What are Automated Trading Bots in Cryptocurrency?

As technology advances, people enjoy its benefits, such as AI, automation, etc. Moreover, these concepts are also becoming prominent in the cryptocurrency industry. One such excellent innovation is automated trading bots, which simplify trading for newcomers in the crypto market.

Automated trading bots are computer programs or apps that traders use to trade crypto automatically on the market. They can be simple rule-based software that follows predefined instructions or complex bots that use AI and machine learning to make trading decisions.

Automated trading bots or softwares are machines that use commands and criteria that users set to perform the following tasks:

- Market and technical analysis

- Tracking price movements

- Analyzing demand volume and trading

- Staying updated about important events.

That way, the program is ready to execute the trade on your behalf, with little to no human intervention. Additionally, traders can program bots like Immediate Matrix to make trades depending on different conditions, strategies, analyses, etc.

In this article, we learn about automated trading in the cryptocurrency economy.

Table of Contents

Benefits & Risks

Many people are concerned about the way automated trades work. Some people want more control over their actions, so the idea of software doing the trading for them is not comfortable for everyone.

Does it mean we should avoid using bots? The answer is no. However, one must know the risks and benefits before using automated trading bots.

| Benefits | Risks |

| Trading bots work 24/7 as they are softwares. Therefore, if required, they can make decisions for you while you sleep. | Relying on bots increases our dependence on technology, reducing reliance on our judgment. |

| The bots perform extensive analysis in a matter of seconds and can make quick trading decisions faster than humans. | Trading bots can experience technical issues, leading to malfunctions or vulnerabilities to hacking. |

| Unlike humans, who are likely to make decisions based on emotions, bots follow set rules and parameters and make logical and objective decisions. | Bots lack emotional intelligence, which can result in poor trading decisions due to their inability to comprehend human sentiments. |

Are Automated Trading Bots Legal?

As these bots are only tools and software solutions that automate some processes, so there is no legal concern around them. Moreover, these trading bots are useful for stock and forex trading. Therefore, it means they are not illegal in general.

However, there are still some complexities we must understand, such as:

- Bots are legal, according to regulations, but sometimes, people use them to manipulate markets and engage in unfair practices.

- Some individual platforms may limit the usage of bots. You can easily find that information in their terms and conditions.

- The legality of trading bots depends on the location, too, meaning what’s legal in one country may not be in another. This is because, in the past, there were cases of pump-and-dump schemes using trading bots, so some platforms and countries limit their usage for good.

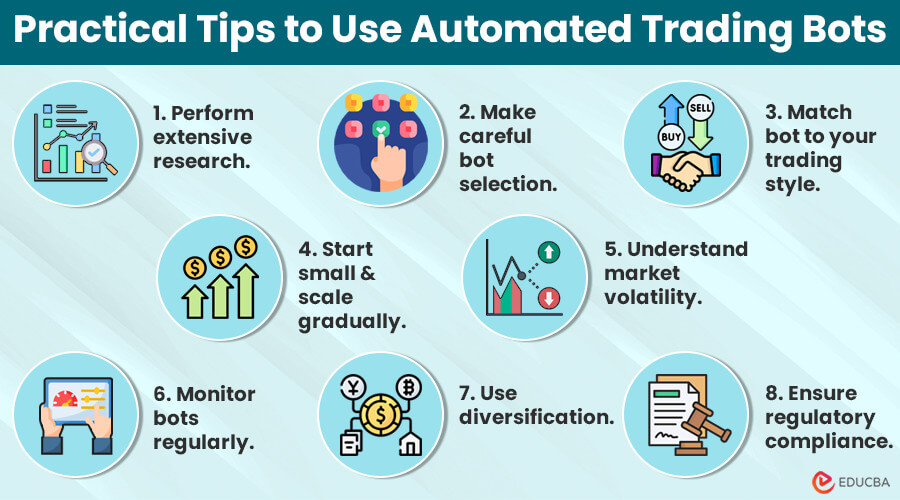

Practical Tips to Use Automated Trading Bots

While bots offer benefits like 24/7 trading and emotional discipline, they still need human supervision to navigate the cryptocurrency market effectively.

So, here are some tips on what you can do,

- Perform Extensive Research: If you are considering trying automated crypto trading, it is important to research and understand how different bots work.

- Make Careful Bot Selection: Choose a reputable platform and bots with a proven track record and good reviews.

- Match Bot to Your Trading Style: Make sure the bot understands your trading style and risk tolerance.

- Start Small, Scale Gradually: Start with a small amount of money, and once you get used to the concept, you can scale your efforts and achieve predictable outcomes.

- Understand Market Volatility: Never forget that the crypto market is volatile, no matter how good your bot is. Therefore, be aware of the market, upcoming events, and all factors affecting crypto volatility.

- Monitor Bots Regularly: Check on the bot regularly so you can identify strategy weaknesses and adjust its performance according to market conditions.

- Use Diversification: Diversify your portfolio by using various bots if you want to test different strategies.

- Ensure Regulatory Compliance: Understand the regulations to avoid accidentally indulging in illegal and unethical practices. Monitor its performance and watch for any suspicious activity.

Boost your chances of winning in the crypto world by following these tips. While bots are helpful, remember they don’t ensure success, so be smart and plan carefully.

Final Thoughts

While automation is a great thing for crypto traders, there are some limitations we must be aware of. Make sure you read all the tips, complexities, and concerns we mentioned so you can easily decide whether trading bots are good for you. In conclusion, while trading bots are not inherently illegal and can enhance your trading journey, it’s crucial to exercise caution. Ultimately, as a human capable of reasoning, remember that bots are merely software tools that rely on your guidance.

Recommended Articles

We hope this article on automated trading bots answers most of your queries about automation in cryptocurrency trading. For similar content, visit the following recommendations by EDUCBA.