Updated November 15, 2023

Difference Between CFA vs CA

The battle of making a career-oriented decision in finance goes on two different paths. CFA offers a program of Investment Management that covers topics like equity investments, derivatives, corporate finance, fixed income, and portfolio management. These subjects contribute to your Research, Investment Banking, Portfolio Management, and Investment Analysis career goals. Conversely, CA offers a career in Accounting, Auditing, Taxation, Budgeting, and Management Accounting. CA obtains the responsibility of managing the financial accounts of a firm. Let it be taxable accounts, budget analysis, and involve itself in an arm of auditing. Worldwide CA practice is possible.

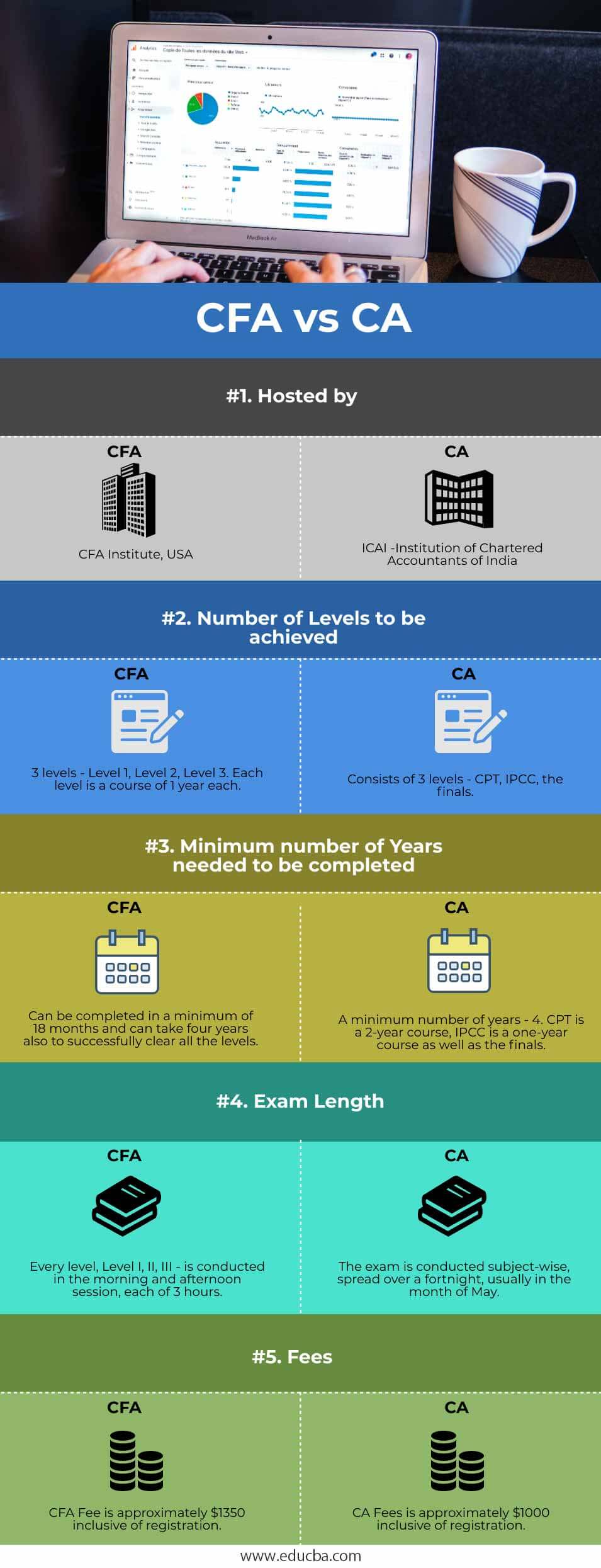

Head To Head Comparison Between CFA vs CA (Infographics)

Below is the top 5 difference between CFA vs CA

How Does CFA® Contribute to Your Profession?

Recruiting CFA Charter holders and CFA candidates is intense by top global financial institutions like Morgan Stanley, UBS, JP Morgan, Deutsche Bank, Credit Suisse, and Bank of America. CFA, being more investment professional-focused, is essential for MNCs and investment banks in this sector. The CFA charter holders and candidates are exposed to great ethical behavior and work experience, making them a better bag as investment professionals.

