Updated July 14, 2023

What is the LIFO Method in Accounting?

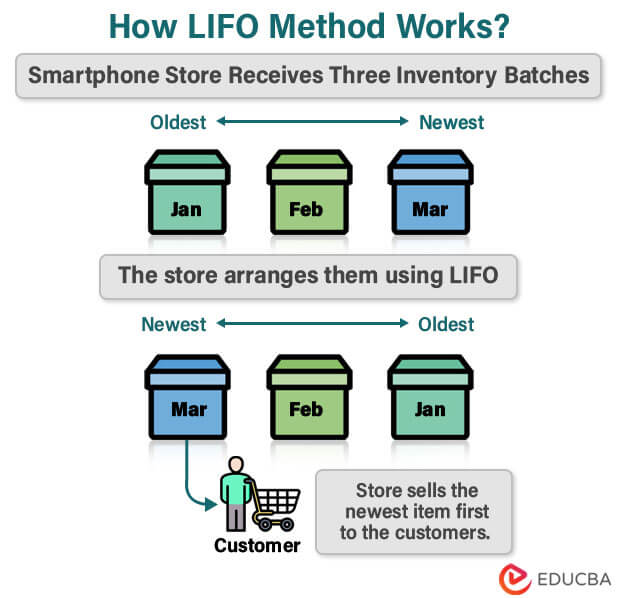

The LIFO method, also known as last-in, first-out, is one of the three common methods for inventory valuation. It assumes that when companies sell products, they sell the most recently manufactured products first. Older items stay in the inventory until the company sells them.

The other two methods are FIFO (First in, first out) and the weighted average cost method. To understand the LIFO method, consider a smartphone-selling company that produces 100 smartphones on May 1st and another 100 smartphones on June 1st. When the company sells 100 smartphones, the LIFO method assumes they are from the June 1st batch. On the contrary, the FIFO method assumes they are from the May 1st batch.

Automotive, pharmaceutical, and petroleum-based companies often use the LIFO method. They sell products that don’t spoil, like petrol, or they want to reduce their taxes, as seen in the automotive industry.

Impact on Financial Statements

The LIFO inventory valuation method directly impacts two key areas of a company’s financial statements: The Cost of Goods Sold (COGS) on the Income Statement and the Inventory value on the Balance Sheet.

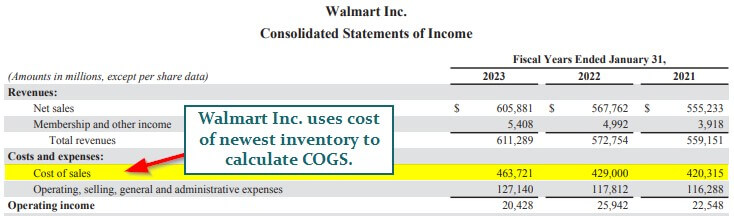

1. How LIFO impacts the calculation of COGS on an Income Statement?

When a company follows the LIFO method, the COGS shown in the income statement reflects the value of its most recently purchased or produced inventory items.

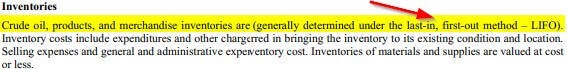

For instance, Walmart uses LIFO for its inventory valuation. Thus, it calculates the COGS or cost of sales using the cost of the newest inventory sold.

(Image Source: Walmart Annual Report 2023)

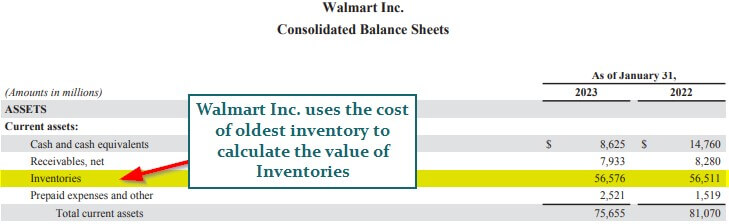

2. How LIFO impacts the inventory valuation on a Balance Sheet?

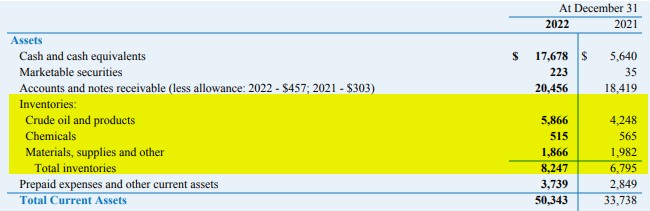

When using LIFO, we determine the closing inventory value on the balance sheet by considering the costs of older unsold inventory items. As a result, the LIFO method affects current asset valuation, including the inventory component in the balance sheet.

For instance, Walmart uses the cost of its oldest inventory to find the value of its total closing inventories for the fiscal year.

