Updated July 27, 2023

Interest Formula (Table of Contents)

What is the Interest Formula?

This article will discuss the Interest Formula, the Introduction, and various Examples of Simple Interest and Compound Interest.

The term “interest” may refer to the income earned by the lender or the expense incurred by the borrower. Nevertheless, it is the amount the borrower must pay the lender as a percentage of the loan amount.

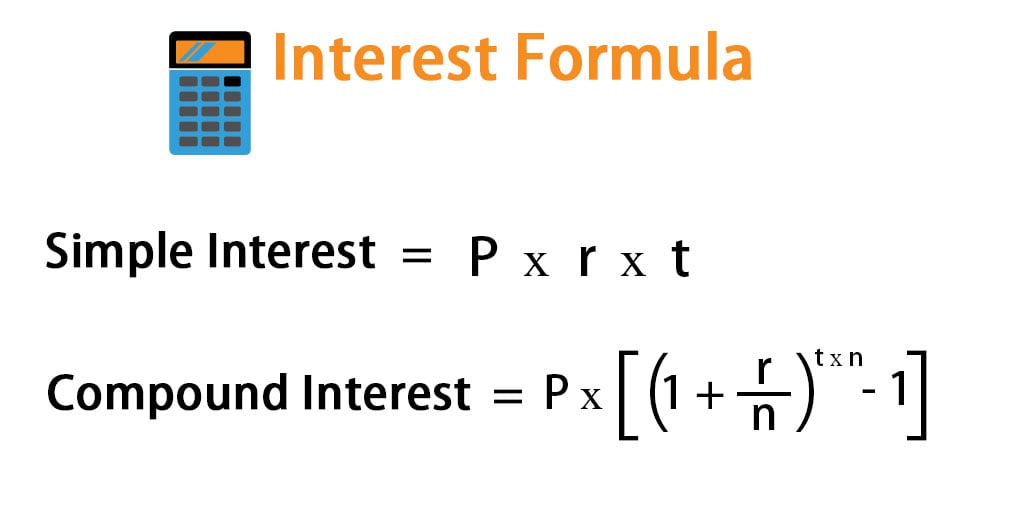

We can derive the formula for simple interest by multiplying the outstanding loan amount, interest rate, and loan tenure.

Formula For Simple Interest is represented as,

where

- P = Outstanding Loan Amount

- r = Interest Rate

- t = Tenure of Loan.

We can derive the formula for compound interest by considering the outstanding loan amount, interest rate, loan tenure, and the number of compounding periods per year.

The formula For Compound Interest is represented as s,

where

- P = Outstanding Loan Amount

- r = Interest Rate

- t = Tenure of Loan

- n = Number of Compounding Per Year

Examples of Interest Formula (With Excel TeLet’se)

Let’s take an example to understand the calculation of interest in a better manner.

[wbcr_sni “pet id” “167600”]Example #1

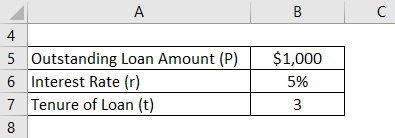

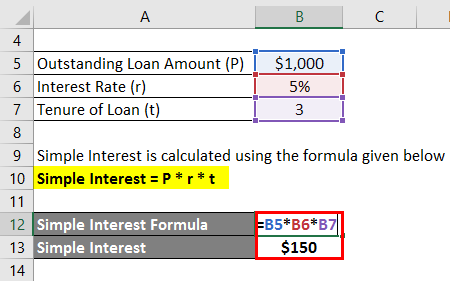

Let us take a simple example of $1,000 borrowed by Travis from his friend Tony. Travis promised to pay a simple interest of 5% for three years, and then he will repay the loan to Tony. First, calculate the interest to be incurred by Travis.

Solution:

The formula for calculating simple interest is as follows:

Simple Interest = P * r * t

- Simple Interest = $1,000 * 5% * 3

- Simple Interest = $150

Therefore, Travis will incur an interest expense of $150 during the loan tenure.

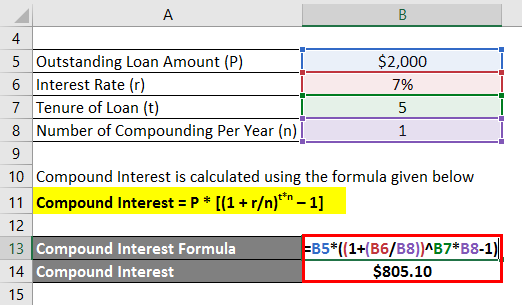

Example #2

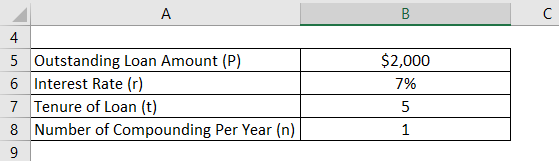

Let us take the example of Dennis, who borrowed $2,000 from the bank. The bank charged interest at the rate of 7% compounded annually. The loan is for a period of 5 years. Calculate the interest expense to be incurred by Dennis.

