Paystub Maker for Accurate Wage Records

With the market evolving, accurate wage records should be mandatory. Paystub generators serve as a convenient solution for employers and employees to achieve this goal. They make creating pay stubs easy, ensuring all details are accurately updated. A paystub maker can be an effective tool when used correctly to record wages. Therefore, in this guide, we will provide a simple breakdown of how to use a paystub maker for accurate wage records.

Understanding Paystub Makers

A paystub maker lets you create detailed earnings statements. They make it easy to track wages, taxes, deductions, etc. Users can create professional paystubs with all relevant information using these tools. This feature helps employers with payroll processing and employees with financial planning.

Why a Paystub Maker is Beneficial to You?

There are many benefits of using a paystub maker. It helps to increase accuracy by reducing human error. Automated tools help minimise the risk of human error associated with manual calculations. Second, paystub makers save time. Manual paystub creation is time-consuming, while digital tools simplify the process. Lastly, they provide consistency, which is important for documentation and regulations.

Key Features to Look For When Selecting a Paystub Maker

Every business has different needs; therefore, it is important to find a paystub maker that better serves your requirements. Choose tools with customizable features to meet your requirements. This allows you to customize pay stubs to meet your company’s needs. Also, ensure the tool provides secure data handling and processing of sensitive data. Another important feature is user-friendliness. With an intuitive interface, the process is easy, even for people with little to no technical know-how.

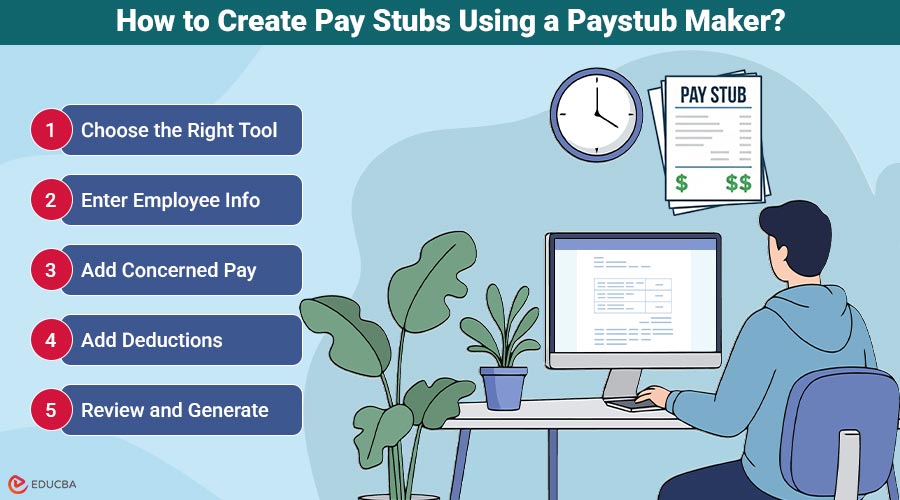

How to Create Pay Stubs Using a Paystub Maker?

Follow these simple steps to create accurate wage records using a paystub maker:

- Choose the right tool: Do some research first. Pick a paystub maker that suits your needs and budget.

- Enter employee info: Input name, address, and Social Security Number. This information is important for the identity and tax requirements.

- Add concerned pay: Add information regarding the hourly rate or salary, and then the hours worked. Edit to ensure it shows the accurate income.

- Add deductions: Enter any tax, insurance, or retirement contributions. Ensure the information provided is accurate for the correct calculation of net pay.

- Review and generate: Once satisfied, generate the paystub. Most tools take you to a screen where you can download or print the document immediately.

Common Mistakes to Avoid

A paystub maker is simple to use; however, the process can lead to errors. Incorrect data entry is one of the most common errors. Never finalise a pay stub without verifying the information. Another mistake is failing to adjust tax rates or deduction items. Before using these figures, ensure they are up to date to avoid errors. Finally, not saving pay stubs can lead to a loss of records.

When creating paystubs, it is essential to obey the law. Compliance laws vary by region. Therefore, it is important to understand these rules to provide accurate information. Examples of information needed are gross vs net income, tax withholdings, and overtime hours. By ensuring compliance, you not only steer clear of legal troubles but also gain the trust of your employees.

How Paystub Makers Contribute to Enhancing Financial Literacy?

Paystub makers also contribute to the growth of financial literacy among business employees. Earnings statements show employees where they stand financially. When people know deductions, taxes, and net pay, they make sound financial decisions. Employers can also help by providing financial management resources or workshops.

Final Thoughts

Paystub makers are indispensable for maintaining accurate wage records. A user can document things more accurately if they follow a systematic approach and use the features properly. This makes payroll management easy and encourages transparency and trust. If financial precision is a priority, then this tool can be very helpful for businesses.

Recommended Articles

We hope this guide to using a Paystub maker helps you maintain accurate wage records. Explore these recommended articles for more tips and insights to streamline payroll and financial documentation.