Updated November 9, 2023

Table of Contents

Difference Between ACCA vs CPA

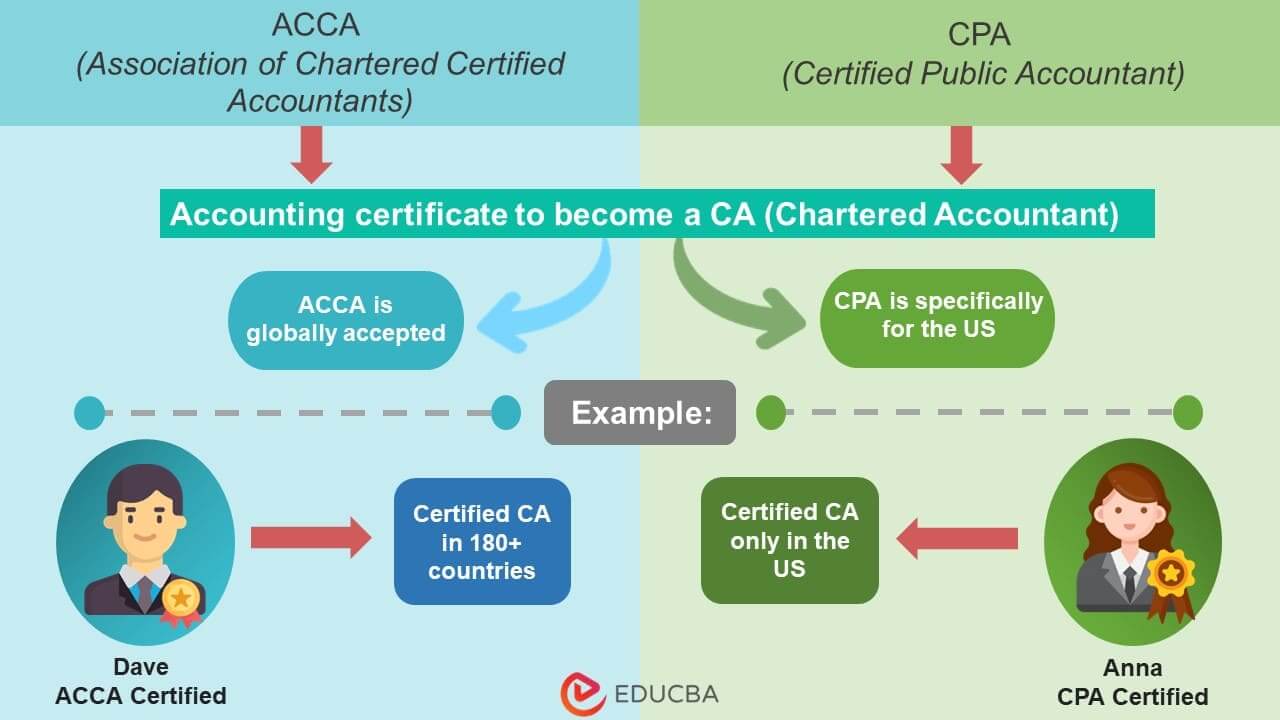

ACCA vs. CPA are both accounting certifications for becoming a chartered accountant. The major difference is that ACCA (Association of Chartered Certified Accountants) allows you to practice anywhere globally, while CPA (Certified Public Accountant) is only US-specific and focuses on US-based accounting principles and tax laws.

What is CPA?

CPA is a designation for individuals who handle accounting and finance, mostly in the United States. To become a CPA, candidates must pass the CPA examination that assesses a candidate’s knowledge of US Generally Accepted Accounting Principles (GAAP), auditing standards, taxation, and business laws.

CPA is one of the most highly regarded professions in the US, and the person holding this degree must be highly knowledgeable in accounting. Moreover, getting a degree in CPA is important if you want to make a career in public accounting, corporate finance, government agencies, and more.

What is ACCA?

AACA is a globally recognized professional accounting body based in the United Kingdom. It is a very vast course that offers comprehensive knowledge in the field of accounting and finance. Its syllabus covers various topics such as financial accounting, management accounting, taxation, audit, and business ethics.

