Updated November 10, 2023

Difference Between CA vs ACCA

ACCA stands for the Association of Certified Chartered Accountants. The Candidates primarily deal with the rules and regulations and implementations of policies within a company and compile with the Auditing and Taxation part. The Institute of Chartered Accountants of India gives a CA degree in India. CA works with the government and a private organization at the level of Gazette Officer. CA and ACCA are highly qualified finance courses designed for accounting and finance professionals passionate about pursuing careers in accounting, taxation, auditing, and finance.

Let us understand much more about CA and ACCA in detail:

- The Association of Certified Chartered Accountants (ACCA) grants Chartered Accountant degrees in collaboration with the London-based Association of Chartered Accountants. ACCA has more or less the same kinds of opportunities, and the term charter in ACCA stands for the Royal Charter, referred to as the Royal Charter granted in 1974. The CA course was granted in 1944; the governing body was ICAI. Every area of business, non-business, and other regions needs professionals.

- ACCA’s degree was introduced to give protection to SMEs and individuals. The Exam of ACCA consists of 14 papers, and the course structure prioritizes the core values of integrity, accountability, diversity, logic, etc. The degree is accepted across the globe within 180 countries. The Degree has a reputation of one hundred years, and the professionals have provided services to more than 7500 employers across different fields. ACCA consists of three important steps: applied knowledge (Diploma), applied skills (advanced diploma), and essentials.

- The chartered Accountant degree, which ICAI issues, is well competent with ACCA, but it has a certain difference in contents. The Institute of Chartered Accountants of India gives a CA degree in India. As the Legal and corporate laws and accounting standards depend on India, the content mainly focuses on the Indian constitution. To enroll for the course, one has to pass the matriculation and can opt for enrolling in the course. Work experience is optional to enroll in the course. A one-year internship under a firm or a company is a mandatory course requirement.

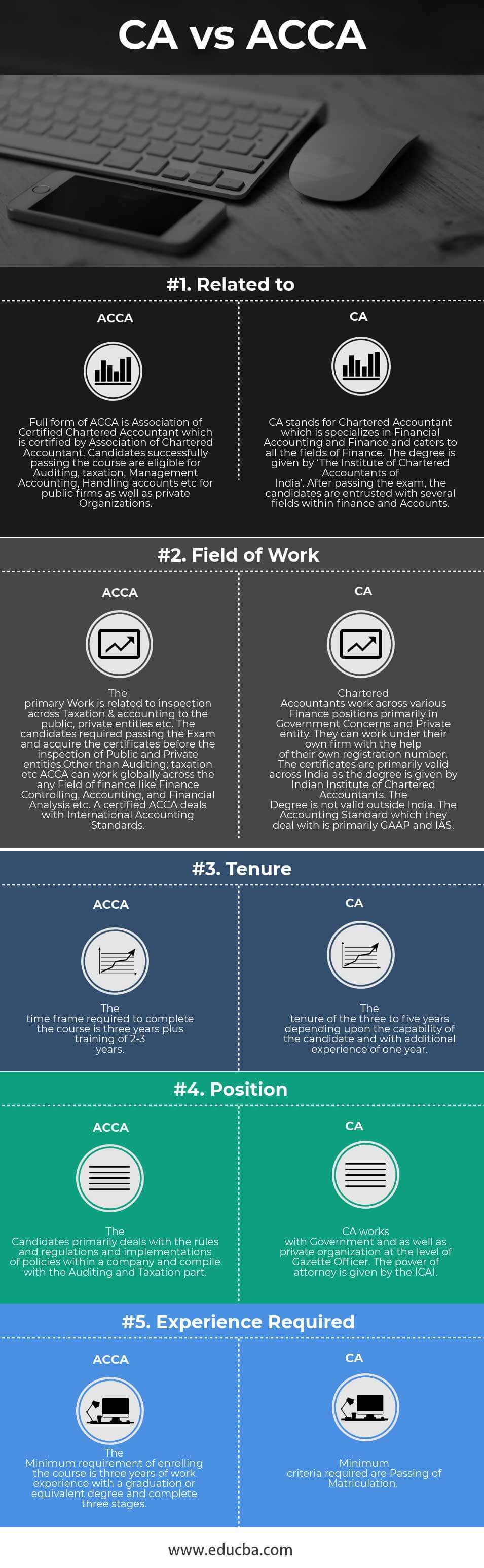

Head To Head Comparison Between CA vs ACCA (Infographics)

Below is the top 5 difference between CA and ACCA

Key Differences Between CA vs ACCA

Both CA vs ACCA are popular choices in the market; let us discuss some of the major Differences:

- ACCA is an international degree accepted globally in more than 180 countries. CA is only valid in India as the course is designed for India only. The Institute of Chartered Accountants is the authorized entity for the course.

-

ACCA, accepted in almost every country, is over 100 years old. Commenced in the year 1944, CA is applicable only in India.

- The course content differs – ACCA is very advanced and covers all the internationally accepted regulations. The course is updated based on the requirements of Indian constitutions and taxation policies only. However, the subjects are more or less similar to each other.

- The work experience required for enrolling for the course of ACCA is three years of experience in Accounting along with a Graduation degree. However, any Indian citizen who has passed the Matriculation level can opt for the course Chartered Accountant.

CA vs ACCA Comparison Table

Let’s have a look at the Comparison between CA vs ACCA:

|

Basis Of Comparison |

ACCA |

CA |

| Related to | The full form of ACCA is the Association of Certified Chartered Accountants, certified by the Association of Chartered Accountants. Candidates successfully passing the course are eligible for Auditing, taxation, Management Accounting, Handling accounts, etc, for public firms as well as private Organizations. | CA stands for Chartered Accountant, specializing in Financial Accounting and Finance, and caters to all fields of Finance. ‘The Institute of Chartered Accountants of India grants the degree to candidates. Upon passing the exam, several fields within finance and accounts entrust the candidates with responsibilities. |

| Field of Work | The primary work relates to inspection across Taxation & accounting to the public, private entities, etc. The candidates must pass the exam and obtain the certificates before public and private entities inspect them. Other than Auditing, taxation, etc., ACCA can work globally across any Field of finance like Finance Controlling, Accounting, Financial Analysis, etc. A certified ACCA deals with International Accounting Standards. |

Chartered Accountants work across various Finance positions, primarily in Government Concerns and Private entities. They can work under their firm with the help of their registration number. The Accounting Standard that they deal with is primarily GAAP and IAS. The certificates are primarily valid across India as the Indian Institute of Chartered Accountants gives the degree. The Degree is not valid outside India. |

| Tenure | The time frame required to complete the course is three years plus 2-3 years of training. | The tenure of three to five years depends upon the candidate’s capability and an additional year of experience. |

| Position | The Candidates primarily deal with the rules and regulations and implementations of policies within a company and compile with the Auditing and Taxation part. | CA works with the government and a private organization at the level of Gazette Officer. The ICAI gives a power of attorney. |

| Experience required | The Minimum requirement for enrolling in the course is three years of work experience with graduation or equivalent degree and completing three stages. | The minimum criteria required is Passing Matriculation. |

Conclusion

In this CA vs ACCA article, we have seen the legal aspect, along with the implementation of different policies within the business, is very necessary. Thus, a bunch of Finance professionals is so important in modern business. CA and ACCA courses are in-depth and include almost everything finance professionals require. The professionals can cater to the retail public, Individuals, Government bodies, non-profit making organizations, and business houses. The fields across which they cater are taxation, accounting, auditing, finance, financial analysis, etc. Thus, CA vs ACCA courses come into the picture to ensure the organization works smoothly.

Recommended Articles

This has been a guide to the top difference between CA vs ACCA. We also discuss the CA vs ACCA key differences with infographics and a comparison table. You may also have a look at the following articles to learn more –