Updated October 12, 2023

What Is The Forex Trading Strategies?

Forex Trading Strategies – Have you ever wondered about the import-export happening in the countries?

Consider, If India exports its Alphonso mangoes to the US, what will it receive in return? Any guesses?… US mangoes? US goods?

No!!! But the Money. Some may question, ” What kind of money will India receive?” If it receives dollars, then what government will do with the dollars? Will it circulate for daily use with Indian rupees?

Again, the answer is “No!!!”

The dollars given by the US are converted into Indian rupees, and then they will be circulated for use in the country. How is this conversion done? By doing some magic tricks or printing the dollars in the rupee form.

Let me help you out in clearing this confusion.

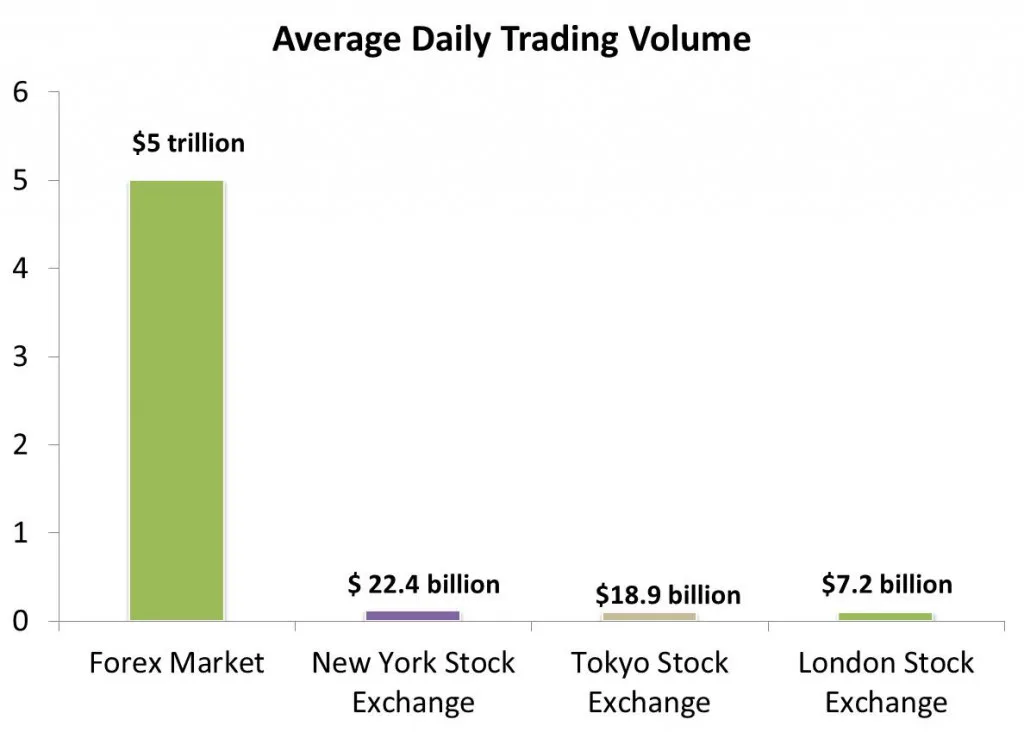

The foreign exchange market, usually known as “forex” or “FX,” is the largest financial market in the world with a $5 TRILLION a day trade volume.

Below is a forex trading strategies chart from which you can get an idea of what kind of trading must happen in the forex market.

What are Forex Trading Strategies (Forex)?

Foreign exchange refers to a discussion of currencies. It is the trading of currencies from different countries against each other. The FX market is the place where various currencies are traded.

What is traded in the Forex market?

Nothing but the MONEY. There is no physical buying or selling of goods, which can be confusing.

- Consider buying a forex trading strategy currency as buying a share in a particular country, like buying stocks of a company. The currency’s price is a mirror that shows what the market thinks about the current and future health of that Country’s economy.

- You purchase a “share” of the Australian economy when you buy the Australian dollar. You believe the Australian economy is doing well and will improve over time. Once you sell those “shares” back to the Market, hopefully, you will end up with forex trading, meaning profit.

It is all about the trading of money, but where is the Market or the place where this trading takes place?

Hold on!!! There is also a concept called FOREX Market, explained in the following paragraph.

FOREX Market

The foreign exchange market (FOREX Market) is the World’s biggest O-T-C Market or the “Interbank” Market because the entire Market is run electronically, within a network of banks, continuously over 24 hours.

This means that the forex market is spread globally with no central location.

The Forex market is the most liquid in the World. You buy one forex trading strategy’s currency and sell the other to make a profit. The main goal is to profit when the exchange rates of the currencies traded move as per your speculation. Over 90% of all currencies are traded against the US Dollar (USD).

How Do Forex Trading Strategies Work?

Forex Trading strategies are similar in concept to share trading; that is, as a trader, if you choose a currency pair, which accordingly you expect to change in value; that is, if you had purchased 500 Euros in June 2012 of cost USD 700 and after waiting for some time like 10-12 months the value has increased such that 500 Euros valued at USD 800 then you want to book profit with a gain of 100 dollars.

These trades are placed through a forex trading tips broker or market. And placing orders is very easy, with just a few clicks. In the next step, the Broker will pass the order to the partner bank, where your position for that order is booked. When you want to come out of a trade, the broker will close the position in the market. Thus, according to market conditions, credits or debits happen in your Forex trading tips account.

Reasons for Foreign Exchange Trading

1. Global Business Operations

In today’s global market, businesses operate worldwide as products or goods are transferred from one country to another. For that purpose, countries’ currency differs; for example, India’s currency is Rupees, and the US currency is dollars. Hence, in that case, for a successful trade, they need to exchange their currencies.

