Updated June 2, 2023

IRR Function in Excel (Table of Contents)

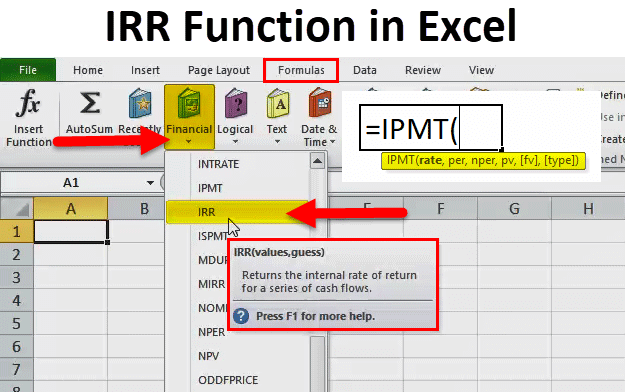

IRR Function in Excel

IRR stands for Internal Rate of Return, which is categorized under the Financial section of Insert Function in Excel. In any investment, IRR calculates what would be the rate of return for a series of cash flow whether that cash flow is inward or outward. To understand better, if we receive some money in 10 different transactions in any or different amounts, then with the help of IRR we can find what would be the internal rate of interest applicable on received amount in multiple transactions.

IRR Formula in Excel:

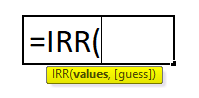

Below is the IRR Formula in Excel :

Explanation of IRR Function in Excel

IRR Function in Excel consists of two things one is VALUES & GUESS.

- VALUES: This is a targeted range of your cash outflows and inflows. The range consists of initial investment and a series of cash inflows (it could be positive or negative).

- GUESS: It is a guessed number by the user, close to the anticipated nearest return. If you ignore this optional argument, the function will take the default value as 0.1, i.e. 10%. If at all IRR gives the #NUM error result, you need to change the value for ages.

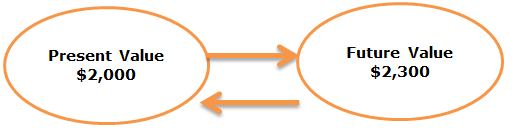

Example: You can get 15% PA interest on your $2,000. So $2,000 earns $300 in one year ($2,000*15% = $300). Your $2,000 is worth $2,300 in one year. Simply put, $2,300 next year is worth only $2,000 now, or the present value of $2,300 next year is $2,000.

How to Use the IRR Function in Excel?

IRR Function in Excel is very simple and easy to use. Let us understand the working of the IRR Function in Excel by some IRR Formula examples. IRR function can be used as a worksheet function.