This course is designed according to international accounting standards, making it relevant in almost all domains. It is a flexible course regarding study options and provides the freedom to choose a career based on your existing qualifications. Moreover, an ACCA certification can boost your career across various sectors, such as accounting firms, MNCs, etc., as it recognizes you as a highly knowledgeable professional.

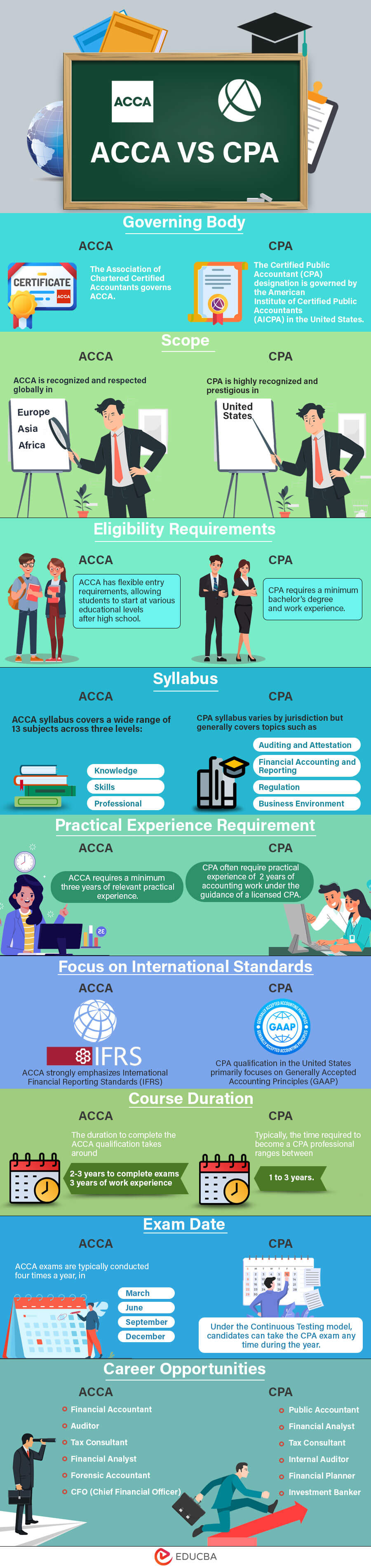

ACCA vs CPA Infographics

Below are the top 5 differences between ACCA and CPA.

Key Differences Between ACCA vs CPA

ACCA and CPA are two of the best finance courses, but they are fundamentally different from each other. Let us look into the key differences to understand more:

1. Ongoing Learning and Development

ACCA: To maintain ACCA membership, you must participate in continuing professional development (CPD), which means completing relevant activities to earn CPD units each year.

CPA: To maintain a CPA license, you must fulfill CPE (Continuing professional education) requirements, where generally, you must complete a certain number of CPE hours within a specific period.

2. Cost and Time Investment

ACCA:

Cost: It includes basic registration, exam, and study materials costs. It is typically lower than CPA.

Time: On average, it takes a candidate 3 – 4 years to get the ACCA certificate if they clear the examination on the first attempt and then gain three years of practical experience.

CPA:

Cost: It includes basic costs such as application fees, examination fees for each section, and licensing fees, depending on the jurisdiction.

Time: On average, a candidate can get the CPA certificate within 12 to 18 months

ACCA vs CPA – Comparison Table

Let’s have a look at the Comparison between ACCA vs CPA:

| Basis of Comparison | ACCA | CPA |

| Governing Body | The Association of Chartered Certified Accountants governs ACCA. | The National Association of State Boards of Accountancy (NASBA) and the American Institute of Certified Public Accountants (AICPA) govern CPA. |

| Focus | It covers various topics such as financial accounting, management accounting, taxation, etc. | It focuses on areas specific to a particular jurisdiction and covers business concepts and ethics. |

