Updated July 25, 2023

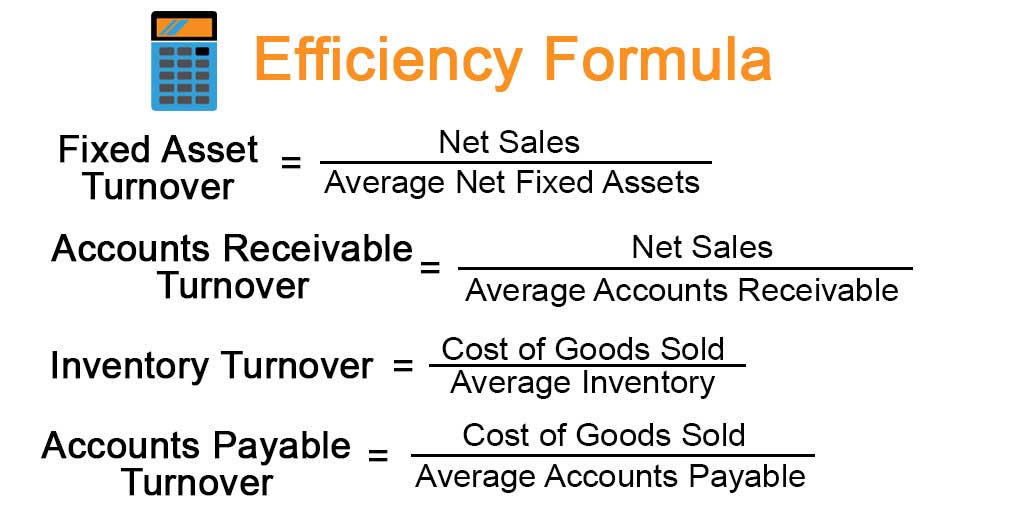

What is the Efficiency Ratio Formula?

The term “Efficiency Ratio Formula” refers to the set of ratios that measure how well a company can utilize its assets and capital to generate revenue.

In this article, we will discuss the following efficiency ratios:

- Fixed Asset Turnover Ratio

- Accounts Receivable Turnover Ratio

- Inventory Turnover Ratio

- Accounts Payable Turnover Ratio

The fixed asset turnover ratio formula can be expressed by dividing the company’s net sales by the average net fixed assets. The mathematical representation of the formula is as below:

The accounts receivable turnover ratio formula can be expressed by dividing the net sales by the average accounts receivable. The mathematical representation of the formula is as below:

The inventory turnover ratio formula can be expressed by dividing the cost of goods sold by the average inventory. The mathematical representation of the formula is as below:

The accounts payable turnover ratio formula can be expressed by dividing the cost of goods sold by the average accounts payable. The mathematical representation of the formula is as below:

Example of Efficiency Ratio Formula (With Excel Template)

Let’s take an example to understand the calculation of the Efficiency Ratio Formula in a better manner.

