Updated July 26, 2023

Introduction to Merger Examples

A merger is a financial activity where two organizations combine into one. Unlike acquisition where the bigger entity buys off the smaller one, here both the entities combine to form a new entity.

The entities are generally near about the same size. Mergers are primarily done to bring synergies together, consolidate the positions, eliminate competition, and enter into new markets or using the goodwill of an unhealthy but branded concern into your own. Following are some of the examples of merger that would help the understanding of the concept:

Examples of Merger (With Excel Template)

Let’s take an example to understand the Merger in a better manner.

Merger Example #1 – Basic

Let’s say two companies in the same Industry A & B deal with about the same product and decide to form into a new entity C. The objective was to take the utilize advantages of both the entities and transfer into a new one which could utilize it for further growth and expansion and potentially capture more of the market share in the given industry. It also works to make use of the opportunities and advantages that they were receiving from their individual suppliers. The economies of scale will benefit the new entity in the long run. Also, strategic and technological benefits will accrue.

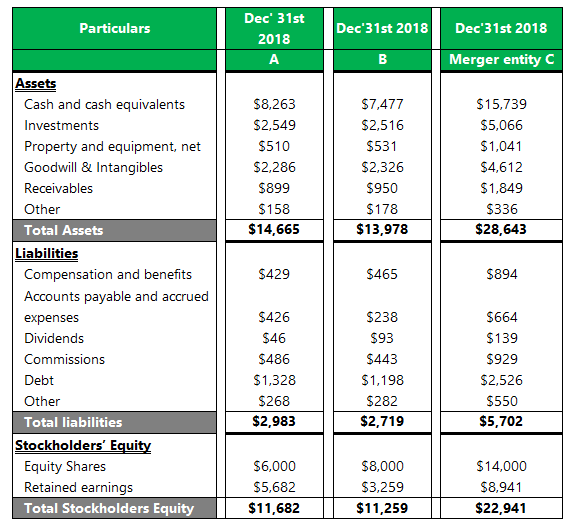

Assuming there are no inter-entity transactions and assets/liabilities due from each other, the merger would mean a simple addition of the elements of both the entities. Although there would be tax implications and change in the elements of shareholding, we have ignored them for the purpose of our depiction.

The following table shows the financial data of both entities A and B as on Dec 31st, 2018 and the resulting entity C which gets formed as a result of the merger.

Balance Sheet Dec 2018

Merger Example #2 (practical) – Microsoft’s Purchase of Skype

In 2011, Microsoft purchased voice over internet protocol (VOIP) company Skype for $8.56 billion in cash. Interestingly it was the second time that a technology major had bought Skype, a few years back it was purchased by Ebay post which sold the majority of its shares. The acquisition is supposed to pave the way for Microsoft to advance its business communication system. The live messenger capabilities of its already existing program Lync is supposed to realign with what Skype has to offer.

At the time of the acquisition, Skype had 124 million active users out of which 8 million were making use of its paid service. Apart from voicemail integration, Skype will benefit Microsoft in its bid to expand the existing office messaging service. Recently, in 2016, skype was integrated with Microsoft Windows 8 and 8.1 versions and has now become an important application for communication be it on phone or desktop devices. It also supports Microsoft devices like Xbox and Kinect bring real-time communication across Microsoft’s products

Merger Example #3 (practical) – Walmart’s Acquisition of Flipkart

US retail giant Walmart acquired a 77% stake in India’s online retailer Flipkart in 2018. The deal is supposed to be valued at $16 billion concluding about a year of negotiation. The acquiring entity, Walmart made it clear that it just wants to empower its Indian acquisition and let it run that it has. The brand will remain distinct from Walmart. The remaining 23% would remain with Flipkart’s founders and early investors.

The deal is supposed to strengthen Flipkart’s position in India’s online landscape which was increasingly getting threatened by global giant Amazon in the recent past. The Indian company is yet to get listed in the stock exchange and the co-founder assured to all its employees that it would not change the road map that they had planned in the past. The deal is supposed to enable the Indian tech start-up to set up its one-day grocery delivery unit apart from the general online services that it provides at present.

The acquisition comes in the wake of a reduction in profits year on year despite ever-increasing in its valuation. There were also doubts about its financial transparency which would be put to rest with Walmart’s entry and management.

Conclusion

One of the primary ways an entity can expand and make a dynamic change in the current capability is through mergers. Irrespective of the end result, the objective of mergers is to bring greater synergies. Shareholders look at mergers as a potential game-changer in the operation of an entity. With improved performance, more cost-cutting, and reduced competition mergers can work wonders in management performance. The kind of merger horizontal or vertical and the method of merger whether buy out or share swap depends on the situation and the market conditions of both the entities.

However, the merger does not guarantee success, a lot of times the end result is far from what the management of the entities had expected. A case in point is the acquisition of Nokia by Microsoft. The windows based operating system on phones did not work and a lot of developers moved out from making programs for it. So even with the software capabilities of Microsoft and the hardware expertise of Nokia, the phones weren’t a success. Also, with the merger, there needs to be adequate consideration paid to the regulatory, company law and taxation environment of the country in which it is carried on. A number of times the proposed merger despite the benefits it could bring was denied to move ahead since it was leading to a monopoly in the market which the government deemed unhealthy.

Recommended Articles

This is a guide to Merger Examples. Here we discuss the introduction and top 3 examples of Merger along with a downloadable excel template. You can also go through our other suggested articles to learn more –