Updated June 28, 2023

Difference Between Margin vs Profit

Getting good margins on a product and getting a good profit are two factors usually viewed holistically together and are directly proportional. But we will try to view them individually to understand the concepts better.

Margin

A margin is a percentage term that denotes the difference between the numerator and denominator. Since companies and products of different sizes and types can have varying numerical terms, a margin is a powerful unit of comparison across sectors, within industries, with supplementary and complementary sectors, etc.

Margins can be viewed and correlated to any term on the income statement or balance sheet to determine a specific unit’s margin. For example, gross Sales Margin and EBITDA Margin are examples of margins based on the Income Statement alone. In contrast, Return on Assets and Return on Equity are margins involving the Income Statement and the Balance Sheet.

Even the interest rate that we deal with regularly, in the corporate world or personal life, is a type of margin that distinguishes between the interest payment and the principal amount in percentage values.

Profit

Profit is a numerical value denoted in currency terms and usually derived from income statement calculations.

A company has a Top Line Sales Revenue figure on top of its Income statement that denotes the total money customers receive via full payments, partial payments, or due payments in exchange for goods and services.

A company also incurs direct and indirect expenses, including rent, wages, salaries, cost of materials, marketing and advertising expenses, utilities, depreciation and amortization costs, etc.

Profit is your Total Expenses deducted from the Top Line Sales Revenue figure. Profit could be divided into 2 major types, Gross Profit and Net Profit.

Example to Understand Both Margin vs. Profit

The following example will explain profits, margins, and some types of margins we usually come across;

Company ABH produces a Mobile Phone named “Letia” for a manufacturing cost of INR 7,200 and sells it for a price of INR 12,000.

The company spends INR 3,600 per unit on marketing, advertising, asset depreciation, and other overheads.

| Selling Price | INR 12,000 |

| Manufacturing Cost | INR 7,200 |

| Gross Profit (Selling Price -Manufacturing Cost) | INR 4,800 |

| Gross Margin (Gross Profit / Selling Price) | 40% |

| Marketing, Depreciation & Other Expenses | INR 3,600 |

| Net Profit (Gross Profit – Expenses) | INR 1,200 |

| Net Margin (Net Profit / Selling Price) | 10% |

Hence, when Company ABH sells a single unit of Letia phones, it’s net “margin” per product stands at 10%, while its actual “profit” stands at INR 1,200.

