Updated June 27, 2023

Difference Between Loan vs Lease

Loan

A loan can be defined as giving money by one party to another party on the agreement that money would be paid back by the latter to the former by the loan agreement. The loan agreement would define interest, tenure, and other terms in advance.

Parties involved in the loan transaction are

- Lender – the one who gives money

- Borrower – the one who takes money

The lender expects the borrower to repay the principal amount along with interest over the tenure of the loan, as specified in the loan agreement. There are different types of loans based on the nature of the usage of funds; they can be called personal loans to business loans. Loans can also be categorized based on the collateral pledged by the borrower to the lender; it ranges from unsecured loans to term loans. Generally, while taking a loan, the borrower has to collateralize some of his assets with the lender.

In a nutshell, irrespective of the nature or type of loan, the borrower must repay the lender’s principal and interest over the loan term.

Lease

A lease is an agreement between two parties, where one party (the owner of the asset, also called lessor) allows the other party (called lessee) to use his/her assets (assets can be anything ranging from real estate, machinery, equipment, etc.) For an agreed period in return for periodic payments. Generally, the lessor fixes the periodic payments, and the quantum of these payments and the lease duration are determined based on the lease agreement. In most cases, the collateral would be the equipment leased.

A lease can be broadly categorized into capital and operating leases. In a capital lease, there is a provision to transfer the ownership of the leased asset to the lessee by the lessor at the end of the lease tenure. In the case of a capital lease, the lessee has to show the leased asset on the asset side and a loan equivalent to the asset’s value on the liability side of the balance sheet. Over the period of the lease, the lessee will depreciate the asset and pay back the loan to a lessor. In an operating lease, the ownership of the leased asset will remain with the lessor, and the lessee will return the asset once the contract is over. The lessee has to record the fixed payment in the profit& loss statement as a rental expense.

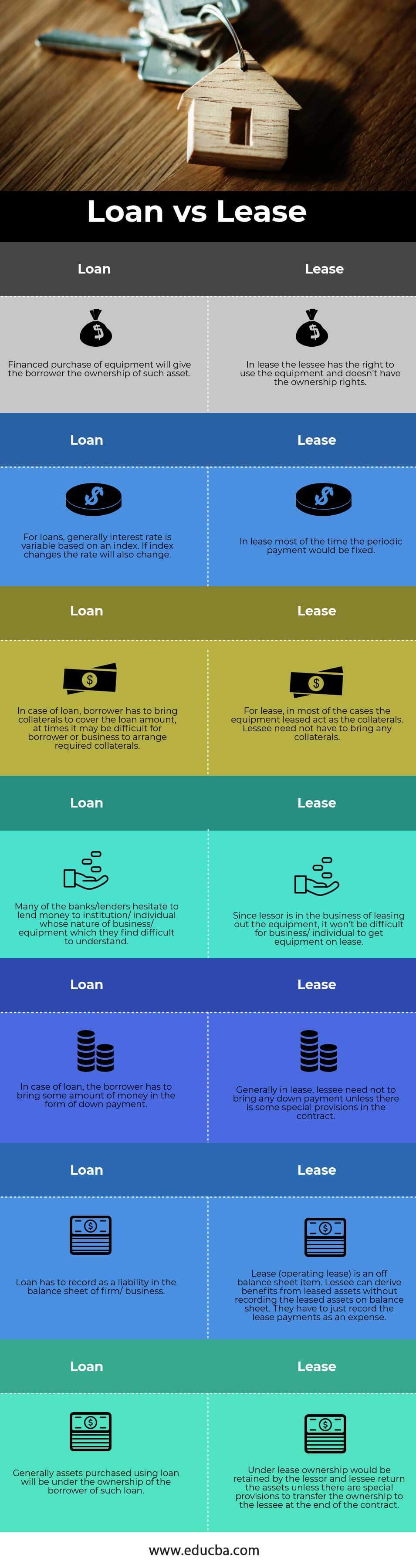

Head To Head Comparison Between Loan vs Lease (Infographics)

Below is the top 7 difference between Loan vs Lease

Key Differences Between Loan vs Lease

Both Loans vs Leases are popular choices in the market. let us discuss some of the major Difference Between a Loan and vs Lease:

- A loan will give the borrower the right of ownership of the purchased assets, whereas, in the lease, it would be only the right to use the leased equipment.

- Looking for a borrower to finance the equipment you need to purchase would be much more time-consuming than leasing the same assets from a lessor.

- Owning equipment through the loan will allow the borrower to depreciate it in their books of accounts. It thus can avail of the tax benefit, whereas, in the case of a lease, a lessor is not allowed to depreciate the assets since there is no recording of assets in the lessee’s books.

- If, after a period of time, the subject equipment would no more interest to the business, the lease method would be much more flexible than the loan method.

- Off-balance sheet accounting provision for lease would give a better performance ratio of the business than what could have been the case with purchasing the assets using a loan (assuming all other things constant)

- There is a down payment in the case of the loan, whereas generally no down payment in the case of a lease.

Loan vs Lease Comparison Table

Below is the 7 topmost comparison between Loan vs Lease:

|

Loan |

Lease |

| The financed purchase of equipment will give the borrower the ownership of such an asset. | In a lease, the lessee has the right to use the equipment and doesn’t have ownership rights. |

| A general interest rate is a variable based on an index for loans. If the index changes, the rate will also change | In a lease, most of the time, the periodic payment would be fixed. |

| In the case of a loan, a borrower has to bring collaterals to cover the loan amount; at times, it may be difficult for the borrower or business to arrange the required collaterals. | In most cases, the equipment leased acts as collateral for a lease. Lessee need not have to bring any collaterals. |

| Many banks/lenders hesitate to lend money to institutions/individuals whose nature of business/ equipment they find difficult to understand. | Since the lessor is leasing out the equipment, it won’t be difficult for a business/ individual to get equipment on lease. |

| In the case of the loan, the borrower has to bring some money as a down payment. | Generally, in the lease, the lessee need not bring any down payment unless there are some special provisions in the contract. |

| A loan has to record as a liability in the balance sheet of the firm/ business. | A lease (operating lease) is an off-balance sheet item. The lessee can derive benefits from leased assets without recording the leased assets on the balance sheet. They have to record the lease payments as an expense. |

| Generally, assets purchased using a loan will be under the borrower’s ownership of such a loan. | Under a lease, ownership would be retained by the lessor and the lessee to return the assets unless there are special provisions to transfer the ownership to the lessee at the end of the contract. |

Conclusion

As mentioned above, both loans and leases have their advantages and disadvantages. A decision of a loan or lease should be made after a holistic analysis of the business situation and the purpose of the equipment to be bought or leased. If the business doesn’t have enough funds to make the down payment or doesn’t have enough collateral to cover the loan, and has to use the asset, then the lease would work best. If a business wants to own the assets for the long term, has enough funds to bring as a down payment, and can go through the documentation of finance, then the loan would be a better option. Also, it is important to understand the various implication of loan vs lease on books of accounts of a business so that the reader can correctly gauge the performance of the business.

Recommended Articles

This has been a guide to the top difference between Loan vs Lease. Here we also discuss the Loan vs Lease Stock key differences with infographics and a comparison table. You may also have a look at the following articles to learn more.