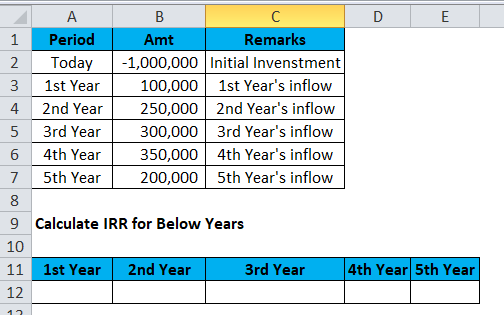

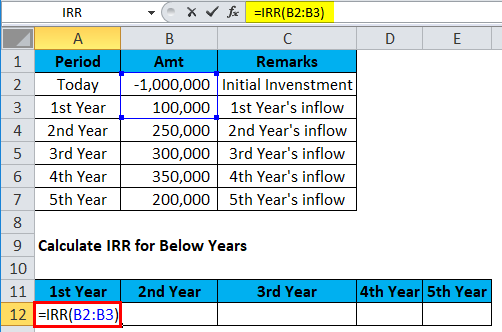

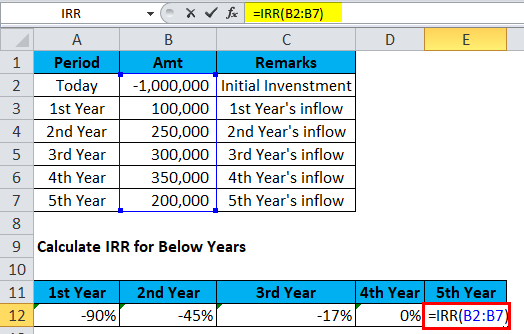

Example #1

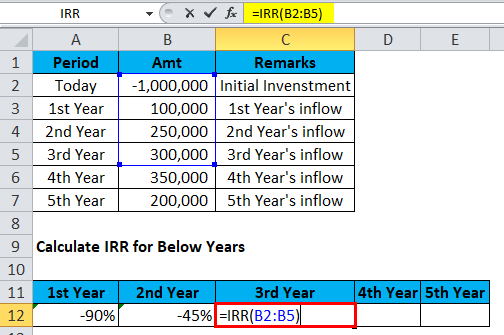

In this IRR Function in Excel example, let us consider the below table for our illustration; Mr. X started his project with an initial investment of Rs. 10,00,000/- and the First 5 years cash inflow is 1 lakh, 2.5 Lakhs, 3 Lakhs, 3.5 Lakhs, and 2 Lakhs respectively. So now, calculate IRR for this investment made by Mr. X.

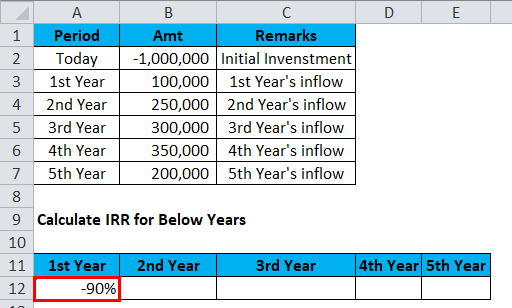

For 1st year’s IRR is -90%. That means Mr. X has recovered 10% of his investment by the end of the first year.

So the result would be :

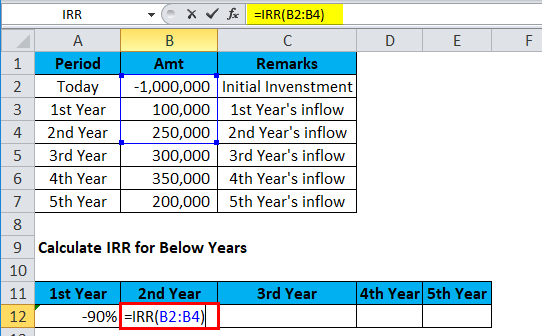

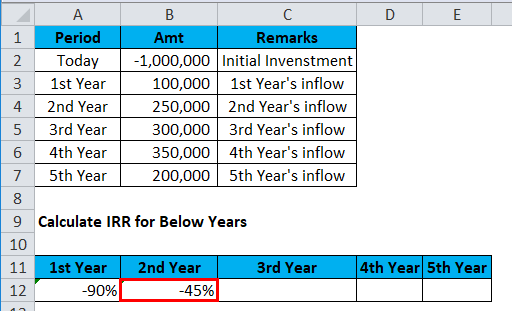

For 2nd year’s IRR is -45%. That means Mr. X has recovered 35% of his investment by the end of the second year. While applying the formula, you must select Initial Investment + First Year Inflow + Second Year Inflow.

Result is :

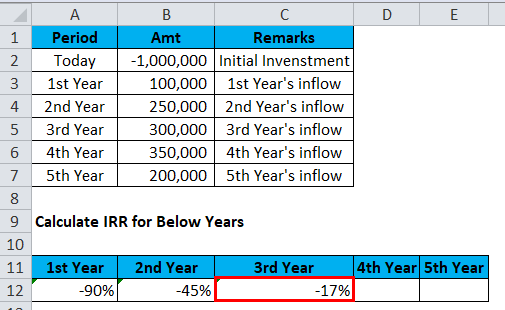

For 3rd year’s IRR is -17%. That means Mr. X has recovered 83% of his investment by the end of the third year. While applying the formula, you must select Initial Investment + First Year Inflow + Second Year Inflow + Third Year Inflow.

