Updated July 15, 2023

Introduction to Currency Exchange Trading Goals

Currency exchange trading goals include buying currencies at a low price and selling them at a higher price in the forex market to make a profit.

The markets revolve around how many traders make money and how many lose it. Most estimates find that 90% of traders lose money, and close to 10% of the traders make profits. If you want to join the select club, be assured that there is no single magic bullet or foolproof method, though some traders rush in where most fear to tread. If you understand the key to trading, it will help you to get on the right path. Currency exchange trading goals need to be established from the start if you want to climb to the top rung. But the ladder to success involves many steps. So, let’s start the journey towards trading well and (most importantly) profitably.

Tips for Trading Goals

Below are a few tips for trading goals.

Tip 1: Select Trading Goals and Find a Strategy that Suits Your Style

The first point is that you need to understand what your goals are before you begin trading. Many new forex traders come into the market indicating that they know, but many do not have a plan or concrete and stable goals. Only after goals have been set can trading methods be established for achieving the goals. Realism in expectation is essential to ensure that the trading methodology chosen fits the style and individual preferences.

Important questions you need to ask yourself:

Once you are clear about your trading goals and the nature of trading that will be most suitable for you, you must work on a detailed trading plan that can be systematically utilized to make the trading process seamless.

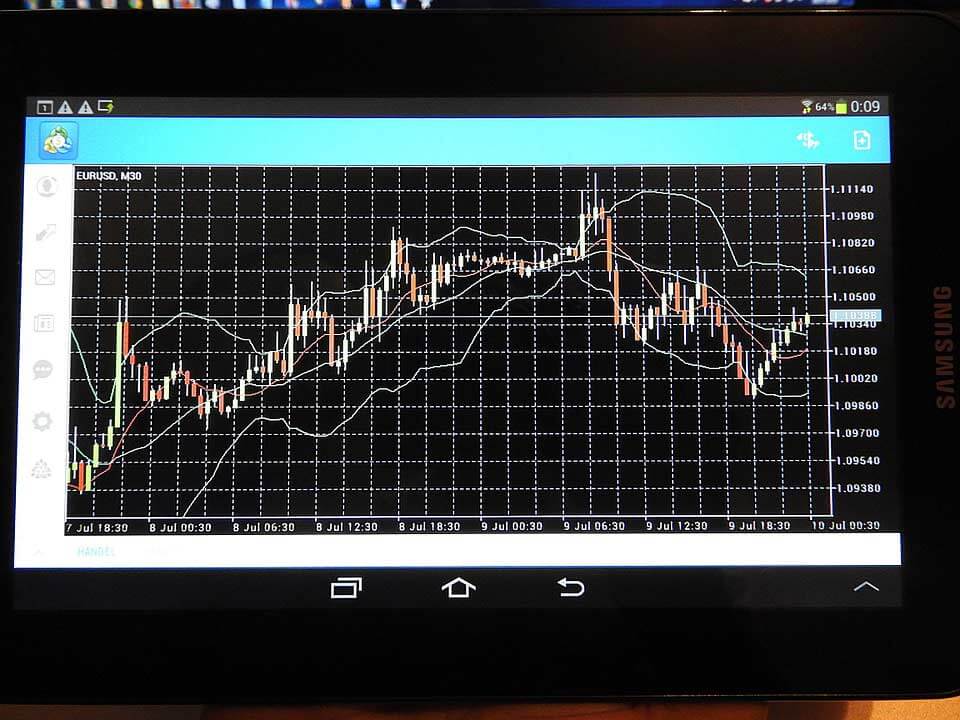

Tip 2: Use Multiple Frames for Analysis and Take a Top Down Approach

Whether you are a day trader, long-term position trader, or swing trader, the top-down approach should be taken for trading markets.

Efforts should be made to start with a higher time frame chart and zoom in to the trading time frame chart. This offers a broader scope to observe the price action. Trading decisions are often made in association with the time frame for trading, indicating a signal time frame. A top-down analysis can help you to beat the markets.

Tip 3: Test Strategies and Know Expectations

Traders aim to identify high-probability steps and execute them without emotions. To reach this point, adequate knowledge about risk control and trading probabilities is necessary. Trading over the long run is possible through tests and validations of forex trading strategies. Specific parameters can be tested and entered into the input. Trade expectancy is linked to the probability of winning and average winning – the probability of loss and average loss.

Tip 4: Keep a Trading Journal and Come Up with a Trading Plan

There is an old saying in the markets- plan your trade and trade your plan. You need to understand the trading plan to trade forex like a pro. Forex trading may not be complex, but a plan outlining details and the trading strategy keeps you accountable and focused. Keep a trading journal to record all your transactions.

Tip 5: Chart Your Trading Transactions

Keep a printed record of all your trades and print out the chart making notes about the following aspects:

- How the trade was initiated

- When the trade was initiated

- Exit and entry points

Tip 6: Trading on Higher Time Frames Will Yield Better Results

Many new traders come into the foreign market because they want to capitalize on currency trading. In currency trading, more extended time frames mean higher rewards. Day trading is fast-paced, but the profits may be slow to accumulate.

