Updated July 27, 2023

Definition of Journal Entry Examples

The journal entry examples article provides knowledge of companies’ most prevalent form of journal entries in their day-to-day economic operations. In finance parlance, the term “journal” refers to the records of each company’s financial transaction as per relevant accounting methodology.

It is also referred to as a journal entry. According to the double-entry Bookkeeping standards, each journal entry involves a credit entry to one or more accounts and a debit entry to one or more accounts for the same amount. Perfect entry results in correct and accurate financial information for the company’s shareholders, analysts, etc. As such, journal entries are the heart and soul of a company’s accounting system.

Examples of Journal Entries in Accounting

Given below are the examples of Journal Entries in Accounting:

Example #1

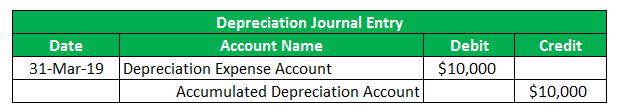

Let us take the example of SAF Ltd, which purchased the equipment at the beginning of the financial year 2019, i.e. April 01, 2018, and is worth $150,000. As per the equipment’s user manual, its useful life is 15 years, and beyond that, it is worthless. You have to show the journal entry for the depreciation expense recorded at the end of the financial year, i.e. March 31, 2019.

For ease of calculation, the depreciation expense has been assumed to be charged on the straight-line method. Therefore, the calculation for yearly depreciation expenses is as follows:

Solution:

Depreciation Expense = (Purchase Value – Salvage value) / Useful Life

- Depreciation Expense= ($150,000 – $0) / 15

- Depreciation Expense= $10,000

Here, let’s consider the following golden rule of accounting.

- Debit Depreciation Expense Account

- Credit Accumulated Depreciation Account

Journal Entry for the Depreciation Expense:

Now, the recording of the journal entry is as follows,

Example #2

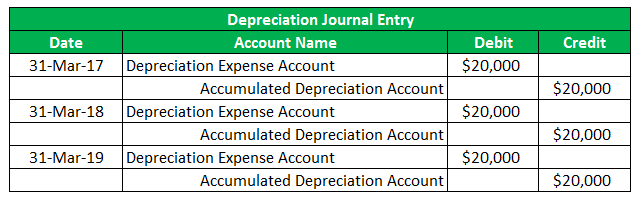

Take another example of ABC Ltd, which produces ice cream and recently bought production equipment. You have to calculate the depreciation expense charged during the life of the equipment and capture the journal entry in the respective financial statements.

Use the following facts:

- On April 01, 2016, ABC Ltd purchased production equipment worth $60,000.

- The equipment has an estimated useful life of 3 years.

- The company will dispose of the equipment at the end of 3 years.

- The company will follow the straight-line method of depreciation.

Therefore, to calculate the yearly depreciation charge, we will use the straight-line method:

Solution:

Depreciation Expense = (Purchase Value – Salvage value) / Useful Life

- Depreciation Expense = ($60,000 – $0) / 3

- Depreciation Expense = $20,000

Journal Entry for the Depreciation Expense:

Now, the journal entry for the depreciation expense for the financial years 2017, 2018, and 2019 is shown below:

Example #3

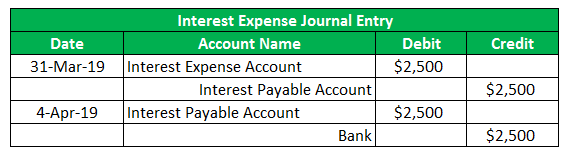

Let us take the example of PQR Ltd, which has to pay interest on the outstanding loan of $500,000 for the month of March 2019 on 4th April 2019. The effective rate of interest being charged is 0.5% per month. Calculate the interest to be paid and record the journal entry for the transaction, given that PQR Ltd reports the year ending as of March 31 of every year.

According to the matching concept, PQR Ltd will record the interest expense of $2,500 (= 0.5% * $500,000) in the financial statements for the year ending on 31st March 2019. However, the interest will be paid in the following month, which means the next accounting period. Therefore, the accounting will again be reversed in the following month on the day of payment of the interest, i.e. 4th April 2019.

Solution:

Journal Entry for the Interest Expense:

Now, the below data is the journal entry for the interest expense.

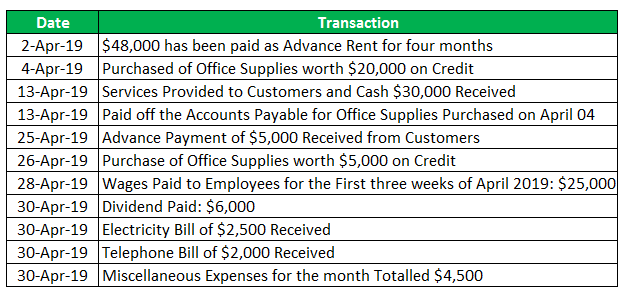

Example #4

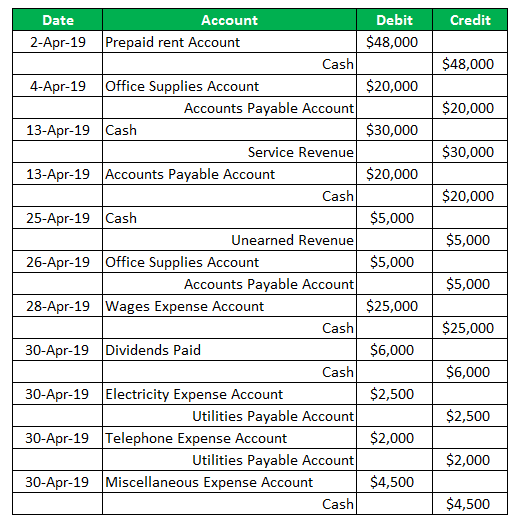

Let’s take the below-updated data of the company SDE Ltd.

The following are the transactions records during its first month (April 2019) of operations:

Solution:

The journal entry for SDE Ltd for the month of April 2019.

Conclusion – Journal Examples

The journal entry is a very important concept to understand from the accounting and financial reporting perspective because any mismatch in the financial statements eventually boils down to the journal entries. So, accountants must lay greater emphasis on the preparation of journals.

Recommended Articles

This article is a guide to Journal Examples. Here we discuss the top 4 examples of journal entries in accounting used by business enterprises. You may also have a look at the following articles to learn more –