Updated July 13, 2023

What are Progressive Tax Examples?

The following article provides an outline for Progressive Tax Examples.

Progressive taxes increase and decrease according to the increase and decrease in the taxpayer’s taxable income. Therefore, high-income earners will have to pay more taxes than low earners. Tax authorities establish this by formulating a tax bracket for taxpayers’ income and assigning the tax rates to each bracket.

Explanation

The progressive tax system is based on the logic that flat or the same tax rate, irrespective of the taxpayers’ incomes, is not a fair scheme; it would put a disproportionate burden on low-income earners. The U.S. tax system is an example of a progressive taxation system.

The structure of the progressive tax system depends on how much tax burden is to be transferred to high-income people. The progressive tax system reduces the tax burden on poor people and gives them the freedom to spend their money on essential commodities and contribute to the economy. It also helps in the collection of more taxes in comparison to a flat rate or regressive tax system, thus, increasing the total revenue generated from the taxes. However, critics sometimes criticize this system because it imposes unwanted burdens or punishments on rich and middle-class individuals.

Examples of Progressive tax

Let us look at the below examples of progressive taxes with calculations:

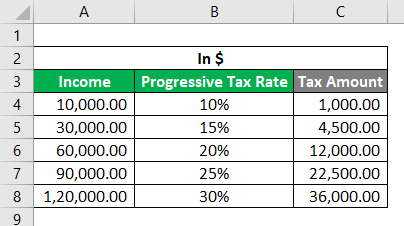

Example #1

Let’s consider an imaginative example where we need to use the first two columns of the tax rates table to calculate taxes according to the progressive tax system. Then, the third column provides the calculated tax figure derived by applying the progressive tax rate on income. We can easily notice that the tax rate also grows as income increases.

So anyone having income up to $10,000 will pay taxes at the rate of 10%, and above that, the combination of rates will be used to calculate the tax liability, which we will see in the next 3 examples.

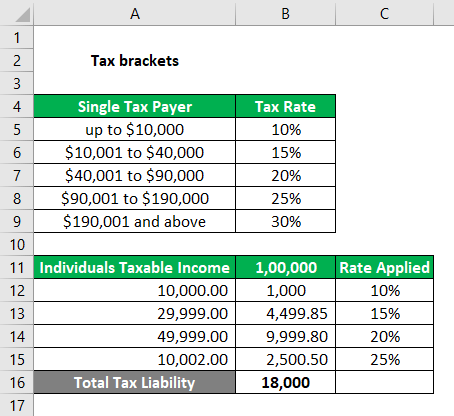

Example #2

Let us take another example; herein, we have tax brackets and an individual whose taxable income is $100,000 annually. We will now see how much tax the individual will pay per the progressive tax system bracket in which the income would fall.

We are not considering any above-the-line or standard deduction amount for ease of calculation. And assuming that $100,000 is the final adjusted taxable income. The total tax liability for the year is $18,000.

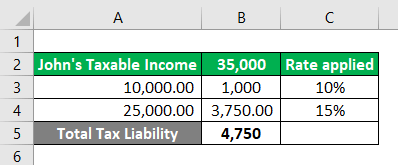

Example #3

Take another example; we will use the same tax rate table. This time, a taxpayer, John earning $35,000 per annum as taxable income, wants to know his tax liability for the year.

John will have to pay taxes at 10% on the first $10,000 of his income and 15% on the remaining $25,000. We are not considering any above-the-line or standard deduction amount for ease of calculation. We are assuming that $35,000 is the final adjusted taxable income. The final tax liability is $4,750.

Example #4

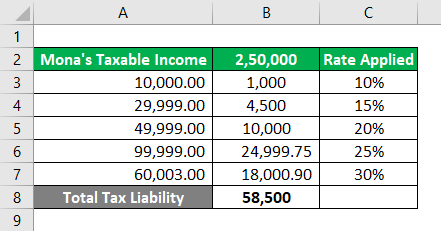

Now in our final example, using the same tax rate table, we have to calculate the tax liability for Mona, whose taxable income is $250,000 per annum. Again, the calculation would be similar but a little complex as more tax rates will be used; let us see below the calculation of the tax liability.

Mona’s tax liability would be calculated as follows:

After referring to the above examples, we can understand how the progressive tax system works. We may notice that the tax payable is increasing according to the income of the individuals. For example, a person whose taxable income is $35,000 per annum is paying $4,750 as tax compared to a person with a taxable income of $250,000 per annum and tax liability of $58,500.

Conclusion

The progressive tax system is designed to not cast an unwanted burden on poor or low-earning populations so that they can spend their money on essential commodities to fulfill their needs and contribute to the economy. Nowadays, the income tax system in many countries is according to progressive tax schemes. It is beneficial because it generates more tax revenue than a flat rate or regressive tax system.

Recommended Articles

This is a guide to the Progressive Tax Examples. Here we discuss the introduction and practical example of Progressive Tax Examples, a detailed explanation, and a downloadable Excel template. You can also go through our other suggested articles to learn more –