Updated July 29, 2023

Difference Between Actual Cash Value vs Replacement Cost

The following article provides an outline for Actual Cash Value vs. Replacement Cost.

Value of a Product:

Humans have decided to formalize exchange values. For this, we have created currencies to measure the worth of a product. This is the Value of the Product. Remember this basic term as it may be of use ahead.

Actual Cash Value vs. Replacement Cost:

These are the two methods of valuing a particular property, and the two differ. Insurance companies may use these terms in their policy statements if you file an insurance claim to value your property.

Actual Cash Value

Actual Cash Value (ACV) is a way to measure the value of a particular property to settle an insurance claim. Insurance companies mainly use Actual Cash Value to determine how much reimbursement to shell out to the insured in case of a claim. Items valued at Actual Cash Value are lower than their actual buying price. The valuation is similar to selling off your laptop or furniture on OLX, Quikr, etc.

At a basic explanatory level, Actual Cash Value is calculated as replacement cost minus the accumulated depreciation. Out of these two distinct factors, depreciation usually estimates the useful life of the asset or product. Actual Cash Value is unclear, as someone might claim a laptop’s useful life to be 8 years, while some might argue it to be 5 years. This affects not only the depreciation value but also the asset’s book value. In the case of vehicles, the value determination becomes a lot trickier as the age of the vehicle, its fuel type, mileage covered, maintenance record, damages, if any, the number of previous vehicle owners, etc., are all key factors in determining the Actual Cash Value of a vehicle.

Replacement Cost

Replacement Cost or Replacement Value is the amount a person would pay to replace an asset. It’s the actual cost to replace an item or asset at its pre-loss condition. While replacement cost may not be as high as a “new market value” of the asset, it may also not be as low as the Actual Cash Value, excluding depreciation.

In cases of an insurance company paying out the Replacement Cost of an asset, in an insurance claim, the insured will have to replace the asset in the first place. After replacing the asset, the insurance company may ask for a lot of information to finalize a full settlement offer for the customer.

Sometimes, the insurance company may disburse insurance claims via 2 cheques. The first cheque to the customer is worth the Actual Cash Value of the damaged or lost asset. The other cheque includes the balance of the replacement cost, sent after verifying that the customer has replaced the item.

Replacement cost valuation has a standard deductible policy for each product. It is reduced from the current market value to finally arrive at the Replacement Cost.

Example 1: Suppose a user has an iPhone XS that costs $1,000 and insures it in full replacement insurance with a deductible of $100. If the user’s phone is stolen and they purchase a new iPhone XS worth $1,000, they can claim $900 from the insurance company.

Example 2: A user purchased a new car worth $8,000 and insured it in full replacement insurance with a deductible of $1,000. Now, if the buyer makes a valid insurance claim after 2 years, the insurance company is liable to offer the user that exact car model’s market price minus the deductible. Let us assume that since 2 years have passed, the same model of the car is now worth $6,500. In that case, the user receives the following;

Market Value of the insured asset – Deductible = $6,500 – $1,000 = $5,500.

