Updated June 9, 2023

Difference Between Annuity vs Lump Sum

Annuity vs Lump Sum is a different payout structure from investments, compensations, or other forms of fund flows. For an investor, annuities are a form of payment where a regular and relatively similar amount is made to the annuity scheme holders. A contract governs the payment timings and amounts and the nature of flows (inflows/outflows). The payment may or may not be inclusive of the interest accumulated on the outstanding amount throughout the life of the contract.

For Example, person A might make a one-time investment of $1000 in company X, which decides to either pay him $100 straight as inflows for the next 12 months or might give out a fixed amount of $90 plus an interest portion based on the amount outstanding. The interest amount will, therefore, vary throughout the life of the contract.

Lump-sum, on the other hand, is a structure where the entire amount of the contract is paid all at once at the end of a predetermined duration. For Example- there could be an insurance policy by person B in company Y, which pays the entire amount of the contract at the end of 15 years.

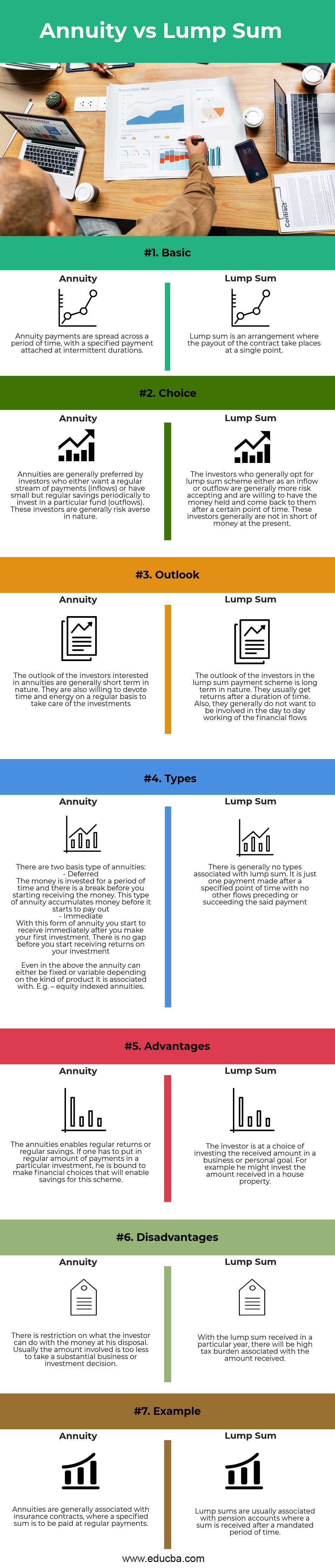

Head-to-Head Comparison Between Annuity vs Lump Sum (Infographics)

Below are the top 7 differences between Annuity and Lump Sum

Key Differences Between Annuity vs Lump Sum

Let us discuss some of the major differences between Annuity vs Lump Sum:

- Nature: Annuity consists of regular payments over a period of time, whereas the flow of a lump sum is at a designated singular point in time

- Taxation: The returns from annuities are spread across periods and hence amenable to taxation over several years. This does not pose a high burden on the recipient; however, the burden does not waive over periods. With a lump sum, there is a tax burden in one particular year, which will be higher than annuities, but it will be a one-time affair.

- Investor type: Annuities are more suited for newly earning or young investors. Not a lot needs to happen initially, and it is because of the less amount flowing in this puts control on the rash decision making. Annuities suit risk-averse and low savings individuals who have just started out. Lump-sum, on the other hand, would warrant a substantial amount put in. It is useful for making high investing and business decisions and is more suited for experienced investors. The lump sum is useful for risk-taking individuals with substantial savings to put into use.

Annuity vs Lump Sum Comparison of Table

Let us discuss the topmost differences between Annuity and Lump Sum

| Features | Annuities | Lump-sum |

| Basic | Annuity payments are spread across a period of time, with a specific payment attached at intermittent durations. | The lump sum is an arrangement where the contract payout occurs at a single point. |

| Choice | Annuities are generally preferred by investors who either want a regular stream of payments (inflows) or periodically have small but regular savings to invest in a particular fund (outflows). These investors are generally risk-averse in nature. | The investors who generally opt for a lump sum scheme, either as an inflow or outflow, are generally more risk-accepting and are willing to have the money held and come back to them after a certain point of time. These investors generally are not short of money at present. |

| Outlook | The outlook of the investors interested in annuities is generally short-term in nature. They are also willing to devote time and energy regularly to take care of the investments. | The outlook of the investors in the lump sum payment scheme is long-term in nature. They usually get returns after a duration of time. Also, they generally do not want to involve in the day-to-day working of the financial flows. |

| Types | There are two basic types of annuities: – Deferred The money is invested for a period of time, and there is a break before you start receiving the money. This type of annuity accumulates money before it starts to pay out. – Immediate With this form of annuity, you start to receive it immediately after you make your first investment. There is no gap before you start receiving returns on your investment. Even in the above, the annuity can either be fixed or variable depending on the kind of product it is associated with. E.g., equity-indexed annuities. |

There are generally no types of lump sum. It is just one payment after a specified time with no other flows preceding or succeeding the particular payment. |

| Advantages | The annuities enable regular returns or regular savings. If one has to make regular payments in a particular investment, one must make financial choices that will enable savings for this scheme. | The investor can choose to invest the received amount in a business or personal goal. For Example, he might invest the amount received in house property. |

| Disadvantages | There is a restriction on what the investor can do with the money. Usually, the amount involved is too little to take a substantial business or investment decision. | With the lump sum in a particular year, a high tax burden will be with the amount one gets. |

| Example | Annuities are generally with insurance contracts, where a specified sum will be paid regularly. | Lump sums are usually with pension accounts, where a sum is received after a mandated period of time. |

Conclusion

Given the nature of both the annuities and the lump sum payment flows, the investor’s choice depends on his financial goals, life expectancy, and the earmarked returns associated with the plans. That said, there is a formula to calculate the present value of the annuities as below:

Present value = {Annuity per period [(1+interest per period) ^number of periods -1]}/interest per period (1 + interest per period) ^number of periods

One can compare this with the lump sum payment directly (if received now) or the present value of the lump sum payment (if received after a point in time). Whichever flow yields a greater amount is preferable.

Recommended Articles

This has been a guide to Annuity vs Lump Sum. Here, we have discussed the annuity vs lump sum key differences with infographics and a comparison table. You can also go through our other suggested articles to learn more –