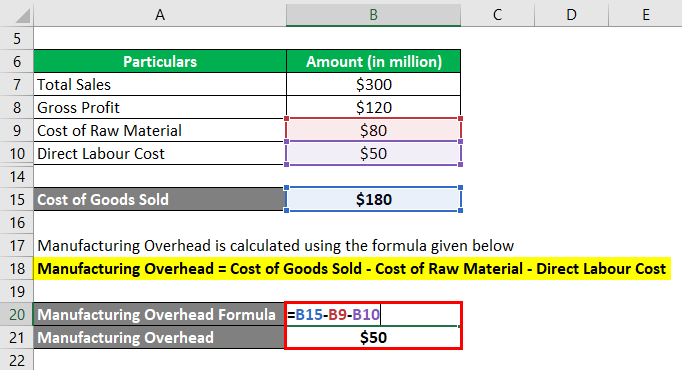

Example #2

Let us take the example of ASF Ltd, which manufactures leather bags. In 2022, the company recorded a gross profit of $120 million on total sales of $300 million. If the cost of raw material and direct labor are $80 million and $50 million, respectively, then calculate the manufacturing overhead of ASF Ltd for the year.

Solution:

Step 1: Determine the Cost of Goods Sold (COGS)

Calculate the cost of Goods Sold using the formula given below:

Cost of Goods Sold = Total Sales – Gross Profit

= $300 million – $120 million = $180 million

Step 2: Determine the Manufacturing Overhead

Manufacturing Overhead = Cost of Goods Sold – Cost of Raw Material – Direct Labour Cost

= $180 million – $80 million – $50 million = $50 million

Therefore, the manufacturing overhead of ASF Ltd for the year stood at $50 million.

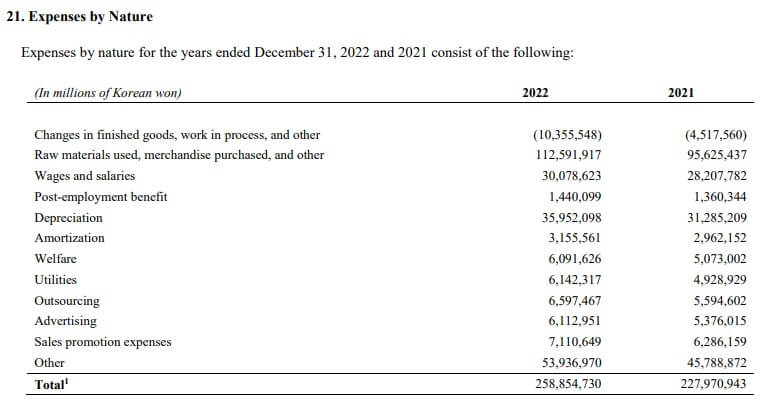

Example #3

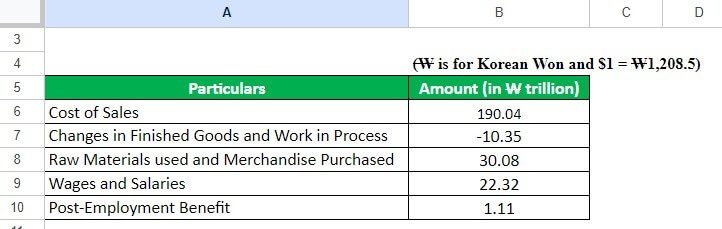

Let us take the example of Samsung’s annual report for the year 2022. During 2022, the company incurred the cost of sales of W190.041 trillion.

The image below shows the various expenses that Samsung incurred in 2022. We will use the data to calculate the manufacturing overhead costs.

(Source: Samsung Annual Report 2022)