Result is :

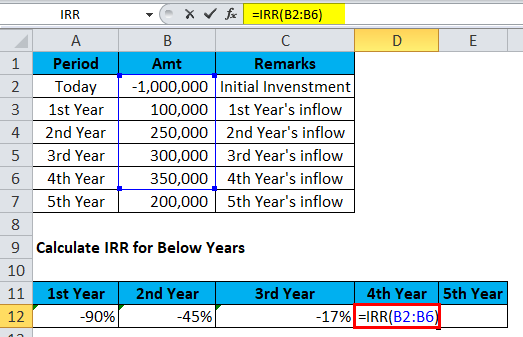

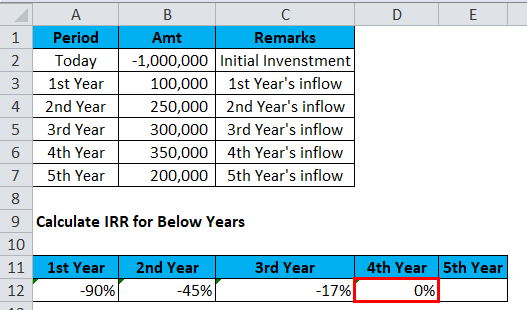

For the 4th year, while applying the formula, you must select Initial Investment + First Year Inflow + Second Year Inflow + Third Year Inflow + Fourth Year. That will give you an IRR of 0.00%. So, Mr. X recovered his entire investment by the end of the 4th year.

So the result will be :

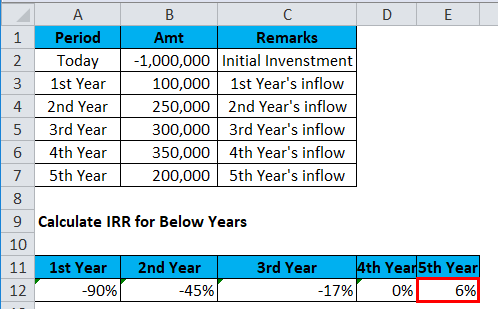

For a 5th year, while applying the formula, you must select Initial Investment + First Year Inflow + Second Year Inflow + Third Year Inflow + Fourth Year + Fifth Year Inflow. That will give you an IRR of 6%. So Mr. X has gained 6% ROI from this project.

The result will be:

MR x will decide to gain 6% from this project for 5 years. Is it worth an investment? Of course, it is not worth it, so Mr. X can now look for other portfolios to invest his money to make a better IRR.

