Introduction to Advantages and Disadvantages of Savings Account

Imagine you are keeping your hard-earned monthly salary in a secure safe at home. But, it is not easy to keep track of the amount spent on every transaction and count the balance amount. That’s why we need proper saving options. Nearly everyone thinks of banks and opening a savings account for long-term investment plans. These accounts are like secure homes for your money and offer easy transactions through debit cards. While it has many benefits, it also has a few drawbacks. In this article, you will learn the top 12 advantages and disadvantages of savings accounts.

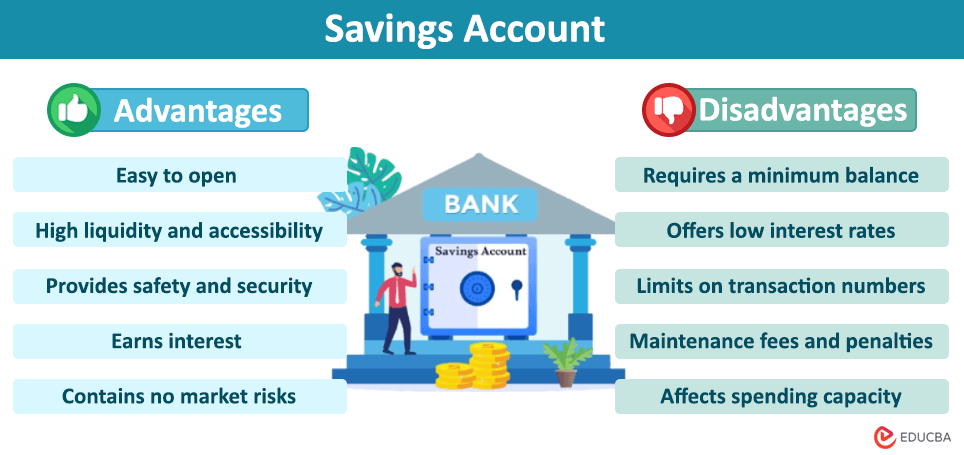

Advantages of Savings Account

The following are the advantages of a savings account.

1. It is easy to open with a minimum amount

Saving accounts are useful for saving money for specific goals like a home down payment, education, family vacation, etc. You can open a savings account easily with $1 to $25 online or offline in a few minutes. Also, some financial institutions offer opening accounts with zero deposit.

2. Provide high liquidity and accessibility

Saving accounts offer high liquidity, allowing easy accessibility and availability of money anywhere and anytime. You can withdraw money during bank business hours or 24 hours via ATMs. You can also easily transfer funds through online services or mobile payment (UPIs) in an emergency.

3. Offers safety and security

Saving accounts are a safe and secure way to save money. In addition, government agencies in many countries insure financial institutions and banks, protecting issuers’ accounts for deposited funds.

4. Earn interest on deposited money

Banks pay interest every quarter or annually on money deposited in savings accounts. Various banks offer different interest rates to attract customers. Moreover, depositing money in savings accounts is always advantageous rather than keeping it idle without getting any interest.

5. There are no market risks

Unlike investments in stocks, mutual funds, or any other riskier financial matters, savings accounts are not subject to market fluctuations. It is like a long-term investment plan with minimum risk and provides financial security. The principal amount is safe and not affected by stock prices or ups and downs in the financial market.

6. There is no lock-in period

This account type does not have a lock-in period. It means you can easily withdraw money when needed. Also, you can switch accounts without any penalties. It is better than a fixed deposit account, where the amount is fixed for a specified period and can only be accessible after completion.

Disadvantages of Saving Account

The following are the disadvantages of savings accounts.

1. May have to maintain a minimum balance

Some banks require you to maintain a yearly or monthly minimum balance in savings accounts. The bank may impose a penalty if you fail to maintain this balance.

2. Offers low-interest rates

Banks provide low-interest rates compared to other investments. Also, it can change at any time, depending on market conditions.

3. Provide limited access to funds

Saving accounts comes with transaction limitations also. Most banks set a limited number of free transactions or withdrawals for saving accounts per month. After this limits, it may incur penalties or restrictions on each transaction.

4. Applies account fees and charges

Some banks may apply account maintenance fees as it’s service charges. Also, banks charge a penalty for not maintaining a minimum balance, crossing the limit of transactions, or for huge amounts of transactions.

5. Provide no tax benefits

Even though you don’t have to pay interest on the account balance in a savings account, you have to pay tax on the interest earned in that period. Other investment accounts, like retirement accounts, provide tax benefits.

6. It affects the spending capacity of the holder

High liquidity and easy access to money reduce customers’ saving capacity, as they can spend easily using debit cards or online payment services.

Final Thoughts

It is necessary to consider all factors before opening a savings account, such as interest rate, transaction limit, minimum balance requirements, and more. Every bank offers additional benefits with opening savings accounts, like rental lockers, insurance, credit cards, etc. So, choose wisely and consider the advantages and disadvantages of savings accounts to avoid any unnecessary penalties.

Recommended Articles

We hope this “Advantages and disadvantages of savings account” article was informative. To learn more, refer to our articles below.