What Is a Home Warranty?

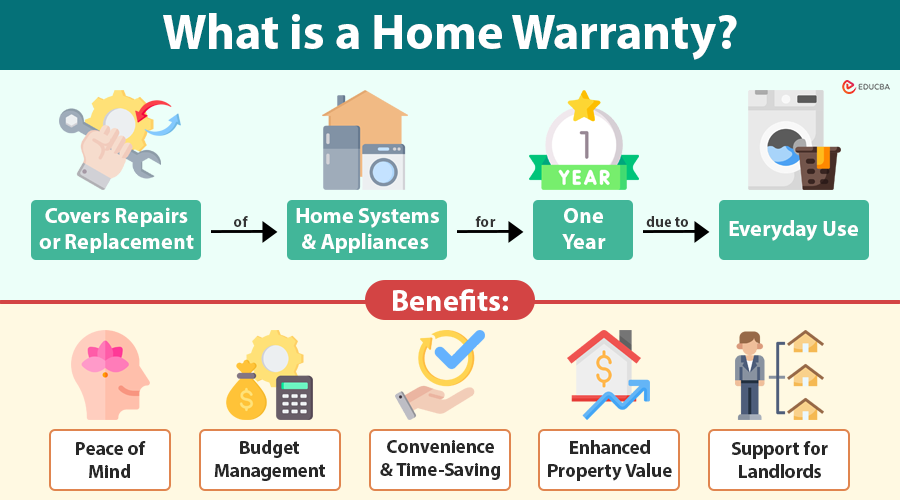

A home warranty is a one-year plan that helps pay for fixing or replacing important home systems and appliances when they malfunction due to everyday use.

For example, you move into a new house. A few months later, your washing machine starts leaking. With a home warranty, you file a claim, pay a service fee (typically $100), and a technician comes to fix or replace the item, potentially saving you hundreds.

Renewal: Most home warranties are 12-month contracts that are renewable annually. Some plans allow monthly payments, though discounts are often available if paid upfront.

Table of Contents

- What Is a Home Warranty?

- How Does a Home Warranty Work?

- What Does a Home Warranty Cover?

- What Is Not Covered?

- Benefits of a Home Warranty

- Drawbacks of a Home Warranty

- Home Warranty vs. Homeowner’s Insurance

- Who Should Buy a Home Warranty?

- How to Choose the Right Home Warranty Provider

- Top Home Warranty Providers (2025)

How Does a Home Warranty Work?

Understanding the step-by-step process can help you maximize your warranty coverage.

1. Sign Up for a Plan

You select a provider and choose a plan based on the systems/appliances you want to cover. Some plans are basic, while others are more comprehensive. Add-ons are available for special items, such as pools or sump pumps.

2. Wait for Coverage to Begin

Most providers enforce a 30-day waiting period before you can file claims, preventing you from signing up only after a breakdown occurs.

3. File a Claim

When something breaks, call the company or use their online portal to submit a service request. Many providers offer 24/7 claim submission.

4. Pay a Service Fee

You will pay a pre-set service call fee (usually $75–$125) each time a technician visits your home. This fee is per claim, not per repair task.

5. Technician Visit & Repair

The provider sends a licensed technician from their approved network. Suppose your plan covers the issue, the company repairs or replaces it at no additional cost. If it is not covered, you will be required to pay the full cost.

6. Repeat as Needed

There is typically no limit to the number of claims you can file during the contract year, although there may be dollar caps per item.

What Does a Home Warranty Cover?

Coverage depends on the provider and plan, but most plans usually include the following items.

Covered Systems

- HVAC (Heating, Ventilation & Air Conditioning): Includes thermostats, ductwork, heat pumps, and central air systems.

- Plumbing: Interior plumbing lines, water heaters, toilets, faucets, and some garbage disposals.

- Electrical: Interior wiring, circuit breakers, light switches, ceiling fans, and outlets.

Covered Appliances

- Kitchen appliances: Refrigerator, oven, range, cooktop, microwave (built-in), dishwasher.

- Laundry appliances: Washer and dryer.

- Other items: Garage door openers, exhaust fans, instant hot water dispensers.

Optional Add-Ons

You can typically customize your plan to include:

- Swimming pool/spa equipment

- Roof leak repair

- Septic system

- Well pumps

- Free-standing ice makers

- Wine refrigerators

- Second refrigerator or deep freezer.

Coverage Tips

- Most plans set limits on how much they will pay per item (e.g., $2,000–$3,000).

- Replacements may not match the original brand/model.

- Home warranty providers often exclude upgrades or code compliance costs unless your plan specifically includes them.

What Is Not Covered?

Knowing exclusions helps you avoid surprises when claiming.

Common Exclusions

- Pre-existing conditions: Issues that existed before the contract start date or were known but not disclosed.

- Improper installation or modification: Most home warranty providers usually exclude DIY or non-code-compliant work from coverage.

- Neglect or lack of maintenance: Neglecting to maintain your systems (e.g., not changing HVAC filters) can cause the provider to deny your claim.

- Cosmetic damage: Scratches, dents, or noise issues that do not impact functionality.

- Non-mechanical parts: Knobs, handles, doors, or shelving inside appliances.

Also Not Covered

- Commercial-grade appliances

- Outdoor items like sprinkler systems (unless added)

- Chimneys or fireplaces

- Pest damage

- Flood-related damage (covered by home insurance).

Benefits of a Home Warranty

Home warranties offer significant value, particularly in homes with aging appliances or systems.

- Peace of mind: You do not have to worry about unexpected repair bills or finding a technician on short notice. Help is just a phone call away.

- Budget management: For a few hundred dollars annually, you protect yourself from potentially thousands of dollars in repairs. This predictability is ideal for budgeting.

- Convenience and time-saving: No more researching service providers or negotiating prices. The warranty company handles all logistics.

- Enhanced property value: Homes listed with an active home warranty attract more buyers and may even sell faster.

- Support for landlords: If you rent out your property, a warranty saves you time managing emergency maintenance calls and tenant frustrations.

Drawbacks of a Home Warranty

Homeowners should carefully weigh the potential drawbacks that come with home warranties, despite their advantages.

- Limited payouts: Many plans cap payouts per item. If your HVAC repair exceeds the cap, you will be responsible for the additional cost.

- Slow response times: Some users complain about delayed technician appointments, especially in rural areas or during holidays.

- Denied claims: Providers may deny claims due to vague or unclear contract language, leading to frustration and out-of-pocket expenses.

- Lack of technician choice: If you have a preferred contractor, most warranty companies will not allow you to use them unless pre-approved.

- Not ideal for new homes: If your systems are new and covered under manufacturer or builder warranties, paying for an additional plan might be unnecessary.

Home Warranty vs. Homeowner’s Insurance

Here is how the two differ—and why they complement, not replace, each other:

| Feature | Home Warranty | Homeowner’s Insurance |

| Covers | Mechanical failure due to wear & tear | Damage from fire, theft, storms, vandalism |

| Example Claim | Broken water heater or dishwasher | Roof damaged by hailstorm |

| Cost | $300–$700/year + $75–$125 per claim | $1,000+/year + deductible |

| Required by Lender | No | Yes (almost always) |

| Ideal For | Internal systems/appliances | Structure and liability protection |

Who Should Buy a Home Warranty?

- First-time buyers: If you are a first-time homeowner, a warranty provides added protection as you become accustomed to maintaining your home.

- Owners of older homes: With older systems and appliances, the likelihood of failure is higher, making a warranty a worthwhile investment.

- Landlords and property investors: Save time and reduce tenant complaints by outsourcing repair requests.

- Home sellers: Offering a home warranty can enhance buyer confidence and help close deals more quickly.

- Senior citizens: Elderly homeowners often appreciate the convenience of having repairs handled without hassle.

How to Choose the Right Home Warranty Provider

Choosing a reputable, customer-focused provider is crucial for obtaining value.

- Check reputation: Read reviews on BBB, Yelp, and Consumer Affairs. Look for consistency in claim handling and response times.

- Read the fine print: Look for exclusions, payout caps, service limits, and coverage waiting periods. Some plans are more restrictive than others.

- Compare coverage: Ensure the plan aligns with your home’s setup, especially if you have additional features such as second refrigerators, pools, or septic tanks.

- Evaluate pricing: Balance the annual premium, service fee, and maximum payout caps to find the best long-term value.

- Test customer service: Contact the provider’s hotline or use the website chat feature before signing up to assess their responsiveness.

Top Home Warranty Providers (2025)

| Provider | Best For | Key Features | Coverage Options |

| American Home Shield | Custom plans & older homes | Flexible coverage, optional add-ons | Systems, appliances, combos |

| Choice Home Warranty | Broad coverage at good price | Affordable, simple plans | Basic & total plans |

| Liberty Home Guard | Customer service & customization | 40+ add-ons, A+ BBB rating | Highly customizable |

| Select Home Warranty | Budget-conscious users | Free roof coverage, low premiums | Systems, appliances, roof leaks |

| First American | Appliance-heavy homes | Strong appliance coverage, optional upgrades | Systems, appliances |

| Cinch Home Services | Fast digital claims | Quick service, online tools | Appliances, systems, optional extras |

| AFC Home Club | Long repair guarantees | Choose your technician, lifetime work guarantee | Combo, systems, appliances |

Final Thoughts

A home warranty is not a magic solution, but it can serve as a valuable financial and logistical buffer against the many unknowns of homeownership. Whether you are trying to keep maintenance costs low or want peace of mind, a home warranty can make homeownership more manageable and less stressful, especially in older homes or when you are too busy to handle repairs yourself.

Frequently Asked Questions (FAQs)

Q1: Do home warranties cover accidental damage?

Answer: No. They cover wear and tear, but not accidental damage, flooding, or fire (which are typically covered by insurance).

Q2: Can I choose my contractor?

Answer: Generally, no. Providers have approved technician networks. However, some companies may reimburse you if you use your technician with prior approval.

Q3: Are home warranties transferable?

Answer: Yes. If you sell your home, the warranty can often be transferred to the buyer, sometimes at no extra cost.

Q4: What if an appliance is too old?

Answer: Age usually does not matter, as long as the item is in working condition when coverage begins.

Q5: Can I cancel my plan?

Answer: Yes. Most companies allow cancellations within 30 days for a full refund. After that, a prorated refund (minus fees) is typical.

Please let me know if you would like a concise version, a comparison table infographic, or a downloadable checklist for home warranty buyers.

Recommended Articles

We hope this comprehensive guide to Home Warranties has helped you understand how they work and how they can protect your household budget from unexpected repairs. Explore these recommended articles to learn more about home insurance, maintenance strategies, and tips for first-time homeowners.