Updated July 25, 2023

Difference Between Sales and Trading

Sales and Trading activities are two very important jobs in investment banking. The term refers to the various activities associated with buying and selling financial instruments and securities. An investment bank executes these types of tasks on behalf of its clients. The task is performed by salespeople and traders, where salespeople call institutional investors with various investment ideas and possibilities. Traders advise the clients about when to enter and exit the financial positions and execute the same on behalf of the clients. Traders are paid on how much profit they have generated from buying and selling instruments. If the investment banking firm cannot trade efficiently, it would be very difficult to create and retain clients and generate a good amount of profit.

What are Sales?

Sales are the first and most important activity in an investment banking firm. Salespeople play a vital role in the firm, generating an idea and various investment opportunities for investors. When investment banks handle the IPO issue, they promise to sell off the minimum number of shares. To meet the expectations and avoid the need to buy part of the remaining shares, salespeople play a very important role in doing this job for investment banks and make sure to sell the required number of stocks successfully as committed. Salespeople also get in touch with portfolio managers and traders’ staff. To know what types of investment the traders focus on, they also develop good relationships with large investors. In some traditional broker firms, salespeople also act like traders.

What is Trading?

Traders’ main job is buying and selling securities for the investment banking firm or the client. They need to maximize the profits for the risk they are taking. Traders continuously watch the market and use the pricing charts on some well-known terminals like Bloomberg to execute the transactions with accuracy.

Commonly there are two types of trading, agency trading, and proprietary trading. In agency trading, traders act as agents, and in proprietary trading, traders have the freedom to trade on behalf of banks. But proprietary traders have some limitations to take the risks set by the investment banks.

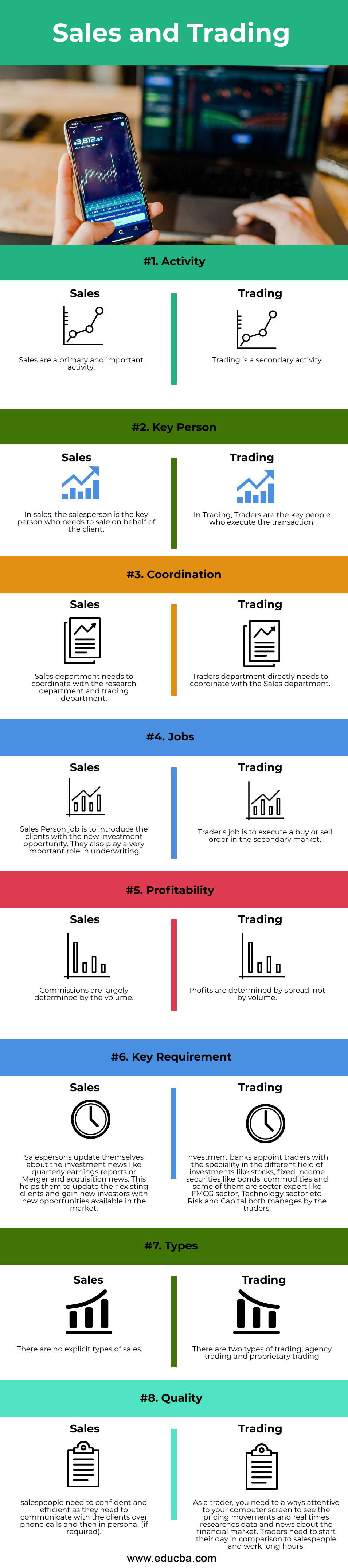

Head To Head Comparison Between Sales and Trading (Infographics)

Below are the top 8 differences between Sales vs Trading

Key Differences Between Sales and Trading

let us discuss some of the major differences between Sales and Trading:

- Sales and Trading are both very crucial parts of investment banks. Under sales, a salesperson needs to interact with clients and sell investment ideas to them. Where traders are secondary persons, they need to execute the orders effectively.

- Under Sales, the Sales department needs to attend a meeting days before the salespersons start pitching to the clients; the meeting is called a morning meeting. On the other side, traders need to spend their time in front computer screen by looking at the pricing charts on trading terminals to execute the order with the highest accuracy.

- The sales job is very important as it is more client-oriented work. Hence salespeople need to be confident and efficient as they need to communicate with the clients over phone calls and then in personal (if required). As a trader, you need to always be attentive to your computer screen to see the pricing movements and real times research data, and news about the financial market. Traders need to start their day in comparison to salespeople and work long hours.

- Traders are responsible for executing the trade per the client’s need and ensuring that at a reasonable price. In sales, commission depends on the volume coming in; in trading; it depends on the pricing (spread).

- Salespersons update themselves about investment news like quarterly earnings reports or Merger and acquisition news. This helps them to update their existing clients and gain new investors with new opportunities available in the market. While, Investment banks appoint traders with a specialty in the different fields of investments like stocks, fixed income securities like bonds, and commodities, and some of them are sector experts like the FMCG sector, the Technology sector, etc. Risk and Capital both manages by the traders.

Sales and Trading Comparison Table

Let’s discuss the top comparison between Sales and Trading:

| Basis for Comparison | Sales | Trading |

| Activity | Sales are a primary and important activity. | Trading is a secondary activity. |

| Key Person | In sales, the salesperson is the key person who needs to sell on behalf of the client. | In Trading, Traders are the key people who execute the transaction. |

| Coordination | Sales department needs to coordinate with the research department and trading department | The trader’s department directly needs to coordinate with the Sales department. |

| Jobs | Sales Person’s job is to introduce the clients to the new investment opportunity. They also play a very important role in underwriting | The trader’s job is to execute a buy or sell order in the secondary market. |

| Profitability | The volume largely determines commissions. | Profits are determined by spread, not by volume |

| Key Requirement | Salespersons update themselves about investment news like quarterly earnings reports or Merger and acquisition news. This helps them to update their existing clients and gain new investors with new opportunities available in the market. | Investment banks appoint traders with a specialty in the different fields of investments like stocks, fixed-income securities like bonds, and commodities, and some are sector experts like the FMCG sector, the Technology sector, etc. Risk and Capital both manages by the traders |

| Types | There are no explicit types of sales | There are two types of trading, agency trading, and proprietary trading |

| Quality | salespeople need to be confident and efficient as they must communicate with the clients over phone calls and in person (if required). | As a trader, you need to always be attentive to your computer screen to see the pricing movements and real times research data and news about the financial market. Traders need to start their day in comparison to salespeople and work long hours. |

Conclusion

As we have seen, sales and trading activities are crucial tasks in an investment bank. In an investment banking firm sales job is the face of trading. Salespeople need to focus on volume as it will lead to more commission. Traders are more of a trading-oriented job as they must focus on maximizing profitability using their strategies to trade. In the latter days, trading commodities, fixed-income securities, and derivatives have been booming compared to equity trading because of technological advancement in trading software and terminals. Both sales and trading play an important role in the bank’s profitability.

Recommended Articles

This has been a guide to Sales and Trading. Here we have discussed the Sales and Trading key differences with infographics and comparison tables. You can also go through our other suggested articles to learn more –