Updated September 30, 2023

What is a Loan Stock?

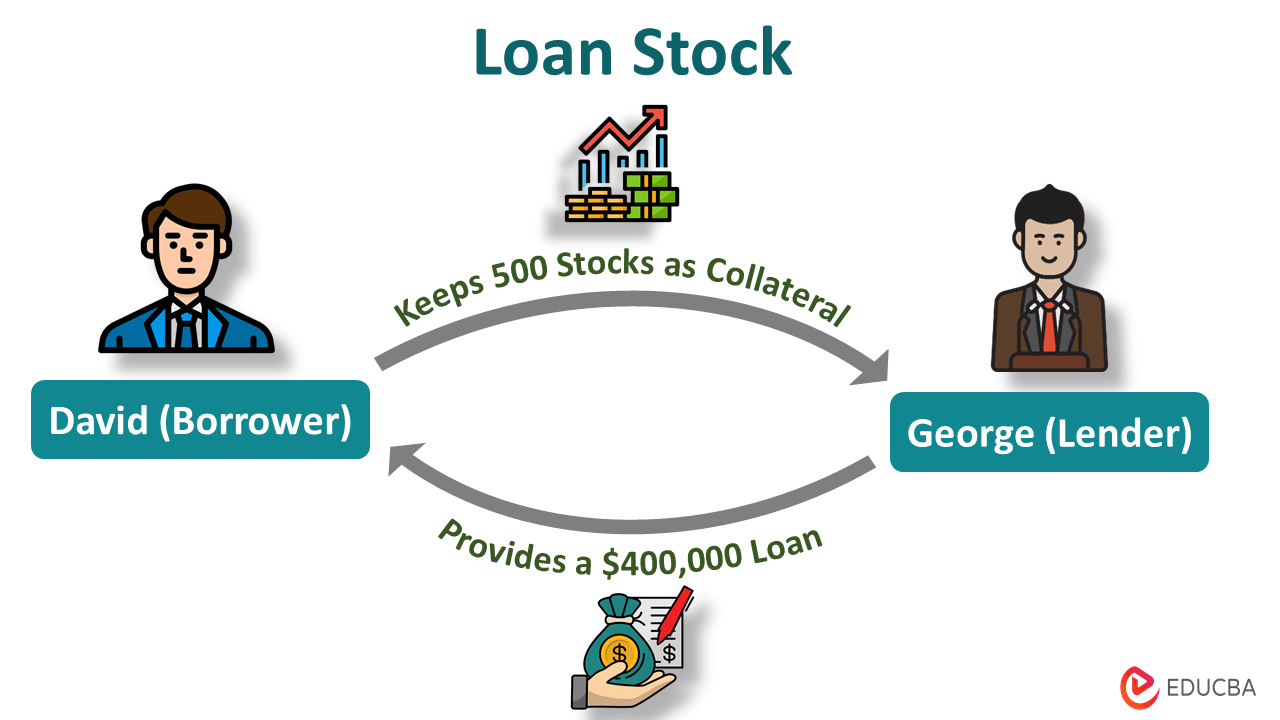

When a company or person wants to borrow some capital, and they keep the stocks/shares they own as collateral with the lender, it is known as loan stock.

A company can use this type of loan to raise money for various purposes, such as financing business operations, funding projects, or debt management. Here, the lender holds the authority of shares until the company pays off the loan. For this purpose, lenders typically ask for publicly traded shares, which they can easily sell if borrowers default on the debt.

Table of Contents

Key Highlights

- Loan stock is a type of loan where the borrower (company or individual) can give their shares to the lender as collateral instead of property or land.

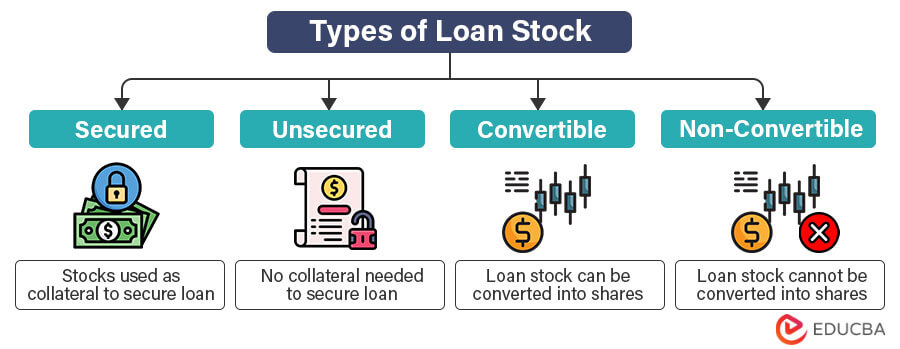

- It has four types: Secured, unsecured, convertible, and non-convertible.

