Insurance Claim Meaning

An insurance claim is a request to avail the insured support from the insurance company for the damage/loss of the object insured under the policy. For example, a fire in Oklahoma on 27 October 2022 damaged approximately 256,629 acres of land. The agricultural landowners then sued the insurance companies to cover their damages.

People who purchase a home, life, health, or auto insurance make regular payments to insurers known as premiums. When an incident causes financial damage, such as a car accident, workplace accident, etc., the insured files the claim and receives benefits from the company.

Key Highlights

- An insurance claim is the invocation of an insurance policy when the policyholder suffers damage or loss and needs reimbursement

- The process of filing a claim depends on whether it’s a third-party, first-party, or a life cover policy

- These insurance policies cover life, health, property, and other claims

- Addressing financial needs helps people get back on their feet after unfortunate circumstances. However, the process can be complicated, and sometimes insurers do not adhere to policies.

How Does an Insurance Claim Work?

- To claim insurance, report the loss to the insurance company within a reasonable time.

- Always mention critical details like time and reason; adding proof can be beneficial. For instance, if claiming medical care, one can add a doctor’s report

- People can make claims by phone or email, but a detailed written form can make things smooth

- After receiving the claim, the insurance agency conducts its assessment of the circumstances to decide whether to approve the claim or not

- For various reasons, the insurance company may deny some insurance claims. Like, if the premiums are unpaid, the policy doesn’t cover the specific loss and more

- The insured gets the specified policy’s benefits if the request is approved.

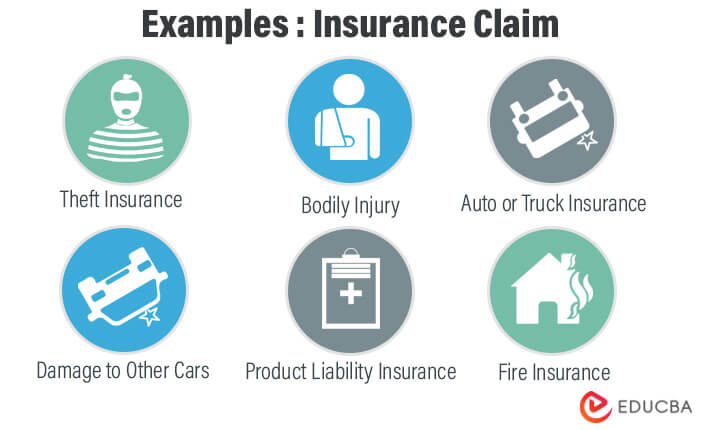

Insurance Claim Examples

Example 1

A FedEx employee, Jennifer Harris, registered an unfair treatment claim against FedEx for racial bias. As it is an immaterial loss and damage to her moral integrity, the company had to pay her $366 million. Although FedEx is appealing against the allegation, it isn’t likely to win the case.

Example 2

A resident buys a home and buys a homeowner’s insurance policy. After a few years, they face damage to their home due to floods in the city. They have a homeowners policy, so they raise a claim with their agency and receive the necessary assistance.

Types of Insurance Claims

Individual Insurance

- Life insurance provides financial security to beneficiaries (family) in the event of the insured’s death

- Disability insurance provides services and assistance for a personal injury or disability as a result of an accident

- Health insurance provides medical coverage as well as a capital benefit or reimbursement of medical expenses

- Dependency insurance covers clients with a physical or mental limitation that necessitates the assistance of another person.

Property or Liability Insurance

- Car insurance covers the risks that can occur while driving, which is necessary by law. Additionally, it includes coverage against theft, fire, and vehicle damage

- Credit insurance protects against losses caused by debtor insolvency

- Transport insurance provides coverage for material damage to goods during transportation

- Fire insurance protects if an insured object catches fire

- Civil liability insurance compensates the third party when the insured is held liable for the caused damages.

Insurance for the Provision of Services

- Travel assistance insurance covers unforeseen events during a trip

- Death insurance pays for the insured’s funeral expenses as well as the procedures and procedures after the death

- Legal expenses insurance covers legal and non-legal assistance services.

Process of Insurance Claim

Disclosure to the Insurer

- The first step in claiming damages is to disclose the incident to your insurer as soon as possible

- It should be immediately after a person encounters an unfortunate event such as death, property loss, vehicle damage, etc.

Inquiry

- After contacting the insurance company, one has to provide information about the incident, including where it took place, the date, what happened, and the injuries

- They may also ask for receipts or photos of your vehicle if applicable.

Coverage Decision

- As the insurance company receives the claim, they start an inquiry to decide the coverage

- They evaluate the policy and the suit and analyze how much coverage they can provide.

Resolution

- In the end, if the insurer decides to approve the claim, the insured person will receive the benefits

- However, the company can reject the claim due to various conditions, like the incident not coming under the policy coverage, the person not paying the premiums, and more.

Importance of Insurance Claim

- Having the right coverage helps reduce the financial burden in an unfortunate time

- It provides mental relief and peace of mind to the person and their family

- They allow victims to get a settlement that gives them the compensation needed to rebuild after a tragedy

- It serves as proof that the company needs to comply with the policy.

Conclusion

Insurance claims are common because people lose their properties yearly due to natural calamities like earthquakes, floods, etc., or unnatural disasters like theft, accidents, and riots. Policyholders must have a copy of the policy while claiming benefits. The insurance company then gives the money to repair/replace damaged items or cover medical costs.

Frequently Asked Questions(FAQs)

Q1. How do I file my insurance claim?

Answer: Insurers provide a phone number to call in a claim or an online claim form. When making an insurance claim through phone, please provide them with all the requested information. However, the online forms are detailed, and you can add all the information asked.

Q2. How many times can a person claim insurance?

Answer: A person can claim insurance any number of times. The drawback is that, with increasing claims, the premium gets expensive. Also, if your claims exceed the value of your coverage, your policy will expire.

Q3. Why does filing a claim increase insurance premiums?

Answer: Insurance companies pay close attention to claims history. A higher claim history can mean that your policy carries a higher risk, which isn’t favorable for insurance companies. Therefore, the fewer times you file a claim, the less expensive your premium will be.

Q4. What are the most common insurance claims?

Answer: Small businesses’ most common insurance claims are theft and fire. Theft makes up almost 20% of the claims. On the other hand, fire is the most common cause of property damage.

Recommended Articles

This was a guide to an insurance claim. Read the following articles to learn more,