Updated July 10, 2023

What is a Prime Rate?

The term “prime rate” refers to the interest rate commercial banks charge their corporate customers with a healthy credit profile. In other words, commercial banks charge lower interest rates to preferred borrowers as they are less likely to default, which means the loans are safer.

The Federal Reserve Bank determines the federal funds rate, influencing the fixed prime rate known as the prime lending rate or PLR. Generally, banks set the prime rate at approximately 300 basis points above the federal funds rate.

Examples of Prime Rate

Let’s consider a simple example in the banking industry involving David, who has applied for a home loan from a commercial bank, XYZ. In this case, the bank has sanctioned the loan at an interest rate of 8% per annum for a tenor of 20 years. Now, let’s delve deeper to comprehend how the interest rate is determined based on the prime rate of 3% per annum.

Typically, financial institutions derive the interest rate to be charged by considering three key components: the prime rate, risk premium, and inflation premium.

Multiple factors determine the charging of the risk premium, including the customer’s creditworthiness and the home’s value. On the other hand, the inflation premium considers general price increases in the country.

Let us assume that the risk premium is 2% and the inflation premium is 3%. The interest rate (8%) has been derived using the prime rate (3%), risk premium (2%), and inflation premium (3%).

If the case of a very creditworthy customer, the bank may not charge the risk or even the inflation premium. So, the interest rate will be solely based on the prime rates.

Breaking Down Prime Rate

Commercial banks typically charge a lower rate that works best with their preferred customers, resulting in multiple floating prime rates in the economy. Major commercial banks usually calculate the single prime rate by averaging all the available prime rates they charge.

While these rates primarily affect large corporations, they can also interest other individuals within the business ecosystem as they can influence the interest rates of other financial products, such as personal loans, credit cards, mortgages, or SMEs.

The economic climate typically regards credit deterioration among prime customers in any commercial bank as an early warning sign of imminent downward pressure. This can adversely affect all other bank borrowers, leading to a reaction in the interest rates of other financial instruments like mortgages or personal loans, increasing their rates.

Uses of Prime Rates

There are several uses, and some of the most significant ones are as follows:

- All banks use the same prime rates as their base rate. So, a borrower can compare the interest rates offered by two banking institutions.

- Loans with higher spreads over the prime rate help identify the riskier assets of the bank.

- It helps in keeping inflation under the government’s control.

- In most cases, it is the minimum interest rate charged by the banks. So, it helps in determining the minimum revenue for banks.

Prime Rate Graph

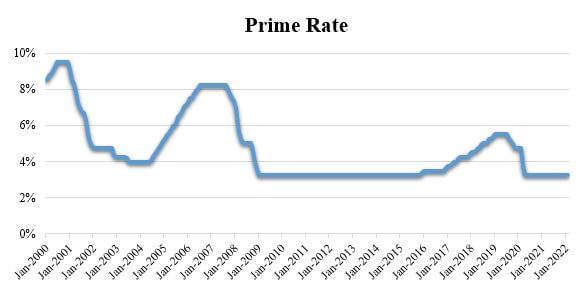

The overnight or federal rates are closely linked. The interest rates banks charge while lending money to other banks. If the federal rate increases, the commercial banks’ creditworthiness declines, as witnessed around 2006-2007 (in the graph below). So, it can indicate that the overall economy is struggling. In short, when large corporations face trouble or run into difficult economic conditions, the prime rates invariably increase.

The graph for the prime rate sourced from FRED shows two major spikes between 2000 and 2021. The first peak of 9.50% between August 2000 and December 2000 came just after the dot-com bubble shocked the world. Again, the next spike of 8.25% between August 2006 and August 2007 came around the financial crisis of 2006-07.

Source: FRED

Key Takeaways

- Commercial banks charge their most creditworthy corporate clients an interest rate known as the prime rate.

- The prime rate serves as the basis for determining interest rates on various financial products like personal loans, business loans, and mortgages.

- Lenders calculate the interest rate offered to non-prime customers by combining three main elements: the prime rate, a risk premium, and an inflation premium.

- Commercial banks’ increase of prime rates can be interpreted as an early indication of a potential economic downturn, which puts downward pressure on the overall economy.

Conclusion

Usually, lenders reserve prime rates for the most creditworthy customers with the least default risk. This restriction limits access to prime rates to large and stable businesses, excluding other borrowers. Nonetheless, prime rates serve as the benchmark for various financial products, impacting the borrowing terms of other individuals and entities who do not benefit directly from its advantages.

Recommended Articles

This is a guide to Prime Rate. Here we also discuss the definition, examples, uses, and graph of Prime Rates and it’s breaking down. You may also have a look at the following articles to learn more –