(Image Source: Walmart Annual Report 2023)

Example of LIFO Method

Consider Mr. David, who started a stationary retail store on February 1, 2023, and produced rubber stamps during the first two months (February and March). By the end of March, Mr. David had sold approximately 500 rubber stamps for $30 each. Now, he needs to calculate the cost of goods sold for the remaining inventory on March 31, 2023.

Below is the detailed information about the purchase:

| Date | Units Produced | Price Per Unit ($) |

| 01-Feb | 300 | $20 |

| 15-Feb | 250 | $21 |

| 25-Feb | 100 | $21 |

| 05-Mar | 100 | $22 |

| 20-Mar | 100 | $23 |

Solution:

Step 1: Find COGS

We need to determine the units sold from each inventory to calculate the cost of goods sold (COGS) for the 500 rubber stamps sold.

The table below illustrates how we can calculate the value of COGS. We will start with the most recent inventory and stop the calculation when we have sold 500 units. In this case, we will stop at 200 units (Date: 15-Feb) instead of the original inventory of 250 units.

| Date | Units Produced | Price Per Unit | Units Considered for Calculation | COGS |

| 20-Mar | 100 | $23 | All 100 Units | $2,300 (100 x $23) |

| 05-Mar | 100 | $22 | All 100 Units | $2,200 (100 x $22) |

| 25-Feb | 100 | $21 | All 100 Units | $2,100 (100 x $21) |

| 15-Feb | 250 | $21 | Only 200 Units (Remaining Units: 250-200 = 50) |

$4,200 (200 x $21) |

| 01-Feb | 300 | $20 | Not to be considered (Remaining Units: 300) |

– |

| Total Units: 500 | Total COGS: $10,800 |

Therefore, the COGS, i.e., total money it takes the company to produce and sell 500 units, is $10,800.

Step 2: Determine Closing Inventory

As we know, Mr. David sold 500 rubber stamps, so the closing inventory will include those still unsold.

The below table shows the value of the closing inventory. We will add the remaining units from the previous table.

| Date | Remaining Units |

| 15-Feb | 50 |

| 01-Feb | 300 |

| Closing Inventory Units: | 350 |

Thus, David still has 350 units in his inventory, which is his closing inventory.

Step 3: Calculate Profit

The total profit David made by selling 500 rubber stamps at $30 will be:

Profit = (Units x Price Per Unit) – COGS

= (500 x $30) – $10,800

= $15,000 – $10,800

= $4,200

Result:

These are the final values:

1. COGS = $10,800

2. Closing Inventory = 350

3. Profit = $4,200

LIFO Case Study

In this case study, we will understand how the LIFO method impacts a company’s balance sheet and income statement. We will focus on how it affects the inventory value on the balance sheet and important financial metrics on the income statement, like COGS, gross profit, tax, and net income. To provide a comparison, we will also consider the results obtained using the FIFO (first in, first out) method.

Let’s consider Schmitt Retailers, which has a chain of electronic stores and uses the LIFO method for inventory valuation. We have the following financial data for Schmitt Retailers:

- Most recently produced units: 100 units ($20 per unit)

- Previously produced units: 400 units ($15 per unit)

- Total units produced: 500

- Units sold: 300

- Revenue: $10,000

- Operating Expenses: $2,000

- Depreciation & Amortization: $500

- Interest Expense: $200

- Tax Rate: 20%

Solution:

To determine the net income of Schmitt Retailers, we will first find the following:

- Value of Closing Inventory (Balance Sheet Item)

- COGS

- Gross Profit

- Tax Payable

Finally, we will calculate the net income. We will calculate all the metrics using both the LIFO and FIFO method.