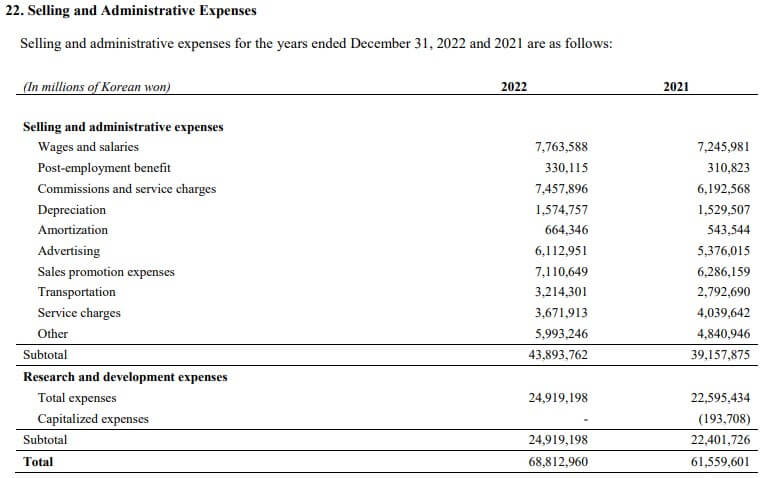

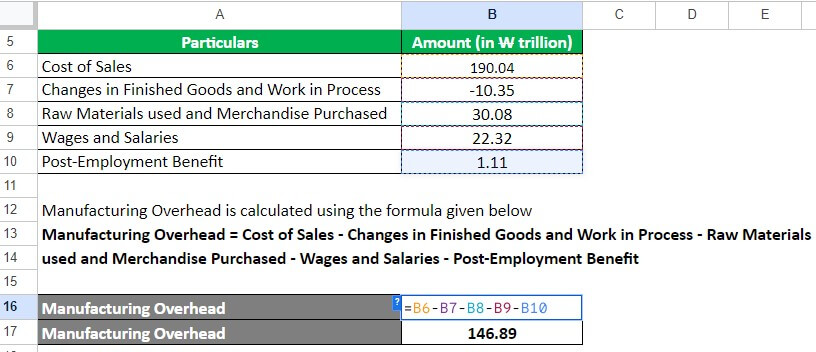

Solution:

The following is the break-up of the cost of sales. Using the given information, we will calculate the manufacturing overhead of Samsung for the year 2022. The data in the table is from Samsung’s annual report for 2022. We have added the Excel template to simplify the calculations for you.

To arrive at the wages and salaries amount, we subtract the wages and salaries in the selling and administrative expenses section (W7.76) from the wages and salaries present in the expenses by nature section (W.30.07). We do the same for post-employment benefits.

In the above break-up, we identify changes in finished goods and work in process, raw materials used and merchandise purchased wages and salaries, and post-employment benefits as direct production costs.

Therefore, Manufacturing Overhead will be,

Manufacturing Overhead = Cost of Sales – Changes in Finished Goods and Work in Process – Raw Materials used and Merchandise Purchased – Wages and Salaries – Post-Employment Benefit

= W190.04 – (- W10.35) – W30.08 – W22.32 – W1.11

= W146.89 trillion

Therefore, the manufacturing overhead of Samsung for the year 2022 stood at W146.89 trillion.

Applied Manufacturing Overhead Formula

The manufacturing overhead formula calculates all the indirect costs of making products. Simply, it helps companies figure out how much it costs them to make all their products combined. However, the applied overhead formula takes the total indirect costs calculated by the manufacturing overhead formula and assigns a portion of those costs to each product. It helps companies determine how much it costs them to make each specific product.

To calculate the applied manufacturing overhead, we use a formula that considers Actual manufacturing overhead costs (the actual amount of indirect costs) and the predetermined overhead rate.

The predetermined overhead rate is a numerical estimate of how much the company will spend on indirect costs and how much it plans to produce during the period. Businesses calculate it before the start of an accounting period. It is based on estimating the total indirect manufacturing costs and the total manufacturing activities incurred during the accounting period.

The formula is,

Example:

A company estimates it will incur $100,000 in total manufacturing overhead costs for the upcoming accounting period and expects to produce 10,000 units. The predetermined overhead rate for this period would be $10 ($100,000/10,000 units). During the period, the actual manufacturing overhead costs incurred by the company were $110,000. To determine the amount of manufacturing overhead to apply to each unit of product, we would use the applied manufacturing overhead formula:

Applied Manufacturing Overhead = Actual Manufacturing Overhead Costs x Predetermined Overhead Rate

= $110,000 x $10 = $1,100,000

Therefore, the company would apply $1,100,000 of manufacturing overhead costs to the 10,000 units produced during the period. It would result in an applied manufacturing overhead rate of $110 per unit ($1,100,000 divided by 10,000 units).

Allocation Manufacturing Overhead Formula

The allocated manufacturing overhead formula focuses on assigning indirect costs to specific products or cost centers. In contrast, the manufacturing overhead formula focuses on calculating all the indirect production costs.

