Definition of Tax:

“Tax is an obligatory contribution (Financial charge) from the Person (individual, company, firm, and others) to the government to meet the expenses incurred in the common interest of Society.”

“Tax is imposition financial charge which levied upon a taxpayer by Government authorities for benefit of people in the country”

Basics of Taxation

Taxation plays a prominent role in the economic development of any country. Taxation is a system through which government raises or collect revenue from Public. Governments use these revenues for the welfare of society in various forms like paying salaries of soldiers and police, Construction of dams and roads, to operate schools and hospitals, to provide food to the poor and also medical services, and for other purposes. Without taxes, any government could not exist. Taxation can redistribute a higher class society’s wealth by imposing taxes on them in order to maintain equality in society.

What do you understand by the term Tax?

In simple words, It is the part of our income which the Government collects from us and provides several facilities like, water and drainage system, school facility, medical facilities, construction of roads and dams and so on. Tax is a compulsory payment or contribution levied by the government authority on individuals or companies to meet the expenditure which is required for the welfare of society.

Characteristics of Tax:

It is a compulsory contribution.

- It is a contribution for the benefit of society.

- It is a personal responsibility.

- A tax is paid out of the total income of the taxpayer.

- A tax requires legal sanction.

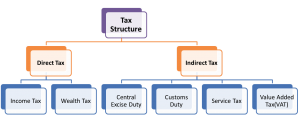

Taxation structure (Indian Perspective)

There are mainly two directions of taxes

- Direct Tax

- Indirect Tax

Direct Tax: “It is the tax, which is paid directly by the public to the government”

“The tax whose burden directly falls on the taxpayers or it is paid directly by a taxpayer to the respective authority.” It cannot be shifted to others. E.g. Income tax.

Indirect Tax: “It is the tax, which is paid indirectly by people to the government.”

The burdens of tax indirectly fall on the ultimate consumer are called as Indirect Tax. E.g. Service Tax, These are the taxes that can’t be seen by ultimate consumers.

Generally, Direct tax is again divided into the following types:

a) Income tax- As the name suggests itself it is a tax on the total income of the taxpayer.

b) Wealth Tax- It is charged on the net wealth of the assessee

Generally, Indirect tax is again divided into the following types:

a) Central Excise Duty- Excise duty is levied on production or manufacture of goods.

b) Custom Duty- Custom duty is a duty which is levied by Central Govt. on import of goods and export of goods from India.

c) Service tax- It is a tax levied on taxable services. generally, service provider pays tax and recovers from the consumer from the recipient of taxable service

d) Value Added Tax (VAT) – VAT is a tax on the sale of goods within the states only. it is a multi-stage tax, It is paid by the manufacturer, wholesaler, retailers and finally, it is on transferred on consumer

Difference between Direct Tax and Indirect Tax

| Basis | Direct Tax | Indirect Tax |

| Definition | Direct Tax is paid directly by the public to the government | Indirect tax is paid indirectly by people to the government |

| Burden of tax | The burden of tax cannot be shifted to others. | The burden of tax shifted to Ultimate consumer. |

| Tax Collected | after the income for a year is earned | At the time of sale of purchases or rendering of services |

| Example | Income tax | Service tax |

Basic terms in taxation

Assessee-

In simple words, assessee means a Person by whom any tax or any other sum of money is payable is called assessee. E.g. Mr. Shyam is liable to pay income tax so he is assessee. So any person who is liable to pay tax or any sum of money under the Income Tax Act is called assessee.

Assessment year-

Assessment year means the period of twelve months starting on 1st April every year and ending on 31st March of the next year.E.g. The assessment year 2014-15 will starts from 1st April 2014 then period of 12 months and it ends on 31st March 2015

Previous year-

It is the financial year immediately preceding the assessment year. In simply words, the year in which income is earned is known as the previous year. E.g. If any persons earns income let’s say 2012 this is the previous year and it is taxable in next year i.e. A.Y. 2013

Income-

The definition of income includes profits and gains from business, any winnings from lotteries, crossword puzzles, races and other, income received from dividends, capital gain from transfer of capital assets, any voluntary contributions received by a trust or scientific research association.

Person-

The definition of a person is in an inclusive manner.it includes-

- An Individual. e.g. Mr. Aakash

- HUF ( Hindu Undivided Family).

- Company. e.g. ABC Pvt. Ltd.

- Partnership firm. e.g. M/S A and associates.

- An association of persons (AOP) or a Body of Individuals (BOI).

- Local Authority. e.g. Municipal Corporation.

- Every Artificial Juridical person not falling within any of the above categories. Pune University.

Gross Total Income –

Total of five heads i.e. aggregate of Income from Salaries, Income from House Property, Profits and Gains from Business or Profession, income from Capital Gains, Income from Other Sources.

Total Income-

Gross total income less (minus) permissible deduction under section 80 to 80 U.

Income tax Slabs

The Income tax slab and rates applicable for the Financial Year (FY) 2013-14 and Assessment Year (AY) 2014-15 are mentioned below:

1. For Individual’s and HUF (Hindu Undivided Family)

| Income (in Rupees) | Tax Percentage |

| 0 to 2,00,000 | No tax |

| 2,00,001 to 5,00,000 | 10% |

| 5,00,001 to 10,00,000 | 20% |

| Above 10,00,000 | 30% |

2.Senior Citizen(Age 60-less than 80)

| Income (in Rupees) | Tax Percentage |

| 0 to 2,50,000 | No tax |

| 2,00,001 to 5,00,000 | 10% |

| 5,00,001 to 10,00,000 | 20% |

| Above 10,00,000 | 30% |

3.Very Senior Citizen(Age 80 and above)

| Income (in Rupees) | Tax Percentage |

| 0 to 5,00,000 | No tax |

| 5,00,001 to 10,00,000 | 20% |

| Above 10,00,000 | 30% |

Taxation FAQ’s

Who has to pay Income Tax?

A Person who’s earned Income in India, exceeds a prescribed limit or income slabs has to pay income tax

What happens if I don’t pay the Income Tax?

Any people who will evade the payment of tax, penalty or interest levied under Income Tax Act.

Who has to file the Income Tax Return?

Filing of Income Tax Return is compulsory if the taxable income exceeds the basic income tax exemption limit.

How can I (salaried Employee) pay the Income Tax?

For Salaried Persons:

Income Tax can be paid on the basis of Form 16 Certificate, which is issued by his employer which contains the details of the salary received from the employer.

What are the various heads of Taxable Income?

There are Five Heads of Income

a. Income from Salary

b. Income from House Property

c. Income from profits and gains of Business or Profession

d. Income from Capital gains

e. Income from Other Sources.

What is meant by Income tax Exemptions?

It means a reduction from the taxable amount on which tax will not be paid.

What is a PAN?

PAN (Permanent Account Number) is a unique alphanumeric combination issued by Income tax Authority.

Who has to need to acquire PAN?

Every person, who is liable to pay the tax required to obtain Permanent Account Number by making an application in form No 49A.

What is meant by TDS(Tax Deduction at Source)?

TDS (Tax Deduction at Source) means the tax required to be paid by the Assessee, which is deducted by the person (please refer above definition) paying the income to him.