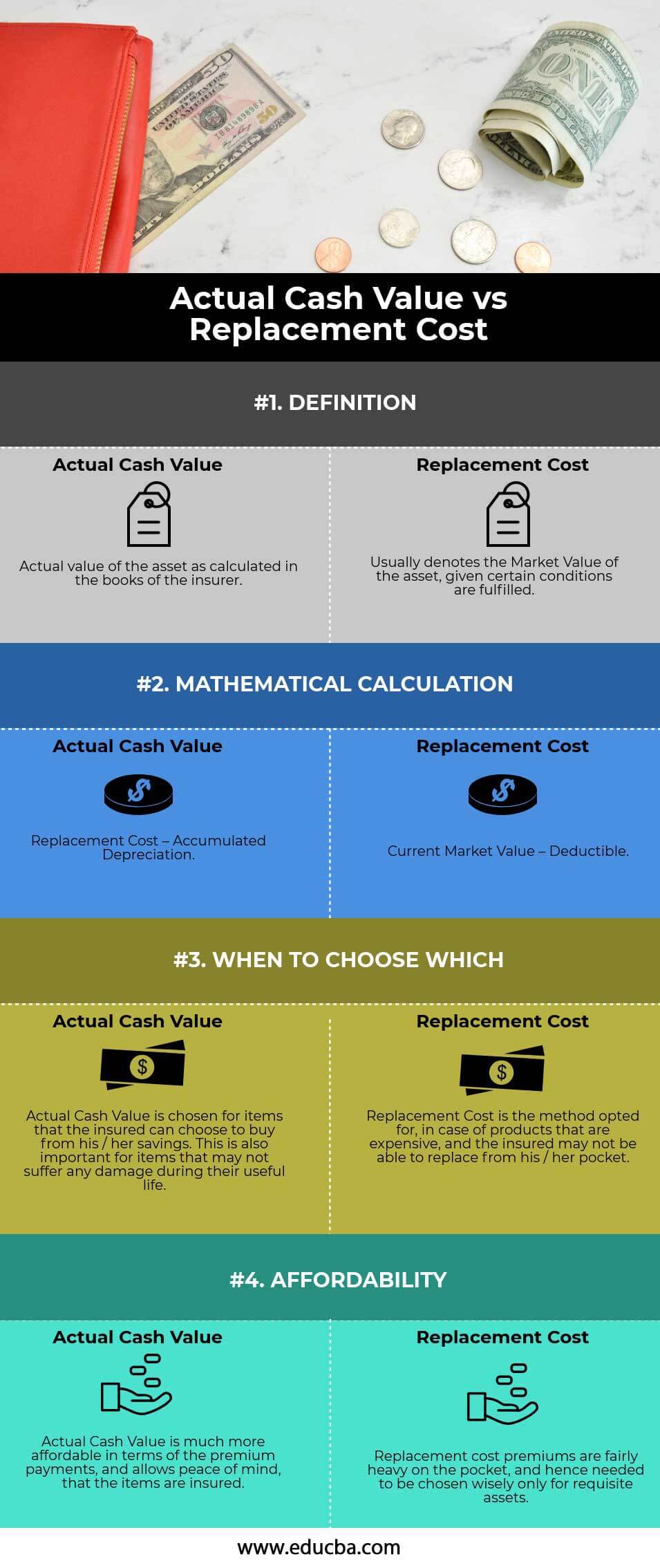

Head-to-Head Comparison Between Actual Cash Value vs. Replacement Cost (Infographics)

Key Differences Between Actual Cash Value vs Replacement Cost

Both Actual Cash Value vs Replacement Cost methods is mainly based on today’s cost to replace a damaged asset with a new one.

Let us discuss some of the major differences:

- However, Actual Cash Value indicates the book value of the asset or item in the insurance company’s books. This particular issue is always heavily contested as depreciation is heavily subjective. On the other hand, the replacement cost is comparatively simple. The only factor affecting the cost there is the age of the replacement asset.

- The calculation involves deducting depreciation in the calculation of Actual Cash Value, whereas replacement cost involves the reduction of only a standard and mostly pre-determined deductible.

- Insurance policies using Actual Cash Value are mainly applicable for replaceable items by the user. In contrast, the replacement cost method insurance is useful for fairly costly and tough assets.

Actual Cash Value vs Replacement Cost Comparison Table

Let’s look at the top 4 comparisons between Actual Cash Value vs Replacement Cost:

|

Actual Cash Value |

Replacement Cost |

| Definition | |

| The asset’s actual value is calculated in the insurer’s books. | The replacement cost denotes the asset’s market value on fulfilling certain conditions. |

| Mathematical Calculation | |

| Replacement Cost – Accumulated Depreciation. | Current Market Value – Deductible. |

| When To Choose Which | |

| Actual Cash Value is chosen for items that the insured can choose to buy from his/her savings. This is also important for items not damaged during their useful life. | Replacement Cost is the available option in case of expensive products, and the insured may not be able to replace them from his/her pocket. |

| Affordability | |

| Actual Cash Value is much more affordable regarding the premium payments and allows peace of mind that the items are insured. | Replacement cost premiums burden the pocket and are useful only for requisite assets. |

Conclusion

While both methods assure a user the ease of replacing the item or asset in case of damage, the user has to appropriately select the method of valuation, where he/she can balance both the risks and the affordability of the replacement of the product.

Recommended Articles

This is a guide to Actual Cash Value vs Replacement Cost. Here we also discuss the key differences between the Actual Cash Value vs Replacement Cost with infographics and a comparison table. You may also have a look at the following articles to learn more –