Updated July 26, 2023

Stock Turnover Ratio Formula (Table of Contents)

What is the Stock Turnover Ratio Formula?

The term “stock turnover ratio” refers to the performance ratio that helps determine how well a company manages its stock inventory while generating sales during a given time period.

In other words, the ratio indicates how many times during a specific period of time (usually a year) a company can sell its inventory. The formula for a stock turnover ratio can be derived by dividing the cost of goods sold incurred by the company during a given period of time by the average inventory held during the same period. The mathematical representation of the formula is:

Examples of Stock Turnover Ratio Formula (With Excel Template)

Let’s take an example to better understand the Stock Turnover Ratio Formula calculation in a better manner.

Example #1

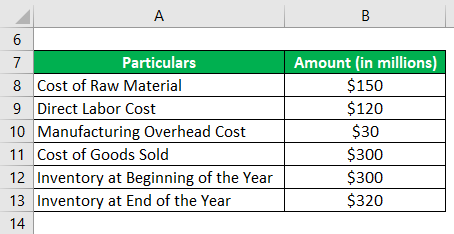

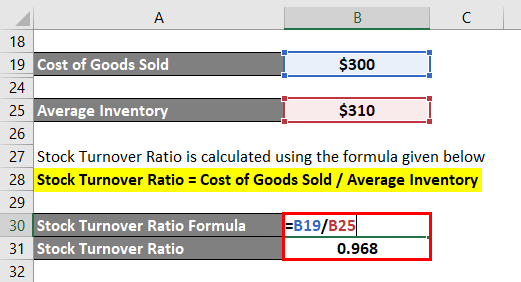

Let us take the example of a company to demonstrate the stock turnover ratio concept. During 2018, the company incurred a raw material cost of $150 million, a direct labor cost of $120 million, and a manufacturing overhead cost of $30 million. The inventory holding at the beginning of the year and at the end of the year stood at $300 million and $320 million, respectively. Calculate the stock turnover ratio of the company based on the given information.

Solution:

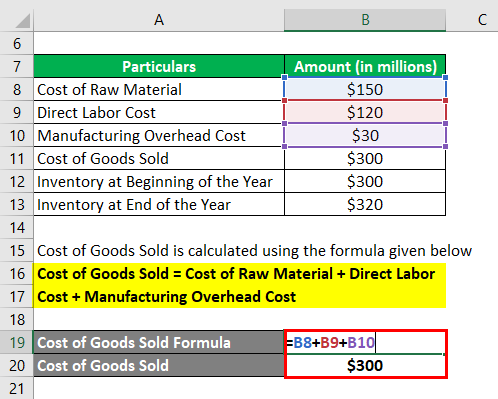

The formula to calculate the Cost of Goods Sold is as below:

Cost of Goods Sold = Cost of Raw Material + Direct Labor Cost + Manufacturing Overhead Cost

- Cost of Goods Sold = $150 million + $120 million + $30 million

- Cost of Goods Sold = $300 million

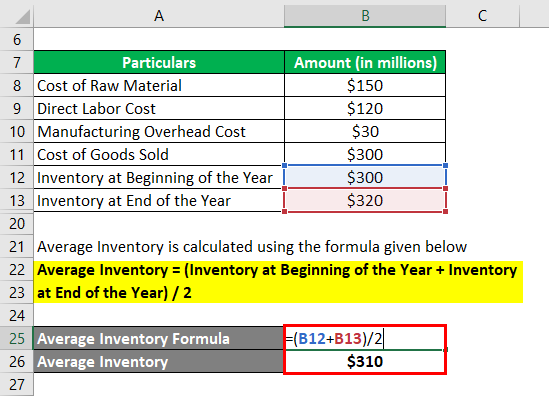

The formula to calculate Average Inventory is as below:

Average Inventory = (Inventory at Beginning of the Year + Inventory at End of the Year) / 2

- Average Inventory = ($300 million + $320 million) / 2

- Average Inventory = $310 million

The formula to calculate Stock Turnover Ratio is as below:

Stock Turnover Ratio = Cost of Goods Sold / Average Inventory

- Stock Turnover Ratio = $300 million / $310 million

- Stock Turnover Ratio = 0.968

Therefore, the stock turnover ratio of the company for 2018 stood at 0.968 times.

