Updated July 29, 2023

Debtor Days Formula (Table of Contents)

- Debtor Days Formula

- Examples of Debtor Days Formula (With Excel Template)

- Debtor Days Formula Calculator

Debtor Days Formula

Every company needs sales to run its business. Customers buying the products from the company can either pay upfront or after some time. If they choose to pay in the future, they will become the debtors, and this amount will become accounts receivable for the company.

Debtor days are the average days the business requires to receive customer payment. It measures how quickly a business can collect cash from debtors.

If the debtor days are very large, the company is not getting payment timely, and their money is stuck in account receivables. So they must put in additional pocket money to run the business. Similarly, if debtor days are smaller, it means that money is being collected on time, and it can be used for other operations.

Several factors derive the debtor days. For example, what is the industry norm, is a discount given on early payments, billing errors, etc? We will discuss this in detail later in the article.

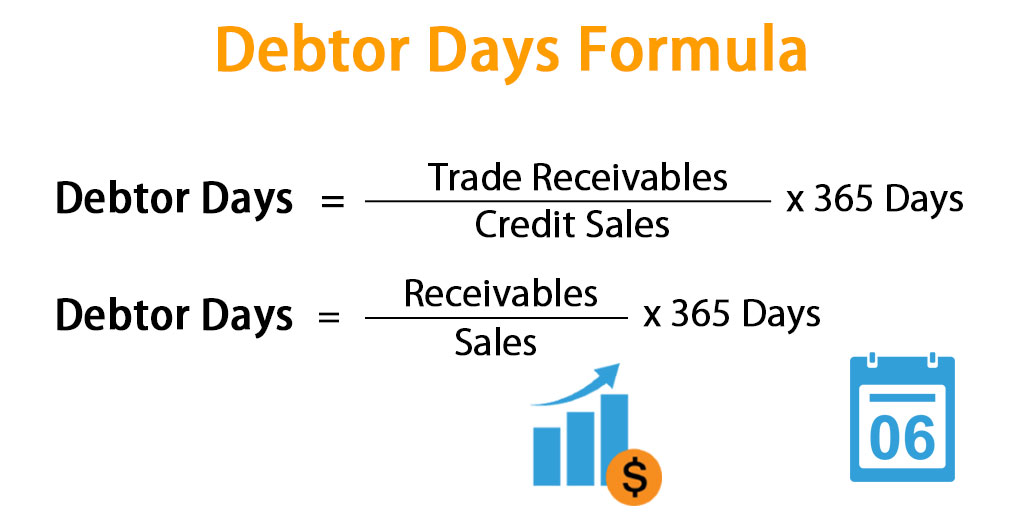

A formula for debtor days is as below:

Sometimes it is also called Days sales Outstanding and can be given by

This is a mixed ratio i.e. it uses both income statement and balance sheet. Receivables can be found in the balance sheet under the current assets section. Sales are the top line of the income statement.

Examples of Debtor Days Formula (With Excel Template)

Let’s take an example to calculate the Debtor Days better.

Example #1

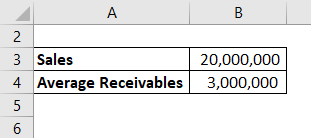

Let’s Say Company X has the following data point for the year 2018.

The formula to calculate Debtor Days is as below:

Debtor Days = (Receivables / Sales) * 365 Days

- Debtor Days = (3,000,000 / 20,000,000) * 365

- Debtor Days = 54.75 days

This number, you see alone, has no significance as such. We need to compare this number with the other companies in the same industry and see where we stand. If the number is more than what is in the industry, the company needs to improve the debtor days to have early cash to run its operations.

Example #2

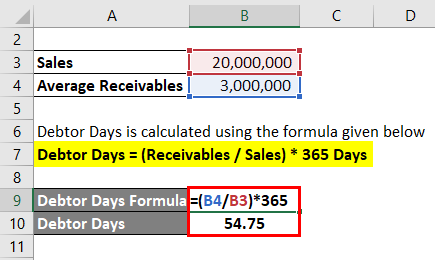

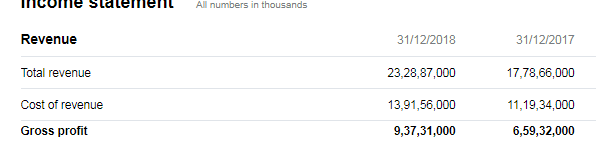

Let’s see an example from the industry to understand debtor days. I am taking Amazon as an example.