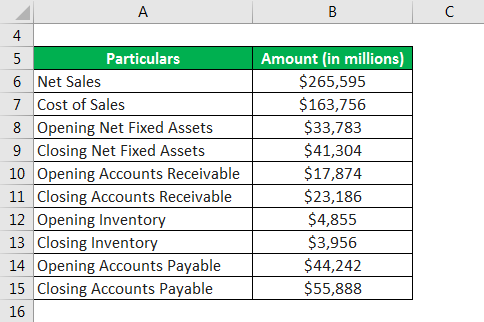

Example #1

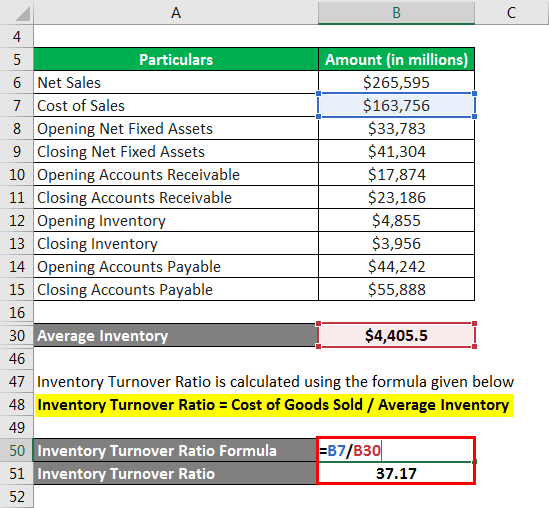

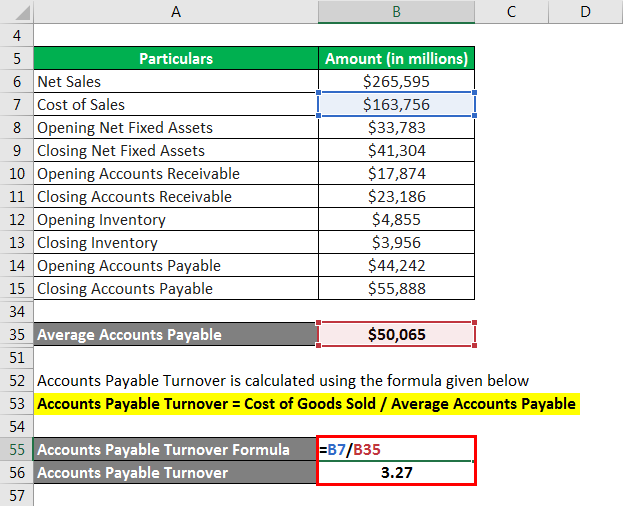

Let us take the example of Apple Inc.’s annual report for the year 2018 to illustrate the efficiency formula’s concept. Calculate the efficiency ratios for the year 2018 based on the below-given information.

Solution:

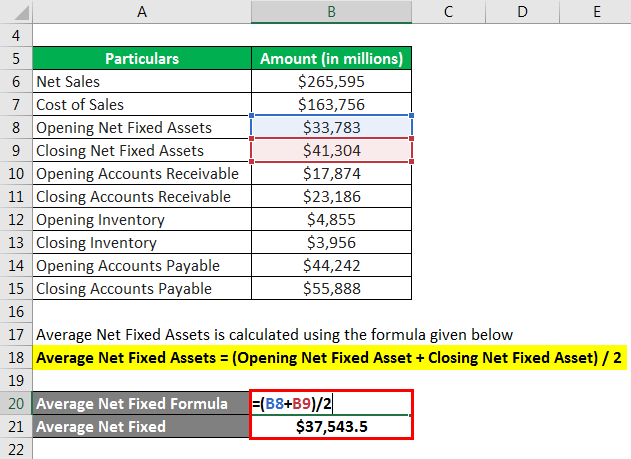

The formula to calculate Average Net Fixed Assets is as below:

Average Net Fixed Assets = (Opening Net Fixed Asset + Closing Net Fixed Asset) / 2

- Average Net Fixed Assets = ($33,783 million + $41,304 million) / 2

- Average Net Fixed Assets = $37,543.5 million

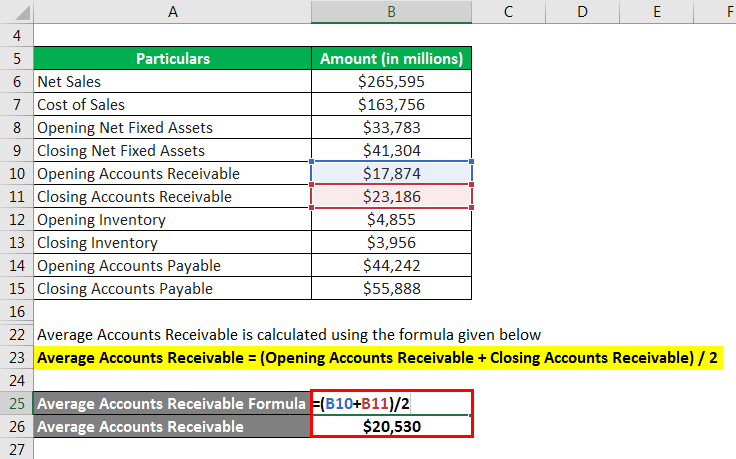

The formula to calculate Average Accounts Receivable is as below:

Average Accounts Receivable = (Opening Accounts Receivable + Closing Accounts Receivable) / 2

- Average Accounts Receivable = ($17,874 million + $23,186 million) / 2

- Average Accounts Receivable = $20,530 million

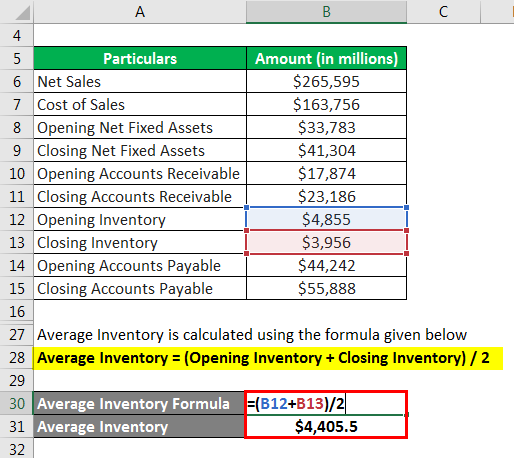

The formula to calculate Average Inventory is as below:

Average Inventory = (Opening Inventory + Closing Inventory) / 2

- Average Inventory = ($4,855 million + $3,956 million) / 2

- Average Inventory = $4,405.5 million

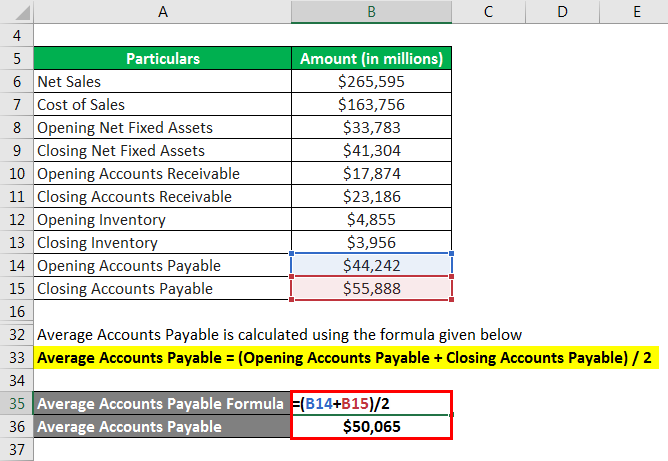

The formula to calculate Average Accounts Payable is as below

Average Accounts Payable = (Opening Accounts Payable + Closing Accounts Payable) / 2

- Average Accounts Payable = ($44,242 million + $55,888 million) / 2

- Average Accounts Payable = $50,065 million

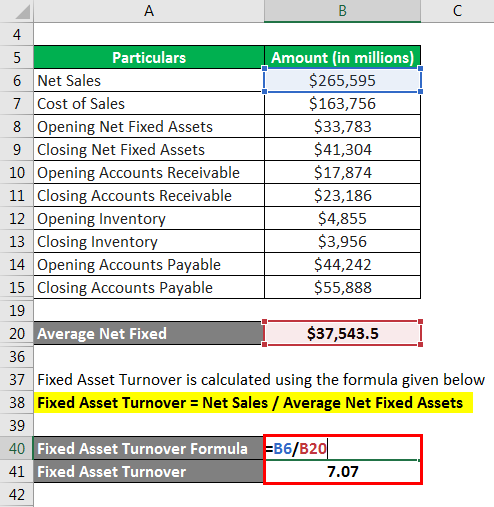

The formula to calculate Fixed Asset Turnover is as below:

Fixed Asset Turnover = Net Sales / Average Net Fixed Assets

- Fixed Asset Turnover = $265,595 million / $37,543.5 million

- Fixed Asset Turnover = 7.07

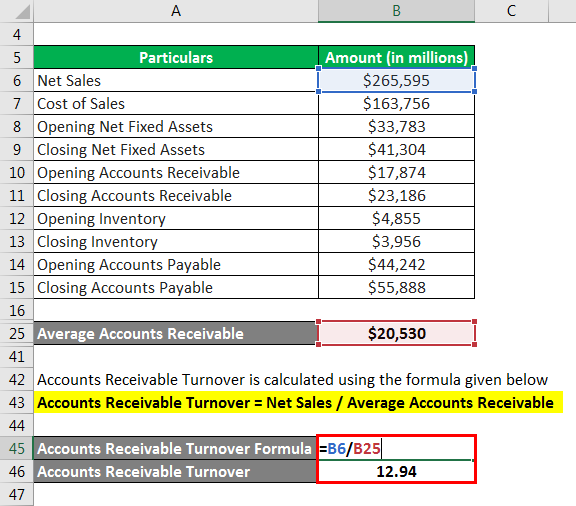

The formula to calculate Accounts Receivable Turnover is as below:

Accounts Receivable Turnover = Net Sales / Average Accounts Receivable

- Accounts Receivable Turnover = $265,595 million / $20,530 million

- Accounts Receivable Turnover = 12.94

The formula to calculate Inventory Turnover Ratio is as below:

Inventory Turnover Ratio = Cost of Goods Sold / Average Inventory

- Inventory Turnover Ratio = $163,756 million / $4,405.5 million

- Inventory Turnover Ratio = 37.17

The formula to calculate Accounts Payable Turnover is as below:

Accounts Payable Turnover = Cost of Goods Sold / Average Accounts Payable

- Accounts Payable Turnover = $163,756 million / $50,065 million

- Accounts Payable Turnover = 3.27

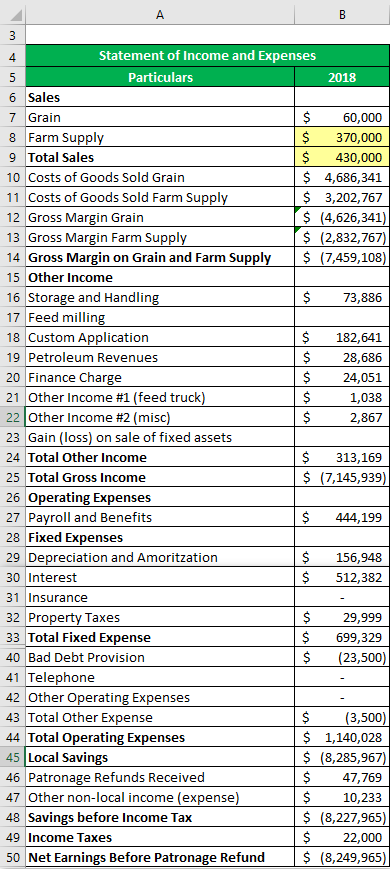

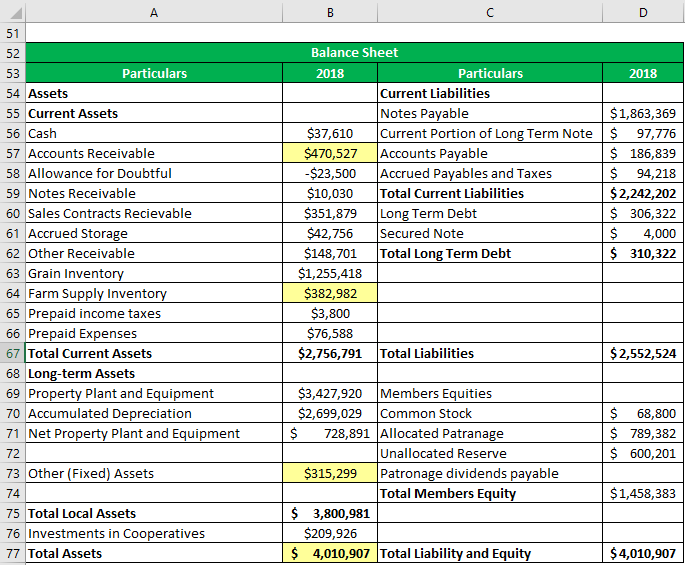

Example 2

Let us look at a comprehensive example and calculate the important efficiency ratios based on the income statement and balance sheet of ABC Limited.

Solution:

Using the above statements, let us now calculate the efficiency ratios –

Total Asset Turnover calculation:

Total Asset Turnover = Total Sales / Total Assets

- Total Asset Turnover = $4,30,000 / $40,10,907

- Total Asset Turnover = 0.11x

Total Assets to Sales calculation:

Total Assets to Sales = Total Assets / Total sales

- Total Assets = $40,10,907 / $4,30,000

- Total Assets = 9.33

Fixed Assets to Total Assets = Fixed Assets / Total Assets

- Fixed Assets to Total Assets = $3,15,299 / $40,10,907

- Fixed Assets to Total Assets = 7.86%

Explanation

The Efficiency Ratio Formula can be calculated by using the following steps:

Step 1: First, determine the company’s net sales during the given period.

Step 2: Next, determine the cost of goods sold, which is the aggregate of all the directly assignable costs of production, primarily raw material cost and direct labor cost. It is also reported as a cost of sales in many income statements.

Step 3: Next, determine the average net fixed assets, which are the average of the net fixed assets at the beginning and the end of the period. The net fixed asset is gross block minus accumulated depreciation.

Average Net Fixed Assets = (Opening Net Fixed Asset + Closing Net Fixed Asset) / 2

Step 4: Next, determine the average accounts receivable, which are the average of the accounts receivable at the beginning and at the end of the period.

Average Accounts Receivable = (Opening Accounts Receivable + Closing Accounts Receivable) / 2

Step 5: Next, determine the average inventory, which is the average of the inventory at the beginning and at the end of the period.

Average Inventory = (Opening Inventory + Closing Inventory) / 2

Step 6: Next, determine the average accounts payable, which is the average of the accounts payable at the beginning and at the end of the period.

Average Accounts Payable = (Opening Accounts Payable + Closing Accounts Payable) / 2

Step 7: Therefore, the formula for the fixed asset turnover ratio can be derived by dividing the net sales (step 1) by the average net fixed assets (step 3), as shown below.

Fixed Asset Turnover = Net Sales / Average Net Fixed Assets.

Step 8: Therefore, the accounts receivable turnover ratio formula can be derived by dividing the net sales (step 1) by the average accounts receivable (step 4), as shown below.

Accounts Receivable Turnover = Net Sales / Average Accounts Receivable

Step 9: Therefore, the formula for the inventory turnover ratio can be derived by dividing the cost of goods sold (step 2) by the average inventory (step 5), as shown below.

Inventory Turnover = Cost of Goods Sold / Average Inventory.

Step 10: Therefore, the accounts payable turnover ratio formula can be derived by dividing the cost of goods sold (step 2) by the average accounts payable (step 6), as shown below.

Accounts Payable Turnover = Cost of Goods Sold / Average Accounts Payable

Relevance and Use of Efficiency Ratio Formula

This ratio is of particular importance to the investors, who use it to measure the company’s performance. This ratio measures the efficiency of the company and how efficiently the company uses its assets. It helps the investors understand how the company is performing and the ability of the company to use its long-term assets.

Moreover, a business can use efficiency ratios to judge the capability of the management. Efficiency ratios primarily measure a company’s time to collect its receivables from the customer or convert inventory into revenue or the return generated on the invested capital. A comparison of the efficiency ratio with the industry benchmarks can provide useful insights into a company’s operation.

Recommended Articles

This is a guide to the Efficiency Ratio Formula. Here we discuss calculating the Efficiency Ratio Formula along with practical examples. We also provide a downloadable Excel template. You may also look at the following articles to learn more –