1. Closing Inventory Value

| LIFO Method | FIFO Method | |

| Closing Inventory | 200 | 200 |

| Price Per Unit | $15 (Previous purchase cost) |

$20 (Most recent purchase cost) |

| Calculation of Inventory Cost (Added to the Balance Sheet) | $3,000

(200 x $21) |

$4,000

(200 x $20) |

2. Cost of Goods Sold (COGS)

| LIFO Method | FIFO Method | |

| Units Sold | 300 | 300 |

| Cost per Unit | $20 for 100 units + $15 for 200 units | $15 for 300 units |

| Calculation | $2,000 + $3000 | $4,500 |

| Total COGS | $5,000 | $4,500 |

3. Gross Profit

| LIFO Method | FIFO Method | |

| Total Revenue | $10,000 | $10,000 |

| COGS | $5,000 | $4,500 |

| Gross Profit | $5,000 ($10,000 – $5,000) |

$5,500 ($10,000 – $4,500) |

4. Tax

| LIFO Method | FIFO Method | |

| Gross Profit | $5,000 | $5,500 |

| Operating Expenses | $2,000 | $2,000 |

| EBITDA | $3000 ($5,000 – $2,000) |

$3500 ($5,500 – $2,000) |

| Depreciation & Amortization | $500 | $500 |

| Interest Expense | $200 | $200 |

| EBT (Earnings Before Taxes) | $2,300 ($3,000 – $500 – $200) |

$2,800 ($3,500 – $500 – $200) |

| Tax Rate | 20% | 20% |

| Tax Payable | $460 ($2,300 x 20%) |

$560 ($2,800 x 20%) |

5. Net Income

| LIFO Method | FIFO Method | |

| EBT (Earnings Before Taxes) | $2,300 | $2,800 |

| Tax Payable | $460 | $560 |

| Net Income | $1,840 ($2,300 – $460) |

$2,240 ($2,800 – $560) |

Result Analysis:

| Metric | LIFO | FIFO |

| Closing Inventory Value: LIFO uses the oldest inventory purchase cost for calculating closing inventory value, resulting in a lower value than FIFO. |

$3,000 | $4,000 |

| COGS: For COGS, LIFO uses the cost of the most recently acquired inventory items, leading to a higher value. |

$5,000 | $4,500 |

| Gross Profit: Since COGS is higher in LIFO, it results in lower gross profit. |

$5,000 | $5,500 |

| Tax Payable: As the gross profit is less, taxable income will be lower, too, leading to a lower tax payable. |

$460 | $560 |

| Net Income: As the gross profit is lower in LIFO, the resulting net income will be lower too. |

$1,840 | $2,240 |

Companies Using LIFO Method

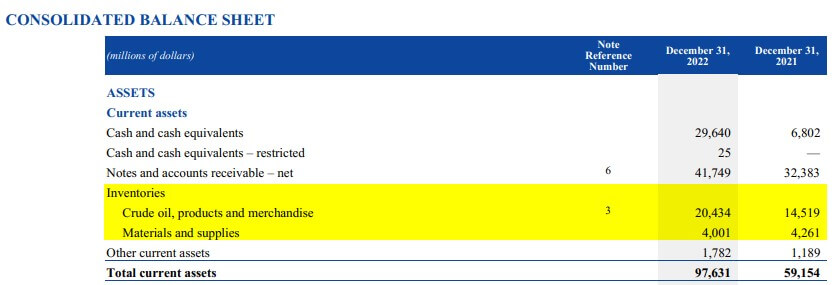

1. ExxonMobil

Using the LIFO method, ExxonMobil values its inventory, including crude oil, merchandise, and other materials.

(Image Source: ExxonMobil Annual Report 2022)

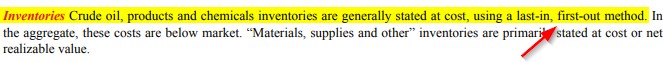

2. Chevron

Chevron uses the LIFO method to value its inventory (crude oil, chemicals, materials, etc.).

(Image Source: Chevron Annual Report 2022)

Advantages of the LIFO Method

1. Tax Planning: During inflation, it can help businesses reduce their reported profits, reducing the amount of tax they have to pay. It happens because the cost of recently produced goods and their selling price does not have a large gap. However, it is unacceptable outside the US and for companies that follow the IFRS regulations.

2. Realistic cost allocation: It calculates inventory value by looking at the newest products and their current market prices. This gives an accurate view of the cost of goods sold and the value of what’s left in inventory.

3. Improved cash flow: As during inflation, companies can use LIFO accounting to save taxes, they have extra funds that they can use for other prospects. They can use it for business operations, investment, or other financial needs.

Frequently Asked Questions (FAQs)

Q1. What are the problems with LIFO?

Answer: The issues in using the LIFO method of accounting are given as follows:

- When using this method, the first batch of products created remains in the store, becoming outdated or very old.

- Due to inflation, the prices of items keep rising. As LIFO calculates the cost of inventory using older items (since new inventory is sold first as per LIFO), the value may come out less, which will be incorrect in the inflation period.

- It is not allowed for financial reporting purposes under International Financial Reporting Standards (IFRS).

- It challenges worldwide industry comparisons since only US-based companies can use the LIFO method.

Q2. Which is better, LIFO or FIFO?

Answer: Both LIFO and FIFO have their benefits. FIFO is more favorable when prices increase because it ensures that older, lower-cost items are turned into revenue first. In contrast, LIFO is preferable when prices are falling. It allows the company to sell the expensive items first, so before the prices fall too much, the company can profit a little from the new expensive products sold.

Recommended Articles

The above guide gives you a comprehensive overview of the LIFO method. We cover its definition, examples, calculations, advantages, disadvantages, and more. You may go ahead and read the below articles too: