What is a Crummey Trust?

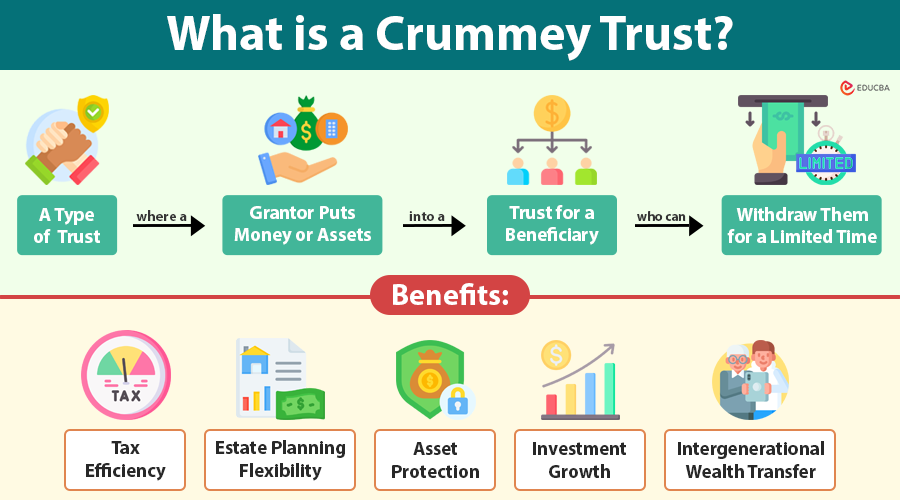

A Crummey Trust is a type of trust where a person (the grantor) deposits money or assets into the trust for the benefit of someone else (the beneficiary), and the beneficiary has the right to withdraw those gifts for a limited period. The grantor can take advantage of tax benefits and control how the money is used over the long term.

For example, a parent contributes $18,000 annually to a Crummey Trust for their child. The child receives a notice and could theoretically withdraw the funds, but chooses to leave them in the trust. Over time, the funds grow, potentially exceeding $200,000 after ten years, all while remaining exempt from gift taxes.

Table of Contents

- Meaning

- Explanation

- Historical Background

- Key Features

- How Does it Work?

- Benefits

- Limitations and Considerations

- Use Cases

Crummey Trust Explanation

Estate planning helps people pass on their assets to heirs, lower taxes, and protect family wealth. Traditional gifting in intergenerational wealth transfer can face challenges, including gift taxes, limitations on future interests, and a lack of control over how beneficiaries utilize the assets.

A Crummey Trust allows a grantor to contribute to an irrevocable trust while still qualifying for the annual gift tax exclusion, even if beneficiaries cannot access the assets immediately. This trust is particularly valuable for families who want to transfer wealth efficiently, fund education or healthcare expenses, or create a lasting financial legacy while maintaining oversight of the assets.

Historical Background

The Crummey Trust concept originates from the 1968 case Crummey v. Commissioner of Internal Revenue. In this case, the court ruled that gifts placed into a trust could qualify for the annual gift tax exclusion if beneficiaries had a temporary right to withdraw contributions, effectively treating the gift as a “present interest” rather than a “future interest.”

Before this ruling, contributions to irrevocable trusts typically failed to qualify for the annual gift exclusion because the beneficiaries could not access the funds immediately. This legal precedent revolutionized estate planning by providing a mechanism for grantors to fund trusts for future generations while still taking advantage of annual gifting exemptions, thereby reducing potential estate tax exposure.

Over time, the Crummey Trust has become a standard tool in wealth planning, particularly for high-net-worth families and those seeking to use life insurance or other investment assets for long-term estate planning.

Key Features of a Crummey Trust

A Crummey Trust has several distinguishing features that differentiate it from other trust structures:

- Irrevocable nature: A Crummey Trust is generally irrevocable, meaning the grantor cannot change or cancel it once created. This ensures assets are permanently removed from the grantor’s estate, reducing estate taxes.

- Beneficiary withdrawal rights: Beneficiaries can withdraw the contributions for a short period, typically 30–60 days. This makes gifts qualify as present interest gifts for the annual gift tax exclusion.

- Annual gift tax exclusion: Contributions to a Crummey Trust count toward the annual gift tax exclusion, letting the grantor give a set amount each year to each beneficiary without paying gift taxes.

- Trustee control: The trustee manages the assets and ensures distributions follow the grantor’s instructions. This protects assets from misuse and allows professional investment management.

- Flexibility in asset growth: Crummey Trusts can hold a variety of assets, including cash, stocks, bonds, real estate, and insurance policies. Assets can grow tax-free or tax-deferred, providing long-term financial benefits.

How a Crummey Trust Works?

The mechanics of a Crummey Trust are straightforward but require careful administration:

- Trust creation: The grantor establishes an irrevocable trust and appoints a trustee to manage and distribute the trust assets. Trust documents outline the rights of beneficiaries, the powers of trustees, and permissible distributions.

- Funding the trust: The grantor contributes cash, securities, or other assets. Each contribution triggers a Crummey notice to beneficiaries.

- Issuance of crummey notice: Beneficiaries receive formal written notice explaining their right to withdraw the gifted assets within a defined time frame. This notice is essential for tax compliance.

- Withdrawal period: Beneficiaries can exercise their right to withdraw funds. Most do not, allowing the assets to remain in the trust and benefit from professional management and growth.

- Trust management and distribution: The trustee invests and manages trust assets, distributing funds in accordance with the grantor’s instructions. For example, the trustee may restrict distributions until the beneficiaries reach a specific age or complete milestones, such as pursuing higher education.

Benefits of a Crummey Trust

Crummey Trusts provide numerous advantages for estate planning and wealth management:

- Tax efficiency: The primary benefit is tax efficiency. Gifts qualify for the annual exclusion, reducing both gift and estate taxes. This enables families to transfer substantial wealth without eroding capital through taxation.

- Estate planning flexibility: The trust provides structured control over how and when beneficiaries receive assets. Grantors can specify age-based distributions, educational funding, or other conditions, offering long-term planning flexibility.

- Asset protection: Assets in a Crummey Trust are legally shielded from creditors, lawsuits, or divorce settlements (depending on the jurisdiction), thereby protecting the wealth intended for the designated beneficiaries.

- Investment growth: Assets remain professionally managed and invested, allowing compounding growth over time, which can significantly increase the financial impact of annual gifts.

- Intergenerational wealth transfer: Crummey Trusts enable families to pass wealth across multiple generations while minimizing tax liabilities, ensuring that financial resources benefit not only children and grandchildren but also great-grandchildren.

Limitations and Considerations

Despite their advantages, Crummey Trusts have some limitations:

- Complex administration: Trustees must send Crummey notices for each contribution and maintain meticulous records to ensure compliance with IRS regulations.

- Beneficiary awareness: Beneficiaries must understand their rights; otherwise, unintended withdrawals could impact tax treatment.

- Legal and tax costs: Establishing and maintaining the trust can involve significant attorney, accounting, and administrative fees.

- Irrevocability: Once created, the grantor generally cannot change the trust terms, which may limit flexibility in responding to changing family circumstances or laws.

- Limited liquidity: Beneficiaries may not be able to access the contributed funds to meet their immediate financial needs, as the grantor intends most contributions to remain invested for the long term.

Use Cases

Crummey Trusts are often employed in specific planning scenarios:

1. Funding Education and Life Milestones

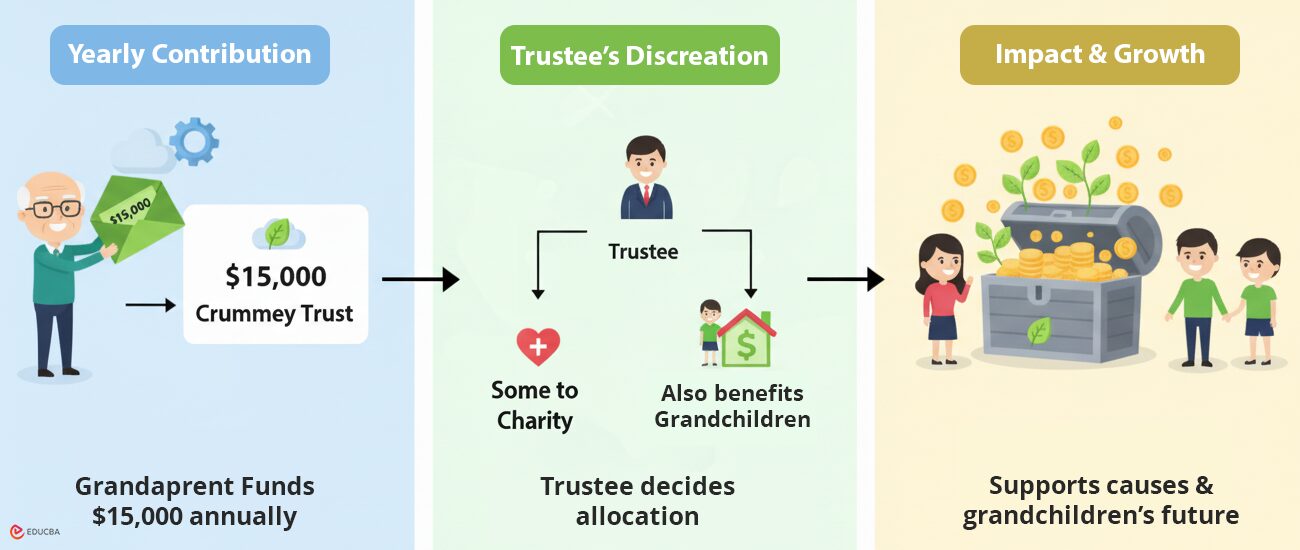

Parents and grandparents can use the trust to fund education, weddings, or first homes for children and grandchildren, combining immediate gift exclusion with long-term oversight.

2. Estate Tax Planning

High-net-worth individuals can gradually remove substantial assets from their taxable estates over time by utilizing annual exclusion contributions and employing professional investment strategies.

3. Life Insurance Trusts

Life insurance premiums can be paid into a Crummey Trust, allowing the death benefit to pass to beneficiaries outside the taxable estate while benefiting from annual exclusion gifts to fund premiums.

4. Charitable Giving

Crummey Trusts can also be structured to include charitable beneficiaries, allowing a combination of estate tax planning and philanthropic objectives.

Final Thoughts

A Crummey Trust is a powerful estate planning tool that combines tax efficiency, controlled wealth transfer, and asset protection. By converting gifts to present interests through temporary withdrawal rights, grantors can leverage the annual gift tax exclusion while ensuring long-term asset management.

However, the trust’s complexity requires professional legal and financial guidance. Proper administration, meticulous record-keeping, and clear communication with beneficiaries are critical to maximizing benefits. When implemented effectively, a Crummey Trust serves as a cornerstone for preserving intergenerational wealth, planning legacies, and achieving financial security.

Frequently Asked Questions (FAQs)

Q1. Can a Crummey Trust be used for minors?

Answer: Yes. Minors can be beneficiaries, but the trustee typically manages the trust on their behalf until they reach a certain age or milestone specified in the trust document.

Q2. Are Crummey Trusts subject to gift or estate taxes?

Answer: Contributions that stay within the annual gift tax exclusion are not subject to gift tax. However, any contributions exceeding the annual limit may require reporting or could count against the lifetime exemption. The trust generally removes assets from the grantor’s estate for estate tax purposes.

Q3. Can a beneficiary exercise the right to withdraw every year?

Answer: Yes, beneficiaries have the right to withdraw each annual contribution during the designated period. Most beneficiaries leave the funds in the trust, but exercising the right is legally allowed.

Q4. Can a Crummey Trust be combined with other estate planning tools?

Answer: Absolutely. People often use Crummey Trusts in conjunction with life insurance trusts, ILITs, or family limited partnerships to maximize estate planning and tax benefits.

Q5. Is professional guidance necessary to establish a Crummey Trust?

Answer: Yes. Crummey Trusts involve complex IRS rules, including providing proper notice, maintaining accurate records, and adhering to these regulations. It is important to work with an estate planning attorney or tax advisor.

Q6. How does a Crummey Trust benefit multi-generational planning?

Answer: By making annual contributions that grow over time, a Crummey Trust can fund multiple generations while staying within gift tax limits. It allows wealth to pass efficiently from grandparents to grandchildren and beyond.

Recommended Articles

We hope this article on Crummey Trusts helps you understand how structured gifting and estate planning can preserve wealth and reduce taxes. Look at the articles below to learn more about estate planning strategies, trusts, and wealth management tools.