Updated July 13, 2023

Definition of Profit and Loss Accounting

Profit and loss accounting can be defined as a statement prepared at the end of an accounting period, usually a year or quarter, which summarizes all revenue nature transactions as revenue earned, various costs and expenses incurred, providing insights into the company’s ability or inability to earn profits, revenue, and cost trends during that period and is also known by various other terminologies like profit and loss statement, income statement, statement of operations or statement of financial results.

Explanation

Profit and loss accounting is a financial statement that summarizes all costs, revenue, and expenses incurred during the financial period. It is one of the major components of financial statements that every public company issues quarterly or yearly, along with other statements like balance sheets and cash flow statements. This statement calculates and quantifies the value of profit or loss earned by the business during a period and hence is the most commonly used financial statement. Profit and loss statements provide useful information regarding the top and bottom lines of the organization. It starts with the entry of revenue, known as the top line. It subtracts expenses like the cost of goods sold, tax, operating, interest, and other extraordinary expenses. The difference between both is known as the organization’s bottom line or net income.

It is quite important to compare income statements of different accounting periods. The change in operating costs, research and development expenses, revenues, and net earnings over time is more useful than studying and analyzing single-year figures. Profit and loss accounting is one of the most important tools for monitoring an organization’s financial health. It depicts the organization’s realized profits and losses for an accounting period by comparing its total revenue with the total cost and expenses. Intra and inter-firm comparisons can help stakeholders monitor the company’s ability to increase profits by increasing the revenue or decreasing costs. Investors, accountants, and analysts study the profit and loss accounts to scrutinize the company’s debt financing and cash flow. Depending upon the applicable GAAP, companies are required to prepare and present their Profit and Loss Accounting statement.

The main components of a profit and loss account are:

- Revenue

- Cost of goods sold

- Selling administrative and general expenses

- Marketing and advertising expenses

- Technology, research, and development expenses

- Interest expenses

- Tax expenses

- Net income

Examples of Profit and Loss Accounting

Below is a profit and loss account of Orange Inc. for the year ended 31 March 2020.

Mercedice Inc.

Consolidated Statement of Operations

(fig in a million dollars)

| Particulars | 2020 | 2019 |

| Net Sales | 1,40,000 | 1,00,000 |

| Net Service | 60,000 | 40,000 |

| Total Net Sales (A) | 2,00,000 | 1,40,000 |

| Operating Expenses: | ||

| Cost of Goods Sold | 1,00,000 | 80,000 |

| Fulfilment | 25,000 | 18,000 |

| Marketing | 10,000 | 8,000 |

| Research and Development | 20,000 | 12,000 |

| General and Administrative | 4,000 | 3,000 |

| Other Operating Expenses | 500 | 300 |

| Total Operating Expenses (B) | 1,59,500 | 1,21,300 |

| Operating Income (C) = (A-B) | 40,500 | 18,700 |

| Interest Income | 1,500 | 700 |

| Interest Expense | -3,000 | -1,500 |

| Other Income and Expenses Net | 800 | 200 |

| Total Non-Operating Income and Expenses | -700 | -600 |

| Income Before Income Tax | 39,800 | 18,100 |

| Provision for Income Tax | 4,800 | 2,100 |

| Net Income | 35,000 | 16,000 |

Example:

From the below-mentioned information, Draw P&l A/c and Derive Net Profit/loss:

| Particulars | Amount ($) |

| Purchases | 10,00,000 |

| Opening Stock | 1,00,000 |

| Closing Stock | 1,50,000 |

| Freight | 20,000 |

| Gross Sales | 15,00,000 |

| Bad Debts | 10,000 |

| Adm. Expenses | 2,00,000 |

| Selling and D Bs. Exp. | 30,000 |

| Dividend Distributed to Equity Share Holders | 15,000 |

Solution:

Profit and Loss A/c

| Particulars | Amount ($) |

| Sales | 15,00,000 |

| Change in Stock(cl. – Op. Stock) | 50,000 |

| 15,50,000 | |

| Less: | |

| Purchases | 10,00,000 |

| Freight | 20,000 |

| Adm. Expenses | 2,00,000 |

| Selling and D Bs. Exp. | 30,000 |

| Bad Debts | 10,000 |

| Total Expenses | 12,60,000 |

| Net Profit Before Tax (A) | 2,90,000 |

| Tax @ 30% (B) | 87,000 |

| Net Profit After Tax (C) = (A-B) | 2,03,000 |

Importance of Profit and Loss Accounting

Every Businessman and concerned stakeholders are interested in knowing the results of operations, i.e., whether business operations have earned profits or are incurring losses. Businesses measure and present their income performance with the help of a financial statement known as a profit and loss account. This account lists all the revenue sales, cost of goods sold, expenses, and any other expenses generated by the company for the given period. The profit and loss account provides knowledge about the business income and expenses net, showing profit or loss. It helps the owner or management evaluate the business’s performance and provides a base for future performance forecasts and growth analyses. It also presents important information required by the banks to sanction loans. Profit and loss accounts elaborate various business activities, such as expenses and revenues, which are the most useful for risk assessment, cost trend analysis, and future income analysis.

It also helps in determining the tax obligations of the business. Net income is the amount left after subtracting all the costs of goods sold, operating, and non-operating costs for the period. Various stakeholders also use net income in their financial statement analysis. For example, a company will present negative earnings if its expenses incurred during a period exceed the income earned. Investors use this statement to analyze the return generation capability of an entity, creditors and capital funding organizations like bank looks at p&l a/c for determining their repayment capacity, govt organization looks at p&l a/c for ensuring correct tax payments, etc.

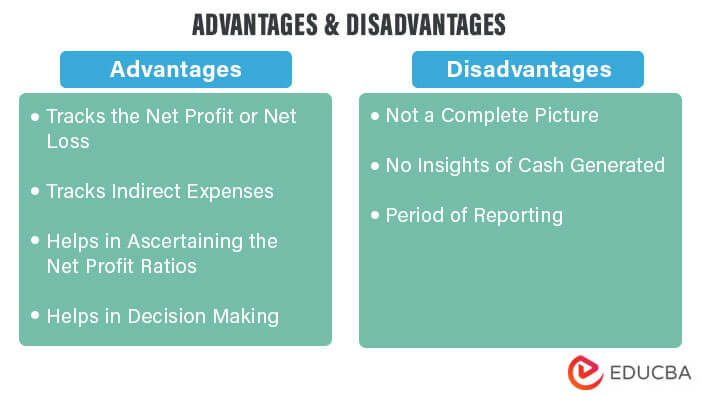

Advantages & Disadvantages of Profit and Loss Accounting

Here is a list of advantages and disadvantages to know about accounting.

Advantages

- Tracks the Net Profit or Net Loss: The Most important benefit of preparing a profit and loss account is to track business performance in terms of net profit or net loss.

- Tracks Indirect Expenses: Indirect expenses of a particular period can be easily tracked and monitored with the help of data provided in a profit and loss account and thus can help lower or minimize the excess expenses, thereby increasing profitability.

- Helps in Ascertaining the Net Profit Ratios: This statement helps conduct financial statement analysis. With the help of net profit, a company may easily determine the net profit-linked ratios.

- Helps in Decision Making: With the help of profit and loss statements, a comparison can be made between the current year’s data and the previous year’s data, forecasting the future performance and thus helping in making future plans and decision-making.

Disadvantages

- Not a Complete Picture: Financial decisions based solely on profitability analysis may not be appropriate as one also needs to understand its financial position, the value of risk undertaken, etc.

- No Insights of Cash Generated: Neither item presented in p&l a/c depicts actual cash inflows/ outflows. Management also needs to know the organization’s cash position. p&l a/c cannot serve this management’s need. Accordingly, they need to prepare a cash flow statement.

- Period of Reporting: P&l A/c is based on historical data. Sometimes it might be late for stakeholders to make decisions and result in an incorrect decision.

Conclusion

P&l accounting can summarize all revenue nature transactions incurred during an accounting period and determine its net profit/ loss earned during that period. This forms an important part of the financial statement and is widely used by stakeholders for their independent analysis. This statement has its own pros and cons, which need to be considered while conducting its analysis.

Recommended Articles

This is a Guide to Profit and Loss Accounting. Here we discuss the definition and examples of profit and loss accounting and its advantages and disadvantages. You may also have a look at the following articles to learn more –