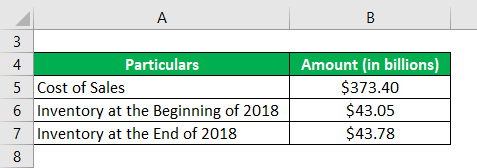

Example #2

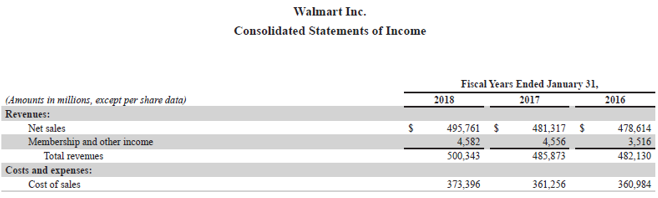

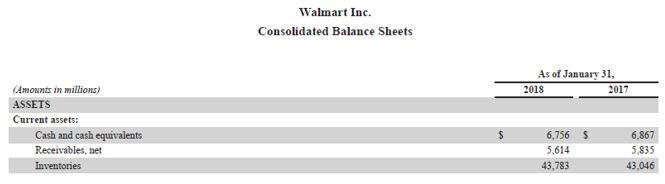

Let us take the example of Walmart Inc.’s annual report for the year. As per the annual report, the following information is available:

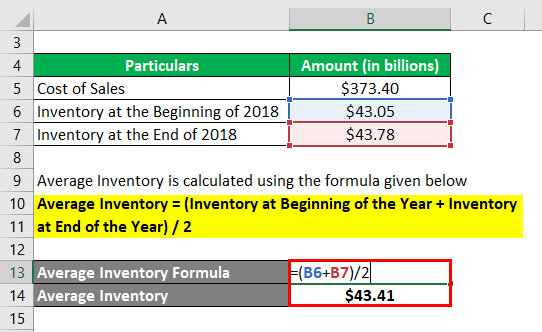

The formula to calculate Average Inventory is as below:

Average Inventory = (Inventory at Beginning of the Year + Inventory at End of the Year) / 2

- Average Inventory = ($43.05 billion + $43.78 billion) / 2

- Average Inventory = $43.41 billion

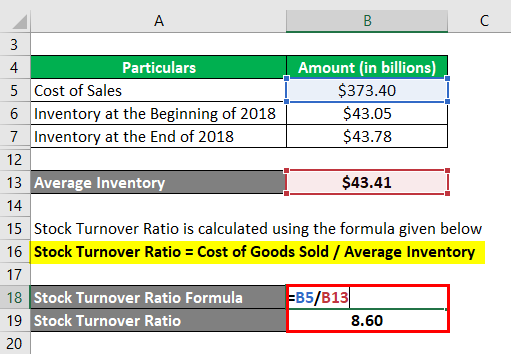

The formula to calculate Stock Turnover Ratio is as below:

Stock Turnover Ratio = Cost of Goods Sold / Average Inventory

- Stock Turnover Ratio = $373.40 billion / $43.41 billion

- Stock Turnover Ratio = 8.60

Therefore, Walmart Inc.’s stock turnover ratio for the year 2018 stood at 8.60 times.

Source: Walmart Annual Reports (Investor Relations)