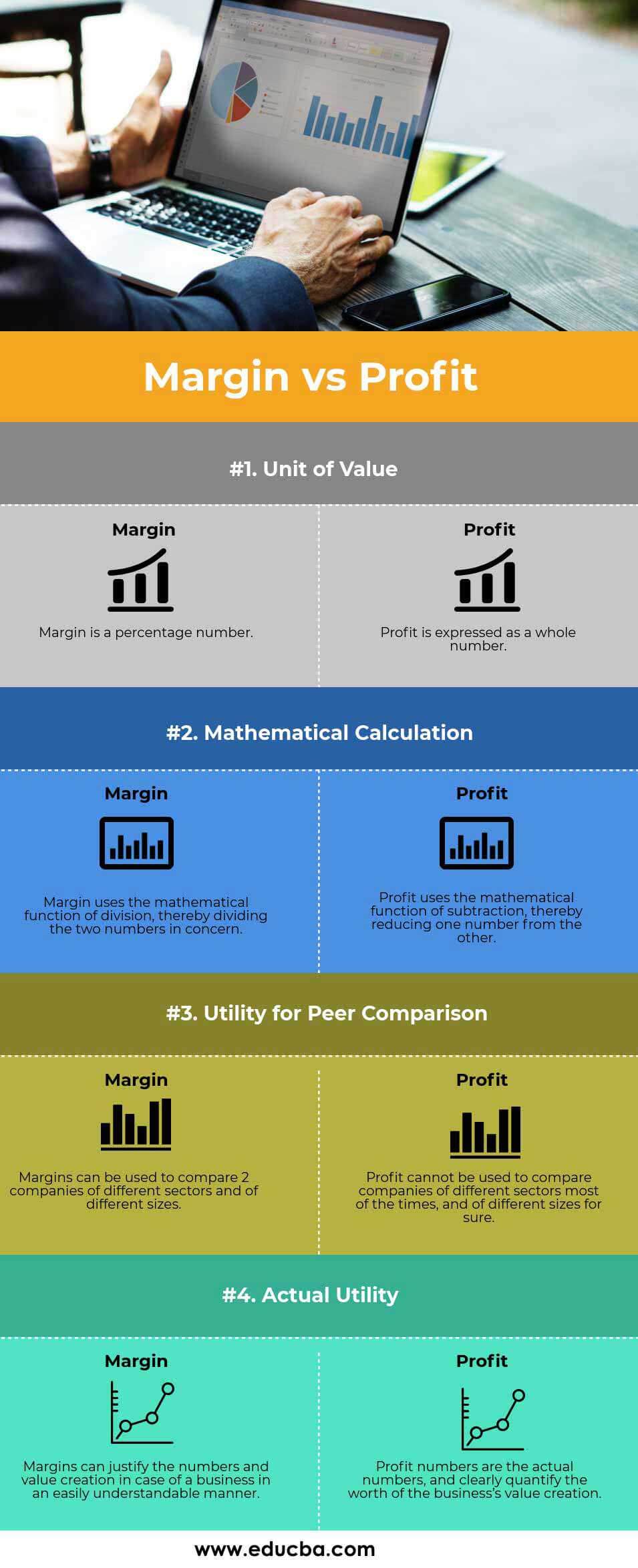

Head To Head Comparison Between Margin vs. Profit (Infographics)

Below is the top 4 difference between Margin vs Profit

Comparison Table

Let’s look at the top 4 Comparisons between Margin vs. Profit.

| The Basis of Comparison |

Margin |

Profit |

| Unit Of Value | A margin is a percentage number. | Profit is expressed as a whole number. |

| Mathematical Calculation | Margin uses the mathematical function of division, dividing the two numbers in concern. | Profit uses the mathematical function of subtraction, thereby reducing one number from the other. |

| Utility For Peer Comparison | Companies can use margins to compare themselves with companies in different sectors and sizes. | Profit cannot compare companies from different sectors, most of the time, and different sizes. |

| Actual Utility | Margins can justify the numbers and value creation in the case of a business in an easily understandable manner. | Profit numbers are the actual numbers and quantify the worth of the business’s value creation. |

Key Difference

Let us discuss some of the major differences between Margin vs Profit.

- While Margin is a percentage term that can always be standardized, Profit is a numerical term usually expressed in a certain currency and can differ in the currency used.

- One can derive margin solely by deploying the mathematical function of division between the two units of numbers in concern.

One derives profit by deploying the subtraction function, typically in a linear calculation between numbers of an Income Statement. - A business’s Margin can be used to quickly check up on its relative performance internally (of different quarters or years in question) or externally (of similar other businesses or companies). In contrast, Profit cannot be used to compare businesses accurately against each other at least.

- Margin can help understand a business or its sector, while Profit is actual numbers and denote the business’s real cash value.

- A lower margin than a previous quarter can still generate a higher profit.

In the above example, if the Selling Price of the product is increased to INR 20,000 and the margin is reduced to 8%, the net profit will still be higher in actual numerical terms at INR 1,600.

Conclusion

However, for running a business, it is important to know the difference. While we attempted to view these as two distinct terms, it is important to recognize that they are closely related and interconnected. If we do not alter any other number or unit (such as selling price, cost of raw materials, other expenses, etc.), then the business’s margin and profit will always move proportionately. While businesses generate earnings in a transaction, the margin represents the percentage value, whereas the profit represents the actual number, translating into actual cash gains.

Recommended Articles

This has been a guide to the top difference between Margin vs Profit. Here we also discuss the Margin vs Profit key differences with infographics and comparison table. You may also have a look at the following articles to learn more.