Tip 7: More Trading Does Not Mean More Money

There is a misconception about what works in the markets. One such is that the more you trade, the greater the payouts. This detracts from the truth because the less one trades, the more money they will likely make in forex trading. The longer the time frame for which you trade, the better it is. This is because transaction costs comprising the following are low:

- Bid spreads

- Ask spreads

- Slippages

- Commissions

Tip 8: Trading is Simple; avoid Complex Indicators

The use of indicators in trading can prove counterproductive. The best indicator of trading is the price. This is because every other indicator on the price chart is influenced by (you guessed it!) price. In trading, catching the opportunities before someone else does is imperative. Price charts and price action will give the whole picture…there is no need for complex indicators. Narrow down the number of your indicators and watch your profits grow! Concentrate mainly on price action.

Tip 9: Find out the Support and Resistance Levels

Zeroing in on support and resistance is an essential concept in trading. Support and resistance are defined in key price levels where buyers and sellers express interest and trade enough volume causing prices to stop or reverse. This creates the critical swing level. Traders can use this level to assess future prices and predict the entry point of buyers and sellers in the market. Support levels formed on daily charts are more reliable.

Tip 10: Watch Out for the Large Players

The support level formed on daily charts is more credible than that started on 30-minute charts! The longer the time frame, the better the data. But it would help if you watched out for the more significant market players, such as hedge funds and financial organizations, which can impact support and resistance levels.

Tip 11: Have Views on News

News events are directly responsible for volatility in the currency markets. Therefore, the forex trader must monitor news events and critical releases for currency trading. Many online resources can be identified where the economic calendar will alert you about essential fates and events.

Tip 12: Trading Cannot Take Place in A Vacuum

Forex traders cannot trade without knowing the source of the impacts that can affect positions. The primary aim of forex traders is risk management. The top goal is to preserve capital. Risk exposure can only be reduced if position size is lowered around highly volatile periods causing extreme price movements and price spikes.

Tip 13: Trading Price Action in the Markets Plays a Key Role

Everyone should consider this important currency exchange trading lesson, whether they are seasoned players or novices. The holy grail of the markets is none other than the price. Price action beats Stochastic; it outperforms RSI, and the cause of this is that indicators are computed from the price itself. The other indicators are mere middlemen in the transactions. If you focus on price action, clarity will result.

Tip 14: Set Achievable Goals

Novices and experts also have to set realistic goals (and believe in those that promise the same). Forex strategies or systems making USD 100, 2000, or 5000 a day are only promises. Sneaky salesmen who promise the moon will only make you plummet. Traders do not look for 100 or 200 percent returns in the year professionally or draw down their accounts by a massive percentage to reach this goal. Assessing risk is responsible if you don’t want to fail in the markets.

Tip 15: Self-Analysis is Critical

Foreign currency trading involves scientific principles and an artful touch. Attaining success in the long term requires a skillful approach.

Talent and hard work will only take you so far. Self-analysis is a crucial part of succeeding in the markets. Hard work is as important as smart work in the market.

Tip 16: Seek Out Well Defined Goals

Starting the journey always means having some idea of the final destination. Just like that, well-defined goals can get you higher profits. Know your trading style and always have a plan which agrees with it.

Tip 17: Choose the Best Broker

Choose a broker with the platform and tools to advance in the markets. Opting for a methodology or strategy in foreign currency trading will pave the way for success. Remember, currency exchange trading is not a game of Russian roulette! Traders who make money don’t do it by chance. Traders choose the broker and the style which will add to their profits, not subtract from them.

Tip 18: Have Clarity When it Comes to Long-Term Goals

Long-term goals will help you to make money in the markets. It will also be hard to achieve, especially because you must use the right approach. It is not enough to know how great goals are. You need to be clear about how to attain them as well. The main reason people don’t get to fulfill their target goals is a lack of action. Here are the steps you need to take:

Step 1: Decide the result you want from trading- Choose whether to be a full-time home-based trader, be mobile, or live anywhere in the world. Other questions you need to ask include if you want to earn money, fill time for trading, or manage other people’s money. Be clear about your trading objective….have a clear long-term trading goal.

Step 2: Break up the goals into chunks- If you have an appetite for market profit, you must divide your goal into bite-sized chunks. Above all, you mustn’t bite off more than you can chew in the markets. Accomplishing these mini goals each month will fuel your natural optimism and build confidence in the primary trading goal. Becoming distracted or losing patience will not get you far in the markets. Neither will overtrade, risk too much, or think excessively. Focus on each step as a short-term goal till it is attained.

Step 3: Avoid running and gunning if you want to accomplish trading goals- Make sure you bite the bullet and trade in a planned manner. Trading is a process where money is a precious resource.

Conclusion – Currency Exchange Trading Goals

Various solutions are offered to make it big in the markets, from forex robots to software that promises quick results. But it is important to remember that you must attain currency trading goals if you want a large chunk of the profits. Early successes or too many failures can be daunting, but with caution and a lot of thinking, you can join the bandwagon regardless of whether your trading style involves trading with trends or bucking them. Remember that going the trend again is a stressful, anxiety-provoking recipe, so make sure you have the stop-loss order in place within your account. It is sort of like personal insurance while you trade.

Recommended Articles

This is a guide to Currency Exchange Trading Goals. Here we discuss the introduction, definition, and the various steps for trading goals. You may also look at the following articles to learn more –