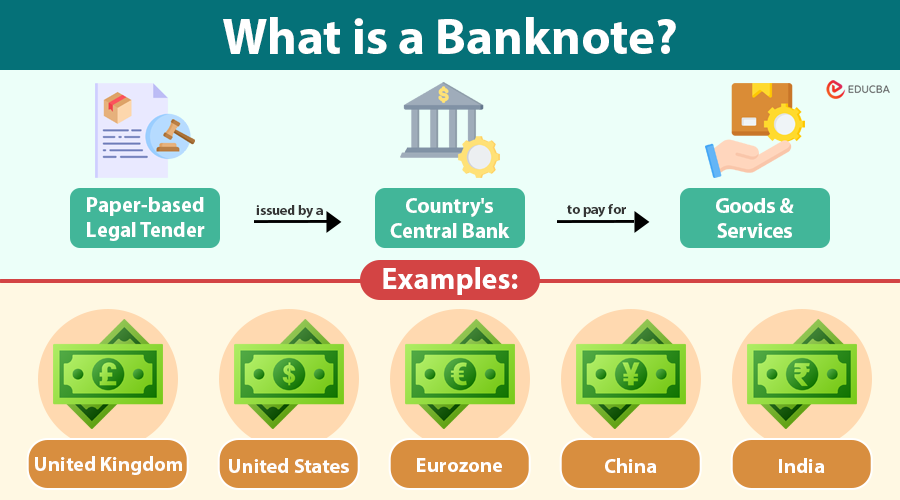

What is a Banknote?

A banknote is a paper-based legal tender issued by a country’s central bank and used to pay for goods and services. It represents the issuing authority’s promise to accept the value printed on the note for all public and private transactions within the country. Banknotes are also commonly known as currency notes or paper money.

Unlike commodities such as gold or silver, the value of a banknote does not come from its material. The government backs it with its authority, and the public trusts it as a reliable form of money. The amount printed on a banknote shows the value payable to the bearer on demand, without any interest.

Banknotes play a vital role in everyday economic activity by enabling smooth transactions, supporting trade, and ensuring easy access to money, especially in areas where digital payments are limited. Even in an increasingly cashless world, banknotes remain an essential part of the global financial system.

Table of Contents

- What is a Banknote?

- History

- How does it Work?

- Key Features

- Types

- Example

- Banknotes vs Coins vs Digital Money

- Impact on the Economy

- Future

- Uses

- Advantages

- Disadvantages

History of Banknote

The history of banknotes dates back over a thousand years and reflects the evolution of money from physical commodities to paper-based legal tender. In ancient times, most transactions relied on precious metals such as gold and silver. However, carrying and storing these metals proved inconvenient, leading to the development of paper currency.

The earliest form of paper money appeared in China during the Tang Dynasty (7th century), where merchants used paper receipts as a substitute for heavy coins. This concept evolved further during the Song Dynasty in the 11th century, when the Chinese government officially issued paper money known as “jiaozi.” These government-backed notes marked the world’s first true banknotes.

Paper currency continued to spread under the Yuan Dynasty (13th century), supported by the Mongol Empire’s extensive trade networks. During this period, foreign travelers such as Marco Polo documented the use of paper money, introducing the idea to Europe. Although Europeans were initially skeptical, the concept gradually gained acceptance.

By the 14th century, several European regions began experimenting with paper currency. The first permanent and systematic issuance of banknotes occurred in 1695, when the Bank of England started issuing notes to finance government debt. In the United States, federally issued banknotes were introduced in 1862 during the Civil War to support wartime expenses.

Initially, banknotes were backed by precious metals such as gold and silver, allowing holders to exchange notes for physical assets. Over time, economies transitioned to fiat money systems, in which banknotes derive their value from government authority rather than from metal reserves. Today, banknotes are widely accepted legal tender, backed by trust in central banks and national economies rather than physical commodities.

How does Banknote Work?

A banknote is a legal tender issued by a country’s central bank and used to settle transactions for goods and services. The issuing government confers value on the banknote through its authority and public trust.

1. Issuance by the Central Bank

Only a country’s central bank has the authority to issue banknotes. For example, the Federal Reserve in the United States or the Reserve Bank of India (RBI) controls the printing and circulation of currency. Central banks decide how many banknotes to issue based on economic conditions such as inflation, growth, and cash demand.

2. Fiat Currency System

Modern governments issue banknotes under a fiat money system and do not back them with physical assets like gold or silver. Instead, their value depends on:

- Public trust in the government

- Stability of the economy

- Supply and demand of money.

This system allows central banks to control the amount of money in circulation to manage inflation and support economic growth.