Example #2

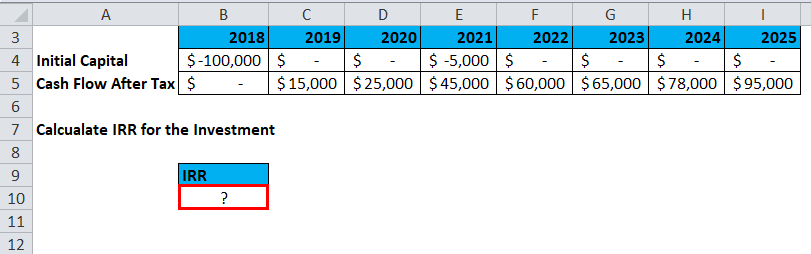

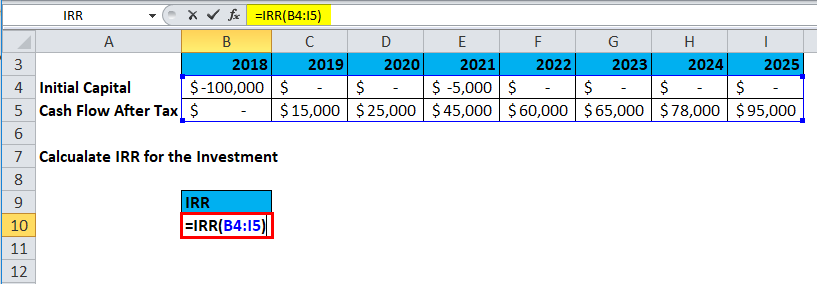

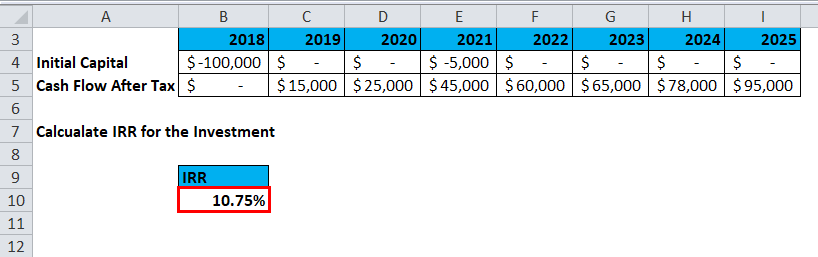

In this IRR Function in Excel example, Mr. Karanth has an investment of 1 lakh USD today, and he wants to invest in one of the projects below table is the information on Outflows and Inflows.

If you look at the table, the investment is for 7 years, the initial outflow is $1,00,000, and in the 3rd year, he introduced an additional capital of $5,000. Now calculate the Internal Rate of Return from this investment.

IRR from this investment is 10.75%.

ERROR HANDLING

Below are certain things you need to look into before applying the IRR formula in Excel.

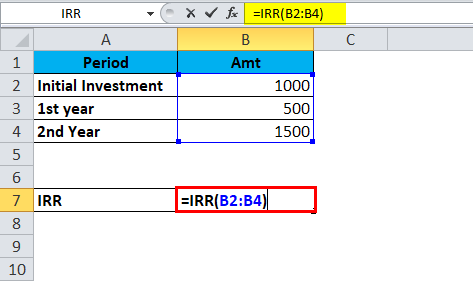

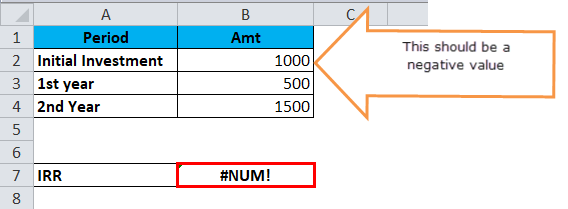

- If the initial outflow value is not shown as negative, Excel will recognize it, as there is no investment for this project.

We will get a #NUM error.

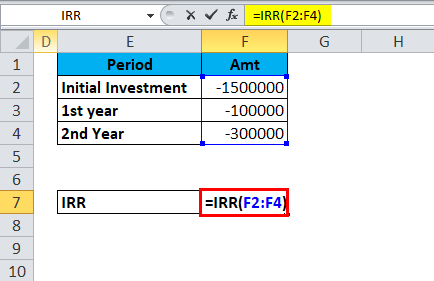

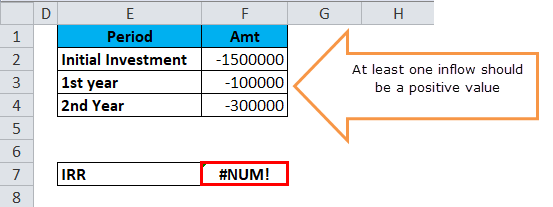

- If all the values are negative, Excel thinks this project has no inflow or income.

We will get a #NUM error.

Relevance and Uses

IRR function is a measure used in financial modeling to estimate the profitability of the investment. In simple terms, it is the rate of return on your investment. You can think of IRR as the growth a project is expected to generate.

IRR function is a financial function and is very useful in financial modeling. Corporate people often use it to compare and decide between capital projects.

Things to Remember

- So to get an accurate result range, numbers must have a minimum of one negative and one positive value.

- For syntax [GUESS], Excel will treat it as 0.1, equal to 10%, if the user does not provide the value by default.

- IRR is always dependent on Net Present Value (NPV). A rate of return given by the IRR function is the return rate equivalent to a zero NPV.

- It does not always equal the annual compound rate of return on an initial investment.

Recommended Articles

This has been a guide to IRR in Excel. Here we discuss the IRR Formula in Excel, how to use IRR Function in Excel, practical examples, and a downloadable Excel template. You can also go through our other suggested articles –