Updated November 10, 2023

Difference Between Mortgagee vs Mortgagor

Mortgagee: A lending institution or banking that provides home financing for buyers can be defined as a mortgagee. In states and countries, mortgagees work with n number of borrowers yearly; their goal is to measure the level of financial risk associated with the potential mortgagor and then develop a lending package accordingly. Lending an organization’s interest is typically protected this way. Mortgagor: To finance a home purchase, a mortgagor is any person or individual who borrows money from a mortgagee. Mortgagors are typically working adults with a verifiable credit history per a regulated standard. To secure the most favorable lending terms possible from the mortgagee, they often pay up to 20 percent of the price of their home as a down payment. The mortgagor also chooses the payback period of the funds being borrowed.

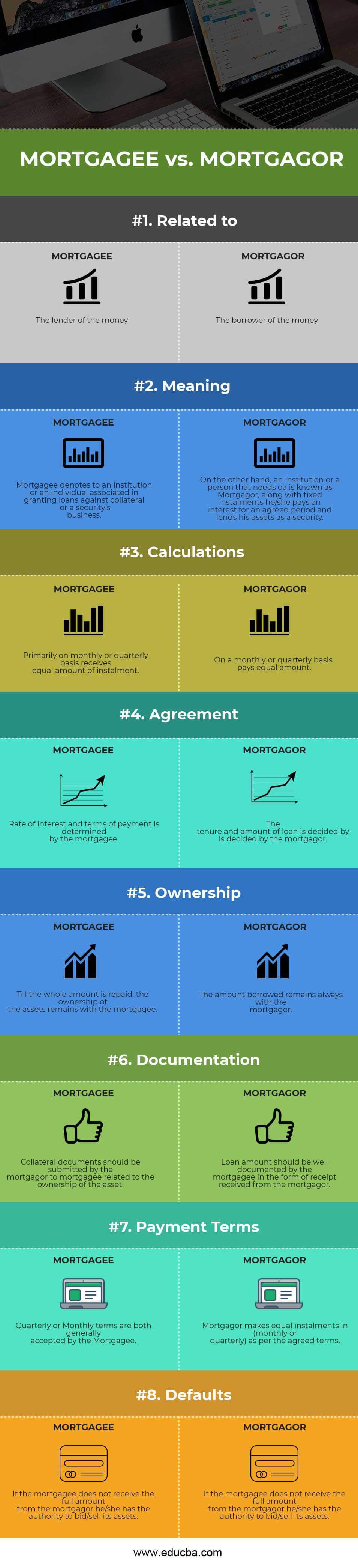

Mortgagee vs Mortgagor Infographics

Below are the top 8 differences between Mortgagee and Mortgagor

Key Differences Between Mortgagee vs Mortgagor

Both Mortgagee vs Mortgagor are popular choices in the market; let us discuss some of the major differences:

- The transaction receiver is a Mortgagor, whereas Mortgagee in a loan deal refers to the ‘giver’ or ‘lender’.

- As the Mortgagee and mortgageor agreed, the principal amount is divided into fixed equal installments and interest. The mortgagor becomes the receiver, and the Mortgagee generally repays the loan amount in equal installments.

- The Mortgagor has the right to know the interest costs, tenure, settlement charges, etc., before the agreement. At the same time, the Mortgagee is answerable to all the queries and has to disclose all the facts to the Mortgagor.

- Before the ‘agreement’, the Mortgagor must present proper documentation of ownership of the assets. Till the Loan amount, along with interest, is fully paid, the owner of the collateral changes from Mortgager to Mortgagee.

- Till the loan is fully paid, including the interest amount, the Mortgagor pledges his collateral to the Mortgagee. On the other hand, the Mortgagee pays the entire loan amount to the Mortgagor.

- If the Mortgagor fails to repay the installments, the mortgager has the right to sell the collateral. At the same time, the Mortgagor has to abide by the guidelines framed by the Mortgagee.

- Lower than the collateral, the Mortgagee holds the principal loan amount, whereas the collateral amount is generally higher than the loan amount; thus, the Mortgagee holds a higher amount of assets in currency terms.

Head To Head Comparisons Between Mortgagee vs Mortgagor

Below are the topmost comparisons between Mortgagee vs Mortgagor

|

Basis Of Comparison |

MORTGAGEE |

MORTGAGOR |

| Related to | The lender of the money | The borrower of the money |

| Meaning | Mortgagee denotes an institution or individual who grants loans against collateral or security business. | On the other hand, an institution or a person that needs a loan is known as a Mortgagor, along with fixed installments, he/she pays interest for an agreed period and lends his assets as a security. |

| Calculations | Primarily, on a monthly or quarterly basis, receives an equal amount of installment. | On a monthly or quarterly basis, pays an equal amount. |

| Agreement | The mortgagee determines the rate of interest and terms of payment. | The mortgagor decides the tenure and amount of the loan. |

| Ownership | Till the whole amount is repaid, the ownership of the assets remains with the mortgagee. | The amount borrowed remains always with the mortgagor. |

| Documentation | The mortgagor should submit collateral documents to the mortgagee related to asset ownership. | The mortgagee should document the loan amount received from the mortgagor as a receipt. |

| Payment Terms | The Mortgagee generally accepts both Quarterly and Monthly terms. | Mortgagor makes equal installments (monthly or quarterly) as per the agreed terms. |

| Defaults | If the mortgagee does not receive the full amount from the mortgagor, he/she has the authority to bid/sell its assets. | The mortgagor has to abide by the decisions laid down by the mortgagee in case of any defaults. |

Conclusion

Mortgagee and Mortgagor are integral parts of the loan business, which involves the borrower pledging assets to the lender. They agree on costs such as settlement costs, transfer of funds to the required person/institution, and interest costs. The Mortgagor pays the entire loan amount and a specified interest charged within a fixed number of installments during the agreed-upon period. Two types of interest are calculated: fixed rate of interest and variable rate of interest.

In case, within the pre-decided time frame, the Mortgagor fails to repay the loan to recover the due amount, the Mortgagee can charge a penalty, or he can bid his assets. Whether it is justified to bid on the assets? The question may arise now. In that case, the answer could be that recovering the due amount in case of default makes sense, as the Mortgagee lends the entire amount in advance and takes the risk of the Mortgagor. The law of business asserts that the Mortgagee, engaged in a business, cannot bear losses by receiving undue advantages.

In a mortgage agreement, the mortgagee lends money to the mortgagor in exchange for a secured interest in real estate. The mortgagor pledges the property as collateral and agrees to repay the loan with a fixed tenure and a specified interest rate.

Recommended Articles

This has been a guide to the top differences between Mortgagee and Mortgagor. Here, we also discuss the Mortgagee vs Mortgagor key differences with infographics and a comparison table. You may also have a look at the following articles to learn more –