Updated November 7, 2023

Difference Between ACCA vs CIMA

Decide your career from the two great professional organizations that can benefit a candidate in the long run. At the same time, the Association of Chartered Certified Accountants (ACCA) is a body for Chartered accountants. On the other hand, the Chartered Institute of Management Accountants (CIMA) is a body for management accountants. At the end of the discussion, it comes down to what you want to do with your career.

Both ACCA and CIMA aspirers require different skill sets and, on completion, will have different levels of responsibilities. Associations like these provide various benefits and can help you advance your career; it includes job placement assistance and provides continuing education, publications, affinity services, and products. Organizations like these offer annual meetings or local and regional conferences. These can help you achieve career status through certifications and exams.

CIMA is for management accountants working in the industry, which is the major difference between ACCA and CIMA. It was founded in 1919. ACCA’s headquarters is situated in London, with administrative offices in Glasgow. As of 2016, the organization reported 188,000 members and 480,000 students in 178 countries, and it was founded in 1904. On the other hand, CIMA is also based in London, and with more than 227,000 members and students in 179 countries, it is currently the largest management accounting body in the world.

ACCA and CIMA differ based on continuing education, membership dues, and certifications. The qualifications are distinguished by various factors, which are discussed in the table and make it easy for a student to choose between ACCA vs CIMA.

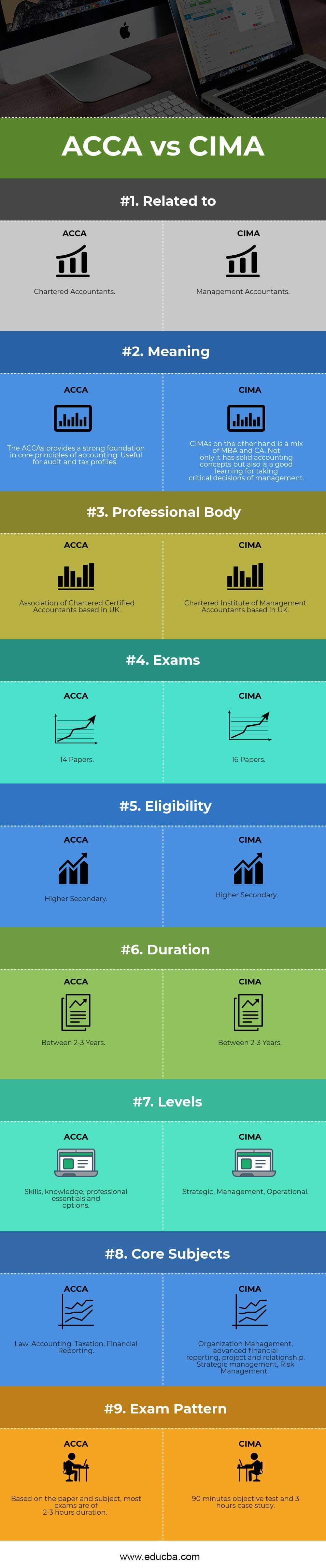

ACCA vs CIMA Infographics

Below is the top 9 difference between ACCA vs CIMA

Key Differences Between ACCA vs CIMA

Both ACCA vs CIMA are popular choices in the market; let us discuss some of the major Differences Between ACCA vs CIMA:

- ACCA charges around $3,000 – $4,000, and CIMA is around $3,000 – $4,000.

- The pass percentage is 30% to 40% for ACCA, and CIMA has a pass percentage of 35%-46%.

- The usual profiles for a job are of financial specialists (Tax and Audit) and general practice for ACCA. At the same time, CIMA has Strategic and Managerial roles in business and finance.

- ACCA is globally accepted but is more common in European countries and the UK. At the same time, the CIMA is a collaboration with the CPA (USA) Institute.

- A maximum of 9 papers exemption is provided for ACCA, whereas 12 papers are exempted for CIMA.

- ACCA is highly preferred in accounting roles like business valuation, tax and treasury management, and forensic accounting. In auditing roles, ACCA faces tough competition from CAs. CIMA is highly preferred in financial services and managerial roles in global banks, accountancy firms, and shared services.

- The ACCAs provide a strong foundation in core principles of accounting. Useful for audit and tax profiles. CIMA, on the other hand, is a mix of MBA and CA. Not only does it have solid accounting concepts, but it also is good learning for making critical decisions for management.

Head To Head Comparison Between ACCA vs CIMA

Below is the top comparison between ACCA vs CIMA –

| The Basis of Comparison | ACCA | CIMA |

| Related to | Chartered Accountants | Management Accountants |

| Meaning | The ACCAs provide a strong foundation in core principles of accounting. Useful for audit and tax profiles. | CIMAs, on the other hand, are a mix of MBA and CA. Not only does it have solid accounting concepts, but it also provides good learning for making critical decisions for management. |

| Professional body | Association of Chartered Certified Accountants based in the UK | Chartered Institute of Management Accountants based in the UK |

| Exams | 14 Papers | 16 Papers |

| Eligibility | Higher Secondary | Higher Secondary |

| Duration | Between 2-3 Years | Between 2-3 Years |

| Levels | Skills, knowledge, professional essentials, and options | Strategic, Management, Operational. |

| Core Subjects | Law, Accounting, Taxation, Financial Reporting. | Organization Management, advanced financial reporting, project and relationship, Strategic management, and Risk Management. |

| Exam Pattern | Based on the paper and subject, most exams are of 2-3 hours in duration. | 90 minutes of objective test and 3 hours of a case study. |

Final Thoughts

While both ACCA and CIMA qualifications can give your career prospects a boost, the perfect accountancy qualification for people who know that they would like to work in the world of management and business, a CIMA qualification is a specialist management accounting qualification. Also, it can overlap with business practice. You need to ask yourself before you choose stuff is what you want from your career.

The ACCA qualification is broader and offers more flexibility. On the other hand, students can still specialize in some areas towards the end of the ACCA course. Still, its pure variety of core accounting skills and knowledge is great for those who want to keep their options open for a while or even to work in various industries.

Both CIMA and ACCA are highly respected and can turn the heads of any employer seeking the right professional talent. And at the same time, both can also offer various opportunities worldwide.

CIMA-qualified accountants who hold the designation of Chartered Global Management Accountants (CGMA) become a part of an international network that earns them recognition wherever they go. This includes a series of partnerships with local accountancy bodies in various locations, making ACCA well-accepted in over 100 countries worldwide.

Suppose one aspires to a career in accountancy and is considering pursuing one of these courses. In that case, they are on the right track, which will open several opportunities and shape an exciting career in many industries and locations. One has to ponder where they want to work in their career and ensure that the qualification they choose is the best fit for the region and is recognized.

Why the ACCA vs CIMA matters over time is an essential question in one’s career. The CIMA vs ACCA frameworks have their importance and are equally prestigious.

Recommended Articles

This has been a guide to the top differences between ACCA vs CIMA. We also discuss the ACCA vs CIMA key differences with infographics and comparison table. You may also have a look at the following articles to learn more-