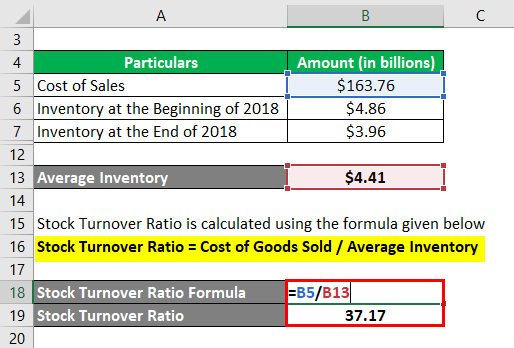

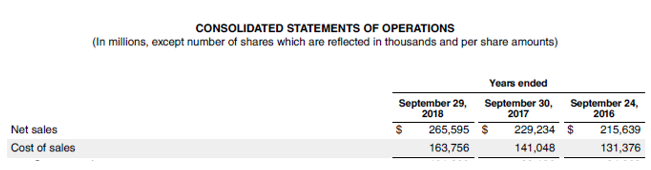

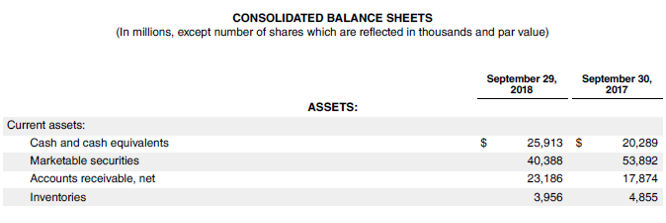

Example #3

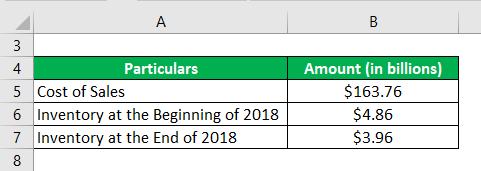

Let us now take the example of Apple Inc.’s annual report for the year 2018. As per the annual report, the following information is available.

Solution:

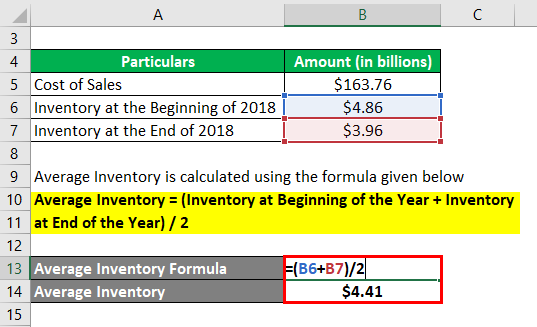

The formula to calculate Average Inventory is as below:

Average Inventory = (Inventory at Beginning of the Year + Inventory at End of the Year) / 2

- Average Inventory = ($4.86 billion + $3.96 billion) / 2

- Average Inventory = $4.41 billion

The formula to calculate Stock Turnover Ratio is as below:

Stock Turnover Ratio = Cost of Goods Sold / Average Inventory

- Stock Turnover Ratio = $163.76 billion / $4.41 billion

- Stock Turnover Ratio = 37.17

Therefore, Apple Inc.’s stock turnover ratio for the year 2018 stood at 37.17 times.

Source: Apple Inc Balance sheet

Explanation

The formula for a stock turnover ratio can be derived by using the following steps:

Step 1: Firstly, determine the cost of goods sold incurred by the company during the period. The sum of all direct and indirect costs can be apportioned to the job order or product. It primarily includes direct labor costs and the cost of raw materials, and manufacturing overhead costs. The cost of goods sold is also known as the cost of sales.

Cost of Goods Sold = Direct Labor Cost + Cost of Raw Material + Manufacturing Overhead Cost

Step 2: Next, determine the inventory holding of the company at the beginning of the period and the end of the period. Then the average inventory is calculated by computing the mean of the inventory at the beginning of the period and at the end of the period.

Average Inventory = (Inventory at the Beginning of the Period + Inventory at the End of the Period) / 2

Step 3: Finally, the formula for a stock turnover ratio can be derived by dividing the cost of goods sold incurred by the company during the period (step 1) by the average inventory held across the period (step 2), as shown below.

Stock Turnover Ratio = Cost of Goods Sold / Average Inventory

Relevance and Uses of Stock Turnover Ratio Formula

It is important to understand the concept of stock turnover ratio as it assesses the efficiency of a company in managing its merchandise. A higher value of the stock turnover ratio indicates that the company can sell the stock inventory relatively quickly. A lower value means the company holds a higher inventory value at any time. To draw meaningful insights, it is advisable to compare the stock turnover ratio for companies in the same industry and preferably of comparable sizes.

Stock Turnover Ratio Formula Calculator

You can use the following Stock Turnover Ratio Calculator

| Cost of Goods Sold | |

| Average Inventory | |

| Stock Turnover Ratio | |

| Stock Turnover Ratio | = |

|

|

Recommended Articles

This is a guide to Stock Turnover Ratio Formula. Here we discussed calculating Stock Turnover Ratio Formula and practical examples. We also provide a Stock Turnover Ratio calculator with a downloadable Excel template. You may also look at the following articles to learn more –