| Scope | ACCA holds worldwide global recognition, particularly in Europe, Asia, and Africa. | It holds more prestige in the United States, but other regions accepting CPAs can offer a better scope, too. |

| Eligibility Requirements | ACCA eligibility is flexible for all students at all educational levels. | It requires at least 4 years of bachelor’s degree and business coursework of 120-150 hours. |

| Professional Designation

|

You get the degree of “Chartered Certified Accountant” (ACCA). | You get a “Certified Public Accountant” (CPA) degree. However, it may depend on the jurisdiction. |

| Practical Experience | You need a minimum of three years of relevant practical experience in ACCA. | It depends on the jurisdiction and involves completing accounting work hours, ranging from 1,600 to 2,000 hours. |

| Focus on International Standards | It relies on International Financial Reporting Standards (IFRS), ensuring a good understanding of global accounting practices. | It focuses on Generally Accepted Accounting Principles (GAAP) and covers International Accounting Standards. |

| Exam Pattern | ACCA exams are conducted online with a duration of 2-3 hours. The questions include both objective-type questions and case studies. | CPA exams are also conducted online with a duration of 4 hours. The questions include multiple-choice questions and task-based simulations. |

| Number of Exams | The ACCA syllabus comprises 13 exams a candidate must complete within 5 years. | A candidate must pass all 4 exams to get the CPA degree. |

| Course Duration | On average, it takes around 4 years to pass all the exams successfully. | Typically, the time required to become a CPA professional ranges between 1 to 2 years. |

| Flexibility and Mobility | ACCA provides members with great mobility and flexibility in their careers. | The mobility of a CPA depends on the specific jurisdiction and its requirements. |

| Career Opportunities | The ACCA qualification offers excellent advantages in the finance domain. | The CPA qualification is particularly valuable if you seek career opportunities in the United States. |

| Exam Date | ACCA exams are held four times yearly in March, June, September, or December. | The continuous Testing model gives more flexibility to candidates as there is no fixed exam date. |

Benefits of ACCA Vs. CPA

| Benefits of ACCA | Benefits of CPA |

| Globally-recognized degree: It is globally accepted and opens doors to endless career opportunities worldwide. | Professional reputation: A degree in CPA has a high value and can boost your professional position. |

| Wide range of skills: It covers various finance and accounting topics that help develop skills. | Diverse career opportunities: You can build a professional career in different fields, such as public accounting, corporate finance, etc. |

| Career growth: It increases your chances of getting hired at good positions such as finance manager or controller. | High-earning potential: A CPA degree offers a competitive salary range as compared to non-certified accountants. |

| Networking benefits: It helps you build a good network with professionals in the same field that can help in your career growth. | Knowledge building: It provides in-depth knowledge of accounting regulations and standards that helps you handle complex finance reporting. |

Final Thoughts

In today’s ever-changing accounting world, just becoming a chartered accountant isn’t enough due to high competition. Aspiring accountants now have many options, with the most prestigious degrees being ACCA certification and CPA. Both courses are different from one another and offer unique career opportunities. Thus, you should choose one according to your preference and career goals, as both require significant time and effort.

Frequently Asked Questions (FAQs)

Q1. Is ACCA worth pursuing in the USA?

Answer: ACCA is well-recognized in most countries. However, it doesn’t have much value in the US. Also, there’s no such agreement that will help someone with an ACCA degree to get qualified for CPA.

Q2. Is the US CPA exam much easier than ACCA?

Answer: The US CPA exam has fewer sections, and a candidate can usually complete it within 18 months. In comparison, the ACCA test takes longer and has more sections. However, the difficulty level of the CPA US exams is much higher than the ACCA tests.

Q3. Which CPA is considered the hardest?

Answer: Financial Accounting and Reporting, or FAR, is the most difficult CPA exam with the lowest passing score. The syllabus, time, and effort needed to clear this exam makes it more difficult.

Recommended Articles

This article is a detailed guide to the key differences between ACCA vs. CPA. It also gives you an infographic with the top 5 comparisons between ACCA and CPA. You can also look at the following articles to learn more: