What is Market Capitalization?

Market capitalization represents the overall value of a company’s outstanding shares computed at the current market price. For example, on 29th September 2022, Porsche concluded its IPO with a market cap of $72 billion. As of now, it is Germany’s second-largest IPO opening.

The forces of demand and supply determine the market price. Thus, this value measures market sentiment toward the company stock. Hence, the stock with a higher value is favorable. It is most helpful in determining a company’s size and, in turn, helps with acquisition decisions.

Key Takeaways

- A firm’s market capitalization is the value of its stocks according to the share market. It is the sum market value of all outstanding shares.

- To calculate, multiply the current market value per share by the total outstanding shares.

- Market capitalization divides companies into small-cap, mid-cap, and large-cap.

- It helps establish a company’s size. It helps compare its financial performance to other businesses of varying sizes.

Explanation

Market capitalization determines the size of a firm by valuing outstanding shares. Its common abbreviation is ‘Market Cap.’ The initial public offering establishes a firm’s capitalization for the first time.

Factors like supply and demand affect the price of a company’s share once it goes public. According to this, a strong demand results in a price increase. So, the market cap provides a rough sign of a company’s actual value.

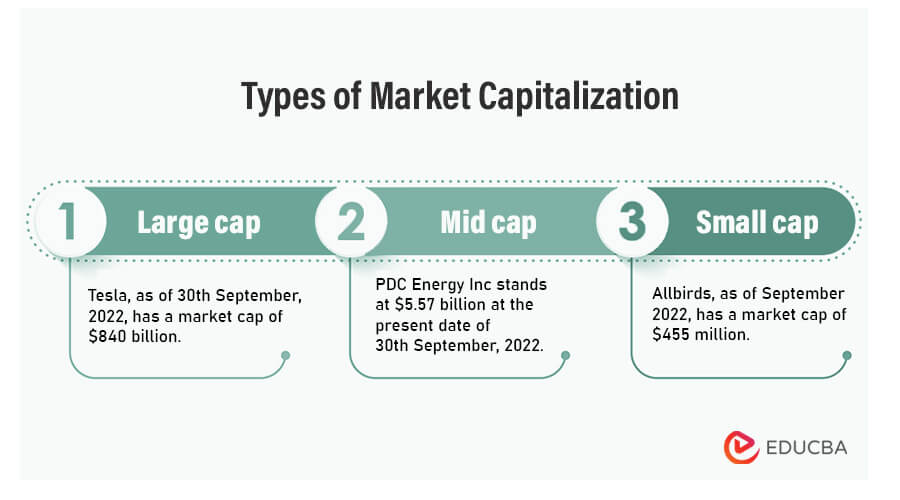

Market Capitalization – Types

There are three market cap categories. The method of categorizing varies from one market to another. It also differs from one index to another within the same financial markets.

1. Large Cap

- Stocks with a market cap of $10 billion or more fall under this category. They are known as the best in their respective industries.

- For instance, as of 30th September 2022, the market capitalization of Tesla was $840 billion.

- When the market is booming, these companies are the highest grosser. Besides, when the market is bearish, they fall less than other stocks.

- These businesses are significant participants in long-standing sectors.

- Although investing in large-cap corporations may not immediately yield high returns, these businesses often pay dividends and raise the value of their shares, rewarding investors.

- Consequently, these are safer stocks in the market with lower volatility.

2. Mid Cap

- Stocks with a market cap of $2 billion to $10 billion fall under this category. PDC Energy Inc stands at $5.57 billion on the 30th of September, 2022.

- These stocks are riskier than large-cap stocks.

- They are relatively new players in the market but have had their fair share of profitability.

- They suit small investors who can’t afford to buy large-cap stocks.

- These stocks are constantly gaining dominance and may give competition to large-cap companies.

3. Small Cap

- Stocks with a market cap of $2 billion or less fall under this category. Allbirds, as of September 2022, has a market cap of $455 million.

- These are the riskiest of the three and provide high-risk, high-return investment profiles.

- When the market booms, these stocks gain only to a certain extent, but when it is bearish, these are most affected.

- Small-cap stock prices have higher volatility and lower liquidity. Still, small businesses offer more room for growth.

- Generally, speculators invest in these by betting on their innovativeness and upcoming growth prospects.

Market Capitalization – Formula

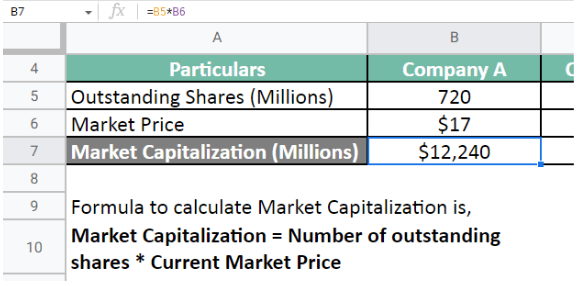

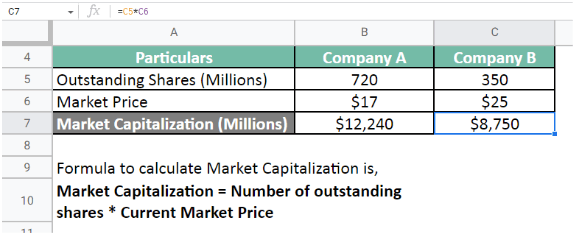

The formula for market capitalization is,

The current market price can be the closing price of that particular day or an average for a period. It is up to the analyst to see which measure is a better indicator.

How to Calculate Market Capitalization? – Example

Download the Excel template here – Market Capitalization Excel Template

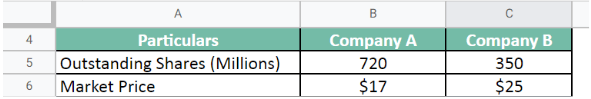

Two investors, X & Y, want to invest in a company. They can choose to buy the stocks of either Company A or B.

As per the records, Company A has 720 million outstanding shares, each priced at $17. In contrast, Company B has a share price of $25 for 350 million outstanding shares. Investor X wants to invest in a mid-cap company, whereas Investor Y intends to invest for the long term. Calculate the market cap for both companies.

Given,

Let us calculate the market cap for Company A.

Let us calculate the market cap for Company B.

Therefore, the market cap for both companies is,

Company A = $12.24 billion; Company B = $8.75 Billion;

As company B is a mid-cap company, investor X can invest. Investor Y can choose to invest in company A.

Factors Affecting Market Capitalization

1. Treasury Stock/Convertibles

- These are shares issued as an outcome of exercising stock options, warrants, or from the conversion of convertible securities.

- These can lead to an increase or decrease in outstanding stocks.

2. Bonus Issue

- Bonus shares are issued free of cost and can increase the number of outstanding shares.

- The goal is to compensate shareholders with shares rather than dividends.

- It also lowers the market share price and makes shares more accessible to investors.

3. Price Movement

- The price fluctuations in the stock market are frequent.

- It is the other component of the calculation. Thus, price movements affect the market cap.

Free Float Market Cap

The free float market cap only considers shares traded on the stock exchange. It does not evaluate the locked-in shares that the government, insiders, etc., have.

Float-adjusted capitalization is another name for the approach. Leading indices around the world use it. Most of the world’s leading indices, like FTSE, S&P STOXX, and others, use this approach.

Use of Market Capitalization in Financial Ratios

Investors need to be aware of financial ratios that use market capitalization.

Price-to-earnings ratio:

- It calculates the potential return on investment from purchasing a company’s stock.

- P/E Ratio = Market Cap / Earning per Share

Price-to-free-cash-flow ratio:

- It calculates the relationship between the cash flow of the company and its share price.

- P/FCF Ratio = Market Cap / Cash Flow per Share

Price-to-book value:

- It helps determine if the corporation is undervalued or overvalued.

- PB Ratio = Market Cap / Book Value per Share

Advantages and Disadvantage

Advantages

Index Weighting

- It is a popular method of index weighting, also known as a value weighting scheme.

- As the other ways are price or equal weighting, they can be misleading.

- In that case, capitalization-weighting depicts the accurate contribution of each commodity to the index.

Performance Metric

- In the long term, a stock sustaining a high price results from its high profitability.

- Stocks with a price higher than the par value or issue price attract positive investor sentiment.

- It enables investors to decide whether to invest in a company and find competitors in the same business or sector.

Disadvantages

Closely Held Stock

- This value calculation also includes shares that do not trade freely. Therefore, the value can be misleading if the proportion of such shares in the total shareholding is very high.

- To avoid such problems, investors can use a free float market cap.

- The calculation does not include the promoters’ shares when using a free-float market cap.

Price Subjectivity

- The price component can vary from analyst to analyst; some take the closing price, and others take the average cost or another measure.

- Therefore, understanding the price component is essential while comparing the market cap of two stocks or analysts.

- It also disregards the debt component of a firm, which is equally essential to its valuation at the time of purchase.

Conclusion

Market capitalization measures a business’s stock value at the current market price. It is a popular measure and very simple to calculate. However, one flaw is that it includes shares other than that traded in the market. As it can be misleading, most indices use free float to calculate market cap.

FAQs

1. What is market capitalization? What is its importance?

Answer: Market capitalization is the amount of a company’s total shares. One can calculate it by multiplying the outstanding shares by the price. For instance, Meta Platforms Inc has a market cap of $366 billion as of September 2022. It is a crucial analytical tool, particularly when comparing businesses. Since most financial measures use market cap, it is a starting point for analysis.

2. What does a high market cap signify?

Answer: A high market cap indicates that the company is more established. Although larger businesses may not have room for expansion as startups, they can access finance easily and generate a steady income flow. Also, companies with larger market capitalization are typically less risky.

3. What causes changes in the market cap?

Answer: Significant fluctuations in stock price can impact a company’s market capitalization. Additionally, it happens when firms issue or buy back shares. Also, investors exercising a considerable number of warrants might increase the number of shares in the market.

4. Is market capitalization the same as market value?

Answer: Yes, market capitalization and market value are interchangeable terms. It is also called open market valuation, the market value of equity, and market cap.

5. What is the market capitalization of cryptocurrency?

Answer: The market cap for a cryptocurrency is the total worth of all extracted coins. We can compute it by multiplying the number of coins on the market by the rate of one coin.

Recommended Articles

This is a guide to Market Capitalization. Here we discuss the types, examples, factors, advantages, and disadvantages. Read the following articles to learn more,