Updated October 26, 2023

ETFs Vs Index Funds – A mutual fund is a basket of stocks, bonds, or other assets professionally managed by an investment company. For operating resources, the fund charges a fee. We select the Holdings by portfolio managers who pick stocks poised to perform the best and leave the rest. But if active management is not your cup of tea, index funds could be the right choice. Is the distinction between exchange-traded funds and Index Mutual Funds a mere storm in a teacup? Or are these two types of funds poles apart? Let us explore the fascinating world of index funds and find out.

The Article on ETFs Vs Index Funds is Structured Below

- Index Fund: Chasing the Market

- Exchange-Traded Funds: The Traditional Route

- ETFs Vs Index Funds: The Trade-Off For Investing

- The Cost Factor: Where Exchange Traded Funds Score over Index MF

- Mutual Fund or Index ETF? The Many Differences

- Conclusion- ETFs vs Index Funds

Index Fund: Chasing the Market

An index fund has a very different strategy from the traditional mutual fund operation method. Rather than picking and choosing stocks in a lookout to beat the market, an index fund purchases all shares, making up an index to replicate the performance of a complete market. So, why would anyone want to settle for average returns when they can ride the storm and win the trading game? Quite simply because index funds are cheap to operate and buy and hold rather than trading frequently- a strategy that suits many people. Research shows that higher expenditure linked to actively managed mutual funds makes index funds attractive.

Winning stocks may beat the market, but index funds provide stable returns- which is increasingly important if you want to avoid testing the waters but sail smoothly. Studies also show active funds do not deliver good returns compared to index funds. In a survey, S&P Dow Jones has found that over 10 years, lower than 20 percent of actively managed funds beat the S&P 500 index!

Exchange-Traded Funds: The Traditional Route

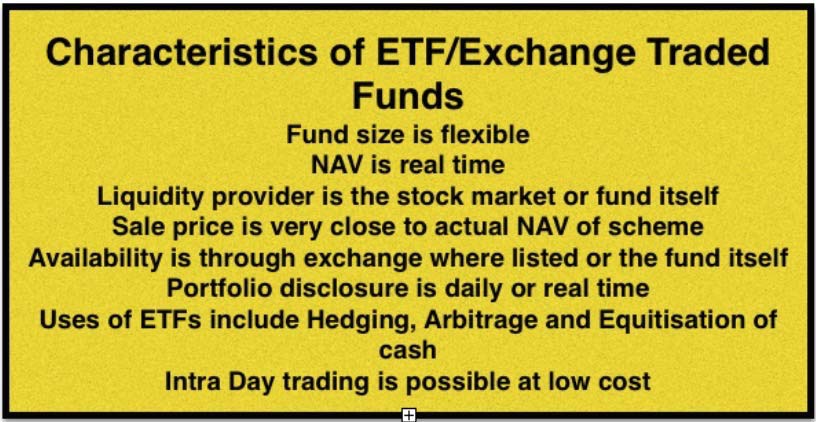

There are two types of index funds- ETFs or exchange-traded funds and index mutual funds. Fund companies list ETFs on the exchange but not on the market(hence the name), and buyers or sellers of shares must own brokerage accounts to trade in these. With an MF, buyers and sellers undertake transactions directly with the fund company.

The best things in life are not free if you invest in exchange-traded funds because you pay a brokerage commission whenever you make a purchase or sale. For small investors, traditional index mutual funds are less costly. But for every market risk, there is a reward, which also holds for ETFs. As they are exchange-traded, such shares can be traded at any hour of the day, which is why ETF shares are popular among investors. Exchange-traded funds have been one of the most rapidly growing segments of the funds business. ETFs trade like stocks and offer flexibility not available in the case of traditional mutual funds.

Investors can trade ETFs throughout the day against conventional index mutual funds. Investors can only purchase units at the NAV or Net Asset Value of the fund published each time toward the end of the trading day. Exchange-traded funds are quickly tradable, offering an undeniable advantage- the risk of the price differential between the time of trade and that of investment is much lower in the case of ETFs. ETFs also need more tracking errors than traditional index funds because of in-kind or creation and redemption facility and lower expense ratio. Long-term investors can avoid suffering on account of short-term investor activity.

ETFs Vs Index Funds: The Trade-Off For Investing

Image source: pixabay.comIndex investors are not necessarily partial to exchange-traded funds as an investment vehicle. This type of fund offers serious cost, size, and time horizon advantages. This is because index funds place retail index investors on the road to success. Moreover, ETFs have existed since the 1990s, while the first index MF was introduced in the 1970s. So why do ETFs still prevail in the clash of the trading Titans?

Exchange-traded funds are flexible investment vehicles and appeal to a wide segment of investors, whether their trading strategy is passive or active. Passive institutional investors prefer ETFs for their flexibility. Active traders prefer it for their convenience. In contrast, passive retail investors choose index funds for their simplicity.

ETFs can be purchased in lower volumes and don’t need separate accounts or documents, another point of contrast. They are also associated with no rollover costs or margins. ETFs also have a wider scope of coverage in that they cover benchmarks where no futures contracts exist. Active hedge fund traders prefer ETFs over indexes because they are exempt from the short sale uptick rule applicable to regular stocks.

The Cost Factor: Where Exchange Traded Funds Score over Index MF

Exchange-traded and index funds have particular costs and payoffs regarding expenses associated with index tracking and trading. Costs incurred in tracking index fall into three basic categories:

- Daily net redemptions

- Cash Drag

- Dividend Policy

Daily net redemptions: The Balancing Act

Image source: pixabay.comExchange-traded funds eliminate the need for this balancing act through a process called creation/redemption in kind. Decoded, this means ETF shares can be created and redeemed with a basket of similar securities. These redemptions result in direct costs in the form of commissions and implicit fees for bid-ask spreads on fund trades concerning index funds.