Allocated manufacturing overhead determines how much indirect costs a company should add to each product produced. It is done by taking the total amount of indirect costs and dividing it by a number (allocation base) that represents how much of a specific activity a company uses to make each product. The company may use the allocation base as the number of hours workers spent making a product or how long a machine was running to create a product.

The formula is,

Example:

Let’s say a company incurred $200,000 in manufacturing overhead costs during a particular period, and the allocation base used to allocate these costs as direct labor hours. If the total direct labor hours for the period were 10,000, the allocated manufacturing overhead per direct labor hour would be:

Allocated Manufacturing Overhead = Total Manufacturing Overhead Costs/Allocation Base

= $200,000 ÷ 10,000 direct labor hours = $20 per direct labor hour

It means every direct labor hour used to produce a product costs $20 in manufacturing overhead.

Accounting For Manufacturing Overhead

To account for manufacturing overhead, companies typically use a predetermined overhead rate. To calculate this rate, divide the estimated total manufacturing overhead for a period by the estimated total units produced for the same period.

After establishing the overhead rate, the firm assigns the actual manufacturing overhead incurred during the period to each production unit based on the given overhead rate. The allocation process usually includes direct labor hours, machine Hours, or output units.

At the end of the period, the business reconciles the difference between the estimated manufacturing overhead cost and the actual manufacturing overhead cost through overhead variance analysis. This analysis helps companies identify inefficiencies in their production processes and make necessary adjustments to improve operations.

Journal Entry Example:

|

Account |

Debit (Dr.) |

Credit (Cr.) |

| Manufacturing Overhead |

$25,000 |

|

| Property Tax Payable

Salaries Payable Inventory (Work in Progress) Inventory (Finished Goods) Cost of Goods Sold |

$3,000 $2,500 $11,000 $6,000 $2,500 |

Relevance and Uses of Manufacturing Overhead Formula

Manufacturing Overhead Formula is suitable for manufacturing companies as it helps them understand the costs of producing goods.

Companies can use this formula to determine the total cost of producing a product, including direct and indirect costs. This information is essential for deciding product profitability and making informed decisions about pricing, production volumes, and cost-saving strategies.

Manufacturing Overhead Formula Calculator

Use our following calculator for manufacturing overhead calculations:

| Cost of Goods Sold | |

| Cost of Raw Material | |

| Cost of Direct Labour | |

| Manufacturing Overhead = | |

| Manufacturing Overhead = | Cost of Goods Sold - Cost of Raw Material - Cost of Direct Labour |

| = | 0 - 0 - 0 = 0 |

Frequently Asked Questions (FAQs)

Q1. What makes up Manufacturing Overhead?

Answer. The following components make up Manufacturing Overhead:

- Indirect Materials: The cost of raw materials that do not directly come into use in the production process, such as lubricants and cleaning supplies.

- Indirect Labor: The wages and salaries of employees not directly involved in the production process, such as maintenance workers and supervisors.

- Factory Overhead: The cost of operating and maintaining the factory building and equipment, such as rent, utilities, repairs, and maintenance.

- Depreciation: The cost of the wear and tear on the equipment and machinery used in the production process.

- Quality Control: The cost of inspecting and testing the final product to ensure it meets the required quality standards.

- Other Indirect Costs: Miscellaneous expenses, such as insurance, property taxes, and legal fees, are not directly related to the production process.

Q.2 Is manufacturing overhead an asset?

Answer. Manufacturing overhead is not an asset but rather an expense. It is an indirect cost associated with the production process and is necessary for producing goods. As such, the company considers it an expense in the period they incur it and record it in the income statement as part of the cost of goods sold.

Q3. What are two types of overhead?

Answer. The two types of overheads are manufacturing and non-manufacturing:

Manufacturing overhead: This is the indirect cost associated with the production process and includes all expenses that do not attribute directly to a specific product, such as:

- Factory rent

- Utilities

- depreciation of equipment

- wages of indirect labor

Non-manufacturing overhead: This is the indirect cost associated with the general operation of a business and includes all of the expenses unrelated to the production process, such as:

- Administrative salaries

- Marketing and advertising expenses

- Office rent and utilities

- Legal and accounting fees

- Insurance

Q4. What is an example of manufacturing overhead?

Answer. Gas and electricity that a company uses to produce goods and services are examples of manufacturing overhead.

Recommended Articles

This was an EDUCBA guide to Manufacturing Overhead Formula. To learn more, please read the recommended articles,