Updated July 13, 2023

Gross Sales Formula (Table of Contents)

What is Gross Sales Formula?

The term “gross sales” refers to a company’s unadjusted topline or the total amount of goods sold during a given period of time. In other words, a company recognizes gross sales as revenue before adjusting for returns, discounts, and allowances.

Consequently, we can derive the formula for gross sales as a summation of net sales, sales returns, discounts, and allowances. Mathematically, we represent it as,

Example of Gross Sales Formula

Let’s take an example to understand the calculation of Gross Sales in a better manner.

Gross Sales Formula – Example #1

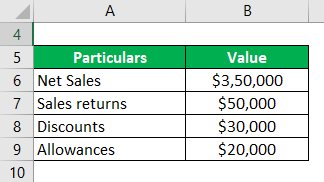

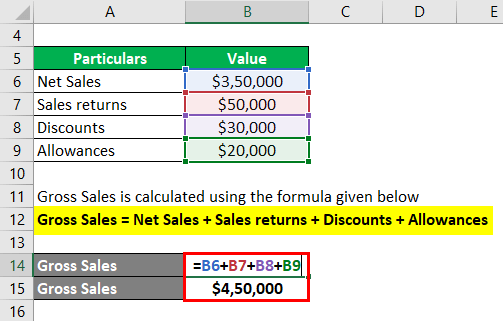

Let us take the example of a company to illustrate the calculation of gross sales. The company recognized net sales of $350,000 in 2019. Further, goods worth $50,000 were returned, while the company offered early payment discounts of $30,000 and allowances of $20,000. Determine the company’s gross sales recognized during 2019 based on the given information.

Solution:

Gross Sales are calculated using the formula given below

Gross Sales = Net Sales + Sales returns + Discounts + Allowances

- Gross Sales = $350,000 + $50,000 + $30,000 + $20,000

- Gross Sales = $450,000

Therefore, the company generated gross sales of $450,000 in 2019.

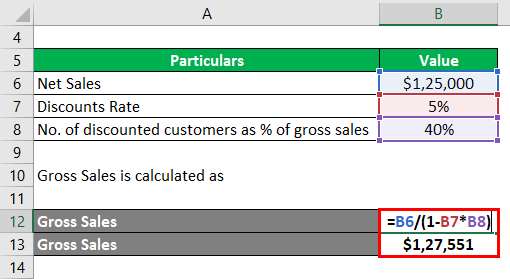

Gross Sales Formula – Example #2

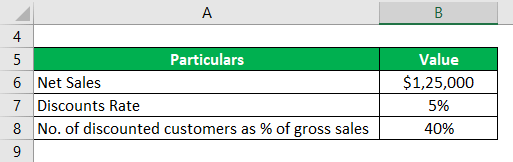

Let us take the example of GHJ Inc., a furniture wholesaler. The company booked net sales of $125,000 during December 2019. It usually offers a discount of 5% when customers make the payment within 7 days from the date of sales. Determine the gross sales of GHJ Inc. if 40% of the customers made early payments and availed of the discount.

Solution:

Gross Sales are calculated as

- Gross Sales = $125,000 / (1 – 5% * 40%)

- Gross Sales = $127,551

Therefore, GHJ Inc. generated gross sales of $127,551 in December 2019.

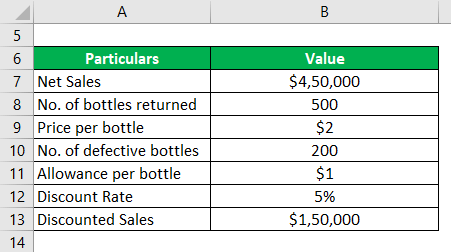

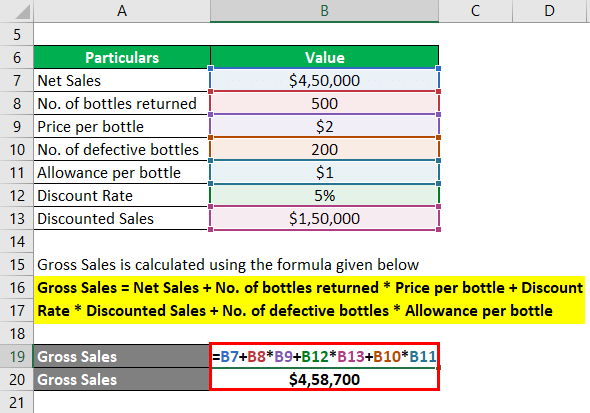

Gross Sales Formula – Example #3

Let us take another example of ZED Inc., a bottle manufacturing entity. In 2019, the company booked net sales of $450,000. Further, the customers returned 500 bottles worth $2 each due to some quality issues, while another 200 defective units were sold at an allowance of $1 per bottle. Some customers availed early payment discount of 5% on sales worth $150,000. Determine ZED Inc.’s annual gross sales based on the given information.

Solution:

Gross Sales are calculated using the formula given below

Gross Sales = Net Sales + No. of bottles returned * Price per bottle + Discount Rate * Discounted Sales + No. of defective bottles * Allowance per bottle

- Gross Sales = $450,000 + 500 * $2 + 5% * $150,000 + 200 * $1

- Gross Sales = $458,700

Therefore, ZED Inc. booked gross sales of $458,700 in 2019.

Explanation of Gross Sales Formula

The below-mentioned steps are to be to derive the formula for gross sales:

Step 1: Firstly, ascertain the net sales booked by the company for the period. The reason for using net sales in the calculation of gross sales is that most companies report net sales as the first line item in their income statement.

Step 2: Next, ascertain the sales return recognized for the period. It captures the monetary value of the goods the end-users have returned for various reasons, such as product quality, business policy, etc. In case of sales return, the customers are refunded the amount paid for the goods.

Step 3: Next, ascertain the discounts offered to some privileged customers during the period. The deduction in the selling price is extended to customers if they make timely or early payments. These discounts are major in controlling trade receivables and facilitating faster recovery.

Step 4: Next, ascertain the amount of allowances offered to customers during the period. These allowances are simply reductions in selling price owing to some defect or damage in the sold goods.

Step 5: Finally, the formula for gross sales can be derived by adding net sales (step 1), sales returns (step 2), discounts (step 3), and allowances (step 4), as shown below.

Relevance and Use of Gross Sales Formula

Although the line item of gross sales is seldom seen in a financial statement, it is still an essential financial concept as it captures a company’s unadjusted revenue, potentially setting the tone of the entire income statement. It represents the overall sales generated by a company. Some companies report gross revenue or gross sales as the first line item in the income statement, followed by sales returns, discounts, and allowances to arrive at the net sales.

However, it fails to capture sales returns, discounts, and allowances’ impact on a company’s revenue. As such, investors and analysts prefer to use net sales over gross sales for various analytical purposes as it provides the true picture of the company’s top line.

Conclusion

So, it is prudent to report gross sales in the income statement as a separate line item, followed by various deductions and net sales. However, some analysts believe that non-disclosure of gross sales and deductions is not a good practice. In such a scenario, the readers of the financial statements are left unaware of some essential sales information.

Gross Sales Formula Calculator

You can use the following Gross Sales Calculator

| Net Sales | |

| Sales Returns | |

| Discounts | |

| Allowances | |

| Gross Sales | |

| Gross Sales = | Net Sales + Sales Returns + Discounts + Allowances | |

| 0 + 0 + 0 + 0 = | 0 |

Recommended Articles

This is a guide to Gross Sales Formula. Here we discuss How to Calculate Gross Sales, practical examples, and a downloadable Excel template. You may also look at the following articles to learn more –