Updated November 15, 2023

Difference Between Perfect Competition vs Monopolistic Competition

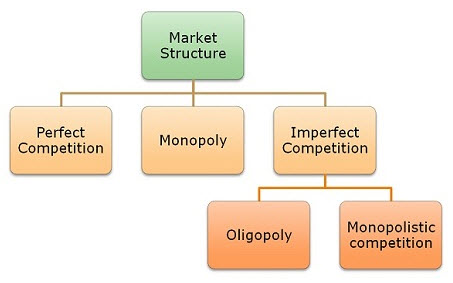

Perfect competition is a market structure in which numerous sellers sell similar goods produced/manufactured using a standard method. Each firm has all information regarding the market and price, known as a perfectly competitive market. Monopolistic competition is a type of imperfect market structure. In a monopolistic competition structure, several sellers sell similar products but not identical ones. Products or services sellers offer are substitutes for each other with certain differences. A market can be described as a place where buyers and sellers meet directly or through a dealer for transactions.

Flowchart Shows Market Structure

What is the Perfect Competition?

- Entry and exit to such a market are free.

- This is a theoretical market situation where the competition is at its peak.

- The firms don’t have price control, so they don’t have a pricing policy. The buyer or seller doesn’t have control over prices. Therefore, a seller has to accept prices determined by market supply and demand forces.

- The product offered by all sellers is the same in all respects so that no firm can increase its price, and if a firm tries to increase the price, it will lose all its demand to the competitors.

What is Monopolistic Competition?

- Monopolistic competition has features of both the market structures, perfect competition, and monopoly. This kind of market structure is found in real life.

- Firms are selling products with certain differences in quality, quantity, etc features, so firms have pricing control and pricing policies of firms in place.

- Entry and exit into the industry are easy because of fewer barriers.

- Product differentiation is one of the features of monopolistic competition, where products are differentiated based on quality or brand.

- One of the differentiating parameters of monopolistic competition is it has a Highly elastic demand curve.

Just a few examples of monopolistic competition include:

- Bars/nightclubs

- Coffee shops

- Grocery stores

- Pharmacies

- Gas stations

- Hotels

- Hardware/home improvement stores

- Furniture Stores

- Landscaping/lawn care services

- Car washes

- Automotive service companies

- Dry cleaners

Monopolistic competition is a practical example of a market scenario; it can be seen around us. Types of products or services provided by each market participant are differentiated. Products or services can be differentiated in many ways, such as brand recognition, product quality, value addition to products or services, or placement.

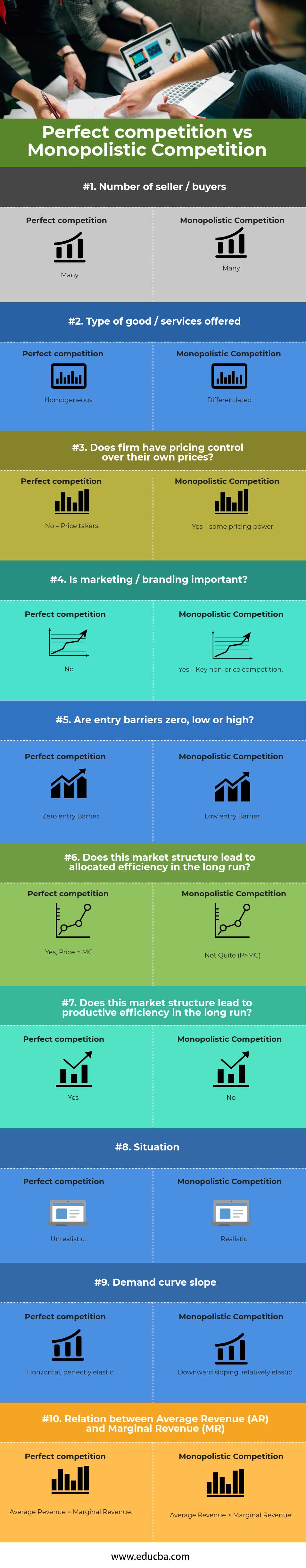

Perfect Competition vs Monopolistic Competition (Infographics)

Below is the top 10 difference between Perfect Competition and Monopolistic Competition:

Key Differences Between Perfect Competition vs Monopolistic Competition

Both Perfect Competition vs Monopolistic Competition are popular choices in the market; let us discuss some of the major differences between Perfect Competition and Monopolistic Competition:

- A market structure where numerous sellers sell close substitute goods/services to the buyers is monopolistic competition. A market structure where many sellers sell similar products/services to the buyers is perfect competition.

- In perfect competition, the product offered is standardized, whereas in monopolistic competition, product differentiation exists.

- Every corporation offers things at its own pricing in monopolistic competition. In perfect competition, the demand and supply forces determine the price for the whole industry, and every firm sells its product at that price.

- Entry and Exit are comparatively easier in perfect competition than in monopolistic competition.

- In monopolistic competition, average revenue (AR) is greater than the marginal revenue (MR), i.e. to increase sales, the firm has to lower its price. On the other hand, the average revenue (AR) and marginal revenue (MR) curves coincide with each other in perfect competition.

- Monopolistic competition exists practically. On the other hand, perfect competition is an imaginary situation that does not exist in reality.

- As faced by a monopolistic competitor, the demand curve is not flat but downward-sloping. This means that the monopolistic competitor can raise its price without losing customers or lower it and gain more customers. Since there are substitutes, the demand curve facing a monopolistically competitive firm is more elastic than the perfect competition without substitutes. If a monopolist raises its price, some consumers will choose not to purchase its product—but they will need to buy a completely different product. However, when a monopolistic competitor raises its price, some consumers will choose not to purchase it. Still, others will choose to buy a similar product from another firm. If a monopolistic competitor raises its price, it will not lose as many customers as a monopoly-competitive firm. Still, it will lose more customers than would a monopoly that raised its prices.

Perfect Competition vs Monopolistic Competition Comparison Table

Below is the topmost Comparison between Perfect Competition vs Monopolistic Competition are as follows –

| Basis of Comparison |

Perfect competition |

Monopolistic Competition |

| Number of sellers/buyers | Many | Many |

| Type of goods/services offered | Homogeneous | Differentiated |

| Does a firm have pricing control over its prices? | No – Price Takers | Yes – some pricing power |

| Is marketing/branding important? | No | Yes – Key non-price competition |

| Are entry barriers zero, low, or high? | Zero entry Barrier | Low entry Barrier |

| Does this market structure lead to allocated efficiency in the long run? | Yes, Price = MC | Not Quite (P>MC) |

| Does this market structure lead to production efficiency in the long run? | Yes | No |

| Situation | Unrealistic | Realistic |

| Demand curve slope | Horizontal, perfectly elastic | Downward-sloping, relatively elastic |

| A relation between Average Revenue (AR) and Marginal Revenue (MR) | Average Revenue = Marginal Revenue | Average Revenue > Marginal Revenue. |

Conclusion

After reading all the above points, it is quite clear that perfect competition vs monopolistic competition is different in many aspects; the major difference can be understood by the fact monopolistic competition has features of both monopoly and perfect competition.

The principal difference between these two is that in the case of perfect competition, the firms are price takers, whereas in monopolistic competition, the firms are price makers. Perfect competition is not realistic; it is a hypothetical situation; on the other hand, monopolistic competition is a practical scenario.

Recommended Articles

This has been a guide to the top difference between Perfect Competition vs Monopolistic Competition. Here, we also discuss the key differences between perfect Competition vs Monopolistic Competition with infographics and a comparison table. You may also have a look at the following articles to learn more.