3. Legal Tender Status

The law recognizes banknotes as legal tender, requiring people and businesses to accept them as payment for debts and transactions within the issuing country. The amount printed on the banknote represents the face value, which the bearer can use without earning or paying interest.

4. Circulation in the Economy

Once issued, banknotes enter the economy through:

- Commercial banks

- ATMs

- Government spending

People and businesses use them for daily transactions, savings, and informal exchanges, especially where digital payments are unavailable.

5. Security and Authentication

To prevent counterfeiting, banknotes include advanced security features, such as:

- Watermarks

- Security threads

- Holograms

- Microprinting

- Color-shifting ink.

These features help users and banks verify authenticity and maintain trust in the currency.

6. Withdrawal and Replacement

Damaged or old banknotes are regularly withdrawn from circulation by central banks. They are replaced with new notes to maintain quality, security, and public confidence in the currency system.

Key Features of a Banknote

A banknote has several distinct features that make it a reliable and legally accepted form of money. These features ensure authenticity, usability, and public trust.

- Issued by central authority: Only a country’s central bank or authorized monetary authority issues banknotes.</li>

- Legal tender status: It serves as legal tender for settling debts and making payments within the issuing country.

- Fixed denomination: Each banknote carries a clearly printed monetary value.

- Security features: Modern banknotes include watermarks, holograms, security threads, microprinting, and color-shifting ink to prevent counterfeiting.

- Portability: They are lightweight, easy to carry, and convenient for daily transactions.

- Uniform design: Standardized sizes, colors, and designs help users easily identify denominations.

- Durability: Many countries now use polymer banknotes that last longer than traditional paper notes.

- Offline usability: They do not require electricity, an internet connection, or digital devices to function.

- Wide acceptance: It serves all sectors of the economy, including rural and informal markets.

Types of Banknotes

You can classify banknotes into different types based on their backing, material, purpose, and circulation. Understanding these types helps explain how modern monetary systems function.

1. Fiat Banknotes

Physical commodities like gold or silver do not back fiat banknotes. Their value comes from government regulation and public trust. Most currencies used worldwide today, such as the US Dollar, Euro, and Indian Rupee, fall under this category.

2. Commodity-Backed Banknotes

Governments historically backed these banknotes with tangible assets such as gold or silver. Holders could exchange them for a fixed quantity of the underlying commodity. While rare today, they played a crucial role in earlier monetary systems under the gold and silver standards.

3. Polymer Banknotes

Governments issue polymer banknotes rather than paper one. They are more durable, water-resistant, and harder to counterfeit. The United Kingdom, Australia, and Canada use polymer notes to make banknotes more secure and durable.

4. Paper Banknotes

A blend of cotton and linen fibers makes up traditional paper banknotes. They are widely used and easy to produce, but they wear out faster than polymer notes and are more susceptible to damage.

5. Commemorative Banknotes

Governments issue commemorative banknotes to celebrate significant national events, anniversaries, or historical figures. These notes often remain legal tender but are commonly collected rather than used for daily transactions.

6. High-Denomination Banknotes

People use high-denomination banknotes for high-value transactions because they carry large face values. Due to concerns about money laundering and other illegal activities, many countries have discontinued or restricted the use of these notes.

7. Limited-Edition Banknotes

Governments issue limited-edition banknotes in small quantities for special occasions. Although they may be legal tender, they are mainly intended for collectors and often carry artistic or cultural significance.

Example of Banknote

Let us now look at examples of banknotes issued by different economies. In this example, we have mentioned the symbols on both sides of the currency.

