Introduction to Advantages and Disadvantages of Insurance

Imagine Jenita, who decided to get health insurance. At first, she thought having a policy was a good idea, but she soon realized there were pros and cons. The advantage was that she didn’t have to worry about paying her medical bills. However, the disadvantage was that she had to pay high monthly premiums, and her policy had a high deductible, which strained her budget. This shows why it’s important to understand the advantages and disadvantages of any insurance policy before making any purchasing decision.

By being informed, individuals can choose a policy that meets their needs and what they can afford. Let’s take a closer look at the advantages and disadvantages of insurance using examples.

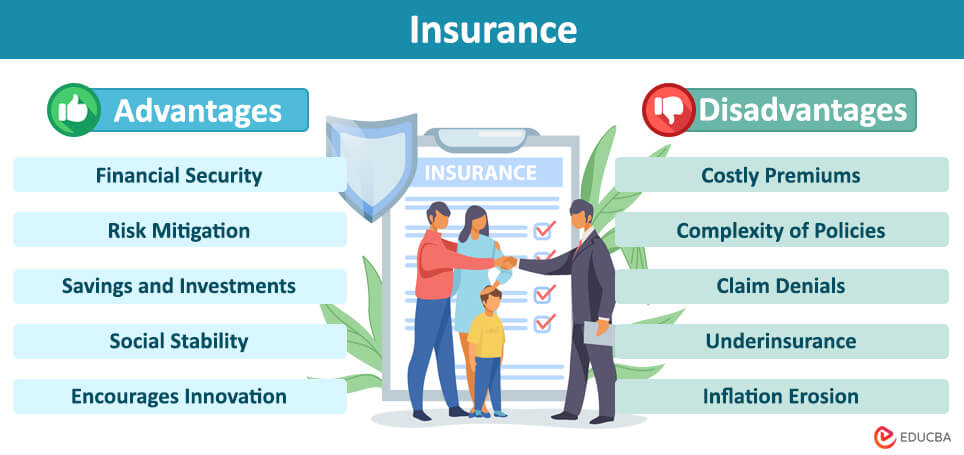

Advantages of Insurance

Let us look at some of the advantages of insurance:

1. Provides financial assistance for individuals and businesses.

Insurance is like a safety net for people and businesses. If something bad happens, like an accident or damage to property, insurance steps in to help financially. Even dogs can be covered by insurance. This way, individuals and businesses don’t face huge financial problems when unexpected events occur. It’s like having a backup plan that ensures you can bounce back from tough situations.

Example: Suppose a fire damages your house, and you have home insurance. So you report the incident to your insurance company. The insurance inspector visits your home and assesses the damage. After determining the coverage amount based on your policy, the insurance company offers a payout for:

- Repairing or rebuilding

- Replacing belongings

- Covering living expenses during reconstruction.

2. Individuals can transfer the financial risk to the insurance company.

The advantage of insurance lies in individuals being able to transfer the financial risk of losses to an insurance company. This risk-sharing mechanism helps in managing and reducing various types of risks. It is a frequently overlooked necessity, yet indispensable in industries like cosmetology. For example, if a client suffers a reaction to a product or sustains an injury during a procedure, liability insurance would cover the costs.

3. Helps in saving and investing.

Insurance does more than protect you; it can also help you save and invest. Some types of insurance, like whole life insurance or endowment plans, cover you and grow in value over the years. This growing value can be used like savings, allowing you to borrow money or get a loan. So, insurance keeps you financially safe and helps you build wealth for the future.

4. Reduces the economic impact of disasters.

Insurance contributes to overall social stability by helping individuals and communities recover from disasters and unforeseen events. When many people are insured, the financial burden is spread across the community, reducing the overall economic impact of destructive events.

5. Contributes to societal progress by encouraging innovation.

By mitigating the financial risks associated with new ideas and technologies, companies feel more confident to try ventures that may otherwise seem too risky. It encourages a culture of experimentation and creativity, driving advancements and breakthroughs in various industries and ultimately contributing to societal progress and economic growth.

Disadvantages of Insurance

Let us look at some of the disadvantages of insurance:

1. Insurance premiums are costly.

The cost of premiums depends on different factors like the type of insurance, coverage amount, and the individual’s risk profile. These premiums can sometimes be high, representing an ongoing expense for individuals and businesses.

2. It has confusing legal terms.

Insurance policies can be confusing because they use many legal words and have rules that are not easy to understand. Figuring out exactly what the insurance will pay for and what it won’t can be tough for people who have these policies.

3. Claim denial can leave policyholders unsupported.

Claim denials happen when the insurance company refuses to pay for a submitted request. The reasons for denials include failure to meet specific requirements or not disclosing crucial information during the application process.

4. Underinsurance may put individuals at risk.

Underinsurance presents a significant drawback as it occurs when individuals underestimate the value of their possessions and opt for insufficient insurance coverage. This exposes them to financial risks, as the coverage might not be enough to handle the costs in the event of an unexpected occurrence.

5. Fixed insurance benefits may lose value due to inflation.

Inflation becomes a problem for insurance policies with fixed benefits. The promised amount may not be enough to cope with rising prices, reducing the real purchasing power of the insurance payout.

Final Thoughts

Insurance is an important part of financial planning. However, ongoing innovation is necessary to address emerging challenges and ensure that insurance adapts to the ever-changing world. This is essential to maintain its role in safeguarding individuals and businesses.

Recommended Articles

If you found our article listing the advantages and disadvantages of insurance helpful, please visit the following recommendations.