Solution:

We calculate compound interest using the formula provided below:

Compound Interest = P * [(1 + r/n)t*n – 1]

- Compound Interest = $2,000 * [(1 + 7%/1)5*1 – 1]

- Compound Interest = $805.10

Therefore, Dennis will incur an interest expense of $805 during the loan tenure.

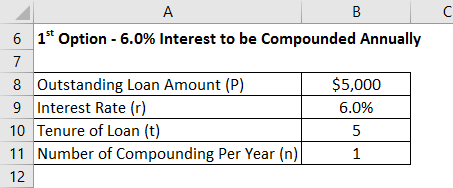

Example #3

Let us take another example to understand the difference between simple interest and compound interest. Monty has decided to start a small hatchery for which is planning to borrow a sum of $5,000 for 5 years. The lender has offered two options-

- 6.0% interest to be compounded annually

- 6.5% simple interest rate.

Help Monty to decide which is a cheaper option for him.

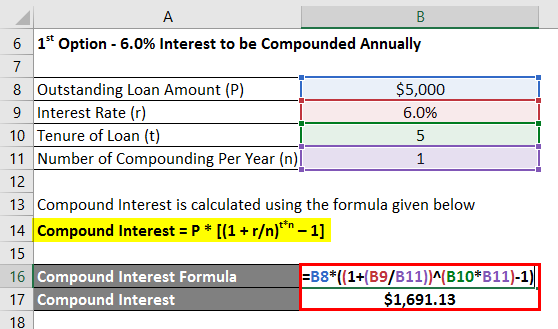

1st option

The formula for calculating compound interest is as follows:

Compound Interest = P * [(1 + r/n)t*n – 1]

- Compound Interest = $5,000 * [(1 + 6%/1)5*1 – 1]

- Compound Interest = $1,691.13

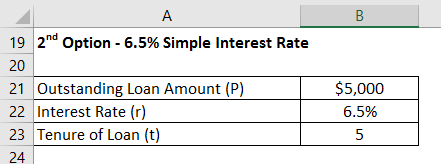

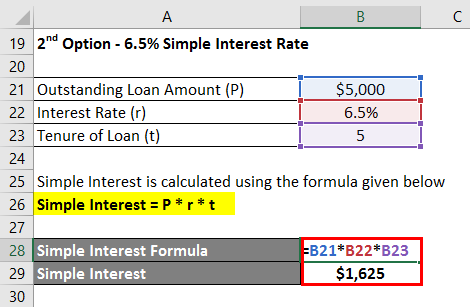

2nd option

We calculate simple interest using the formula provided below:

Simple Interest = P * r * t

- Simple Interest = $5,000 * 6.5% * 5

- Simple Interest = $1,625

Therefore, the 2nd option is cheaper despite higher interest rates because the 1st option is more expensive due to annual compounding.

Explanation

Following are the steps to calculate Simple Interest:

Step 1: Firstly, determine the outstanding loan amount extended to the borrower, denoted by ‘P.’

Step 2: Next, determine the interest rate to be paid by the borrower, which is denoted by ‘r.’

Step 3: Next, determine the tenure of the loan or the period for which the loan has been extended. The tenure of the loan is denoted by ‘t.’

Step 4: Finally, the formula for simple interest can be derived as a product of the outstanding loan amount (step 1), interest rate (step 2), and tenure of the loan (step 3), as shown below.

Simple Interest = P * t * r.

Following are the steps to calculate Compound Interest:

Step 1: Firstly, determine the outstanding loan amount extended to the borrower, denoted by ‘P.’

Step 2: Next, determine the interest rate to be paid by the borrower, which is denoted by ‘r.’

Step 3: Next, determine the tenure of the loan or the period for which the loan has been extended. The tenure of the loan is denoted by ‘t.’

Step 4: Next, determine the number of compounding done per year, denoted’ by ‘n.’

Step 5: Next, calculate the amount at the end of the loan tenure based on the outstanding loan amount (step 1), interest rate (step 2), tenure of the loan (step 3), and the number of compounding per year (step 4) as shown below.

A = P * (1 + r/n)t*n

Step 6: To derive the formula for compound interest, you subtract the initial outstanding loan amount from the amount calculated at the end of the loan tenure in the previous step.

Compound Interest = A – P

- Compound Interest = P * (1 + r/n)t*n – P

- Compound Interest = P * [(1 + r/n)t*n – 1]

Relevance and Uses of Interest Formula

Analysts and accountants attach great importance to the concept of interest expense as it serves as a crucial tool for managing the financial performance of companies. Interest calculation helps the companies recognize the financial expense incurred over the entire loan tenure.

Interest Formula Calculator

You can use the following interest Formula Calculator

[wbcr_sni “pet id” “135739”]Recommended Articles

This is a guide to Interest Formula. Here we have discussed how to calculate the Interest Formula along with practical examples. We also provide an Interest calculator with a downloadable Excel template. You may also look at the following articles to learn more –