2. Profit Speculation

Some traders or individuals see the Forex for profit-making purposes. If these people expect one currency to rise against another, they will trade on that currency.

3. Brokerage Purpose

As the forex trading strategies institutes or the individuals trading in foreign exchange receive various prices from banks or other networks, they tend to receive brokerage in trades.

Primary Participant in the FOREX Market

Following is the major participant in the FOREX market:

- Financial Institution

- Corporates

- Banks

- Government

- HNI (High net worth individuals)

- Hedge Fund

- Mutual Fund

- Pension Fund

- Insurance Companies

List of some currencies with their country name:

| Country | Currency Code | Currency |

|---|---|---|

| AUSTRIA | EUR | EURO |

| AUSTRALIA | AUD | AUSTRALIAN DOLLAR |

| BELGIUM | EUR | EURO |

| INDIA | INR | Rupee |

| CANADA | CAD | CANADIAN DOLLAR |

| SWITZERLAND | CHF | SWISS FRANC |

| GERMANY | EUR | EURO |

| UNITED KINGDOM | GBP | POUND STERLING |

| JAPAN | JPY | YEN |

| NORWAY | NOK | NORWEGIAN KRONE |

| SWEDEN | SEK | SWEDISH KRONA |

| UNITED STATES | USD | US DOLLAR |

| China | CNY | Yuan |

You might be confused about how the currency code is decided from the above table.

Here is an answer to your confusion.

Currency symbols are always indicated by three letters, where the first two letters recognize the country’s name, and the third letter recognizes the name of that country’s currency.

Take USD, for instance. US stands for the UNITED STATES, while D stands for Dollar.

Notation

Forex trading strategies are the simultaneous buying of one currency and selling of another. So, it is clear that we require a pair of currencies for trading the currencies. That is, the trader is buying one currency against another currency. It is expressed in a standard manner,

For example, USD/GBP and EUR/JPY are known as Currency pairs. The first among the pair is “Base Currency”, and the other is “Quote Currency”. USD and EUR are the base currencies, and GBP and EUR are the quote currencies.

The quote values are given to the fourth decimal point, i.e., USD/GBP 0.6734 0.6741

The first numerical value in the above notation denotes the GBP equivalent to one USD. Here, the difference between the prices shown is counted to the fourth decimal place, a pip.

In our case, there are 7 pips.

Another example,

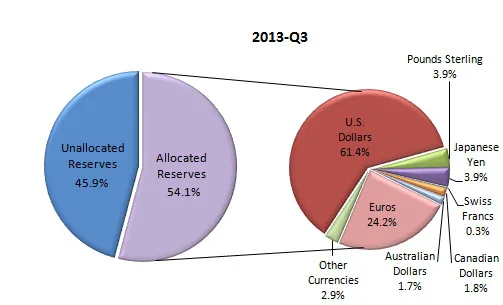

Currency Composition of Official Foreign Exchange Reserves (COFER)

According to the International Monetary Fund (IMF), the U.S. dollar comprises roughly 61% of the world’s official foreign exchange reserves!

There are other vital reasons why the U.S. dollar plays a central role in the forex market.

- The United States economy is the LARGEST in the world.

- The financial markets are the largest and most liquid in the United States.

- Also, being a strong country, it has a stable political system.

Source: International Monetary Fund

Different Ways to Trade Forex

The execution of Forex trading techniques can be done in a variety of ways. The most well-liked ones are:

Spot Market: Traders execute currency trades instantly, or “on the spot,” in the spot market, utilizing the most recent market price. What is important about this market is its simplicity, liquidity, tight spreads, and round-the-clock operations.

Futures: contracts to buy or sell a certain asset at a specified price on some future date. It is a binding contract between the two parties (buyer and seller), allowing them to trade a certain amount of currency pair at a predetermined price in the future.

Options: An “option” is a financial instrument that gives the buyer the right or the option, but not the obligation, to buy or sell an asset at a specified price on the option’s expiration date. If a trader “sold” an option, he or she would be obliged to buy or sell an asset at a specific price at the expiration date.

Exchange-traded Funds: Investors trade exchange-traded funds (ETFs) on stock markets like shares, as these investment funds represent a single currency or a group of currencies. Investors are less inclined towards futures or forex markets use currency ETFs.

Benefits of Forex Trading Strategies

1. Time and Place Flexibility

The market is open 24 hours daily, so we don’t have to worry about managing our time. Also, we don’t have to visit any place or location for trading. It can take place in any part of the world.

2. Highly Liquid Market

The market is so huge that it is extremely liquid. Around 4 trillion dollars are exchanged every day. Using the benefits of Stoploss, you can keep an eye on the market conditions without causing much loss.

3. Low Transaction Costs

The transaction costs are determined by the bid/ask spread, which is usually less than 0.1%, and in the case of large dealers, it may be even lower.

4. Margin-Based Trading

Once you have funded a margin account with your broker, you can engage in any trading activity you wish so long as you have sufficient margin remaining in your account.

Risks in Foreign Exchange Trading

As we know, every coin has two sides; we need to focus on the other side. Foreign exchange trading carries certain risks.

- Exchange Rate Risk: This type of risk can arise when there is an imbalanced supply and demand situation in the forex market. So traders must be careful in limiting trades in the form of stop loss.

- Interest Rate Risk: These risks relate to futures, swaps, and forward trading. This is due to trade fluctuations, maturity gaps, and mismatches.

- Country Risk: This risk is crucial because of the interference of the government involved in the markets. Sometimes, a party may receive some unexpected return due to the country’s policy and norms incorporated by a government.

Recommended Articles

Here are some articles that will help you to get more detail about Forex Trading Strategies, so just go through the link.