Below is the snapshot of Amazon’s Income statement and Balance sheet.

Income Statement:

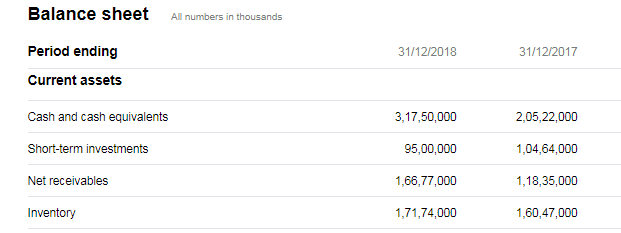

Balance Sheet:

Source: Yahoo Finance

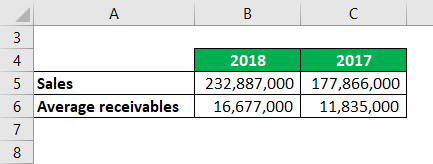

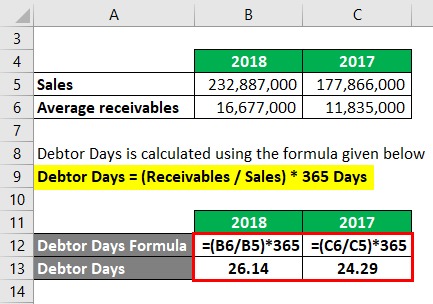

Using the above data points, we have the following information:

Debtor Days = (Receivables / Sales) * 365 Days

Debtor Days for 2018

- Debtor Days = (16,677,000 / 232,887,000) * 365

- Debtor Days= 26.14 days

Debtor Days for 2017

- Debtor Days = (11,835,000 / 177,866,000) * 365

- Debtor Days = 24.29 days

Explanation

As discussed above, debtor days determine how quickly a business can collect cash from its debtors. The longer the customers take to pay back, the higher will be the debtor days and vice versa. If we see that number alone, we cannot make anything out of that. So, there are multiple parameters on which the size of the debtor days depends:

- First, we need to consider the debtor days for that particular industry and then compare that with our number. In some industries, paying late has become a tradition for customers, so there is no point in expecting early payments from them.

- Secondly, what incentives are customers getting if they pay early? Companies offer early payment discounts and other benefits to the customer for advance payments. Companies should determine the discount amount by considering the opportunity value.

It is also important to compare debtor days with your contractual payment terms with the client. For example, if you have 30 days payment term and debtor days are 45, the client is taking 15 excess days from the committed terms.

If the business has high debtor days, it implies that the business will have money stuck with the customers and have less money in hand to use. This could result in a decline in the company’s growth because of a lack of available investment resources. Businesses also have some obligations that they need to cater to, and if fewer funds are available, they have no choice but to take a loan to fulfill those obligations.

Relevance and Uses

For any business, cash flows are a vital part of their operations, and efficient cash flow management will help them to grow. Debtor days are one of the major ratios businesses need to keep a close eye on and monitor regularly. This ratio helps them to understand how much time the customers are taking to pay them back and if there is any need to take effective measures. The more cash in hand businesses will have, the more chances they have to invest in a profitable project and grow. If the money is stuck, they will have to leave that opportunity which will hamper the growth.

Another factor that we have not talked in the size of the customer to the business. If the customer has been a big client for so many years, the business will have less say because they might lose the customer. So they have to be very careful in that aspect also. On average, 30-60 debtor days are an average and decent number that a business can try to maintain.

Debtor Days Formula Calculator

You can use the following Debtor Days Calculator

| Trade Receivables | |

| Credit Sales | |

| Debtor Days Formula = | |

| Debtor Days Formula = |

|

||||||||||

|

Recommended Articles

This has been a guide to Debtor Days Formula. Here we discuss how to calculate Debtor Days along with practical examples. We also provide a Debtor Days calculator with a downloadable Excel template. You may also look at the following articles to learn more –