Updated October 9, 2023

Introduction to Equity Research Jobs

Are you looking for equity research jobs? Here are a few things that will aid you in knowing about the various job structures, positions, and roles in the equity research domain. First and foremost, let’s look at the prerequisites required that you would need to seek equity research jobs.

Criteria and Credentials for Equity Research Jobs

Many candidates look for jobs in Equity research right after graduation or after attending the MBA program. Another approach to getting into equity research analyst jobs is to spend about 5-10 years working for an industry and then look for an analyst position.

Regarding the academic background, a degree in Economics, Finance, or Business specialization would be preferred at an undergraduate level. One would need to know to account for and have good computer proficiency. Further, a Master’s Degree program in Economics, Finance, or Business increases the employment opportunities available to candidates. Another important thing that would help one get an equity research analyst job is completing an investment firm internship and gaining practical experience. CFA institute also provides credentials for those who meet the educational criteria and pass the three levels of their examination, which can prove very useful for job opportunities.

Equity Research Associate Jobs

Because the economy’s constantly changing, this job offers a lot for you to be interested in what you’re doing. Things become boring when everything sets into the routine, but in equity research, every day is different. It gets very challenging, and you’re competing with other analysts at other firms to put out the best research that will keep you on your toes. Though there is a lot of hard work and time that you would put into this job daily, whatever research you produce, the name is published, which is quite a motivation to be proud of. Along with all this comes the high salary level, a good amount of bonuses and increments.

Worst Part of Equity Research Associate Jobs

Due to not-so-good economic conditions getting a job in this field becomes difficult as few good positions are available, and stiff competition. It is a fast-moving industry where some great work you did would get quickly irrelevant. Equity research jobs are fast-paced, and there is a demand for a greater appreciation for these roles due to their dynamic nature. One needs to be able to go with the flow and move on to the next.

Skills Required for Equity Research Jobs

- Financial Modeling using Excel

- Financial analysis skills

- Business analysis knowledge

- Capabilities to write reports and give presentations

- Correct judgment

If you wish to learn these skillsets professionally, you can look at our Online Equity Research Training Program or opt for Equity Research Internships with us.

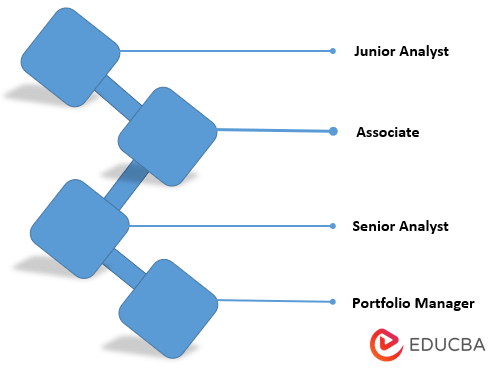

Hierarchy and Role

The job hierarchy in a typical equity research firm could be the following:

1. Junior Analyst

Fresh graduates typically start from this position, depending on their academic credentials. You start at the Junior analyst level; this is where you learn about the 10-20+ companies your team (usually you and your boss) are responsible for by updating the earnings models and industry models (primarily Excel and Access-Based), summarizing any news or recent developments that would probably affect the valuation of your companies, and writing research notes on company news and earnings.

Once you are comfortable with all this, your manager will start bringing you into conversations with clients, allowing you to discuss with them; this is where you can begin building your reputation. After spending a few years in this position, you could probably get promoted to an Associate.

2. Associate

This promotion could come sooner or later depending on how fast you grasp knowledge about the companies, your proficiency at discussing the industry you have researched, and how well you communicate your ideas and give presentations. Associates would be responsible and allotted their sectors to work upon. The most effective Associates have great relationships with clients, company management, and other industry experts who can discuss the expected changes in the industry that could affect the stock prices of the companies they are covering.

3. Senior Analyst

From there, exceptional associates can progress to senior analyst positions in a few years. The senior analyst-level positions would require at least five years of work experience, an MBA or finance-based degree from a reputed college, or the CFA charter. An Analyst’s job is to serve existing clients exceptionally well and attract new clients to grow the business.

4. Portfolio Manager or Vice President

The more business you bring in, the faster your salary and bonus will shoot up, and your title will move to Senior Analyst, followed by Managing Director.

Recommended Articles

This article is a guide to Equity Research Jobs. Here, we discuss the Introduction, criteria, and credentials with skills required for Equity research jobs. You may also look at the following articles to learn more –