- Borrowers and lenders can face financial risks associated with this type of loan. Thus, they must be careful while giving or taking this loan.

How Does it Work?

Here’s how a loan stock transaction works:

- The borrower approaches the lender and asks for a loan.

- The lender agrees to provide the loan when the borrower promises to share the stocks as collateral.

- The borrower signs a security lending agreement, which includes the interest rate, periods of the loan, and the terms and conditions.

- The lender accepts the shares as collateral and lends the money to the borrower.

- The borrower repays the principal amount and interest over a defined period and gets back their shares.

- However, if the borrower cannot pay the money within the agreed-upon time, the lender sells the shares to recover the default loan.

Examples

Let us see some hypothetical examples to understand loan stocks.

Example #1:

Let’s say you have a relative starting a small business who needs money. To raise funds, they offer you a loan stock of $10,000 with a 5% annual interest rate for 2 years. You decide to buy this stock and lend them $10,000. In return, your relative promises to pay you $500 (5% of $10,000) annually for the next 2 years. After 2 years, your relative will return the $10,000 you initially invested. This is a simple example of how loan stocks work.

Example #2:

Suppose a company, XY, wants to expand its business. But instead of taking a loan from the bank, the company decided to issue a loan stock of $5 million with an interest rate of 5% per annum for 7 years.

The company borrows $5 million from interested investors who purchase this stock. In return, the company promises to pay $300,000 (6% of 5$ million) annually for 7 years. However, company XY faces financial challenges and cannot repay the loan amount. So, to avoid loss, investors sold the company’s shares to recover their loan payment.

Risks Involved In a Loan Stock

For Lenders

- Collateral Fluctuation Risk: The value of stocks kept as collateral may not stay the same, usually affected by market fluctuations (rapid rise and fall in value). Thus, the lender can lose money if its stock’s value falls below what they lent.

- Liquidity Risk: Suppose the borrower can’t return the money, and the lender cannot sell the stocks as there are no potential buyers. Thus, the lender faces liquidity risk.

- Market Risk: This is the risk that the general market conditions (like a recession) will affect the loan stock’s value or the borrower’s ability to pay back.

- Regulatory Risk: The regulatory bodies may modify existing rules regarding stocks, which may impact the lender’s ability to retrieve their loaned amount.

For Borrowers

- Collateral Loss: If the borrower can’t repay the loan, the lender might have a right to own or sell the borrower’s stocks.

- Regulatory Changes: Changing stock market regulations could also impact borrowers.

Loan Stock vs. Bond

Let’s understand the difference between loan stock and bonds with the following features.

| Feature | Loan Stock | Bond |

| Definition | Loan stock is a type of loan where a company uses its shares as collateral to secure the loan. | Bonds are written promises or agreements to fulfill a loan with interest within a stipulated time. |

| Issuer | Individuals, banks, or other financial institutions. | Large entities, corporations, or governments. |

| Interest Rates | Can be fixed or variable, possibly higher for unsecured loans. | Can be fixed, variable, or zero; rates might be lower, especially for government bonds. |

| Repayment | At regular intervals (both principal and interest). | Full amount at maturity. |

| Maturity | Fixed or floating maturity date. | Fixed maturity dates such as 5, 10, or 30 years. |

Advantages & Disadvantages

Here are some significant advantages and disadvantages of a loan stock.

| Advantages | Disadvantages |

| It is the easiest way for companies to get money when needed. | Companies have to pay higher interest periodically, which can be costly. |

| Companies can establish flexible terms and conditions that align with their financial requirements. | The value of the stock can fluctuate, which may impact its worth when sold, potentially resulting in gains or losses. |

| Lenders receive a stable interest income. | It’s less liquid and may be hard to sell quickly. |

Frequently Asked Questions (FAQs)

Q1. What is a loan note?

Answer: A loan note is a financial instrument between a borrower and a lender. It is an agreement outlining the terms and conditions of loan payment like principal amount, interest rate, payment schedule, tenure, penalties, if any, etc.

Q2. What is the difference between a debenture and a loan?

Answer: There is a saying that all debentures are loans, but not all loans are debentures. The basic difference is that debentures do not need any collateral or something of equal value from the company, whereas loans require collateral.

Q3. Can an individual take out a loan against shares?

Answer: Yes, individuals can take out loans against their shares. They can use their shares as collateral to secure a loan. There is no need to sell shares; you can again own shares after full loan repayment.

Recommended Articles

This article is a comprehensive guide to loan stock, including its meaning, how it works, types, and examples. It also includes risks involved for borrowers and lenders. You can refer to the following articles to learn more:–