Updated July 25, 2023

Introduction to Merger Accounting

Here we discuss the detail concepts of Merger Accounting.

Identifying a Business Combination: IFRS 3 provides guidance in accounting for business combinations, more commonly referred to as takeovers, acquisitions or mergers.

A business combination is a transaction or event in which an acquirer obtains control of one or more businesses.

An acquirer may acquire control of a business by way of, for example:

- Transferring cash, cash equivalents or other assets

- Incurring liabilities

- Issuing equity interests

- A combination of above, (or)

- Without transferring any consideration, by virtue of contract alone.

A business combination may be structured in a variety of ways for legal, taxation or other reasons. [IFRS 3 Para B5-B6]

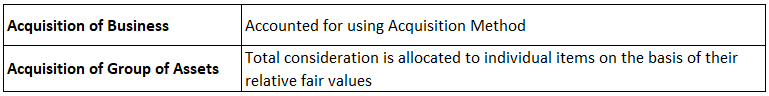

Acquisition Method of Merger Accounting

Business combinations are to account for using the ‘Acquisition Method’ of merger accounting as specified in IFRS 3. For this purpose, a distinction is made between the acquisition of the business and the acquisition of an asset/group of assets. A business is defined as consisting of inputs and processes applied to those inputs that have the ability to contribute to the creation of outputs. [IFRS 3 Para B7]

This method also does not apply to the business combination of entities under common control i.e. in a situation where all the combining entities are ultimately controlled by the same party both before and after the combination, and that control is not transitory.

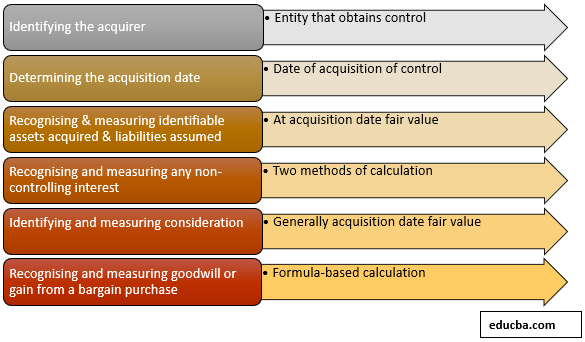

Steps in Acquisition Method of Merger Accounting

Step 1: Identify the Acquirer

In a business combination, an entity that obtains control of another entity (acquiree) is the acquirer.

Investor entity is said to control over the investee entity if it satisfies all the following conditions:

- Power over the investee: An investor has existing rights that give it the current ability to direct the activities of the investee company so as to be able to significantly affect the investee’s returns/earnings.

- Exposure or rights to variable returns from the investee: Implying that the investor’s returns will vary according to the performance of the investee entity.

- Ability to use the power it has over the investee to affect the number of returns it gets from the investee. [IFRS 10 Para 7]

This implies that control need not necessarily be obtained by way of majority ownership in the investee. For example, an investor can be said to control the investee if it has the power to appoint or remove the majority of the board of directors of the investee, or the power to direct the investee’s operational policies and strategies.

If the application of the above definition does not give a clear indication which of the two entities is the acquirer, IFRS 3 [Paras B13 – B18] provides additional indicative parameters as per which, the acquirer is –

- The entity that transfers cash or other assets or incurs the liabilities if the business combination is effected by transferring cash or other assets or by incurring liabilities.

- The entity that issues equity instruments if the business combination is effected primarily by exchanging equity interests.

- The entity whose owners as a group retain or receive the largest portion of the voting rights in the combined entity.

- The entity whose single owner or organized group of owners holds the largest minority voting interest in the combined entity.

- The entity whose owners have the ability to elect or appoint or to remove a majority of the members of the governing body of the combined entity.

- The entity whose (former) management dominates the management of the combined entity.

- The entity that pays a premium over the pre‑combination fair value of the equity interests of the other combining entity or entities.

- The entity whose relative size (for example, assets, revenues or profit) is significantly greater than that of the other combining entity or entities.

If a new entity is formed to issue equity interests to effect a business combination, one of the other combining entities that existed before the business combination shall be identified as the acquirer by applying the principles mentioned above.

Step 2: Determining the Acquisition Date

The acquisition date is the date on which the acquirer obtains control of the acquiree. It is generally the date on which the acquirer legally transfers the consideration, acquires the assets and assumes the liabilities of the acquiree – the closing date. [IFRS 3 Para 8-9]

Exception: It is possible for the acquirer to obtain control earlier than or after the closing date. For example, where a written agreement provides that the acquirer obtains control of the acquiree on a date before the closing date, then control is obtained before the closing date. Hence, all pertinent facts and circumstances of the case are to be considered in the identification of the acquisition date.

Step 3: Recognising & Measuring Identifiable Assets Acquired & Liabilities

Recognising and Measuring Identifiable are explained below:

Conditions for Recognition [IFRS 3 Paras 10-14]

- The identifiable assets acquired and liabilities assumed must meet the definition of assets and liabilities to qualify for the application of the acquisition method.

Exception: Contingent liability assumed in a business combination shall be recognized if it is a present obligation that arises from past events and its fair value can be measured reliably, even if the outflow of resources is not probable. Contingent assets are not recognized.

- The assets acquired and liabilities assumed must be part of the exchange in the business combination transaction rather than the result of separate transactions.

- It is possible that the acquirer’s application of the recognition principle and conditions may result in recognizing some assets and liabilities that the acquiree had not previously recognized as assets and liabilities in its financial statements. For example, the acquirer recognizes the acquired identifiable intangible assets, such as a brand name, a patent or a customer relationship, that the acquiree did not recognize as assets in its financial statements because it developed them internally and charged the related costs to expense.

- At the acquisition date, the acquirer shall classify or designate the assets acquired and liabilities assumed as necessary to apply other IFRSs subsequently, based on the contractual terms, operating/accounting policies, etc. prevalent at the acquisition date.

Exception: In case of a lease contract in which the acquiree is the lessor, the acquirer shall classify the contract on the basis of contractual terms and other factors at the date of inception of the contract, and not the acquisition date. [IFRS 3 Para 17]

Measurement Principle

The acquirer shall measure the identifiable assets acquired and the liabilities assumed at their acquisition‑date fair values. [IFRS 3 Para 18].

Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. [IFRS 13 Para 9]Guidance for the determination of fair value is given in IFRS 13.

Exceptions [IFRS 3 Paras 22-31A]:

| Items of Assets or Liabilities | Measurement Principle |

| Income Taxes | As per IAS 12 Income Taxes |

| Employee Benefits | As per IAS 19 Employee Benefits |

| Indemnification Assets

(The seller in a business combination may agree to indemnify the acquirer for the outcome of any contingency or uncertainty related to any specific asset or liability. For example, the seller may make good any losses above a particular amount arising on settlement of a contingency) |

Measured on the same basis as the indemnified item, subject to a valuation allowance for uncollectible amounts |

| Leases

(where acquiree is the lessee) |

As per IFRS 16 – Leases

An acquirer is not required to recognize right-of-use assets or lease liabilities when – (a) Lease term ends within 12 months of the acquisition date (b) The underlying asset is of low value An acquirer is required to measure the lease liability at the present value of remaining lease payments as if the acquired lease were a new lease at the acquisition date |

| Reacquired Rights

(Acquirer may reacquire a right it had granted to the acquiree to use any of the acquirer’s assets) |

Measured on the basis of the remaining contractual term of the related contract |

| Share-Based Payment Transactions | In accordance with IFRS 2 Share-based Payment |

| Assets Held for Sale | As per IFRS 5, Non-current Assets Held for Sale and Discontinued Operations |

| Insurance Contracts | As per IFRS 17 Insurance Contracts |

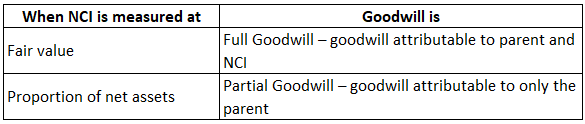

Step 4: Recognising and Measuring Any Non-Controlling Interest (NCI)

Non-controlling interest is the acquiring entity not attributable, directly or indirectly, to the parent. NCI that entitle the holders of the interest to a proportionate share of the net assets of the acquiree in the event of liquidation can be measured at either:

- Acquisition-date fair value, or

- As a proportion of the fair value of net assets of the acquiree on the acquisition date IFRS 3 Para 19]

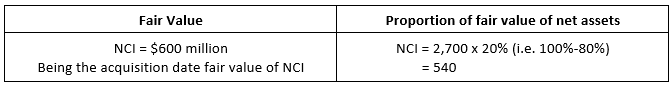

Example

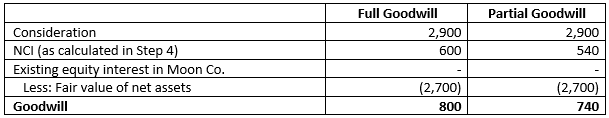

Star Co. acquired 80% of Moon Co. for a consideration of $2,900 million. Star Co. did not have any existing equity interest in Moon Co. on the date of acquisition. The fair value of net assets of Moon Co. calculated as per principles laid down in the standards was $2,700 million at the date of acquisition. The fair value of NCI on the said date was $600 million.

NCI may be calculated as follows

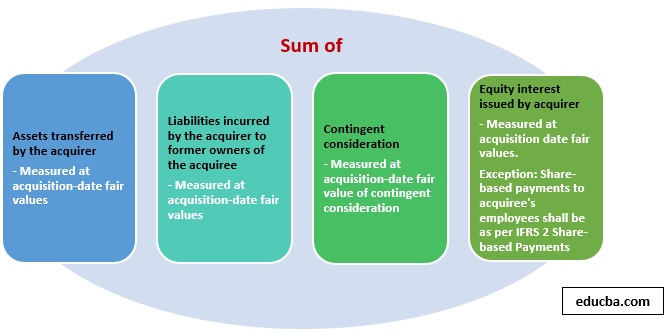

Step 5: Identifying and Measuring Consideration [IFRS 3 Para 37]

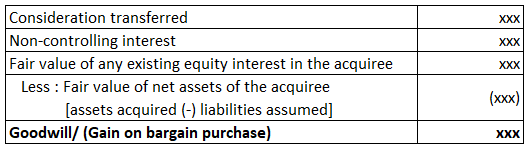

Step 6: Recognising and Measuring Goodwill or Gain from A Bargain Purchase

Goodwill/ Gain on bargain purchase is measured as [IFRS 3 Para 32] –

Gain on bargain purchase should be recognized in the statement of profit or loss. A bargain purchase may arise in a situation such as a forced sale where the seller is acting under compulsion.

Example

In continuation of the example in step 4, goodwill will be calculated as follows –

Key Differences Between IFRS and US GAAP

Key principles for accounting for business combinations as per IFRS 3 and ASC 805 Business Combinations are to a large extent converged. Significant differences between the two standards of merger accounting are given below.

| Basis of Comparison | US GAAP (ASC 805) | IFRS 3 |

| Definition of Business | A business must include, at a minimum, an input and a substantive process that together significantly contribute to the ability to create outputs. | A business consists of inputs and processes applied to those inputs that have the ability to create outputs. [IFRS 3 Para B7] |

| Definition of Control | The essence of the criteria to determine control is similar to IFRS.

However, a dual model of identification of control for consolidation is provided in ASC 810 – (a) Voting interest model – Entity with majority voting rights (i.e. >50%) is said to have control (b) Variable interest model – Additional guidance is provided for when an entity can be said to have control when it invests in a variable interest entity in the absence of majority voting rights. |

An investor controls an investee if and only if the investor has all the following: (a) Power over the investee;

(b) Exposure, or rights, to variable returns from its involvement with the investee; and (c) The ability to use its power over the investee to affect the number of the investor’s returns. [IFRS 10 Para 7] |

| Measurement of NCI | Measured at fair value | NCI holding that entitles the holder to a proportionate share of net assets at the time of liquidation can be measured at

(a) Fair value, or (b) A proportionate share of the fair value of net assets |

| Entities Under Common Control | Receiving entity is required to record net assets at historical cost i.e. carrying amount in the books of the transferor. | No specific guidance in IFRS 3. Entities either follow an approach similar to US GAAP or account at fair value. |

| Operating Leases Acquired | For operating leases of the acquiree (where acquiree is the lessor), if the terms of the lease are favorable in comparison to market terms, an intangible asset is to be recognized. Similarly, an intangible liability is to be recognized if the terms of the lease are unfavorable. | Terms of the lease are considered to determine the fair value of the asset. Recognition of an intangible asset/liability is not required. |

| Contingent Assets and Liabilities | Both contingent assets and liabilities are recognized and measured at acquisition date fair values if the fair value can be determined. Else, they are recognized only if, at the acquisition date, it is probable that an asset or liability exists and the amount can be estimated reasonably. | The contingent liability assumed in a business combination shall be recognized if it is a present obligation that arises from past events and its fair value can be measured reliably, even if the outflow of resources is not probable. Contingent assets are not recognized. |

Conclusion – Merger Accounting

Business combinations are to be identified separately from the acquisition of assets or a group of assets and are to be accounted for using the ‘Acquisition Method’ detailed in IFRS 3.

Acquisition method requires the application of a step by step approach to

- Identify the acquirer,

- Identify acquisition date,

- Appropriately measure the assets acquired and liabilities assumed

- Determine any non-controlling interest,

- Identify and measure consideration, and

- Recognize any resultant goodwill or gain on a bargain purchase transaction.

Through various amendments to IFRS and US GAAP, a great degree of convergence has been achieved between the two standards as regards business combinations, paving way for uniformity in accounting practices globally.

Recommended Articles

This is a guide to Merger Accounting. Here we discuss steps in the acquisition method of merger accounting along with Key Differences of IFRS and US GAAP. You may also look at the following articles to learn more –