A CFA® Charter shall contribute to your profile strongly, adding a great deal of real-world expertise; being professionally trained for an ethical mindset, a CFA® Charter is highly preferred and shall put you in the driving seat of a professional investment career and make you stand apart from the crowd.

A CFA Candidate is eligible to appear for the CFA Exam only after his graduation or in the last year of his graduation. To earn the CFA Charter, the candidate must submit an experience of 4 years of work experience to the CFA University. To keep using the CFA® Designation, an annual membership fee is required, with an attestation of the code of ethics and professional conduct.

Comparison Table Between CFA vs CA

Let us examine some of the differences between CFA vs CA:

|

Basis Of Comparisons |

CFA |

CA |

| Hosted by | CFA Institute, USA | ICAI -Institution of Chartered Accountants of India |

| Number of Levels to be achieved | There are 3 levels – Level 1, Level 2, and Level 3. Each level is 1 year each | It consists of 3 levels – CPT, IPCC, the finals |

| Minimum number of years needed to be completed | It can be completed in at least 18 months and can take four years to clear all the levels successfully. | A minimum number of years – 4. CPT is a 2-year course, IPCC is a one-year course as well and the finals |

| Exam Length | Level I, II, and III levels are conducted in the morning and afternoon sessions, each of 3 hours. | The exam is conducted subject-wise, spread over a fortnight, usually in May. |

| Fees |

|

Indian Students – Rs.22000

Foreign Students – $1100 |

Requirement for CFA

CFA® requires a 4-year combination of education and relevant work experience in finance, which the CFA® Institute shall accept.

- The CFA® program demands you to successfully pass all the 3 levels to obtain a charter with relevant work experience.

- Any person registering for the exam or holding a charter must adhere to the code of ethics and standard of professional conduct of the CFA® Institute.

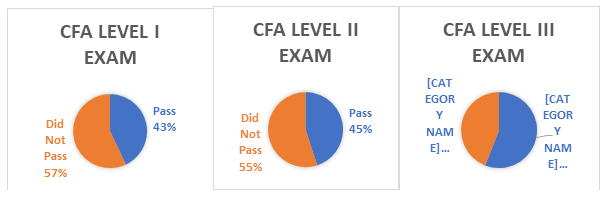

Total Candidates Appearing for June 2018 CFA Exam

- CFA Level I Exam: 79,507

- CFA Level II Exam: 64,216

- CFA Level III Exam: 35,518

There are more than 150,000+ CFA Charter Holders advancing professionalism in the financial markets.

What Does a Chartered Accountant (CA) Do?

A Chartered Accountant can have liberty in various sectors with various business organizations. CA’s are top employees in public and private sector organizations and government bodies. The candidates undergo rigorous training to complete the multiple levels of the examination. A CA’s work area is taxation, auditing, and general management.

Usually, a CA is responsible for managing a firm’s financial accounts. They can set up their firms and render services to their clients independently or work at a CA firm. Worldwide CA practice is possible. Let it be taxable accounts, budget analysis, and involve itself in an arm of auditing.

Requirements for CA

- The candidate must appear for CPT after clearing his 12th or can take up parallel to their graduate studies.

- To pass, you must pass both sections of this intermediate exam. After completing the 1st group, namely, IPC Level, the candidate shall undergo and have exposure as an article assistant for a minimum of 3 years at a chartered firm.

- In the 3rd year of training, before the candidate appears for his finals, the trainee can also have an opportunity to work in the industry.

- To be articled, the trainee should have completed 100 hours of IT training alongside a soft skills development orientation program.

CFA vs CA Both?

Such professional achievements rally your career growth and enable you to improvise and express your great commitment levels to your employers and clients. A combination of CFA® and CA is very much possible, and there is nothing like this. Holding a CFA® Charter and CA Charter shall make you stand out.

Typically, investment banks/ treasuries prefer MBA (with Engineering) students. Engineering graduates carry an analytical thinking process, but since they lack core finance knowledge, a CFA® Charter recognizes their essential value. Alongside, a CA is analytically sound, so a CFA® shall help them stand tall among the rest.

CFA vs CA

The choice remains subjective into which finance area you wish to enter. CFA vs CA are globally renowned and shall carry your profile strongly into the finance industry. CFA vs. CA: the exam requires dedication and effort to get through.

Recommended Articles

This has been a guide to the top difference between CFA vs CA. We also discuss the CFA and CA key differences with infographics and comparison tables. You may also have a look at the following articles to learn more.