Cash drag refers to the cost of holding cash to trade for handling potential daily net redemptions for index funds. ETFs do not incur this cash drag because of their unique redemption process.

Dividend policy is the only cost factor where index funds prevail over exchange-traded funds. Index funds will invest dividends at once. At the same time, ETF shares require cash accumulation during the quarter and their consequent distribution to shareholders concerning dividend policy.

Non-tracking costs include taxation, shareholder transaction costs, and management fees. Management fees are lower for ETFs as this fund does not engage in accounting- this is not so for index funds. Shareholder transaction costs are zero for index funds, on the other hand, unlike ETFs. Taxation of investment vehicles, Exchange Traded Funds, and index funds favor the former over the latter. In the case of index mutual funds, an obligation to sell securities results in tax events. Capital gains inherent in other funds are also not a feature of ETFs.

Index Funds: Precursors to Exchange Traded Funds

While index funds have been available since 1975, exchange-traded funds were traded in 1993. first, ETFs cover as many as 5 times the indexes.

Lack of Liquidity: A Drawback for Exchange Traded Funds

Image source: pixabay.comLess popular ETFs can have a different arbitrage interest than other ETFs. This creates a massive difference between market prices and net asset values. Lack of liquidity in the case of some Exchange Traded Funds increases the bid-ask spread, adding to the cost of trading.

Active or Passive: The Alpha and Beta of Investment

While active investors aim for alpha or the best in the market, passive investors level arbitrage to achieve beta or moderate market returns. There are only two possibilities for passive investors: exchange-traded funds and mutual funds. Both track the underlying index. Tracking error is the degree to which funds fall short of replicating the index.

Two Degrees of Passive Investment: Angles on ETF Versus Index Funds

Image source: pixabay.comPassive investors:

These types of investors aim to achieve asset allocation best suited to objectives at low cost with little activity. An index mutual fund is the best option for such investors. Rebalancing will maintain consistency and ensure exposure adjustment.

Not so Passive investors:

ETF permits users to take a directional view of the market, something that open-ended funds cannot hope to match. It ensures changes in the portfolio with higher precision and speed. Exchange-traded funds are more suitable for this kind of investor.

Investors may also short-sell the ETF if they are passive yet inclined opportunistically. Using exchange-traded funds is an active method of a passive investment strategy. Investors should comprehend market dynamics to make a successful investment, whether they choose ETFs vs. index funds.

Mutual Fund or Index ETF? Many Differences

Mutual funds have different share classes, holding period requirements, and arrangements for sales charges. The game aims to discourage rapid trading. Exchange-traded funds are built for speed. This is the prime difference between ETFs vs. index funds. Individual investors must do their homework to get good grades in the financial market and choose the right index product to make their mark.

ETFs have more volatile prices than index mutual funds. Tax efficiency is a factor on which exchange-traded funds and index mutual funds function equally well. Regarding price fluctuations, index ETF prices vary throughout the trading day. While joint index funds and ETFs share similarities, the differences are many. Investors looking to hold investments for the long term and have a moderate appetite for risk would be more suited to index mutual funds.

In contrast, investors with more risk-taking ability who want short to medium-term returns on their plate should choose ETFs. While ETFs Vs. Index Funds can be used to own the market at a very reasonable rate, and this is where the similarity ends. Here are the brownie points you will score for a bigger risk appetite through exchange-traded funds.

Zero Commissions

If you purchase an index fund run by a brokerage, the fee might be waived off, but if the fund in a specific account is used, get ready to fork out money for a low-risk appetite. Exchange-traded funds are commission-free or cost very little per trade.

More Liquidity

Index funds are mutual funds, so whether you purchase or sell them, you get pricing at the end of the day. This price would be different from what one would anticipate. Liquidity is higher in Exchange Traded Funds, making it easy to track common indices. If you’re juggling asset classes, however, you could strike out.

Less Cost, More Gains

The price war has escalated between ETF providers while peace prevails among index fund providers. Due to fairly bad expense ratios, buying an ETF is less expensive.

Image source: pixabay.comMore Asset Classes

Exchange-traded funds are also perfect for those who want to reasonably invest in numerous asset classes. Index funds limit the scope to mid-cap, specialty, and real estate funds. The flexibility offered by ETF means more choices.

Cash Flows That Work For You

If you purchase index funds, the hassle of deciding what to do about incoming dividends may keep you away from giving the reinvestment. However, short to medium-term investors may prefer ETFs because there is control over where the incoming dividends get reinvested, more so in a commission-free manner.

Conclusion- ETFs vs Index Funds

The question is weighty, but the burden of its implications makes it important. Choosing the right investment strategy involves being proactive. After all, as Warren Buffet remarked, you don’t test the depth of the river with both feet! Financial markets are as unpredictable as possible, even if you are following stock market indices. Concerning your risk appetite, you can formulate the perfect recipe for investment that will score on all counts. The important point is choosing an investment vehicle that matches your financial roadmap and investing strategies.

You can easily decide whether ETF vs. index mutual funds are superior based on resources and preferences of active versus passive funds. Though both are passive funds, the fact is that ETFs are more actively passive than their index counterparts. The thumb rule is that if you buy what you don’t need, you will sell things you need pretty soon. So, opt for an investment vehicle that steers you in the right direction. Individual preferences vary with circumstances and financial resources. Making profits is based on making the right choices. Choose well, and you will get excellent returns. This is the essence of examining the trade-off between ETFs and Index Funds while driving growth through these investment vehicles.

Recommended Article

Here are some articles that will help you to get more detail about ETFs vs. index Funds, so just go through the link.