Updated July 29, 2023

Difference Between Issued Shares vs Outstanding Shares

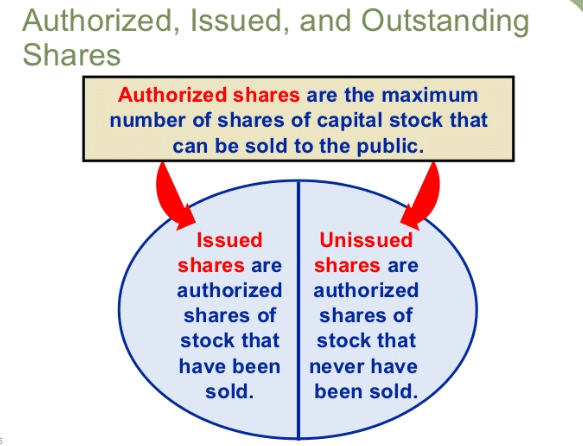

Issued Share Capital ut of Authorised share capital, the shares the company is issuing to the public for raising funds are termed Issued share capital. These shares will be issued to the public and listed on the exchange for an easy buy-sell of the said shares in the market. Outstanding Share Capital out of Authorised share capital, the shares the company has not issued to the public and are kept as a buffer by the company are termed outstanding share capital. During the lifetime, the company can again issue outstanding shares to the public and can convert outstanding shares to Issued share capital.

Share capital is equivalent to the importance of electricity in the house. It’s the lifeline for the company. Any activity, operations, decisions, strategy, vision, and mission of the company are highly dependent on the availability of the share capital with the company. The share capital is the unit of the company’s ownership obtained instead of monetary payment or performing any specific obligation. The share capital is the main source of money for the company’s operations. In India, Share capital needed to be maintained under the statutory provisions of the Companies Act, and any non-compliance with the same will result in a penalty or imprisonment, or both. Also, SEBI has its own prescribed guidelines to control the movement and trading of the capital of the companies whose shares are listed on the stock exchange.

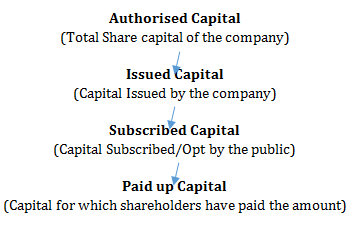

As per the Companies Act, the Share capital can be either equity or can be with some preference. The structure of both share capital is the same; the only difference is that preference share capital will always have preference over common equity share capital and will have some additional statutory requirements that corporates must follow. To raise share capital, there are various procedures that every company has to follow. By way of Initial Public Offering (IPO), companies are raising their funds to carry out the company’s operations. The said capital can be raised only up to the authorized share capital, which means the monetary amount up to which the company can raise funds from the public in the form of capital during its life. Also, during an IPO, companies have the option to either call complete authorized share capital or call a partial amount.

So, the process of any share capital will be as given below:

Let’s take an example to understand the same:

An Ltd has an authorized share capital of 10 lakhs of Rs 10 each. An Ltd goes for the public raising of the funds, in which they raise Rs 60 lakhs by issuing 6 lakh shares. Here, 6 lakh shares will be termed issued shares, and 4 lakh shares will be termed outstanding shares.

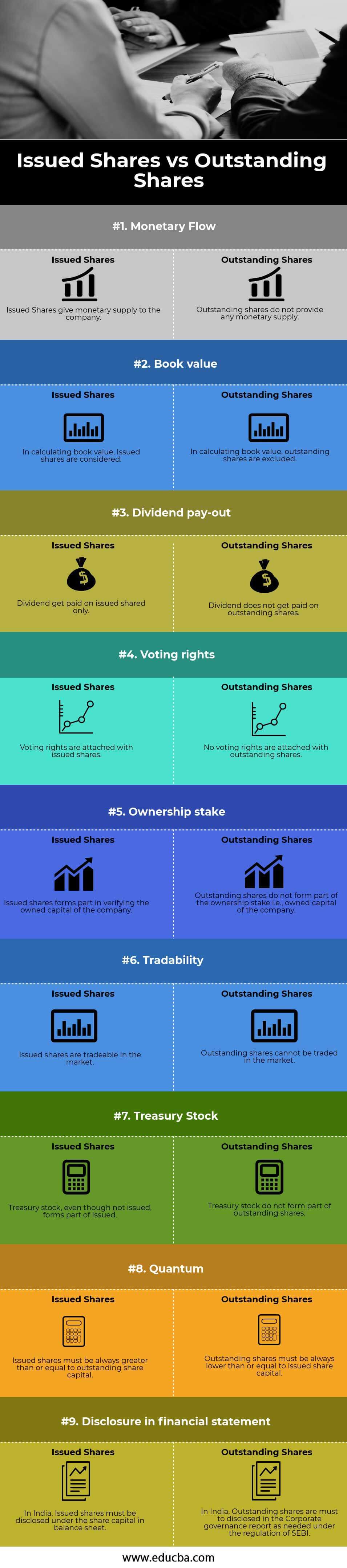

Head To Head Comparison Between Issued Shares vs Outstanding Shares (Infographics)

Below is the top 9 difference between Issued Shares vs Outstanding Shares:

Key Differences Between Issued Shares vs Outstanding Shares

Let us discuss some of the major differences between Issued Shares vs Outstanding Shares:

- Issued shares give a monetary benefit to the company, while outstanding shares do not give any monetary benefit to the company.

- Issued shares form part of the calculation in determining the company’s book value; however, outstanding shares are excluded from the calculation.

- A dividend is always paid on the issued shares; however, outstanding shares are not authorized to receive a dividend.

- Issued shares have the right to vote in general meetings, while outstanding shares can vote.

- Issued shares give the privilege of ownership, while outstanding shares do not give ownership to anyone.

- Issued shares can be easily bought and sell from the stock exchange, while outstanding shares are not tradable.

- Treasury stock forms part of issued shares, while outstanding excludes the same. However, when a company sells the treasury shares, it will form part of the outstanding shares.

- In the financial statement, issued shares will form part of the share capital under the authorized share capital. In contrast, outstanding shares will be disclosed as a part of the corporate governance report.

Issued Shares vs Outstanding Shares Comparison Table

Look at the top 9 Comparisons between Issued Shares vs Outstanding Shares.

| Basis Of Comparison |

Issued Shares |

Outstanding Shares |

| Monetary Flow | Issued Shares give monetary supply to the company. | Outstanding shares do not provide any monetary supply. |

| Book Value | In calculating book value, Issued shares are considered. | In calculating book value, outstanding shares are excluded. |

| Dividend Payout | Dividend gets paid on issued shared only. | A dividend does not get paid on outstanding shares. |

| Voting Rights | Voting rights are attached with issued shares. | No voting rights are attached to outstanding shares. |

| Ownership Stake | Issued shares form part in verifying the owned capital of the company. | Outstanding shares do not form part of the ownership stake, i.e., owned capital of the company. |

| Tradability | Issued shares are tradeable in the market. | Outstanding shares cannot be traded in the market. |

| Treasury Stock | Treasury stock, even though not issued, forms part of Issued shares. | Treasury stock does not form part of outstanding shares. |

| Quantum | Issued shares must always be greater than or equal to outstanding share capital. | Outstanding shares must always be lower than or equal to issued share capital. |

| Disclosure in financial statement | In India, companies must disclose issued shares under the share capital in the balance sheet. | In India, companies are required to disclose outstanding shares in the Corporate Governance report as per the regulations of SEBI. |

Conclusion

As an investor, understanding the difference between Issued Shares vs Outstanding Shares will help them accurately calculate financial ratios. Otherwise, they will result in inflating gains, with which they may offset a realized loss. Financial investors should properly understand underlying terms to make correct decisions from their investment perspective, which will help them earn realistically and realize a high profit.

Recommended Articles

This has guided the top difference between Issued Shares and Outstanding Shares. Here we also discuss the Issued Shares vs Outstanding Shares key differences with infographics and a comparison. You may also have a look at the following articles to learn more.