Updated July 19, 2023

Introduction to Earnout

Earnout can be defined as a contractual arrangement of pricing in mergers and acquisitions where the seller of a business earns compensation in the future after the company achieves its financial goals and objectives following the purchase, usually expressed in the form of specific percentages, say on gross margin or net profit after tax, etc.

Explanation

An earnout is a contractual mechanism between the business seller and the buyer where the buyer of the business agrees to pay in the future based on earnings, usually undertaken when there is disagreement on growth and performance aspects of the target company. This generally takes place over three to five years, involving ten to fifteen percent of the purchase price being assessed after closing the acquisition. An earnouts’ terms and conditions depend on the party that manages the business after completion. An earnout arrangement does not have a hard and fast set of rules to be followed. It is used to bridge the valuation gap between the buyers and sellers.

Example of Earnout

ABC company is running a business of FMCG in which during the last financial year, sales were $300 million, and earnings were $100 million. Mr. John wants to buy the business of ABC Company Ltd. for $150 million. The owner of ABC Ltd. is ready to sell his business, but he believes that the price offered is meager and would also undervalue the company’s future growth prospects.

So the owner asked for a $300 million price for the business, which Mr. John denied. Parties decide to use an earnout method to come to a solution and bridge the gap of the difference amount. The owner of ABC Ltd. asked Mr. John to make the upfront payment of $150 million and earnout payment of $150 million to be paid in case the earnings reach the level of $200 million within three years window or else $50 million will be given as the earnout money to the ABC ltd if the sales reach the level of $100 million. If these targets are not met, then the seller will not be paid anything in the future.

Earnout Structuring

There is no single simple earnout method for the entrepreneur looking for a quick business sale. Significant risks are involved in any acquisition that comprises future conditions. Earnout depends on various variables and goals like determining the crucial members of the organization, cash compensation, length of the contract revenue, net income, EBITDA target, etc. Accounting assumptions need to be considered.

Sellers prefer revenue that could be boosted through business activities. At the same time, buyers prefer net income as the most appropriate point of reflection for the company’s economic performance. Margin level sales, gross profit, operating income, environmental cost, etc., are considered in structuring earnout.

Earnout in M&A Transaction

The following two essential points must be considered to complete a successful merger and acquisition transaction:

- Deal Structure

- Valuation

In the deal structure, earnout allows a specified percentage on which sales prices are agreed upon. The percentage of the sales price is generally related to the performance of the targeted business. If the financial matrix is met, sellers of business will earn more money. In a deal structure, the buyer pays partial purchase consideration to the seller at a specific date once the performing goals are achieved. Here the buyer and seller share the potential risk of future growth, which is not accounted for using a simple EBITDA method.

This process allows the buyer to reduce the risk. It helps buyers and sellers to close the deal. Earnout provides an add-on option to finance an acquisition and lessen the upfront cost. For the seller, it gives the chance of obtaining a higher selling price, capturing the value of an ongoing business. It also involves risk as it depends on the business’s future success. Care should be taken while drafting an agreement for earnout in merger and acquisition.

Another part is the valuation. The higher the business valuation, the more earnout payment the potential buyer needs to make.

Benefits of Earnout

The earnout mechanism is advantageous for both buyer and seller:

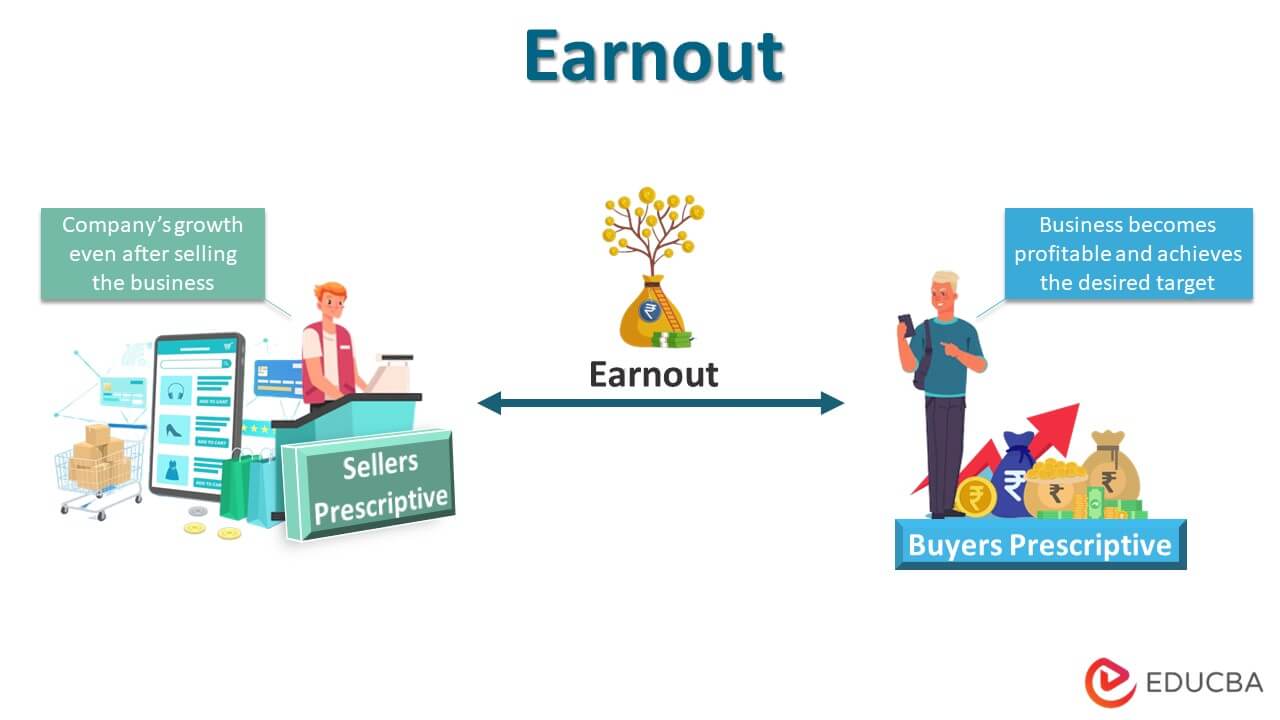

From the Sellers Prescriptive

- The seller can contribute to the target company’s growth even after selling the business.

- Even if the buyer has questions about the target company, the seller still reaps the full benefits of the sale and need not lower the purchase price.

- The seller earns a fixed income after selling the business and achieving the desired targets.

From the Buyer’s Prescriptive

- The buyer has to pay the earnout money only if the business becomes profitable and achieves the desired target.

- Earnout protects against overpaying and uncertainty.

- The amount of the purchase price has cash flow benefits, and the buyer is not relied on being granted a loan.

- Sellers will be motivated to stay in the company, thus helping in client retention and transition for the buyer.

Limitations of Earnout

Some of the limitations are given below:

- It creates a potential threat for future disputes as and when the target company does not earn a profit both for the buyer and seller. Here the seller will feel short of the profit, and the buyer will think he got involved in the wrong deal.

- The seller’s involvement will be retained in the company even after he has sold the business, which would potentially create friction between both parties.

- The buyer would want to pull out the seller in different directions, and the seller would like to maximize his profit during the earnouts period.

Conclusion

If adequately exercised and understood, earnout proves to be an elegant solution to eliminate the valuation gap between buyer and seller. Both parties should be aware of the weakness and strengths of the earnout. An appropriately crafted and drafted earnout agreement is more likely to earn for both parties. The team involved in the earnout agreement, including the investment bankers, should structure the earnout well, and the transaction attorney needs to ensure proper documentation. If done in the right way, earnout turns out to be fruitful for every party involved in the deal.

Recommended Articles

This is a guide to earnout. Here we also discuss the introduction to an earnout, the m&a transaction, benefits, examples, and limitations. You may also have a look at the following articles to learn more –