| Country | Denomination | Obverse (Front) | Reverse (Back) |

| United Kingdom | £5 | Queen Elizabeth II | Elizabeth Fry |

| £10 | Queen Elizabeth II | Charles Darwin | |

| £20 | Queen Elizabeth II | Adam Smith | |

| £50 | Queen Elizabeth II | James Watt & Matthew Boulton | |

| United States | $1 | George Washington | Great Seal of the United States |

| $5 | Abraham Lincoln | Lincoln Memorial | |

| $10 | Alexander Hamilton | Treasury Building | |

| $20 | Andrew Jackson | White House | |

| $50 | Ulysses S. Grant | Capitol | |

| $100 | Benjamin Franklin | Independence Hall | |

| Eurozone | €5 | Classical gateway | Classical bridge |

| €10 | Romanesque gateway | Romanesque bridge | |

| €20 | Gothic windows | Gothic bridge | |

| €50 | Renaissance windows | Renaissance bridge | |

| €100 | Baroque/Rococo gateway | Baroque/Rococo bridge | |

| €200 | Art Nouveau windows | Art Nouveau bridge | |

| €500 | Modern windows | Modern bridge | |

| China | ¥1 | Mao Zedong | Three Pools Mirroring the Moon at West Lake |

| ¥5 | Mao Zedong | Mount Tai | |

| ¥10 | Mao Zedong | Three Gorges of the Yangtze River | |

| ¥20 | Mao Zedong | Guilin Scenery | |

| ¥50 | Mao Zedong | Potala Palace | |

| ¥100 | Mao Zedong | Great Hall of the People | |

| Switzerland | CHF 10 | Le Corbusier | Le Corbusier’s buildings in Chandigarh |

| CHF 20 | Arthur Honegger | Elements from Honegger’s Pacific 231 | |

| CHF 50 | Sophie Taeuber-Arp | Dada Head | |

| CHF 100 | Alberto Giacometti | Man Walking | |

| CHF 200 | Charles Ferdinand Ramuz | Swiss Mountains & Lavaux | |

| CHF 1000 | Jacob Burckhardt | Detail from Palazzo Strozzi | |

| India | ₹10 | Mahatma Gandhi | Sun Temple, Konark |

| ₹20 | Mahatma Gandhi | Ellora Caves | |

| ₹50 | Mahatma Gandhi | Hampi with Chariot | |

| ₹100 | Mahatma Gandhi | Rani ki Vav, Patan | |

| ₹200 | Mahatma Gandhi | Sanchi Stupa | |

| ₹500 | Mahatma Gandhi | Red Fort, Delhi | |

| ₹2000 | Mahatma Gandhi | Mangalyaan |

Banknotes vs Coins vs Digital Money

| Feature | Banknotes | Coins | Digital Money |

| Form | Paper or polymer | Metal | Electronic (online, app, or card-based) |

| Value | Usually higher denominations | Usually lower denominations | Any denomination, flexible |

| Durability | Can tear or wear out | Long-lasting | No physical wear, virtual only |

| Portability | Lightweight and easy to carry | Heavier in large quantities | Extremely portable, accessible via devices |

| Security | Can be counterfeited, requires security features | Harder to counterfeit | Protected by encryption and passwords |

| Accessibility | Usable offline | Usable offline | Requires internet or digital infrastructure |

| Transaction Speed | Instant | Instant | Fast, can be instant or delayed depending on network |

| Cost of Production | Moderate | Low to moderate | Low (mainly system maintenance) |

| Examples | USD 10, GBP 20, EUR 50 | USD 1, INR 10, EUR 2 | PayPal, UPI, Bitcoin, online bank transfers |

Impact of Banknotes on the Economy

Banknotes are more than just paper; they play an important role in driving a country’s economy. Here is how they impact various economic aspects:

1. Facilitates Trade and Commerce

It provides a widely accepted medium of exchange, making it easier for individuals and businesses to buy goods and services. This smooth flow of transactions is essential for economic growth.

2. Supports Financial Inclusion

It allows people without access to digital banking to participate in the economy. Rural populations, low-income households, and small businesses often rely heavily on cash for daily transactions.

3. Maintains Liquidity

Having banknotes in circulation ensures that money is available for transactions, which keeps markets and supply chains running efficiently. It prevents cash shortages that could stall economic activity.

4. Helps Regulate Inflation

Central banks can control the supply of banknotes to influence inflation. Printing too many notes may increase the money supply and lead to inflation, while withdrawing notes can tighten liquidity and reduce inflationary pressure.

5. Enhances Trust in the Financial System

Note issued by the central bank act as a guaranteed store of value. This instills confidence among people and businesses, enabling stable economic planning and investment.

6. Encourages Savings and Investment

It makes it easier to store value physically, especially in economies where digital banking is limited. This encourages saving and can eventually lead to productive investment.

7. Reduces Transaction Costs

By using standardized banknotes instead of bartering or non-uniform coins, economies lower transaction costs, making trade faster and more efficient.

Future of Banknotes

- Coexistence with digital payments: Cash will remain essential in rural areas, developing countries, and situations where digital payments are unavailable.

- Central bank digital currencies (CBDCs): Governments are launching digital currencies to complement traditional banknotes.

- Advanced security features: Future notes will include smart inks, microchips, QR codes, and polymer materials to prevent counterfeiting.

- Eco-friendly banknotes: Polymer notes and longer-lasting materials reduce waste and support sustainability.

- Declining usage in cities: Cash use is decreasing in developed urban areas, though it remains a backup and emergency option.

- Cultural & commemorative notes: Special edition notes will gain value as collectibles and cultural artifacts.

- Smart integration: Future banknotes may connect with digital ecosystems for traceability and financial auditing.

Uses of Banknote

Banknotes play a vital role in the economy and daily life. Their main uses include:

- Medium of exchange: People widely accept banknotes for buying goods and services, making transactions quicker and easier than bartering or using commodities.

- Legal tender: The law requires people to accept them as an official form of payment to settle debts.

- Store of value: It allows individuals and businesses to store wealth in a portable form. People can easily carry notes and use them whenever needed.

- Unit of account: They provide a standard measure for pricing goods and services, simplifying accounting, trade, and economic planning.

- Facilitate trade: It enables both domestic and international trade by serving as a trusted, recognized form of currency.

- Cashless and offline transactions: Even in areas without digital payment facilities, it ensures people can transact without relying on electronic systems.

- Emergency and backup currency: In cases of digital payment failures or network outages, it serves as a reliable backup for financial transactions.

- Symbol of national identity: Many banknotes feature national heroes, cultural monuments, or historic events, promoting a sense of identity and heritage.

Advantages of Banknote

Some of the significant advantages of the Banknote are as follows:

- Ease of transactions: It clearly displays their value, making payments easier and reducing confusion.

- Widely accepted: They are recognized as a means of payment for goods and services.

- Portable and convenient: Carrying large sums in banknotes is lighter and easier than carrying the same value in coins or precious metals.

- Quick, offline use: It enables instant transactions without digital devices or internet connectivity.

- Store of value: They provide a practical way to store wealth for short-term use and everyday expenses.

- Supports economic activities: It facilitates trade, commerce, and business operations by providing a reliable medium of payment.

- No dependence on technology: Unlike digital payments, banknotes work anywhere, anytime, without technical issues.

Disadvantages of Banknote

Some of the significant disadvantages of the Banknote are as follows:

- Easily damaged: They are made of paper and can tear, get wet, or become worn, reducing their usability.

- Counterfeit risk: Fake banknotes can circulate, causing financial losses and requiring vigilance to detect.

- No interest or growth: Unlike digital savings or investments, banknotes do not earn interest or increase in value over time.

- Bulky for large amounts: Carrying large sums in cash can be inconvenient and unsafe.

- Theft risk: Cash can be easily stolen or lost, unlike digital transactions that can be traced or protected.

- Hygiene concerns: Physical currency can harbor germs and bacteria, posing a minor health risk.

Final Thoughts

Banknotes remain a cornerstone of global economies, providing a reliable, portable, and universally accepted form of money. Even as digital payments grow, cash remains important, especially in rural areas, for small businesses, and in places where electronic payments are not possible.

Issuing authorities design banknotes not only as legal tender but also as symbols of national identity, culture, and history. Modern banknotes combine durability, security features, and convenience, ensuring trust and accessibility for millions of daily transactions.

Despite challenges such as counterfeiting, physical wear, and theft risk, banknotes continue to support trade, financial inclusion, and economic stability. As economies evolve, banknotes are likely to coexist with digital currencies and innovative payment systems, retaining their essential role in both everyday life and the broader financial ecosystem.

Ultimately, banknotes are more than just paper; they are instruments of trust, commerce, and national identity, bridging tradition with the modern financial world.

Frequently Asked Questions (FAQs)

Q1. Why do banknotes have different colors and sizes?

Answer: Banknotes use different colors, sizes, and designs to help people quickly identify denominations and prevent counterfeiting. It also makes it easier for visually impaired individuals to distinguish notes.

Q2. What are the most secure banknotes in the world?

Answer: Countries like Switzerland, Canada, and the UK issue some of the most secure banknotes, featuring advanced features such as polymer materials, holograms, and color-shifting inks.

Q3. How long does a banknote usually last?

Answer: The lifespan of a banknote depends on the material and usage. Paper notes last 1–3 years, while polymer notes can last 5–10 years or more.

Q4. Why are some banknotes recalled or redesigned?

Answer: Banknotes are updated to improve security, prevent counterfeiting, celebrate special events, or reflect changes in national leadership or cultural symbols.

Q5. Can a damaged or torn banknote still be used?

Answer: Yes, most central banks accept slightly damaged banknotes for replacement. You must exchange severely damaged or burnt notes at a bank.</p>

Q6. Are high-denomination banknotes being phased out?

Answer: Yes, some countries are restricting or phasing out large-value notes to reduce money laundering, black-market activities, and illegal transactions.

Recommended Articles

This is a guide to Banknote. Here we discuss the introduction, history, working, example, uses, advantages, and disadvantages of Banknote. You may also have a look at the following articles to learn more –